When it comes to filing your taxes, it’s crucial to have all the necessary forms ready to ensure accuracy and compliance with IRS regulations. One such form that is essential for individuals who have received advance premium tax credits is IRS Form 8962. This form is used to reconcile the amount of premium tax credit you received in advance with the actual amount you are eligible for based on your income and family size.

By filling out IRS Form 8962, you can determine if you owe additional taxes or are eligible for a refund based on your premium tax credit. It’s important to complete this form accurately to avoid any potential penalties or delays in processing your tax return. While the form can be quite complex, there are printable versions available online that can make the process easier for you.

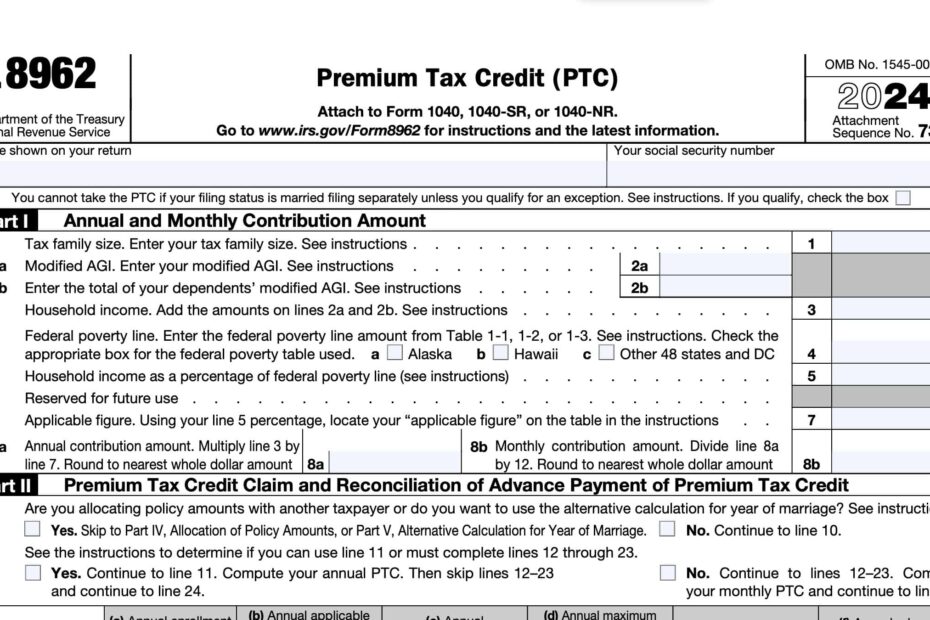

Get and Print Irs Form 8962 Printable

Tax Season 2019 File IRS Form 8962 For Health Insurance Credit

Tax Season 2019 File IRS Form 8962 For Health Insurance Credit

IRS Form 8962 Printable

IRS Form 8962 is a two-page document that requires you to provide detailed information about your household income, family size, and the amount of premium tax credit you received during the tax year. By using the printable version of the form, you can easily fill it out by hand and then submit it along with your tax return. This can be particularly helpful for individuals who prefer to file their taxes manually or do not have access to tax preparation software.

It’s important to note that IRS Form 8962 must be filed if you received advance premium tax credits through the Health Insurance Marketplace. Failure to do so could result in penalties or delays in receiving any tax refunds you may be entitled to. By using the printable version of the form, you can ensure that all the necessary information is included and avoid any potential errors that could impact your tax return.

Overall, IRS Form 8962 is a critical document for individuals who have received advance premium tax credits and need to reconcile them with their actual tax credit eligibility. By using the printable version of the form, you can simplify the process of filling it out and ensure that your tax return is accurate and compliant with IRS regulations. Be sure to download the form from the official IRS website or a reputable tax preparation resource to ensure that you have the most up-to-date version.

In conclusion, IRS Form 8962 Printable is a valuable tool for individuals who have received advance premium tax credits and need to reconcile them with their actual tax credit eligibility. By using the printable version of the form, you can streamline the process of filling it out and avoid any potential errors that could impact your tax return. Make sure to include this form when filing your taxes to ensure compliance with IRS regulations and avoid any penalties or delays in processing your return.