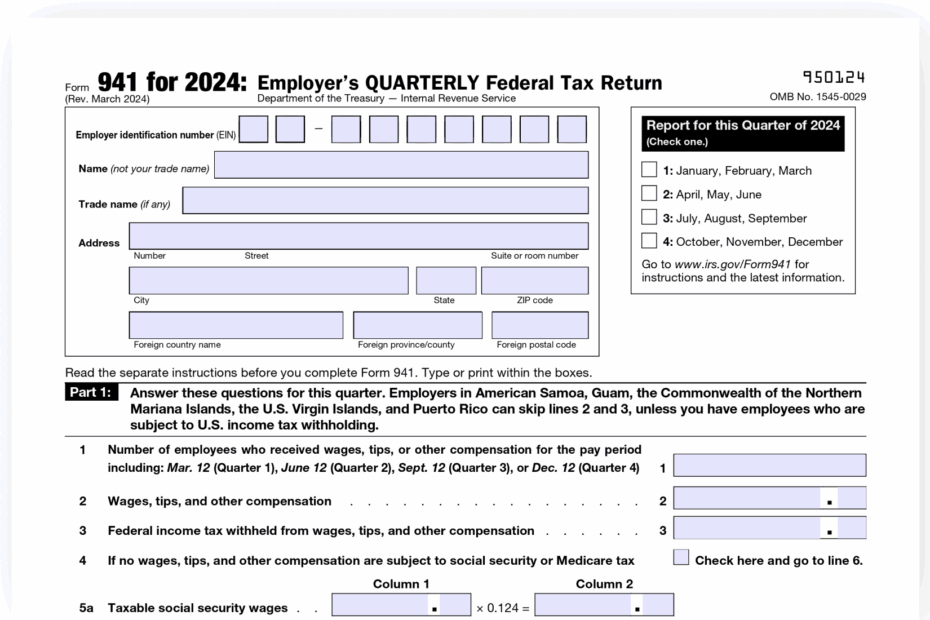

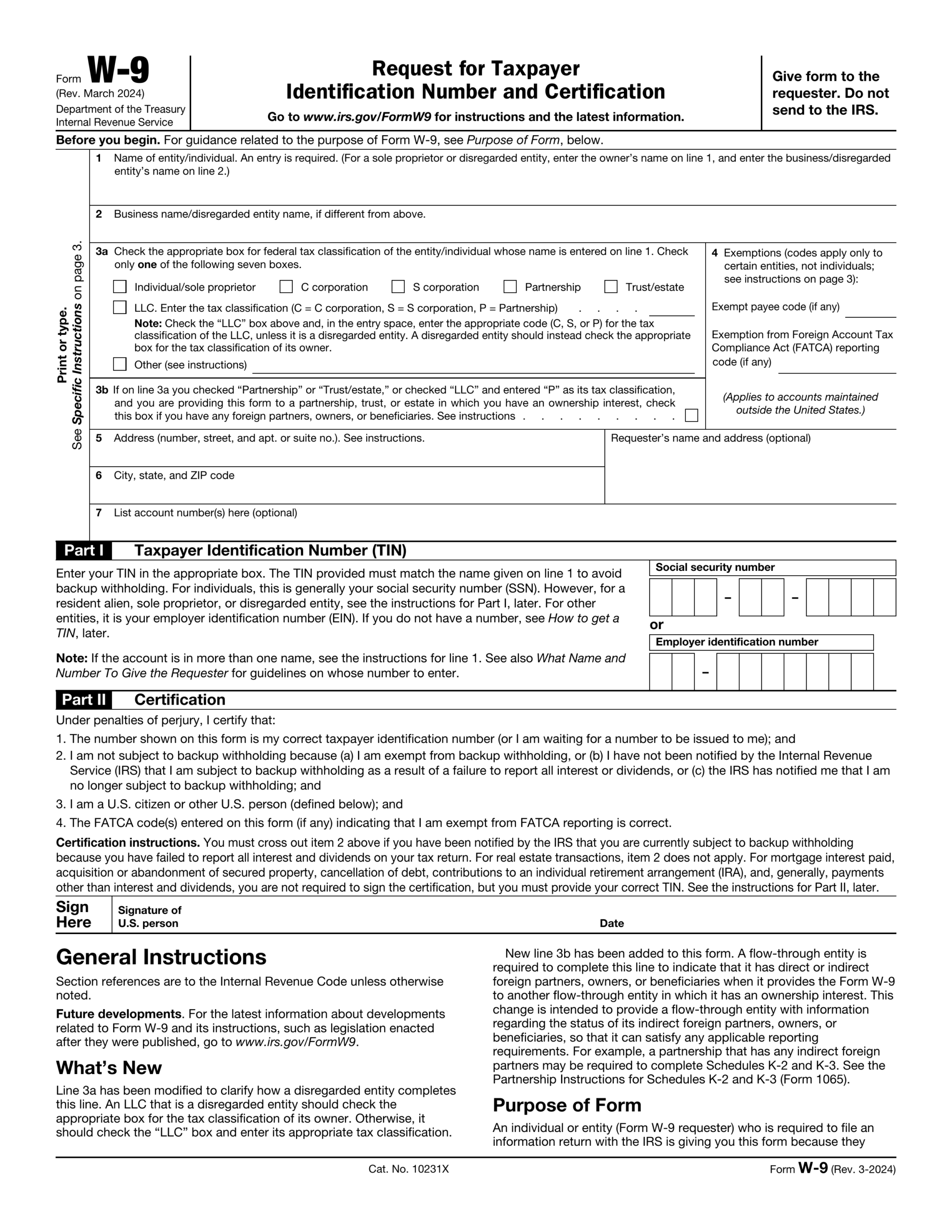

IRS Form 941 is a quarterly tax form that employers use to report wages paid, tips received, and taxes withheld from employees. It also includes employer and employee social security and Medicare taxes. For the year 2025, the IRS has updated the form to reflect any changes in tax laws and regulations.

Employers are required to file Form 941 each quarter to ensure that the correct amount of taxes are being withheld from employees’ paychecks. It is important to accurately fill out this form to avoid any penalties or fines from the IRS. The printable version of Form 941 for 2025 can easily be found on the IRS website or other online tax resources.

