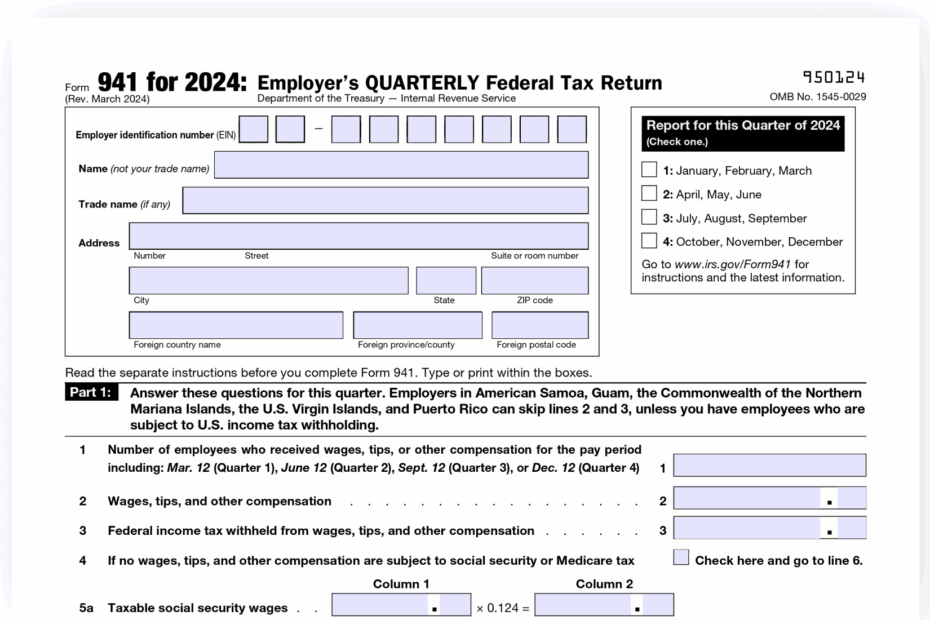

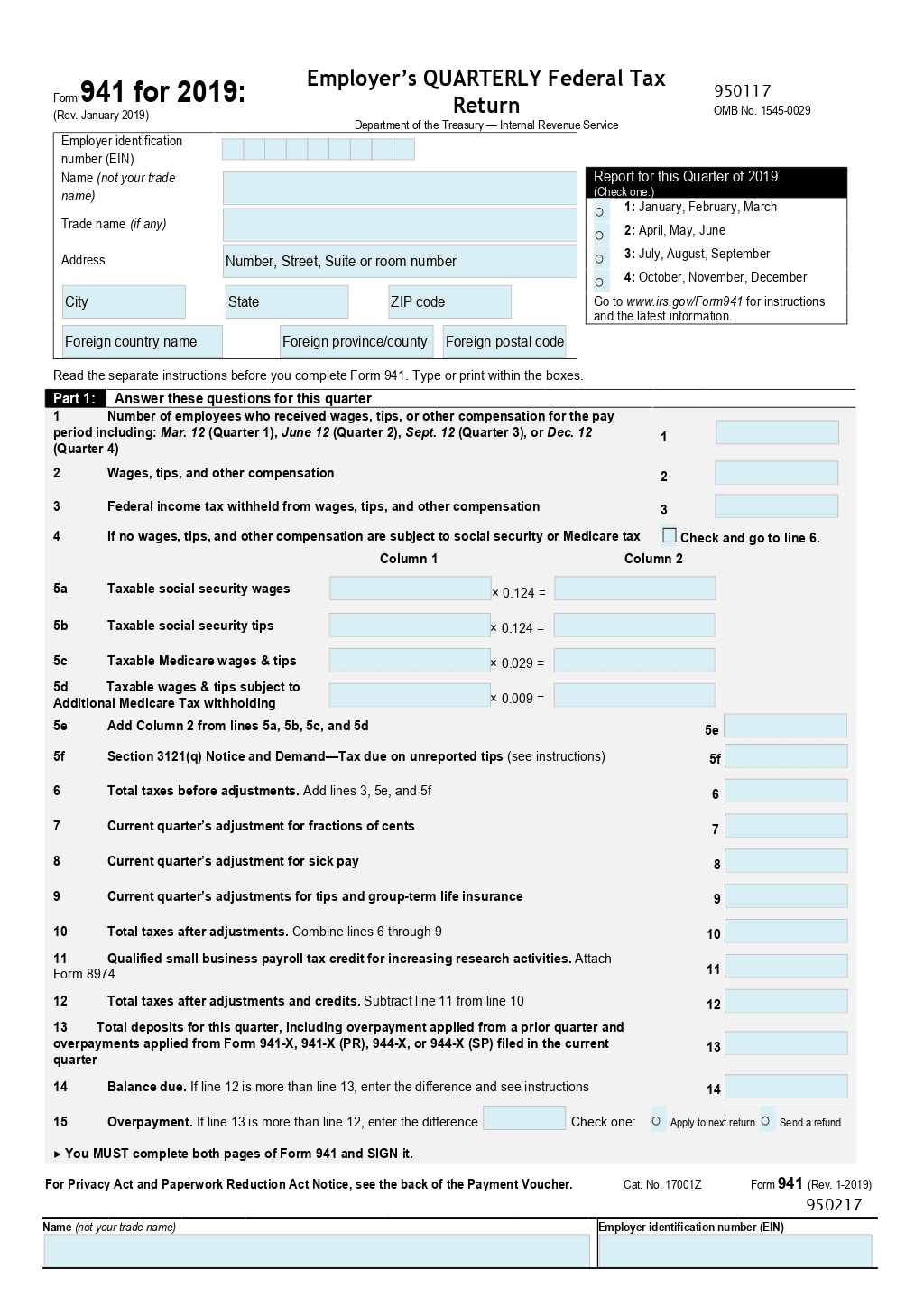

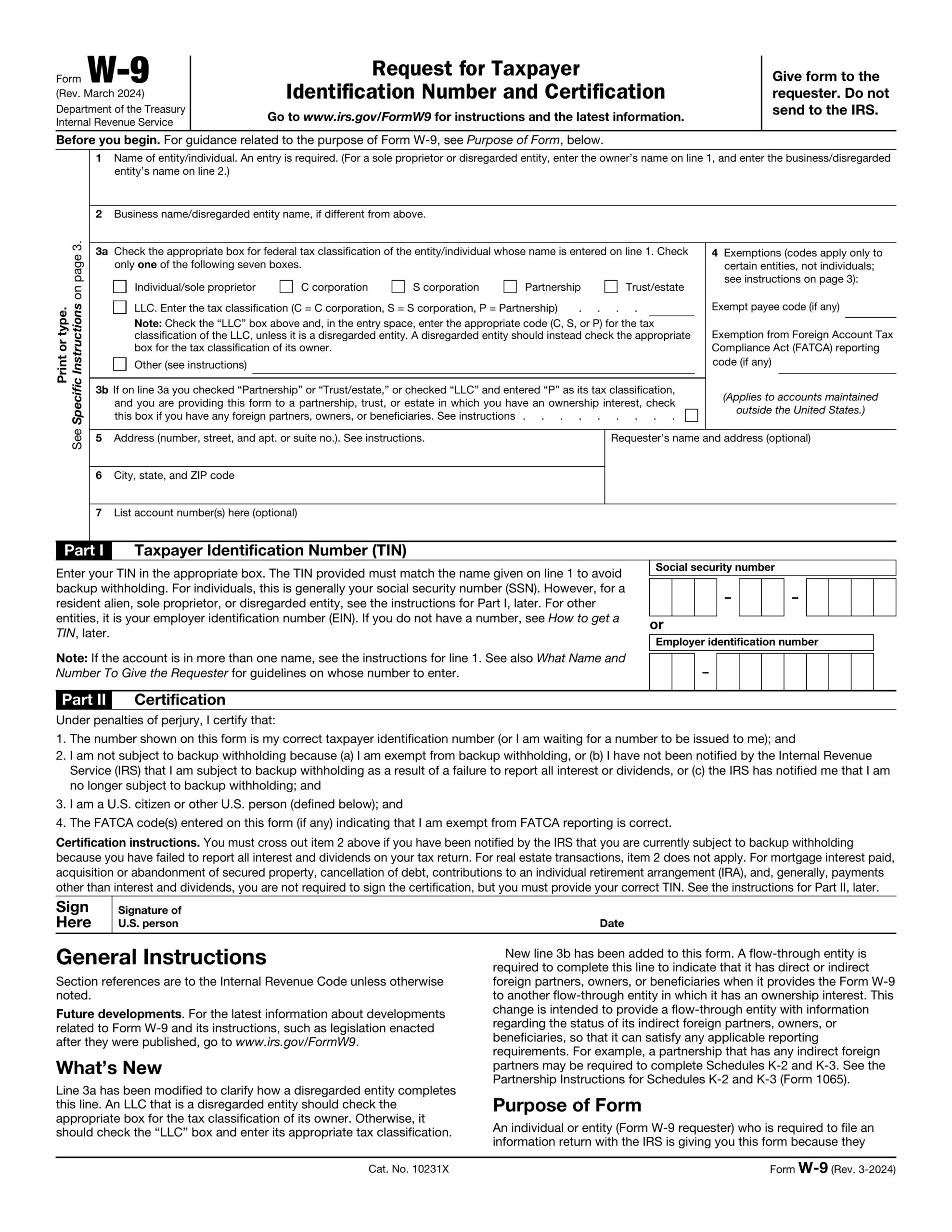

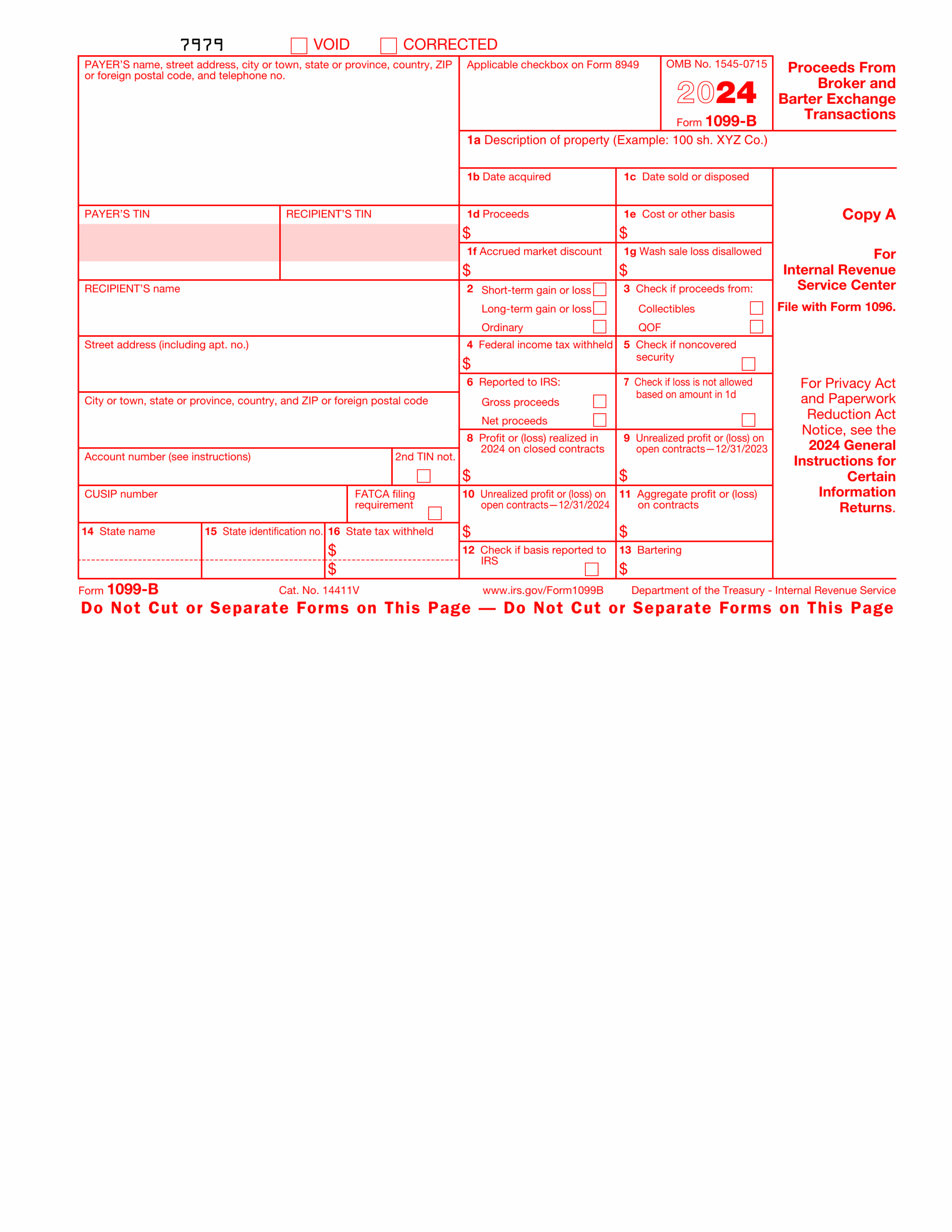

IRS Form 941 is a quarterly tax form that employers use to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. It also includes employer contributions to Social Security and Medicare. For the year 2025, the IRS has made available a printable version of Form 941 for employers to easily fill out and submit.

Employers are required to submit Form 941 for each quarter of the year, reporting wages paid and taxes withheld. The form must