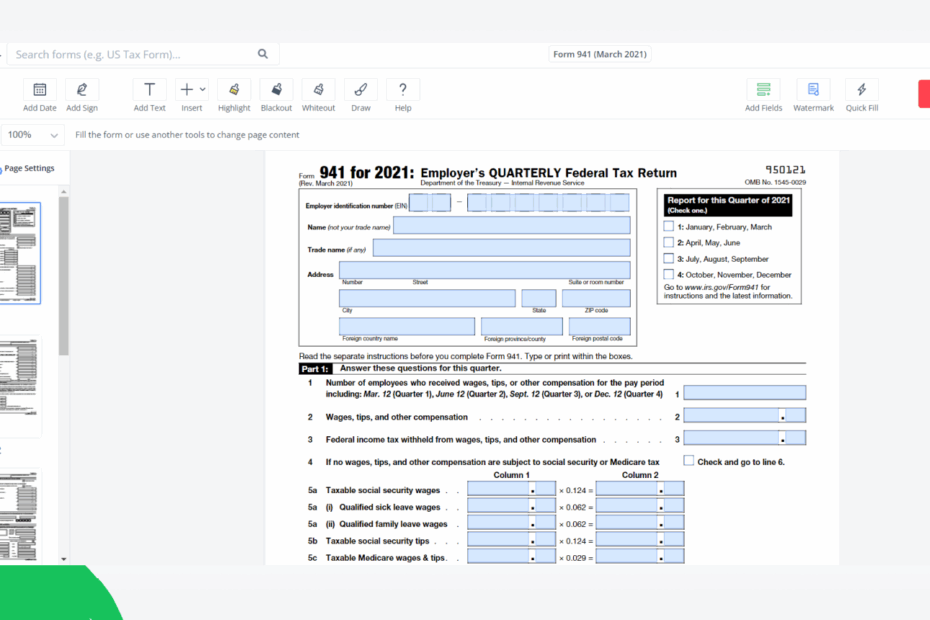

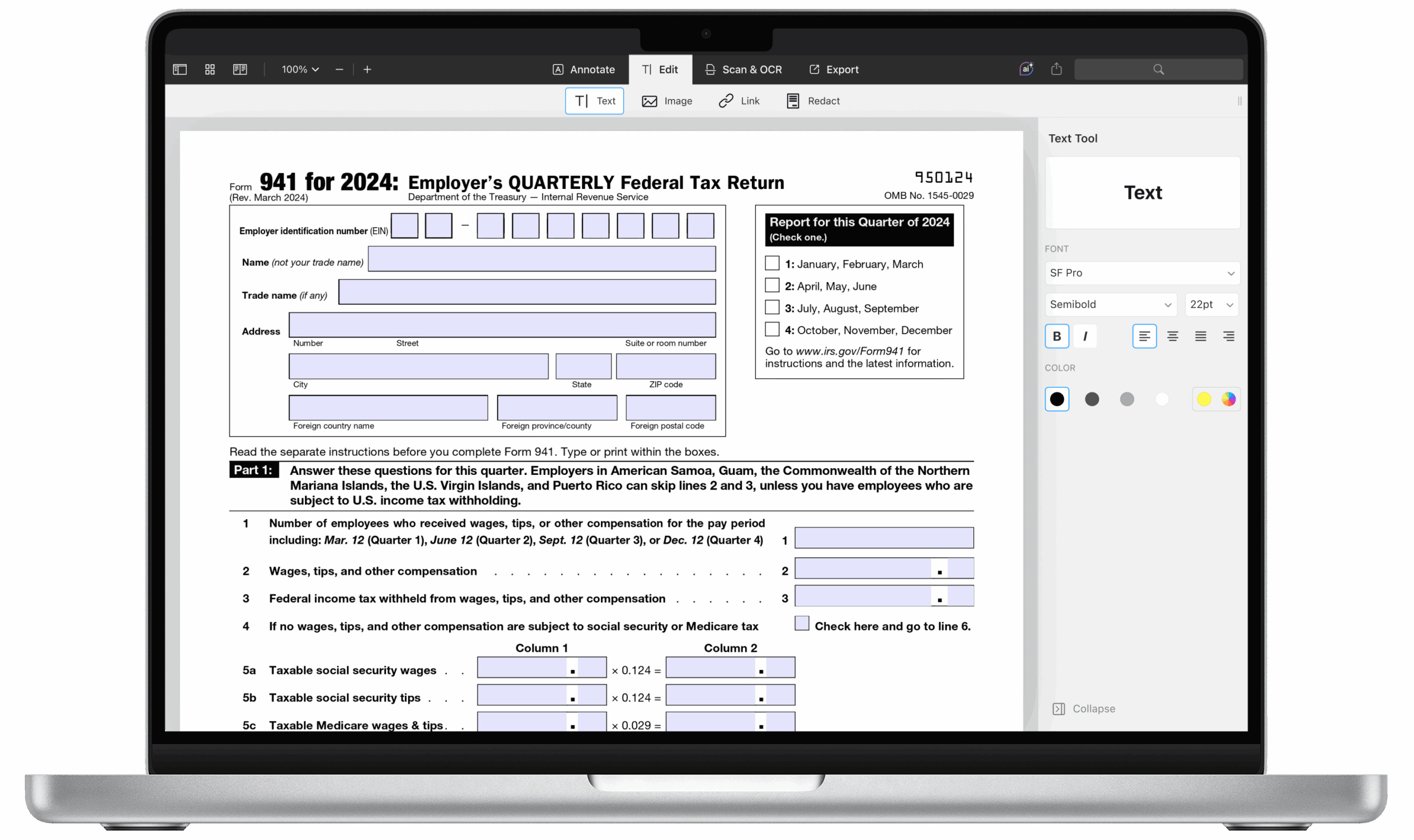

As a business owner, it is essential to stay compliant with IRS regulations when it comes to paying employment taxes. Form 941 is a quarterly tax form that employers use to report wages paid, taxes withheld, and other payroll information. This form is crucial for calculating and submitting federal payroll taxes to the IRS. It is important to ensure that you are using the most up-to-date version of Form 941 to avoid any penalties or fines.