Irs Form 941 For 2025 Printable

Irs Form 941 For 2025 Printable

Save and Print Irs Form 941 For 2025 Printable

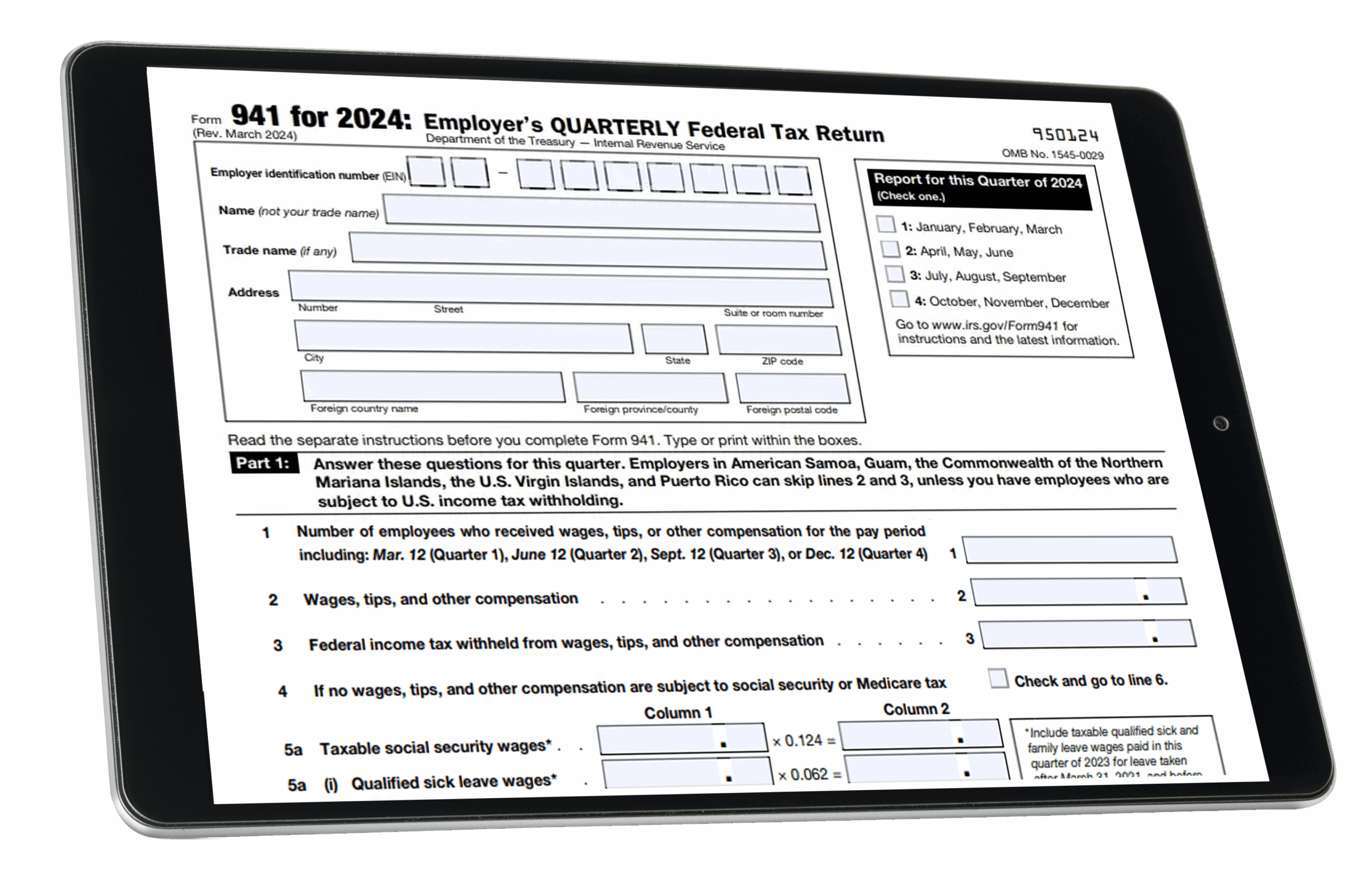

E File 941 For 2024 File 940 944 U0026 941 Schedule R Online

E File 941 For 2024 File 940 944 U0026 941 Schedule R Online

IRS Form 941 For 2025 Printable

The printable version of IRS Form 941 for 2025 includes sections for reporting wages, tips, and other compensation paid to employees. It also includes sections for reporting federal income tax withheld, social security tax, and Medicare tax. Employers must provide their employer identification number (EIN) and other identifying information on the form.

It is important to carefully review the instructions for Form 941 to ensure that all information is accurate and up to date. Employers must also make sure that they are using the correct tax year’s form when filing their quarterly taxes. Filing Form 941 late or with incorrect information can result in penalties from the IRS.

Employers can choose to file Form 941 electronically or by mail. The printable version of the form is convenient for those who prefer to fill it out by hand and mail it in. However, electronic filing is often faster and more efficient. Whichever method you choose, be sure to keep a record of your filings for your own records.

In conclusion, IRS Form 941 for 2025 is an important tax form that employers must file each quarter to report wages, tips, and taxes withheld from employees. The printable version of the form is readily available online and should be filled out accurately to avoid any penalties from the IRS. Make sure to stay informed about any updates to tax laws and regulations to ensure compliance with the latest requirements.