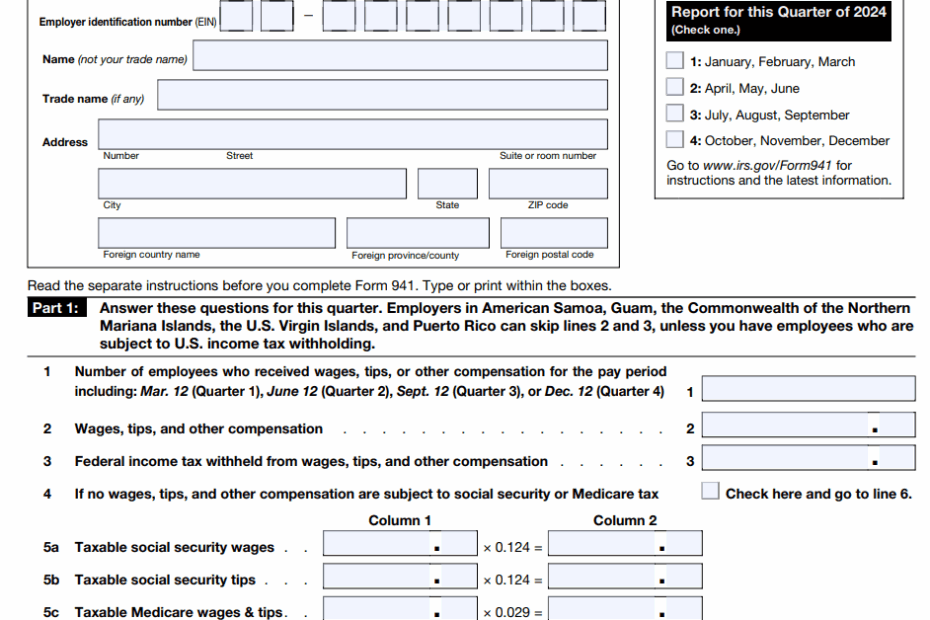

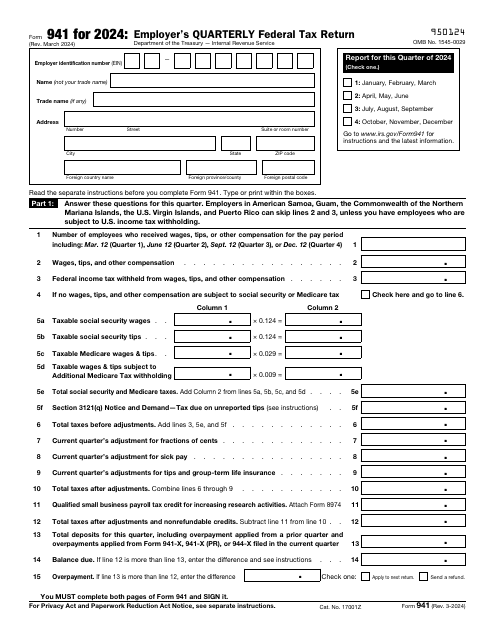

IRS Form 941 is a quarterly tax form that employers use to report wages paid, tips received, and taxes withheld from employees. It is important for employers to accurately complete and submit Form 941 to the Internal Revenue Service (IRS) to ensure compliance with tax laws and regulations. For the year 2024, employers can find a printable version of Form 941 on the IRS website.

Completing Form 941 for 2024 requires information such as the number of employees, wages paid, and taxes withheld during each quarter. Employers must also report any adjustments or corrections to previously filed forms. By using the printable version of Form 941, employers can easily fill out the form and submit it to the IRS by the deadline.

Irs Form 941 For 2024 Printable

Irs Form 941 For 2024 Printable

Quickly Access and Print Irs Form 941 For 2024 Printable

IRS Form 941 Download Fillable PDF Or Fill Online Employer 39 S Quarterly

IRS Form 941 Download Fillable PDF Or Fill Online Employer 39 S Quarterly

When completing Form 941, employers must ensure that all information is accurate and up to date. Any errors or discrepancies could result in penalties or fines from the IRS. Employers should carefully review the form before submitting it to avoid any potential issues.

Employers can also use Form 941 to claim any tax credits or deductions they may be eligible for, such as the Employee Retention Credit or the Sick and Family Leave Credit. These credits can help offset tax liabilities and reduce overall tax payments.

Overall, using the printable version of IRS Form 941 for 2024 is a convenient and efficient way for employers to report their quarterly taxes and ensure compliance with IRS regulations. By accurately completing and submitting Form 941 on time, employers can avoid penalties and maintain good standing with the IRS.

Employers should be aware of the deadlines for submitting Form 941 for each quarter in 2024 and make sure to meet those deadlines to avoid any issues with the IRS. By staying organized and keeping accurate records, employers can streamline the process of completing Form 941 and focus on running their businesses effectively.