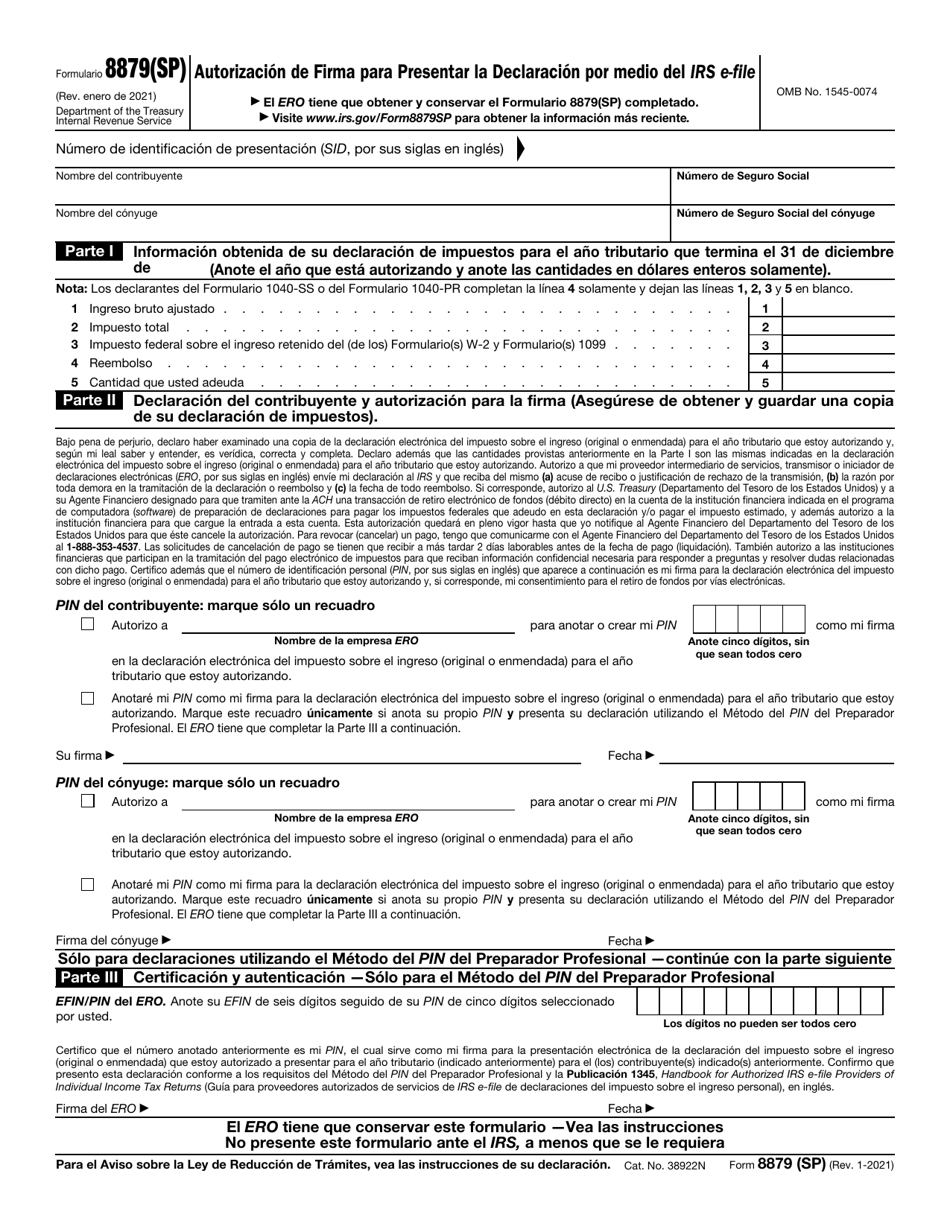

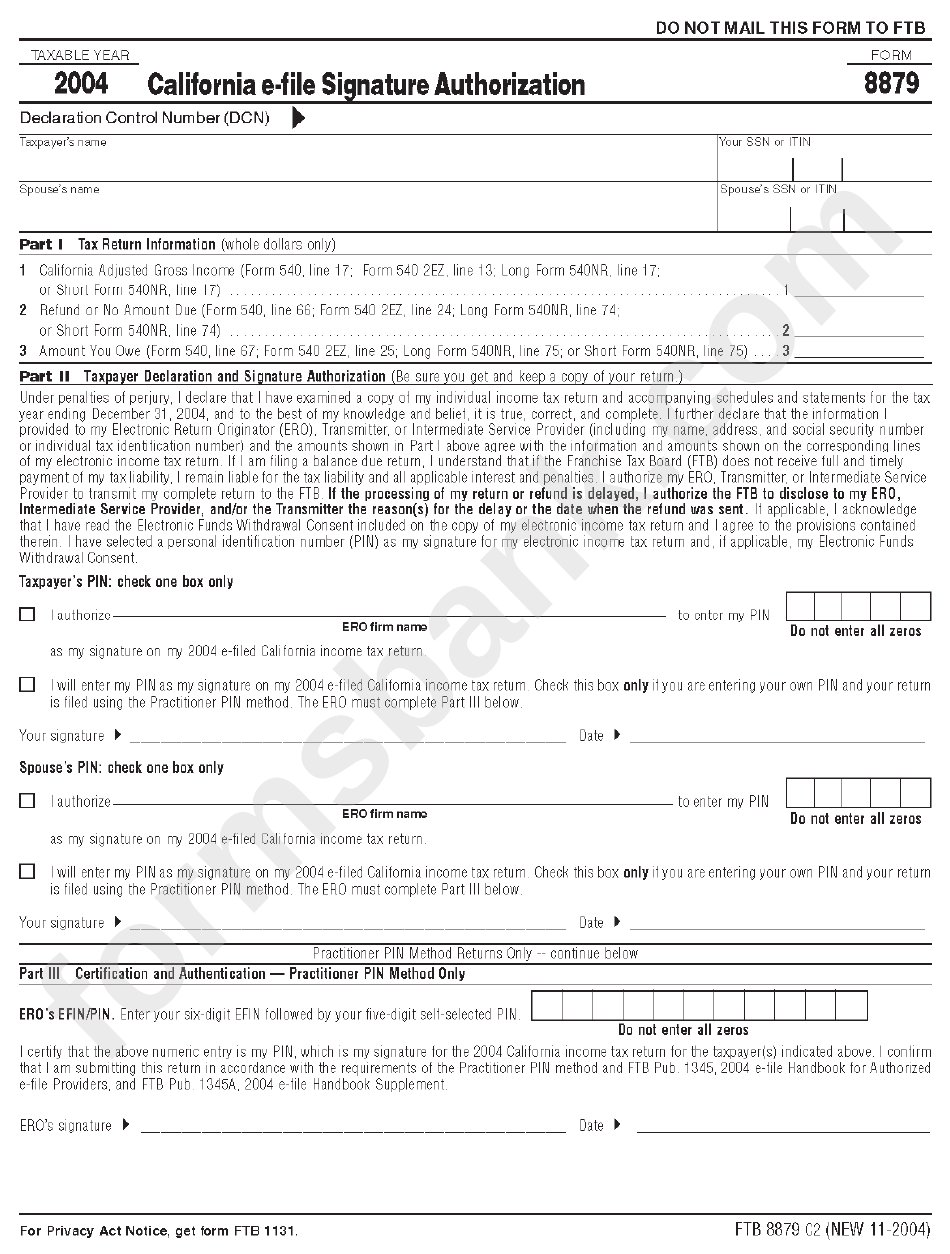

IRS Form 8879 is a document used by taxpayers to authorize their tax preparers to electronically file their tax returns. This form is crucial in the e-filing process as it allows tax professionals to submit returns on behalf of their clients. It serves as a signature authorization for the IRS to accept the electronically filed return.

By signing Form 8879, taxpayers are giving their tax preparers permission to file their tax return electronically. This form is necessary for tax preparers to submit returns on their client’s behalf. It ensures that all parties involved are in agreement and that the return is accurately filed with the IRS.

Save and Print Irs Form 8879 Printable

When it comes to filing taxes, accuracy and efficiency are key. IRS Form 8879 Printable makes the e-filing process easier for both taxpayers and tax professionals. It streamlines the process and ensures that all necessary authorizations are in place before submitting the return to the IRS.

Form 8879 requires both the taxpayer and the tax preparer to sign and date the document. This serves as a verification that the taxpayer has reviewed and approved the return before it is filed. This added layer of security helps prevent any potential errors or discrepancies in the filing process.

Once the form is signed and dated, it should be kept on file by the tax preparer for a minimum of three years. This is in case the IRS requests a copy of the form for verification purposes. By keeping accurate records of Form 8879, tax professionals can ensure compliance with IRS regulations and provide necessary documentation if needed.

In conclusion, IRS Form 8879 Printable is a crucial document in the e-filing process. It authorizes tax professionals to submit tax returns electronically on behalf of their clients, streamlining the process and ensuring accuracy. By following the necessary steps and keeping accurate records, tax preparers can effectively file returns and maintain compliance with IRS regulations.