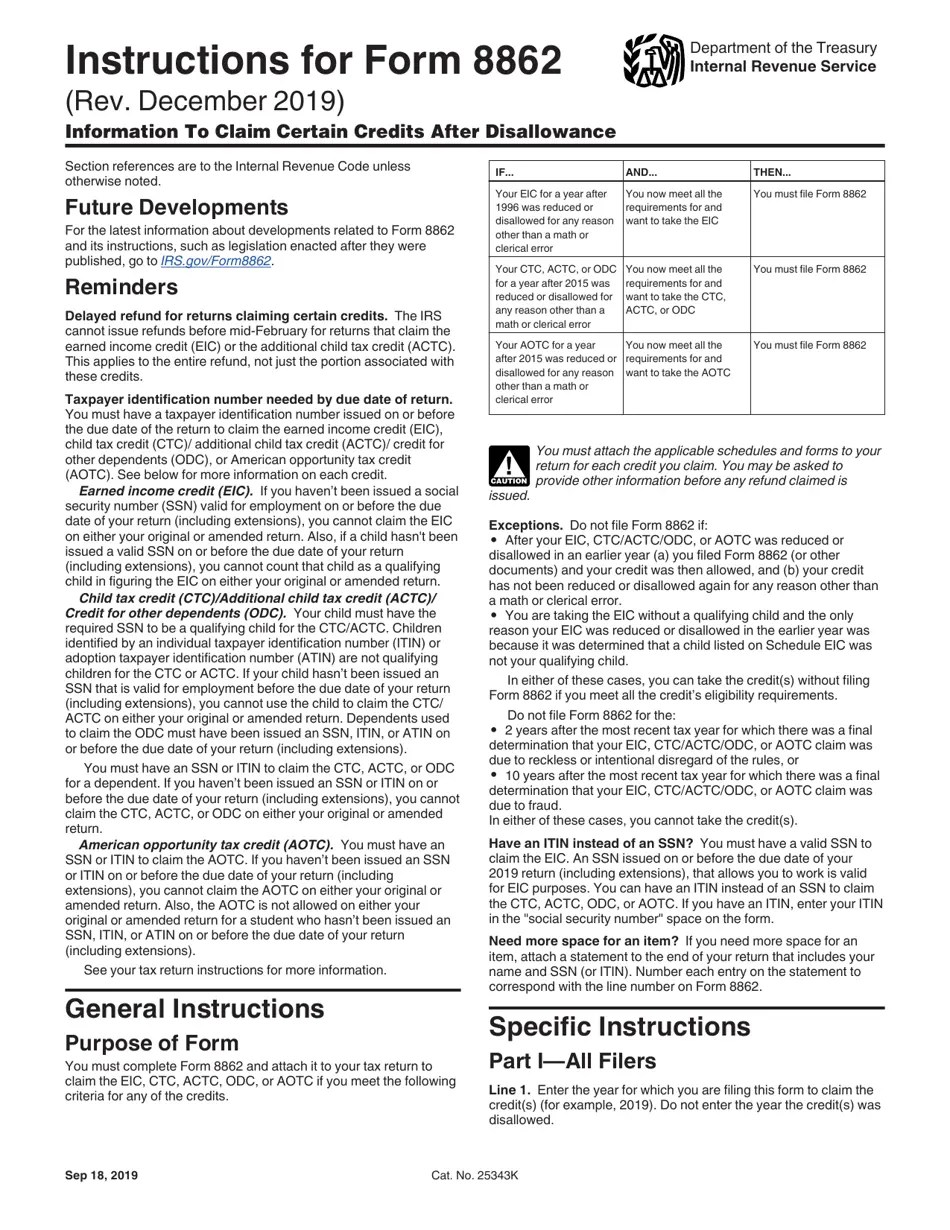

IRS Form 8862, also known as the Information to Claim Earned Income Credit After Disallowance, is a form that taxpayers must fill out if their Earned Income Credit (EIC) was denied in the past and they want to claim it again. This form is used to provide additional information to the IRS to support the claim for EIC.

It is important to note that Form 8862 can only be filed by taxpayers who have had their EIC denied or reduced in the past and are now eligible to claim it again. The form helps the IRS verify that the taxpayer is indeed eligible for the credit and provides the necessary documentation to support the claim.

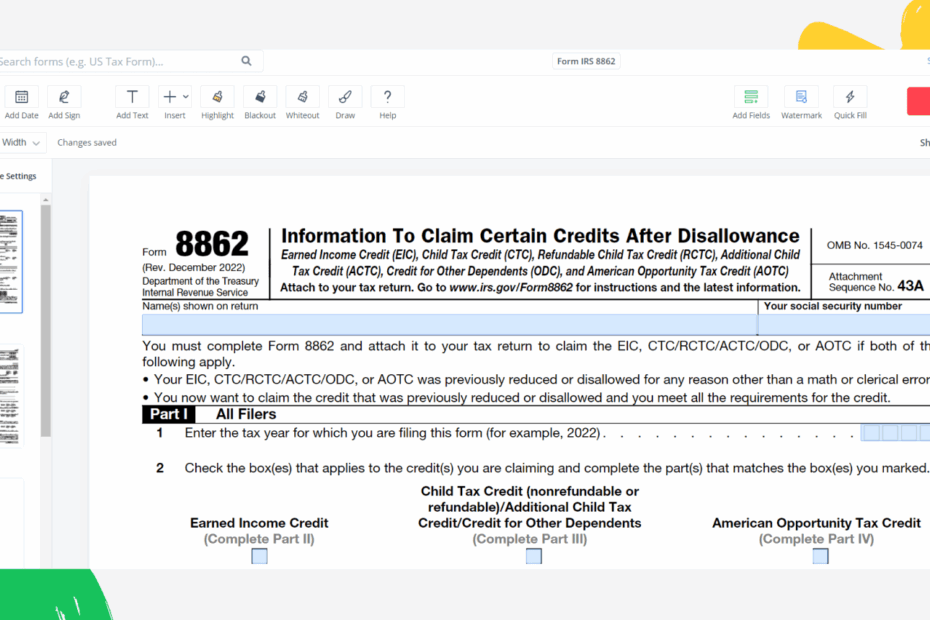

Quickly Access and Print Irs Form 8862 Printable

When filling out Form 8862, taxpayers must provide detailed information about their income, filing status, and dependents. They must also explain why their EIC was denied in the past and provide any additional documentation that supports their claim for the credit.

Once the form is completed, taxpayers can file it along with their tax return to claim the EIC. It is important to fill out the form accurately and provide all the required information to avoid any delays or denials of the credit.

It is recommended to consult with a tax professional or accountant when filling out Form 8862 to ensure that all information is correct and to maximize the chances of having the EIC claim approved by the IRS.

In conclusion, IRS Form 8862 is an important document for taxpayers who have had their EIC denied in the past and are now eligible to claim it again. By providing detailed information and supporting documentation, taxpayers can increase their chances of successfully claiming the credit. It is important to fill out the form accurately and seek professional help if needed to ensure a smooth process.