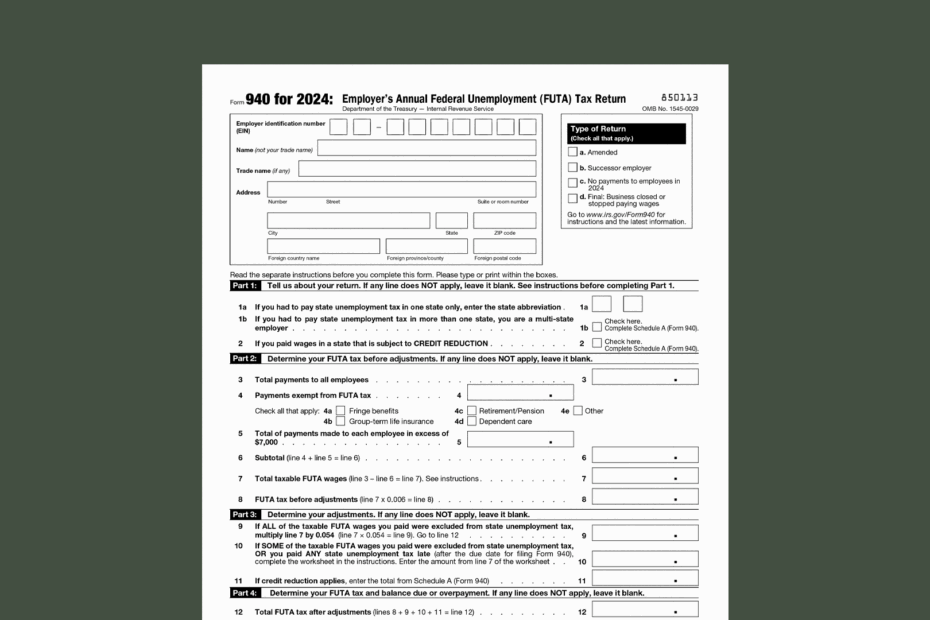

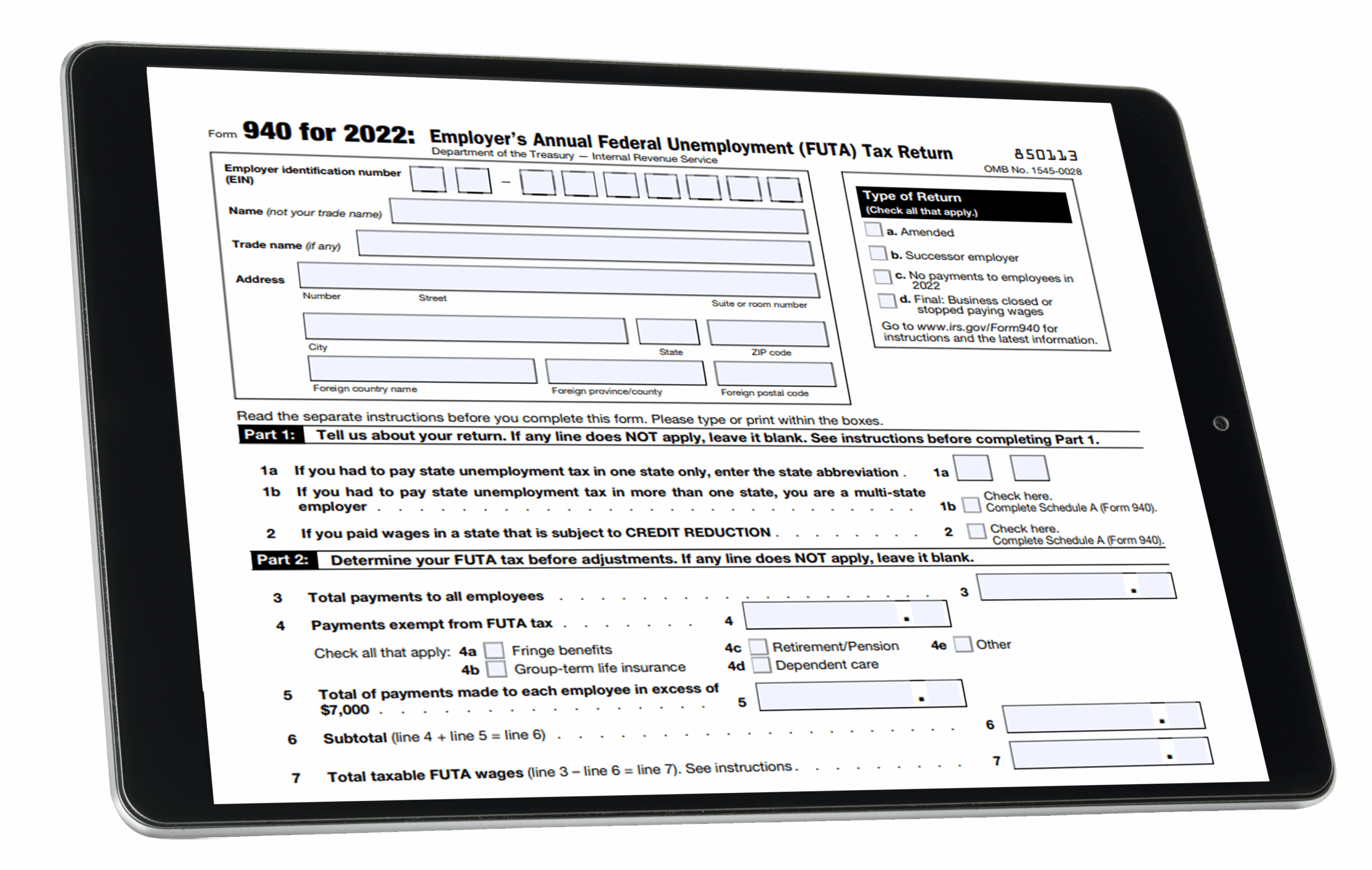

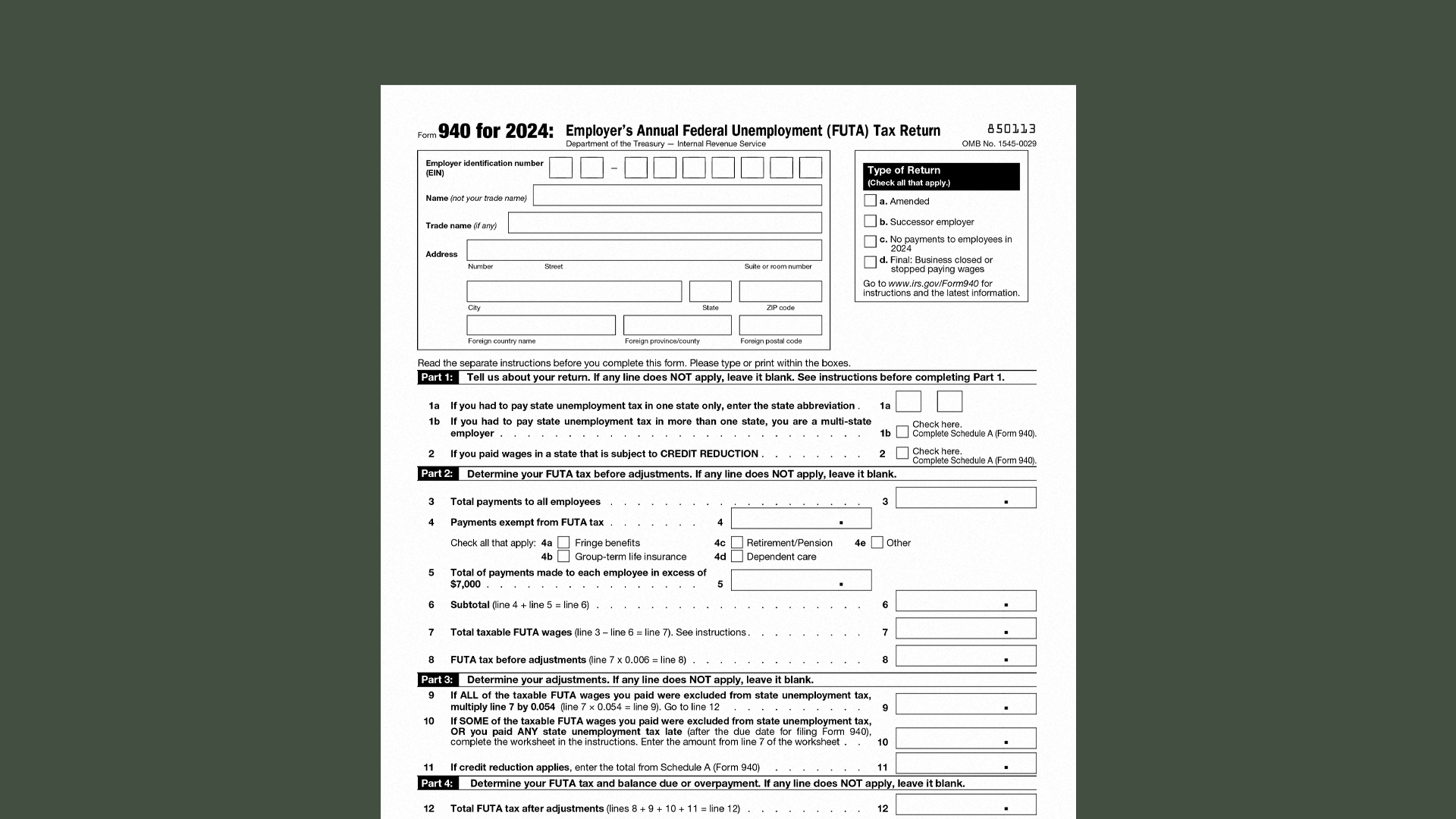

As the year comes to a close, it’s important for business owners to start thinking about tax season. One key form that employers need to be aware of is IRS Form 940 for 2025. This form is used to report the annual Federal Unemployment Tax Act (FUTA) tax that employers must pay on behalf of their employees. By understanding how to properly fill out and submit Form 940, businesses can ensure that they remain compliant with IRS regulations and avoid any potential penalties.

Form 940 for 2025 is essential for employers to report their annual FUTA tax liability. This tax is used to fund unemployment benefits for workers who have lost their jobs. The form must be filed by January 31st of the following year, along with any taxes owed. Business owners can use the IRS website to access a printable version of Form 940 for 2025, making it easy to fill out and submit on time.

