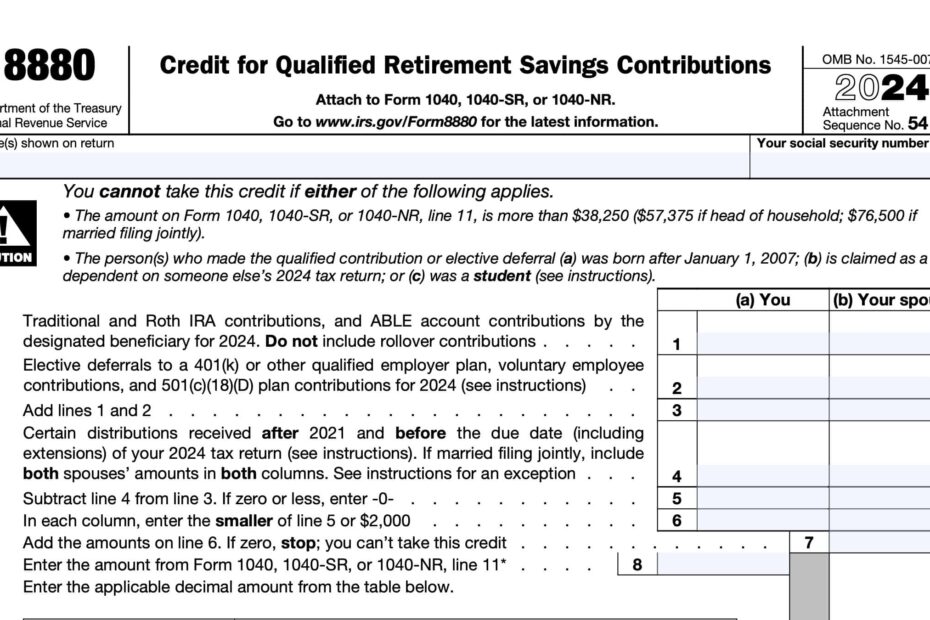

IRS Form 8880, also known as the Credit for Qualified Retirement Savings Contributions, is a form used by taxpayers to claim a tax credit for contributions made to eligible retirement savings plans. This form can help individuals save money on their taxes while also encouraging them to save for retirement.

For those looking to take advantage of this tax credit, having a printable version of IRS Form 8880 can make the process much simpler. By filling out this form accurately and submitting it along with your tax return, you may qualify for a valuable tax credit that can help you boost your retirement savings.

Download and Print Irs Form 8880 Printable

3 11 3 Individual Income Tax Returns Internal Revenue Service

3 11 3 Individual Income Tax Returns Internal Revenue Service

When filling out IRS Form 8880, you will need to provide information about your contributions to eligible retirement savings plans, such as traditional or Roth IRAs, 401(k) plans, or similar accounts. The form will calculate the amount of the tax credit you are eligible for based on your income and contributions.

It’s important to note that the IRS Form 8880 Printable is only for informational purposes and cannot be submitted as your official tax return. You will need to fill out the form electronically or by hand and mail it in along with your other tax documents to claim the tax credit.

Before completing IRS Form 8880, be sure to carefully read the instructions provided by the IRS to ensure you are eligible for the tax credit and to avoid any errors that could delay the processing of your tax return. Taking the time to fill out this form accurately can help you maximize your tax savings and secure your financial future.

In conclusion, IRS Form 8880 Printable is a valuable tool for taxpayers looking to claim a tax credit for their retirement savings contributions. By following the instructions and accurately filling out this form, you can potentially save money on your taxes while also building a more secure financial future. Take advantage of this opportunity to boost your retirement savings and secure your financial well-being.