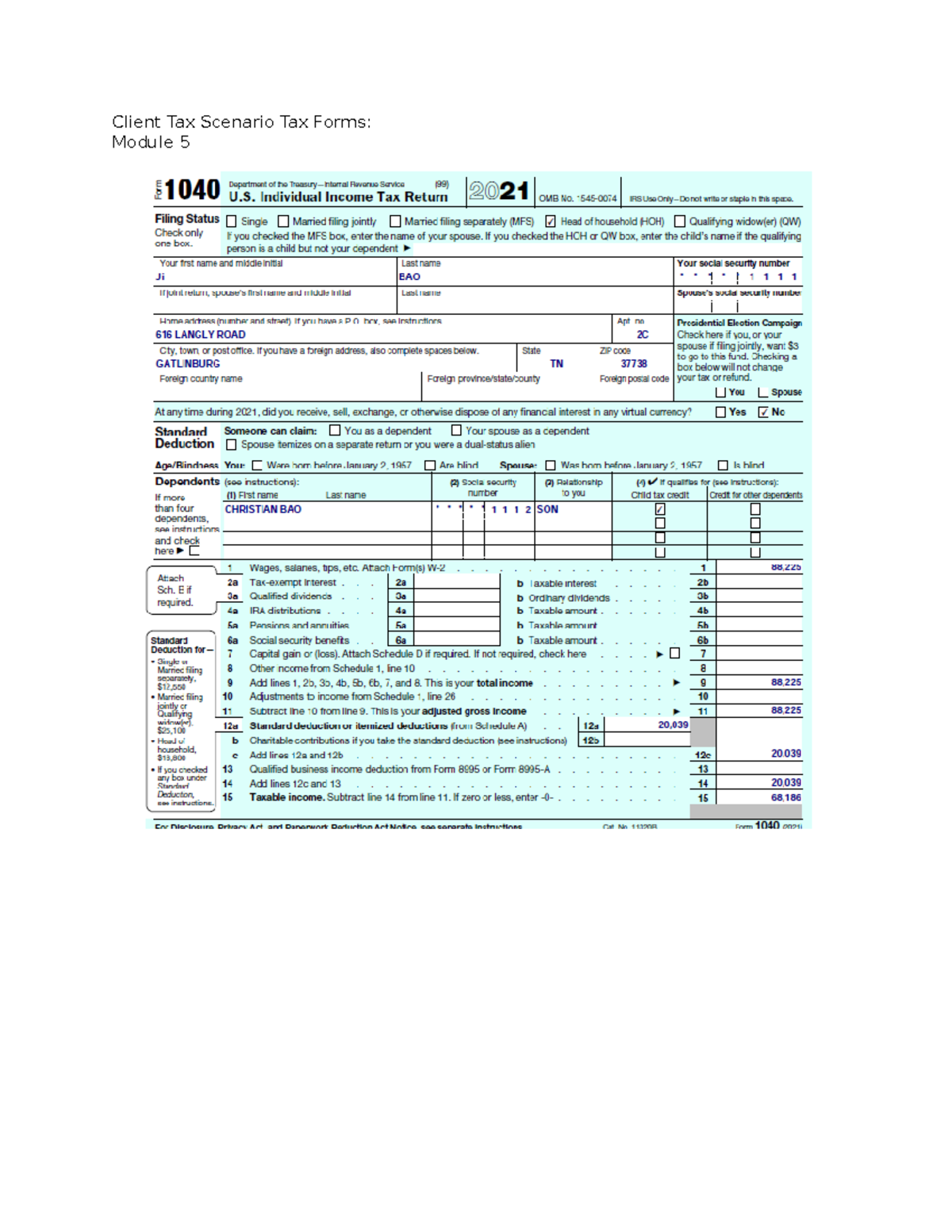

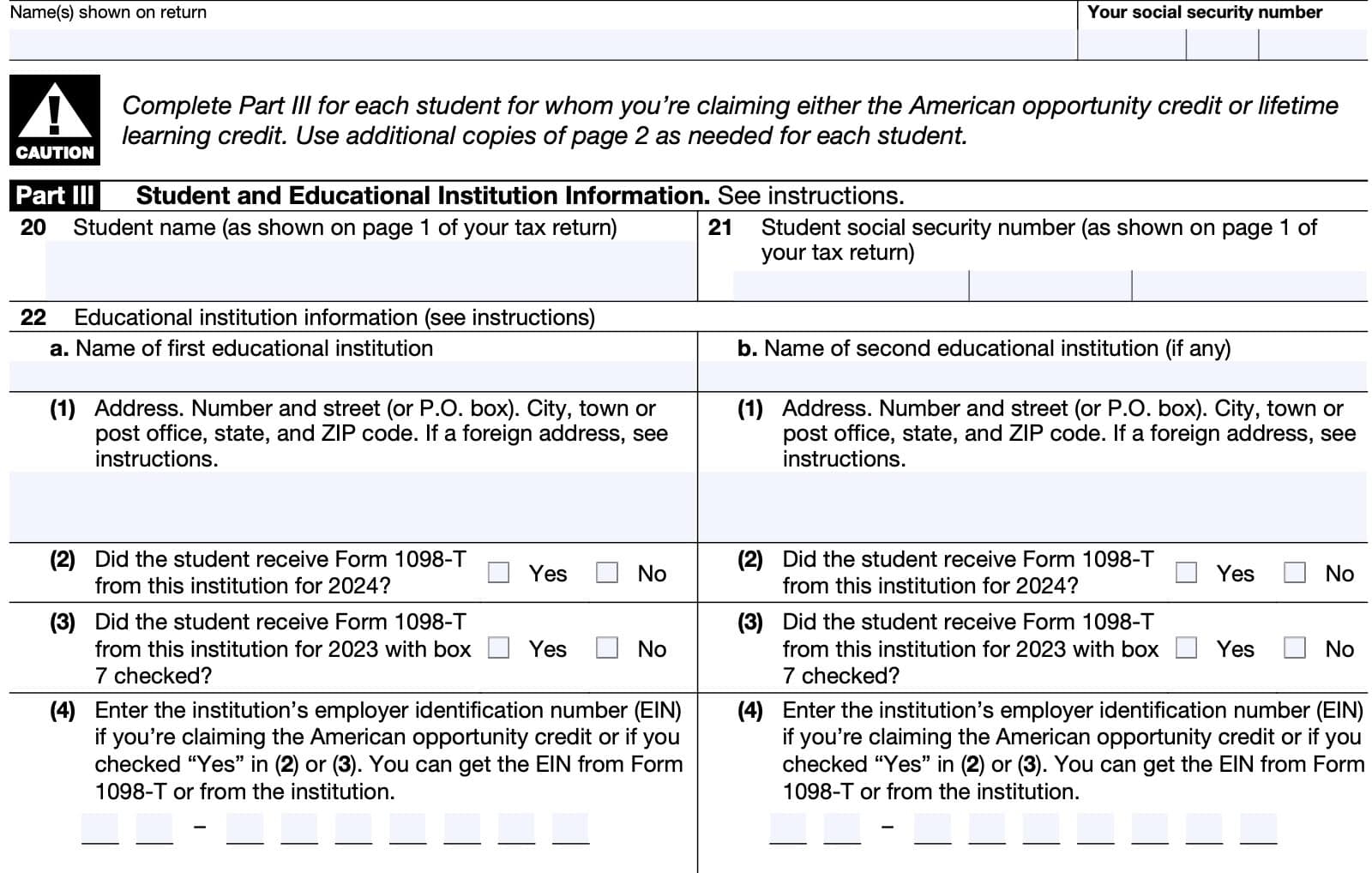

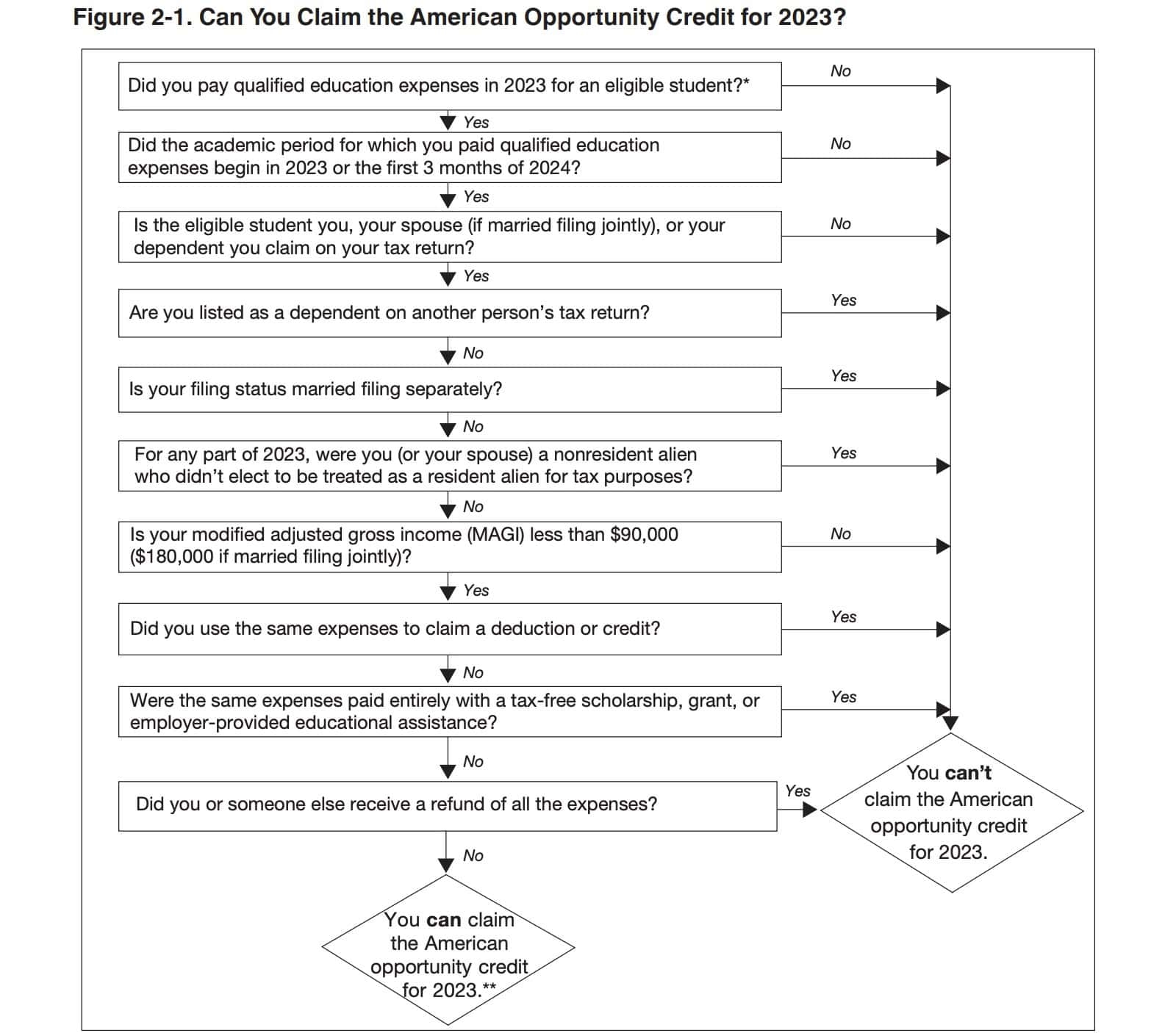

As tax season approaches, many individuals are beginning to gather their necessary documents in order to file their taxes. One important form that taxpayers may need to complete is Form 8863, which is used to claim education credits. This form allows taxpayers to claim the American Opportunity Credit or the Lifetime Learning Credit, both of which can help offset the costs of higher education expenses.

Form 8863 can be a crucial document for individuals who are pursuing higher education or who have dependents attending college. By claiming education credits on this form, taxpayers may be able to reduce their tax liability and potentially receive a refund. It is important to accurately complete this form in order to maximize the benefits available.

