When it comes to filing taxes, it’s important to have all the necessary forms in order to accurately report your income and expenses. One form that may be required for certain businesses is Form 941 Schedule B. This form is used by employers to report the number of employees they have and the wages paid to them during a specific quarter.

For the year 2025, the IRS has released the printable version of Form 941 Schedule B to make it easier for businesses to fill out and submit their information. This form is essential for businesses to report their payroll taxes accurately and ensure compliance with IRS regulations.

Irs Form 941 Schedule B 2025 Printable

Irs Form 941 Schedule B 2025 Printable

Easily Download and Print Irs Form 941 Schedule B 2025 Printable

Fillable Form 941 Schedule B Edit Sign U0026 Download In PDF PDFRun

Fillable Form 941 Schedule B Edit Sign U0026 Download In PDF PDFRun

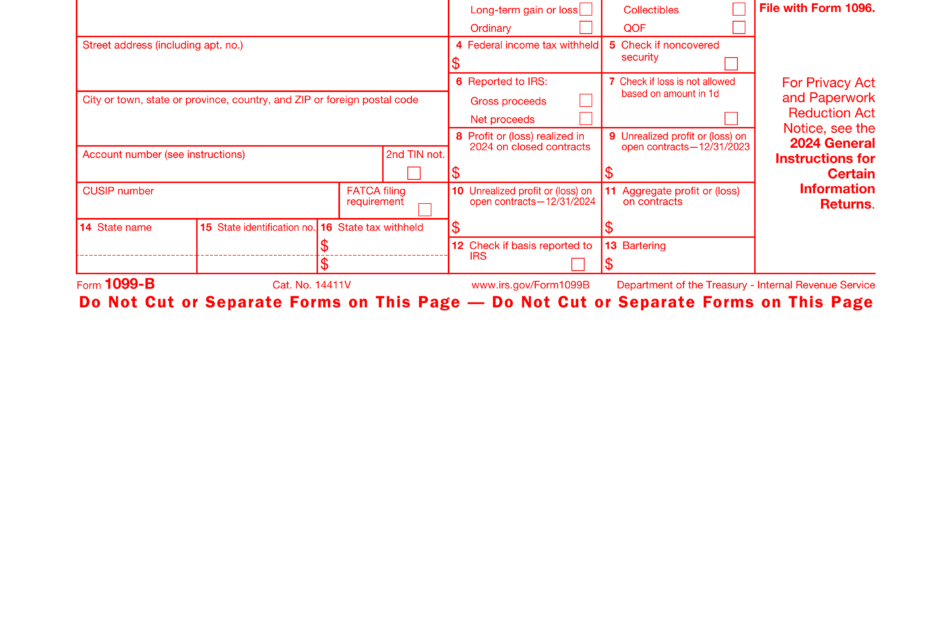

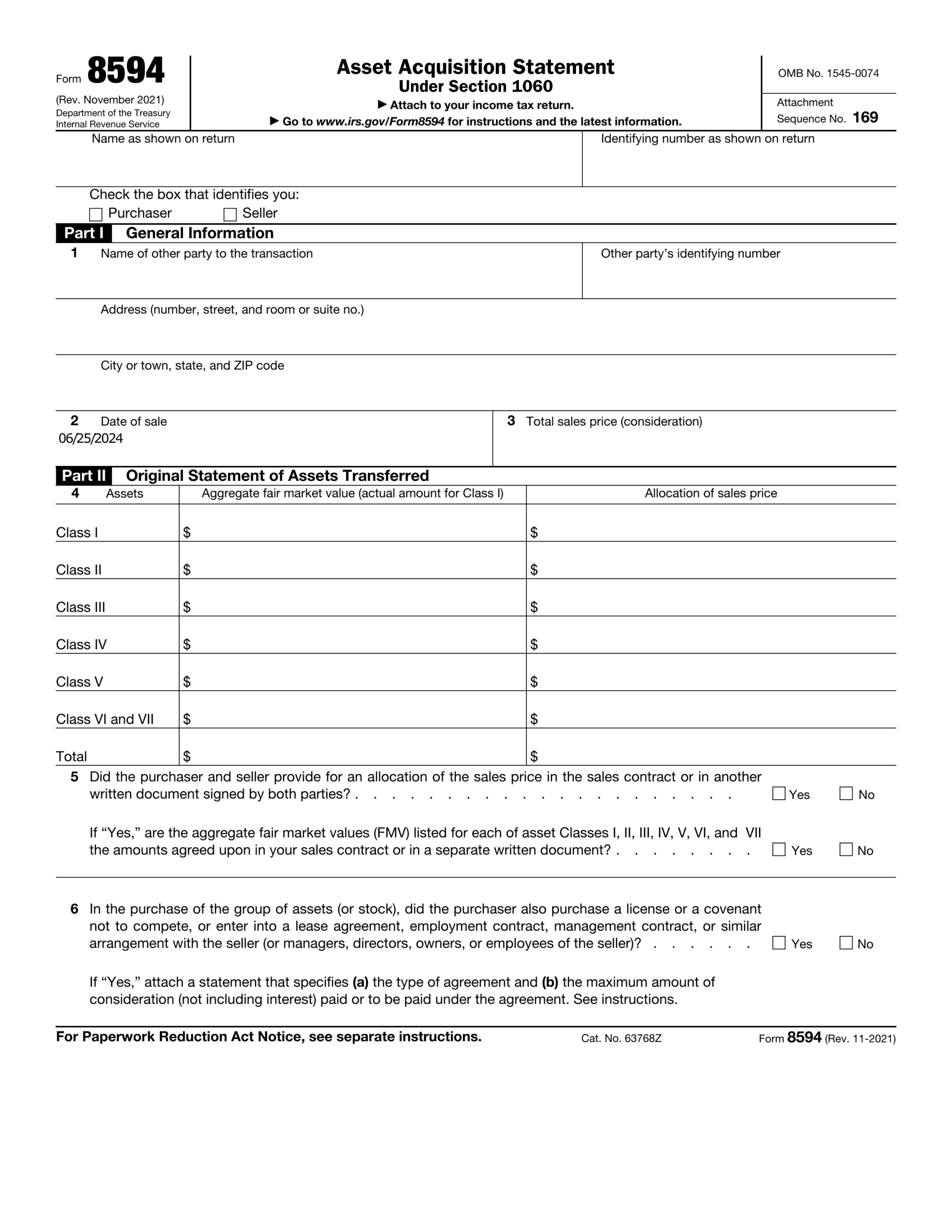

Form 941 Schedule B is divided into various sections where businesses are required to provide details such as the number of employees, their wages, and any adjustments that need to be made. It is crucial for businesses to fill out this form accurately to avoid any penalties or fines from the IRS.

By using the printable version of Form 941 Schedule B for the year 2025, businesses can easily fill out the form and submit it to the IRS on time. This form helps businesses stay organized and compliant with tax regulations, ensuring that they are accurately reporting their payroll taxes.

Overall, Form 941 Schedule B is an essential form for businesses to report their payroll taxes accurately. By using the printable version for the year 2025, businesses can easily fill out the form and submit it to the IRS, ensuring compliance with tax regulations and avoiding any penalties or fines.

Make sure to download and use the IRS Form 941 Schedule B 2025 Printable for your business to accurately report your payroll taxes and stay compliant with IRS regulations.