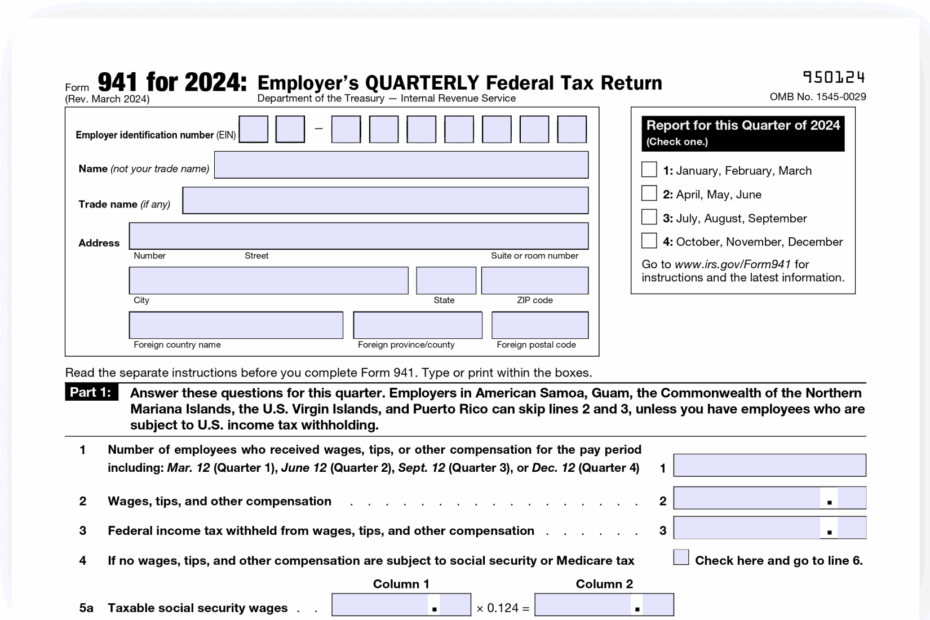

As an employer, it is important to stay compliant with the IRS by filing Form 941 each quarter. This form is used to report wages paid, taxes withheld, and other payroll information for your employees. Filing Form 941 ensures that you are accurately reporting and paying your share of Medicare and Social Security taxes as well as your employees’ withholdings.

For the year 2025, the IRS has released a new version of Form 941 that employers must use for filing their quarterly taxes. This printable form can be easily downloaded from the IRS website or obtained from your tax professional. It is essential to fill out this form accurately and submit it on time to avoid penalties and fines.