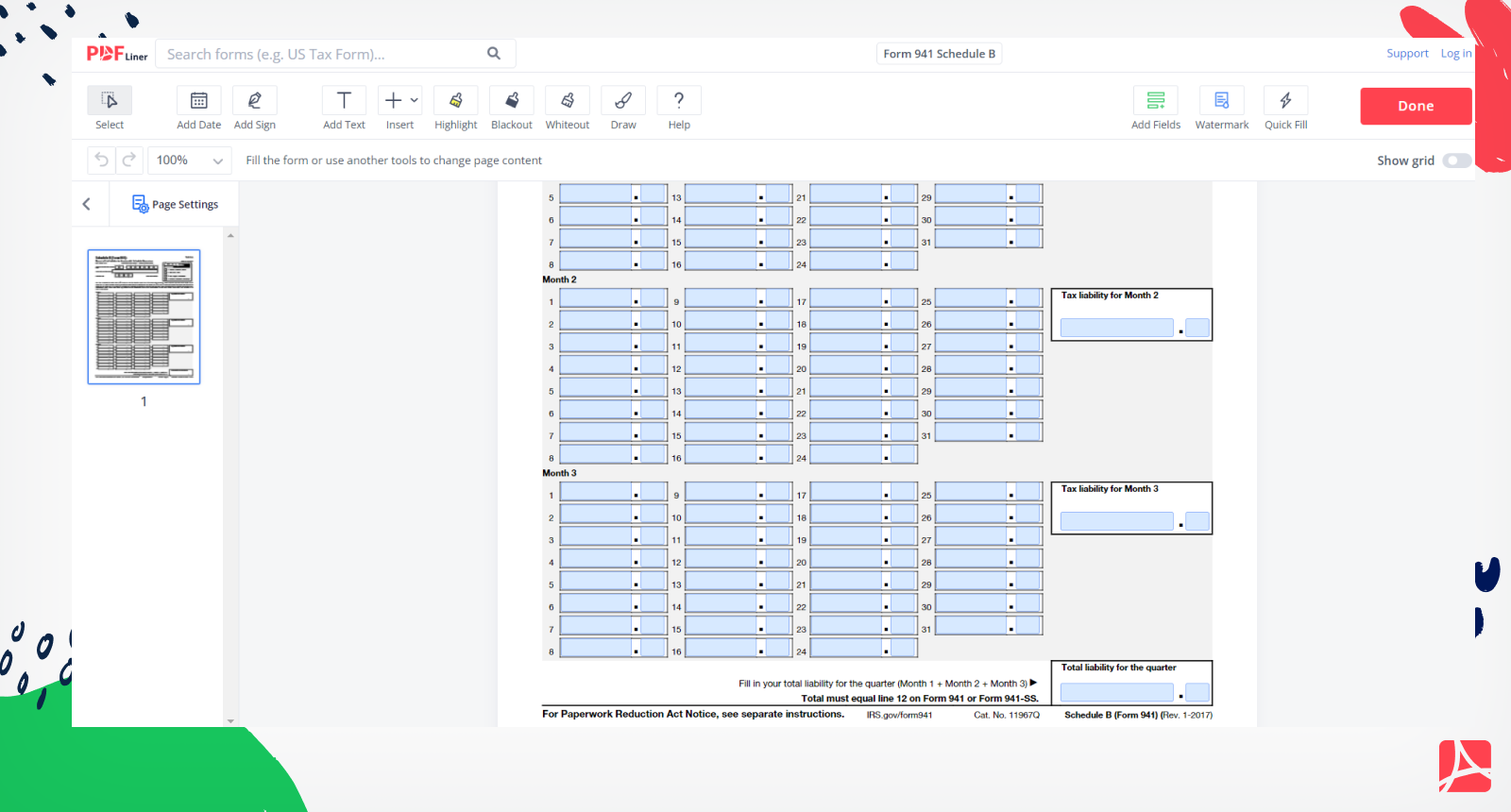

Form 941 is used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. Additionally, employers use this form to report their share of Social Security and Medicare taxes. Form 941 must be filed quarterly by all employers who withhold federal income tax, Social Security tax, or Medicare tax from employee paychecks. Employers must also report any advances received for the earned income credit.

Save and Print Irs Form 941 Printable

How To Fill Out IRS Form 941 2024 2025 PDF Expert

How To Fill Out IRS Form 941 2024 2025 PDF Expert

Employers can easily access and print Form 941 from the IRS website. The form is available in a printable format that can be filled out manually or electronically. It is important to accurately complete all sections of Form 941, including providing information on total wages paid, federal income tax withheld, and total deposits made during the quarter. Employers must also include information on any adjustments or corrections to previously reported amounts.

When completing Form 941, employers must ensure that all information is accurate and up-to-date. Any errors or discrepancies on the form can result in penalties or fines from the IRS. Employers should carefully review the form before submission to avoid any issues. It is also important to keep copies of all filed Forms 941 for your records.

In summary, Form 941 is a vital document for employers to report federal payroll taxes to the IRS. Employers must ensure that they are using the most current version of the form and accurately complete all sections. By staying compliant with IRS regulations, employers can avoid penalties and fines. Accessing and printing Form 941 from the IRS website is a simple process that can help ensure timely and accurate reporting of payroll taxes.