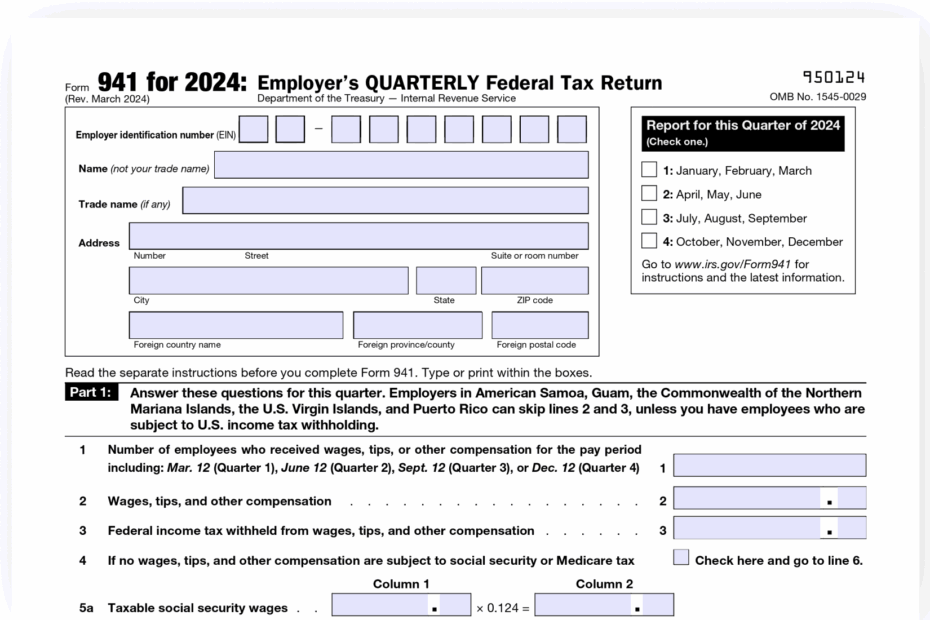

Form 941 is used by employers to report quarterly wages paid to employees and taxes withheld from those wages. It is a crucial document that must be filed accurately and on time to ensure compliance with IRS regulations. For the year 2025, employers will need to use the updated version of Form 941 to report their payroll information.

Employers can easily access and download Form 941 for 2025 from the IRS website. The printable version of the form allows employers to fill it out manually and submit it by mail. It is important to carefully review the instructions provided with the form to ensure all information is reported correctly.

Irs Form 941 For 2025 Printable

Irs Form 941 For 2025 Printable

Quickly Access and Print Irs Form 941 For 2025 Printable

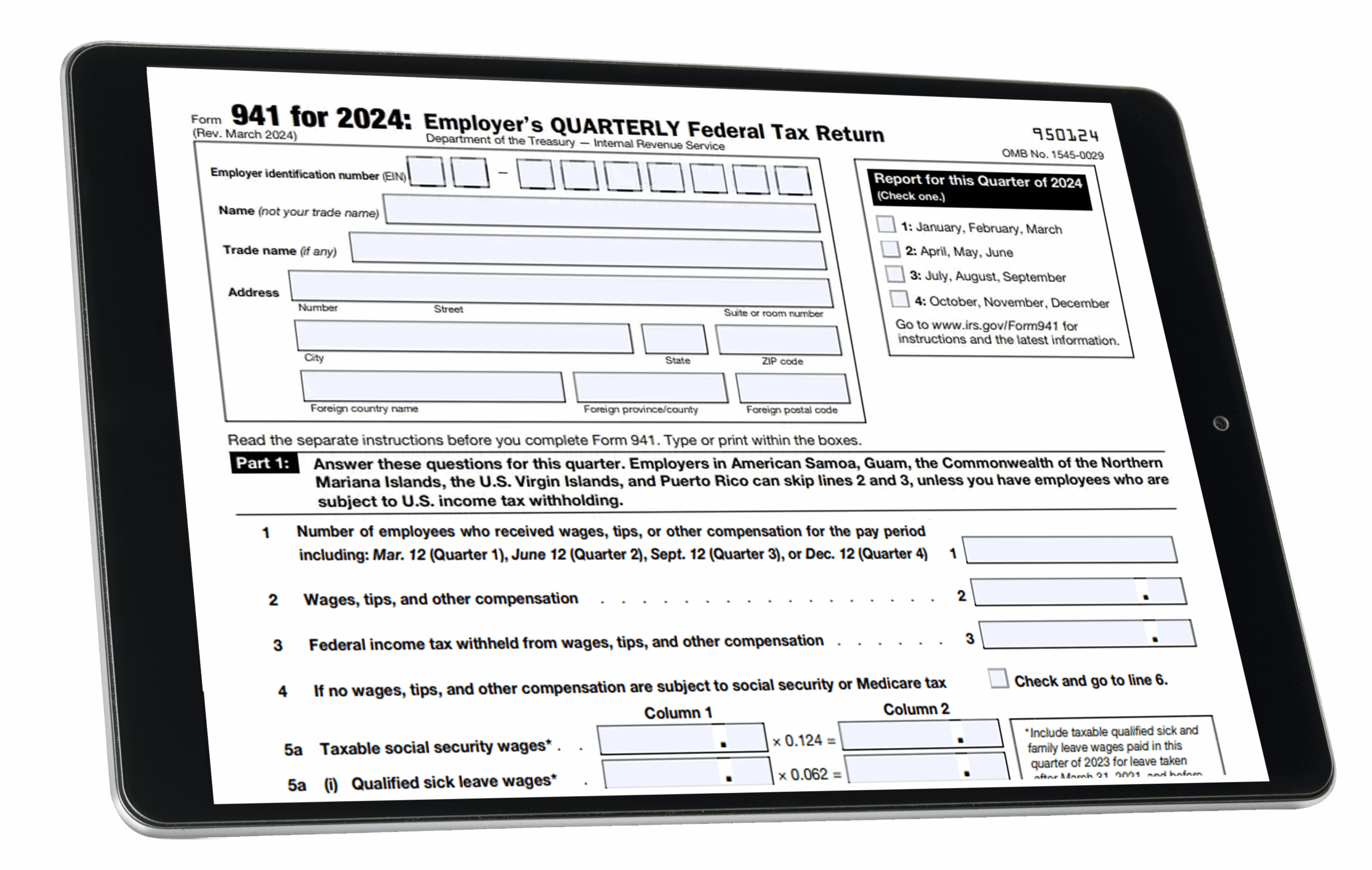

E File 941 For 2024 File 940 944 U0026 941 Schedule R Online

E File 941 For 2024 File 940 944 U0026 941 Schedule R Online

When filling out Form 941 for 2025, employers will need to provide details such as the total number of employees, wages paid, and taxes withheld during the quarter. Employers must also calculate the total tax liability for the quarter and report any adjustments or corrections from previous filings.

It is important for employers to keep accurate records of their payroll information throughout the year to make filing Form 941 easier. By staying organized and keeping track of employee wages and tax withholdings, employers can ensure that their quarterly filings are accurate and compliant with IRS regulations.

Employers should also be aware of the deadlines for filing Form 941 for 2025. The form must be submitted by the last day of the month following the end of the quarter. Failure to file on time or inaccurately reporting payroll information can result in penalties and fines from the IRS.

In conclusion, Form 941 for 2025 is an essential document for employers to report their quarterly payroll information to the IRS. By accessing the printable version of the form and following the instructions carefully, employers can ensure compliance with IRS regulations and avoid potential penalties. It is important for employers to stay organized and keep accurate records of their payroll information throughout the year to make filing Form 941 a smooth process.