Irs Form 941 For 2025 Printable

Irs Form 941 For 2025 Printable

Save and Print Irs Form 941 For 2025 Printable

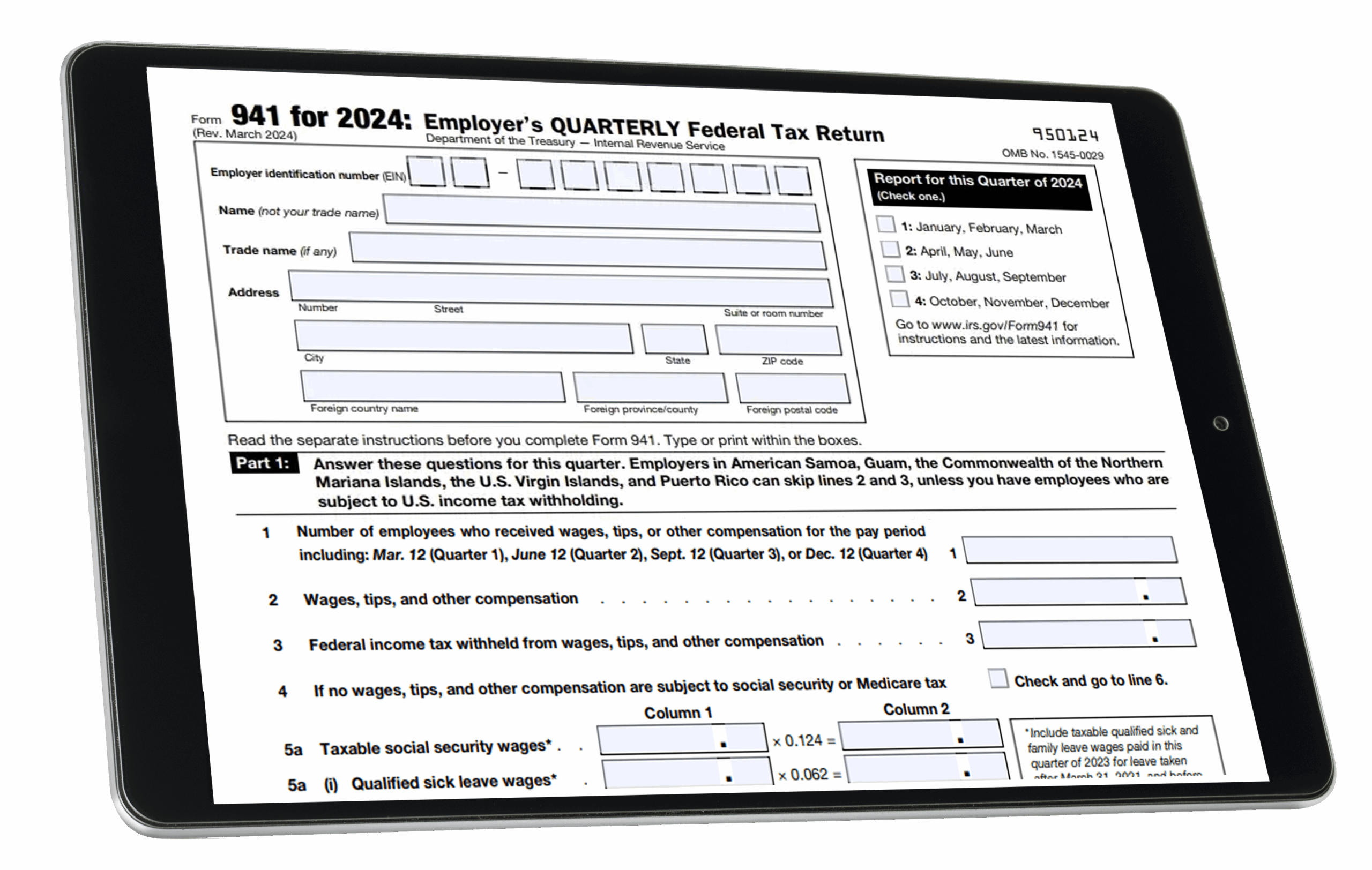

E File 941 For 2024 File 940 944 U0026 941 Schedule R Online

E File 941 For 2024 File 940 944 U0026 941 Schedule R Online

When completing Form 941 for 2025, be sure to carefully review all information related to your business, including the number of employees, wages paid, and taxes withheld. Double-checking your calculations and ensuring that all required fields are filled out correctly can help prevent any errors that could lead to complications down the line.

Employers must also be aware of any changes to tax laws or regulations that may impact the information required on Form 941. Staying up to date with any updates from the IRS and seeking guidance from a tax professional can help ensure that you are in compliance with all requirements when filing your quarterly taxes.

It is important to note that Form 941 for 2025 must be submitted electronically if you have 250 or more employees. Employers with fewer than 250 employees have the option to file either electronically or by mail. Whichever method you choose, be sure to keep a copy of your completed form for your records.

In conclusion, IRS Form 941 for 2025 is a crucial document that employers must fill out accurately and submit on time to meet their tax obligations. By staying informed of any changes to tax laws and seeking assistance when needed, you can ensure that you are in compliance with IRS regulations and avoid any potential penalties. Download the printable form from the IRS website and start preparing for your quarterly filings today.