Irs Form 940 For 2025 Printable

Irs Form 940 For 2025 Printable

Download and Print Irs Form 940 For 2025 Printable

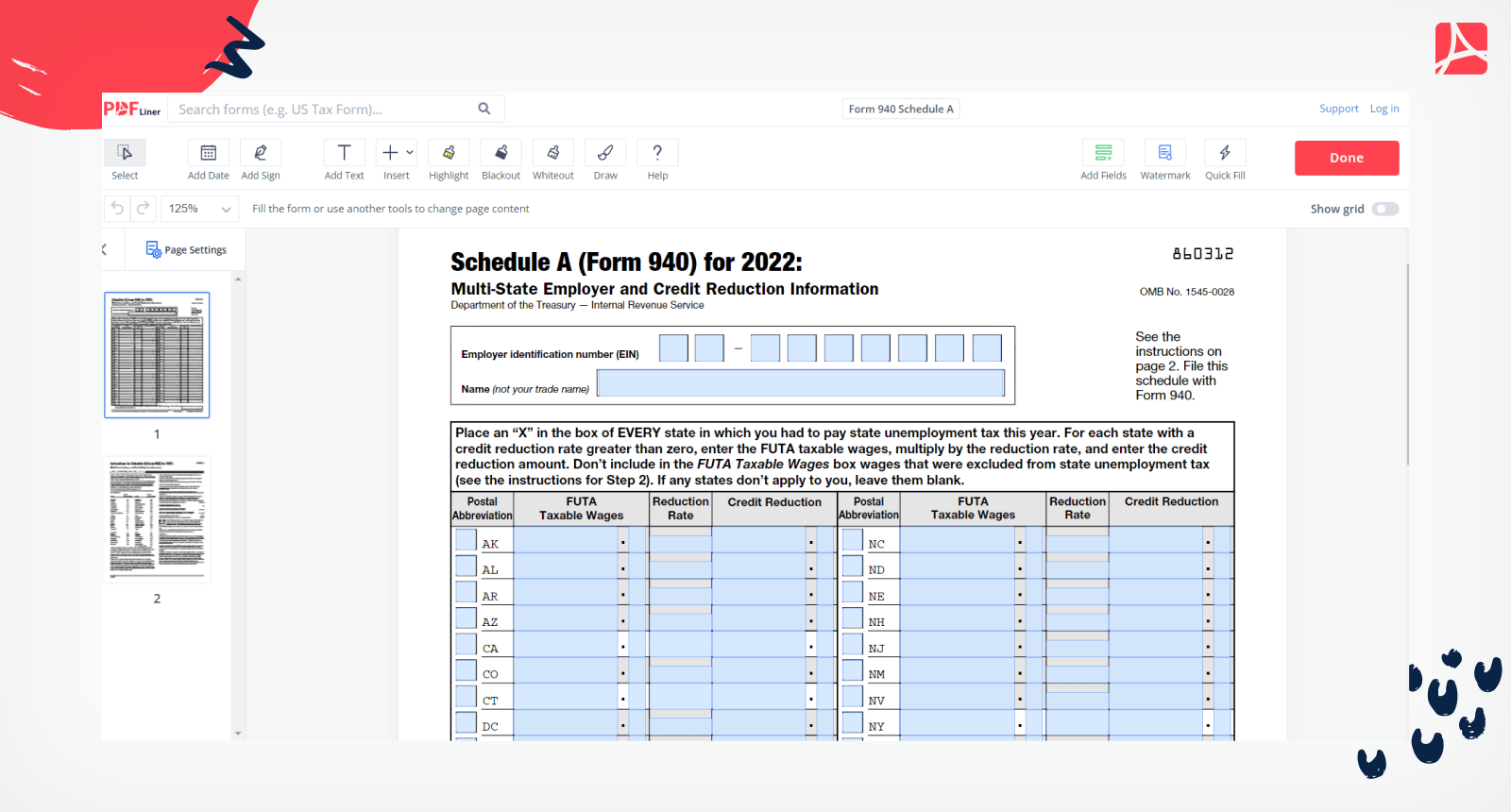

Form 940 Schedule A Printable Form 940 Schedule A Blank

Form 940 Schedule A Printable Form 940 Schedule A Blank

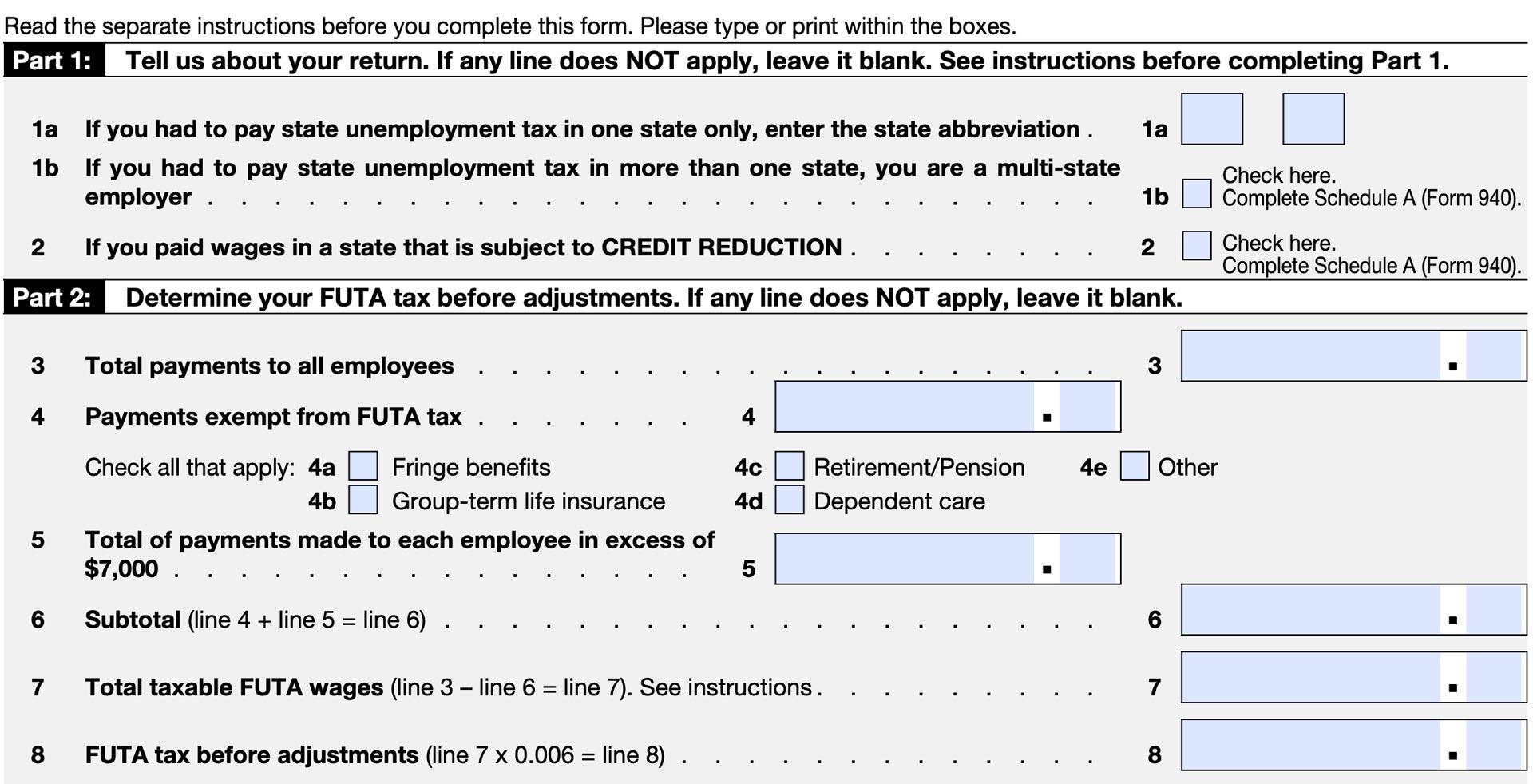

When completing Form 940, employers will need to provide information about their business, including the total number of employees and wages paid during the year. They will also need to calculate their FUTA tax liability based on the wages subject to FUTA tax. By accurately reporting this information, businesses can avoid any discrepancies that may trigger an IRS audit.

It’s important for employers to keep accurate records of their FUTA tax payments throughout the year, as this information will be needed when filling out Form 940. By staying organized and proactive, businesses can streamline the tax filing process and reduce the risk of errors. Employers can also seek assistance from tax professionals or use online tax software to ensure that Form 940 is completed correctly.

In conclusion, IRS Form 940 for 2025 is a vital document that employers must be familiar with as tax season approaches. By understanding the purpose of Form 940 and how to properly fill it out, businesses can fulfill their FUTA tax obligations and avoid any potential penalties. Accessing the printable version of Form 940 on the IRS website and keeping accurate records throughout the year will help ensure a smooth tax filing process for businesses of all sizes.

