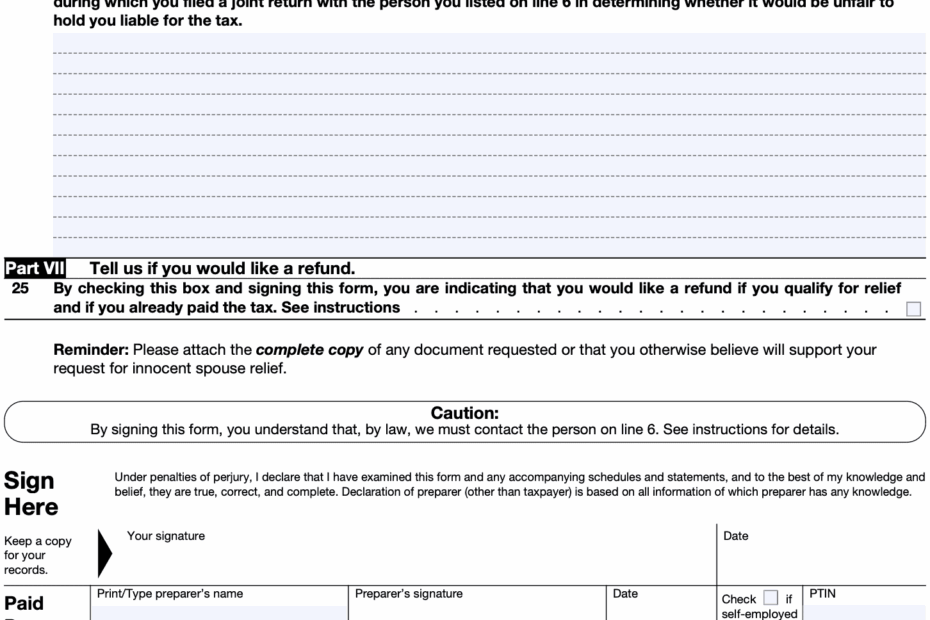

IRS Form 8857, also known as the Request for Innocent Spouse Relief, is a form that allows individuals to request relief from joint liability for taxes, interest, and penalties on a joint tax return. This form is particularly useful for individuals who believe they should not be held responsible for their spouse’s tax liabilities.

By filling out IRS Form 8857, taxpayers can seek relief from the IRS and potentially be granted innocent spouse relief, separation of liability relief, or equitable relief. It’s important to note that there are specific eligibility requirements that must be met in order to qualify for relief under this form.

Download and Print Irs Form 8857 Printable

Fill Form 8857 2024 2025 Create Edit Forms Online

Fill Form 8857 2024 2025 Create Edit Forms Online

When filling out IRS Form 8857, taxpayers will need to provide detailed information about their marital status, financial situation, and the specific tax years for which they are seeking relief. It’s important to carefully review the instructions provided with the form to ensure all necessary information is included.

Once the form is completed, it can be submitted to the IRS for review. The IRS will evaluate the taxpayer’s request and make a determination on whether or not relief will be granted. It’s important to be honest and thorough when completing the form, as any inaccuracies could result in a denial of relief.

Overall, IRS Form 8857 provides individuals with a potential avenue to seek relief from joint tax liabilities. It’s important to carefully review the form and seek assistance from a tax professional if needed to ensure the best possible outcome.

For individuals who believe they may qualify for innocent spouse relief, separation of liability relief, or equitable relief, IRS Form 8857 can be a valuable tool in seeking relief from joint tax liabilities. By carefully completing the form and providing all necessary information, taxpayers can potentially receive the relief they are seeking.

In conclusion, IRS Form 8857 is a valuable resource for individuals seeking relief from joint tax liabilities. By carefully completing the form and following the instructions provided, taxpayers can potentially receive innocent spouse relief, separation of liability relief, or equitable relief from the IRS.