Save and Print Irs Form 8863 Printable

Form 8863 For 2024 2025 Fill Out And Download With PDF Guru

Form 8863 For 2024 2025 Fill Out And Download With PDF Guru

When looking for Form 8863, taxpayers have the option to download and print a copy from the IRS website. The printable version of the form is easily accessible and can be filled out by hand or electronically, depending on individual preference. By having a physical copy of the form, taxpayers can ensure that they have all the necessary information readily available when it comes time to file their taxes.

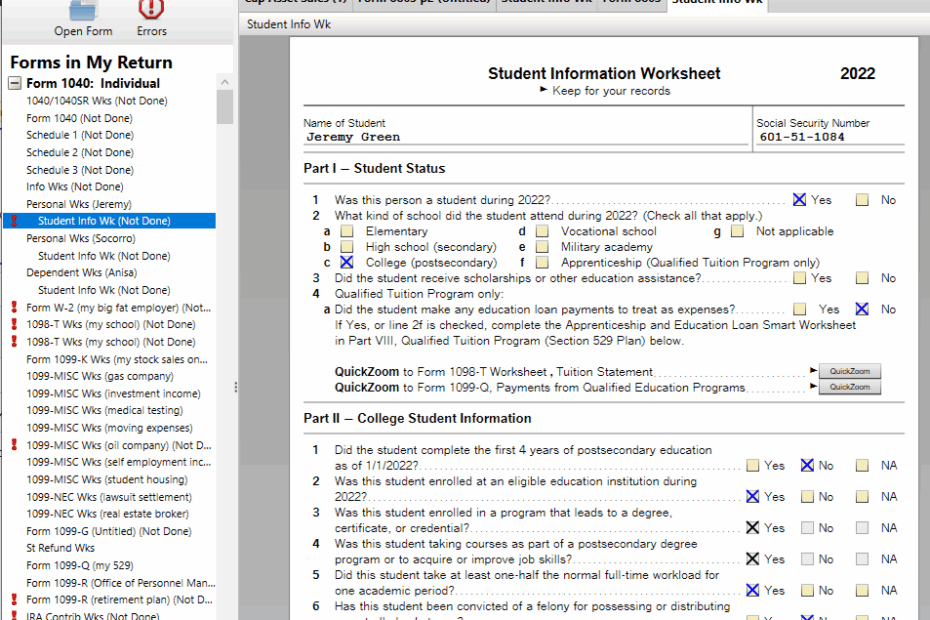

It is important to note that Form 8863 has specific eligibility requirements in order to claim education credits. Taxpayers must meet certain criteria related to enrollment status, qualified expenses, and income limits in order to qualify for the credits. By carefully reviewing the instructions provided with the form, individuals can ensure that they meet all necessary requirements before submitting their tax return.

Overall, Form 8863 is a valuable tool for taxpayers who are looking to offset the costs of higher education expenses. By claiming education credits on this form, individuals can potentially receive a tax break and reduce their overall tax liability. As tax season approaches, it is important to gather all necessary documents, including Form 8863, in order to accurately complete your tax return and maximize your potential benefits.

In conclusion, Form 8863 is an essential document for individuals looking to claim education credits on their tax return. By utilizing the printable version of the form, taxpayers can easily access and complete the necessary information in order to potentially receive a tax break. As tax season approaches, be sure to gather all necessary documents, including Form 8863, to ensure a smooth and accurate filing process.

Form 8863 For 2024 2025 Fill Out And Download With PDF Guru

Form 8863 For 2024 2025 Fill Out And Download With PDF Guru

Solved TAX ACTIVITY 2 UfeffComplete Form 8863 UfeffForm 8863 Chegg Worksheets Library

Solved TAX ACTIVITY 2 UfeffComplete Form 8863 UfeffForm 8863 Chegg Worksheets Library

Need a stress-free solution to manage your finances? Our Irs Form 8863 Printable provide a user-friendly, reliable, and editable solution right from home. Be it for your own needs, small businesses, or keeping track of expenses, printable checks help you save money and effort without sacrificing professionalism. Supports popular bookkeeping tools and designed for easy printing, they’re a wise option to pre-ordered checks. Print your own today and take full control of your check issuing—instant access, zero charges. Browse our free templates and choose the one that suits your style. With our intuitive interface, handling your money has never been this easy. Access your Irs Form 8863 Printable and simplify your payments with ease!.