be filed by the last day of the month following the end of the quarter. The printable version of Form 941 for 2025 can be found on the official IRS website, making it convenient for employers to stay compliant with tax regulations.

Irs Form 941 For 2025 Printable

Irs Form 941 For 2025 Printable

Download and Print Irs Form 941 For 2025 Printable

E File 941 For 2024 File 940 944 U0026 941 Schedule R Online

E File 941 For 2024 File 940 944 U0026 941 Schedule R Online

When filling out Form 941 for 2025, employers will need to provide information such as total wages paid, federal income tax withheld, and both employer and employee portions of Social Security and Medicare taxes. It is important to accurately report this information to avoid penalties and ensure that employees receive proper credit for taxes withheld.

Employers can also use Form 941 to claim any tax credits they may be eligible for, such as the Employee Retention Credit or credits for paid sick leave and family leave. These credits can help offset tax liabilities and reduce the amount of taxes owed to the IRS.

In addition to submitting Form 941, employers must also make quarterly tax payments to the IRS based on the information reported on the form. These payments are crucial to avoid underpayment penalties and ensure that the employer stays current with their tax obligations.

In conclusion, the printable version of IRS Form 941 for 2025 provides employers with a convenient way to report income taxes and payroll taxes for each quarter of the year. By accurately filling out and submitting this form, employers can stay compliant with tax regulations and avoid penalties. It is important for employers to familiarize themselves with the requirements of Form 941 and seek assistance from a tax professional if needed.

