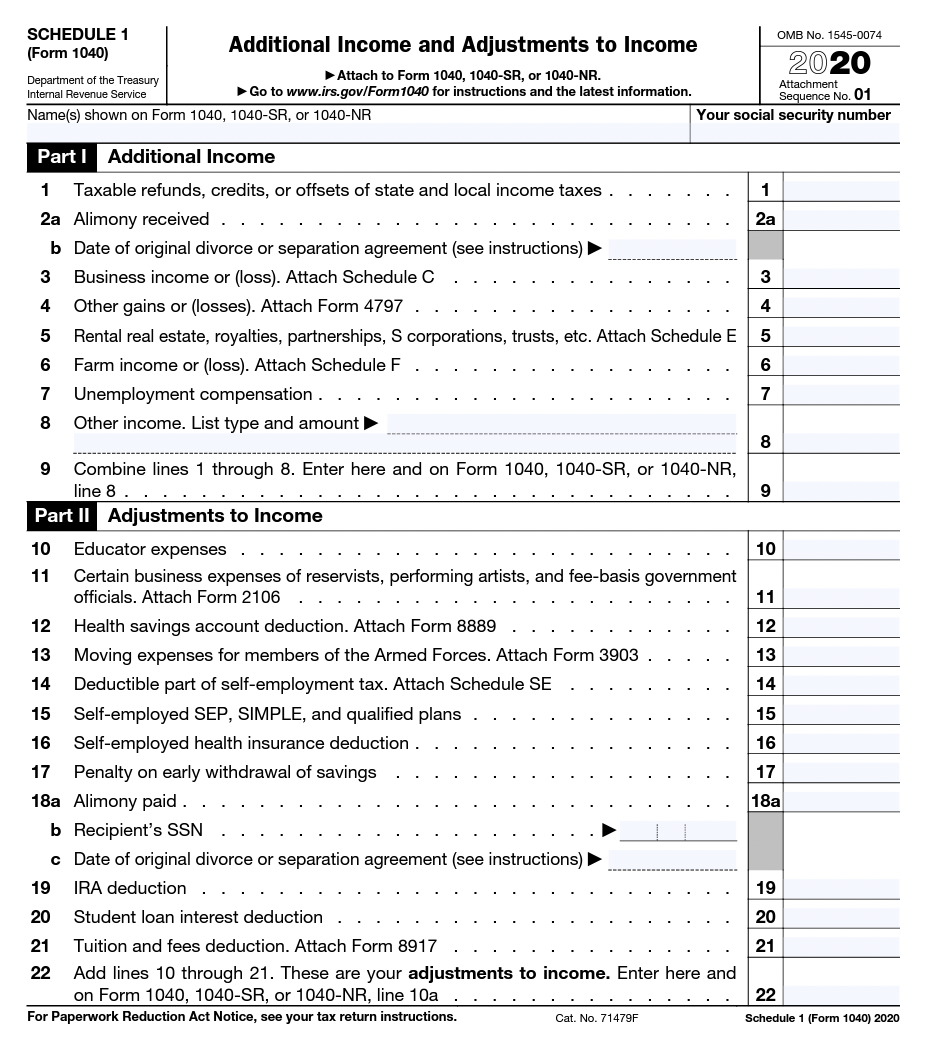

IRS Form 8889 is a crucial document for individuals who have a Health Savings Account (HSA). This form is used to report contributions and distributions from your HSA, as well as any other relevant information such as excess contributions or qualified medical expenses.

It is important to understand how to properly fill out Form 8889 to avoid any potential issues with the IRS. Fortunately, the IRS provides a printable version of Form 8889 on their website, making it easy for taxpayers to access and complete the form.

Easily Download and Print Irs Form 8889 Printable

Most Commonly Requested Tax Forms Tuition ASU

Most Commonly Requested Tax Forms Tuition ASU

IRS Form 8889 Printable

When filling out Form 8889, you will need to provide information about your HSA contributions, distributions, and any other relevant details. The printable version of Form 8889 can be easily downloaded from the IRS website and filled out by hand.

Make sure to carefully follow the instructions provided on the form to ensure that you are accurately reporting all necessary information. It is important to double-check your entries and calculations to avoid any errors that could lead to penalties or delays in processing your tax return.

Once you have completed Form 8889, you will need to attach it to your tax return when filing with the IRS. Be sure to keep a copy of the form for your records in case you need to refer back to it in the future.

If you are unsure about how to fill out Form 8889 or have any questions about your HSA, it is recommended to seek advice from a tax professional or financial advisor. They can provide guidance and ensure that you are accurately reporting your HSA contributions and distributions on your tax return.

By using the printable version of IRS Form 8889 and following the instructions provided, you can easily report your HSA activity to the IRS and avoid any potential issues with your tax return. Be sure to stay organized and keep track of all relevant documentation to make the process as smooth as possible.

In conclusion, IRS Form 8889 is an important document for individuals with a Health Savings Account. By utilizing the printable version of Form 8889 and following the instructions provided, you can accurately report your HSA activity and avoid any potential issues with the IRS.