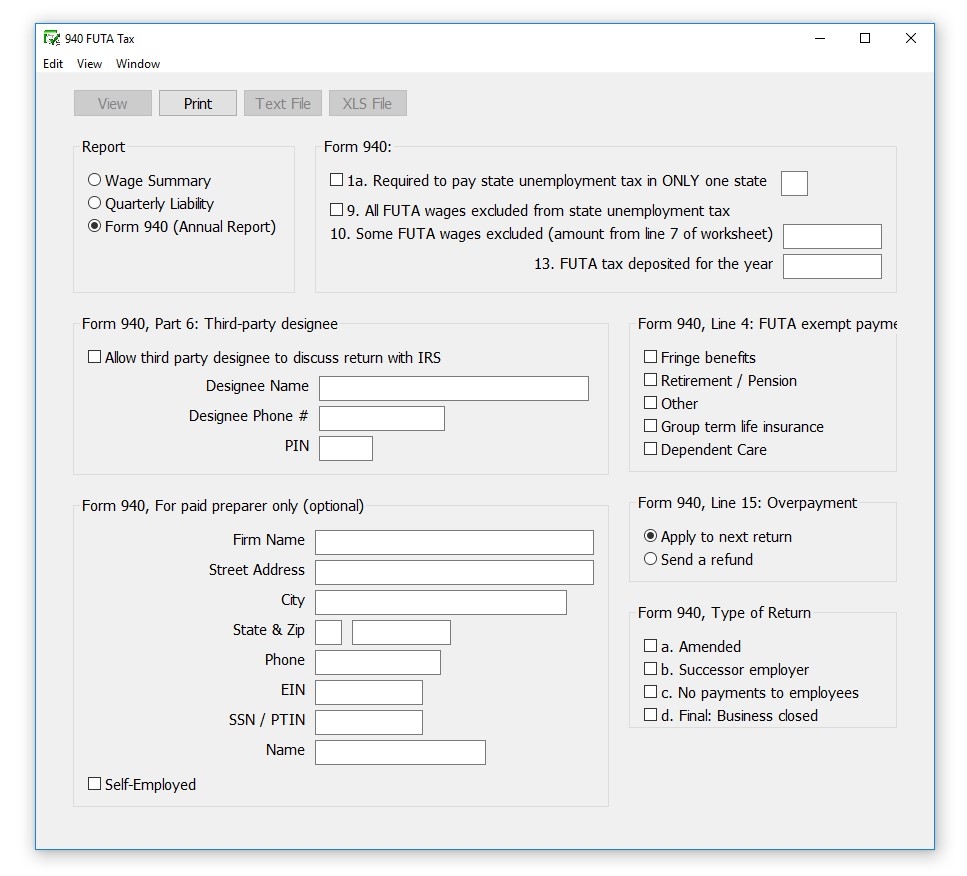

How To Create 940 Reports In CheckMark Payroll Software

How To Create 940 Reports In CheckMark Payroll Software

E File 941 For 2024 File 940 944 U0026 941 Schedule R Online

E File 941 For 2024 File 940 944 U0026 941 Schedule R Online

How To File Form 940 The Employer S Annual Federal Unemployment

How To File Form 940 The Employer S Annual Federal Unemployment

Need a hassle-free method to take care of your finances? The Irs Form 940 For 2025 Printable give you a user-friendly, secure, and customizable alternative from the comfort of your home. Be it for individual purposes, home businesses, or keeping track of expenses, printable checks help you save both time and cash without lowering security. Works well with common finance software and print-ready by design, they’re a wise option to bank-ordered checks. Begin printing now and take full control of your payments—no delays, zero charges. Check out our ready-to-use templates and select the one that fits your needs. With our easy-to-use tools, financial management has never been this streamlined. Download your printable checks for free and optimize your check-writing process with ease!.