941 Schedule B 2024 2025 Fill And Download PDF Guru

941 Schedule B 2024 2025 Fill And Download PDF Guru

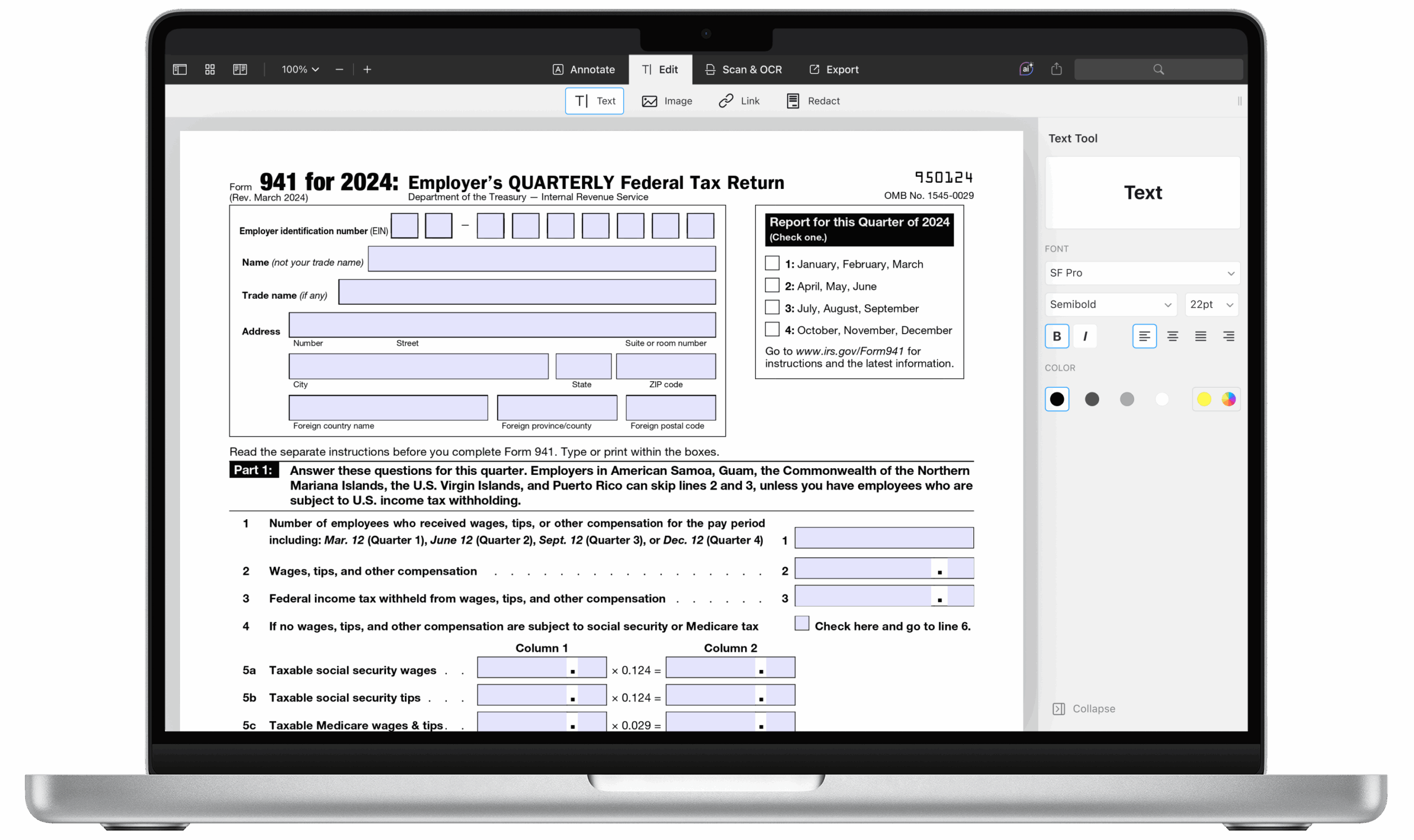

Form 941 Fill Out Form 941 Tax 2025

Form 941 Fill Out Form 941 Tax 2025

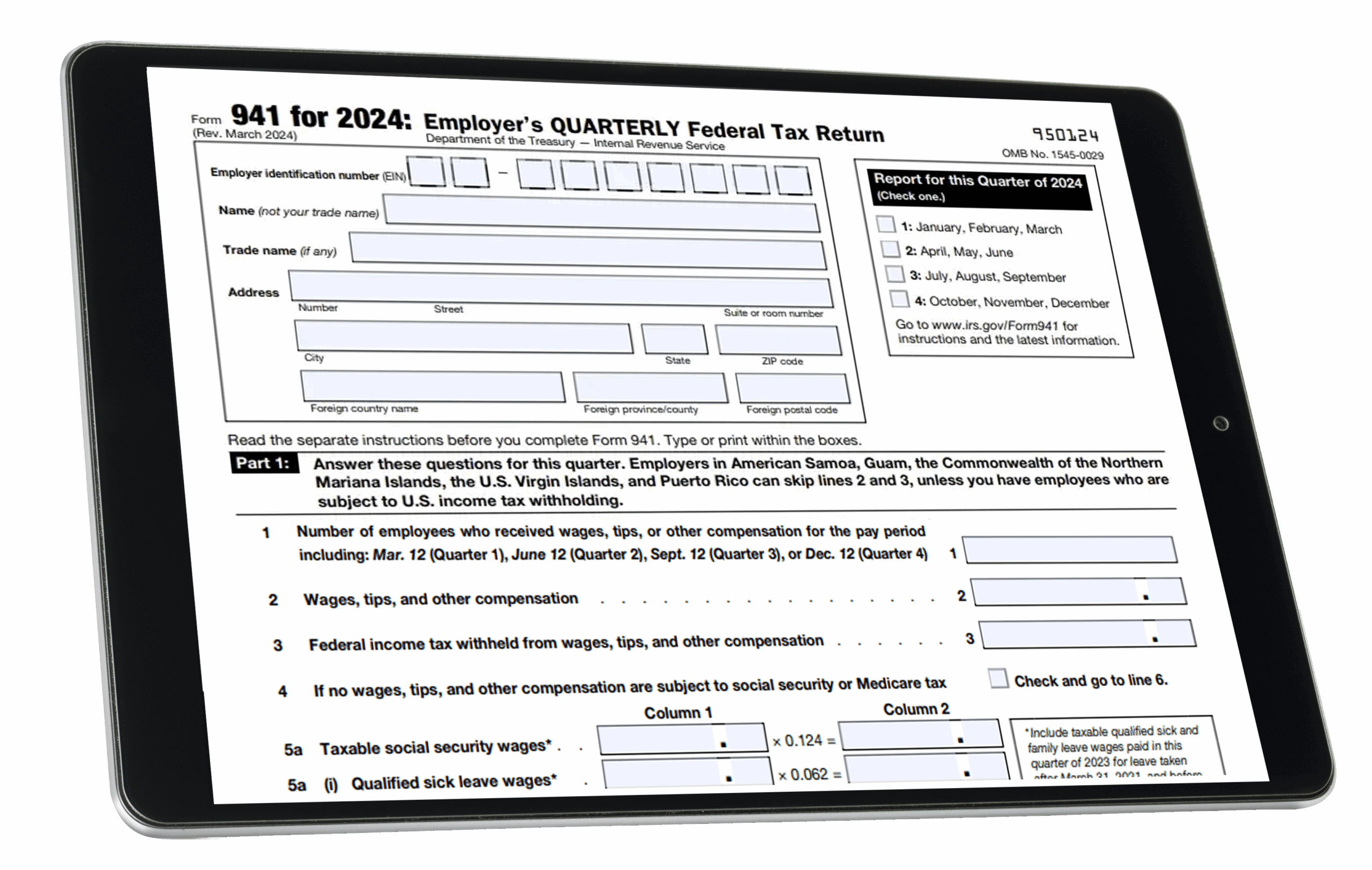

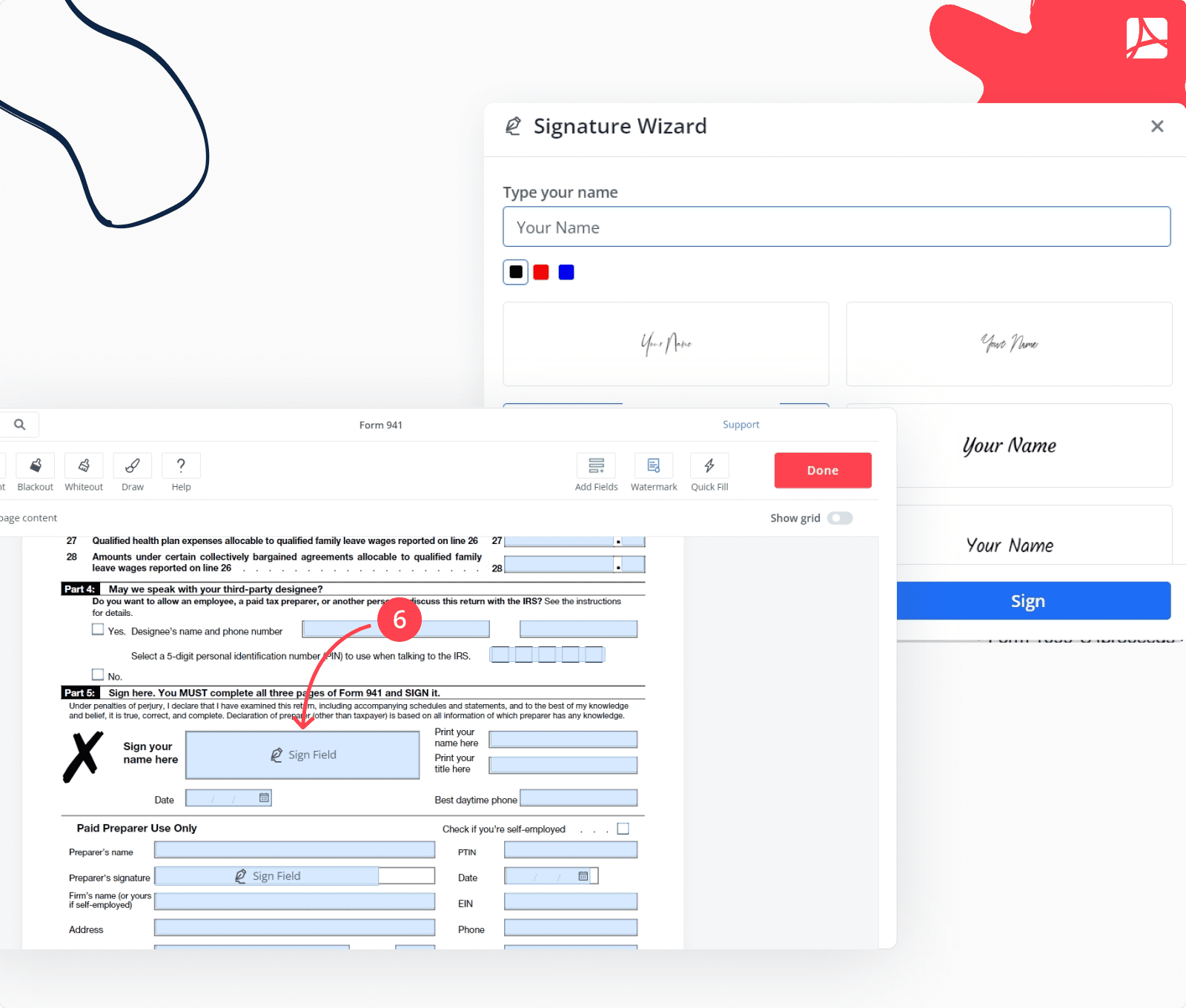

How To Fill Out IRS Form 941 2024 2025 PDF Expert

How To Fill Out IRS Form 941 2024 2025 PDF Expert

Looking for a hassle-free solution to handle your finances? Our Irs Form 941 For 2025 Printable provide a simple, safe, and customizable solution right from home. Be it for your own needs, small enterprises, or keeping track of expenses, these printable checks help you save time and money without compromising professionalism. Supports popular bookkeeping tools and easy to print, they’re a wise alternative to store-bought checks. Start printing today and fully manage your payments—no waiting, zero charges. Browse our collection of templates and pick the one that fits your needs. With our easy-to-use features, handling your money has never been this streamlined. Download your free printable checks and streamline your payments with ease!.