Are you a Canadian citizen who spends a significant amount of time in the United States each year? If so, you may need to file IRS Form 8840 to avoid being considered a U.S. resident for tax purposes. This form is used to claim the Closer Connection Exception, which allows you to maintain your non-resident status even if you spend a substantial amount of time in the U.S.

Form 8840 must be filed annually with the IRS to establish that you have a closer connection to Canada than the U.S. This can help you avoid being subject to U.S. income tax on your worldwide income, as well as other tax obligations that come with being considered a U.S. resident.

Easily Download and Print Irs Form 8840 Printable

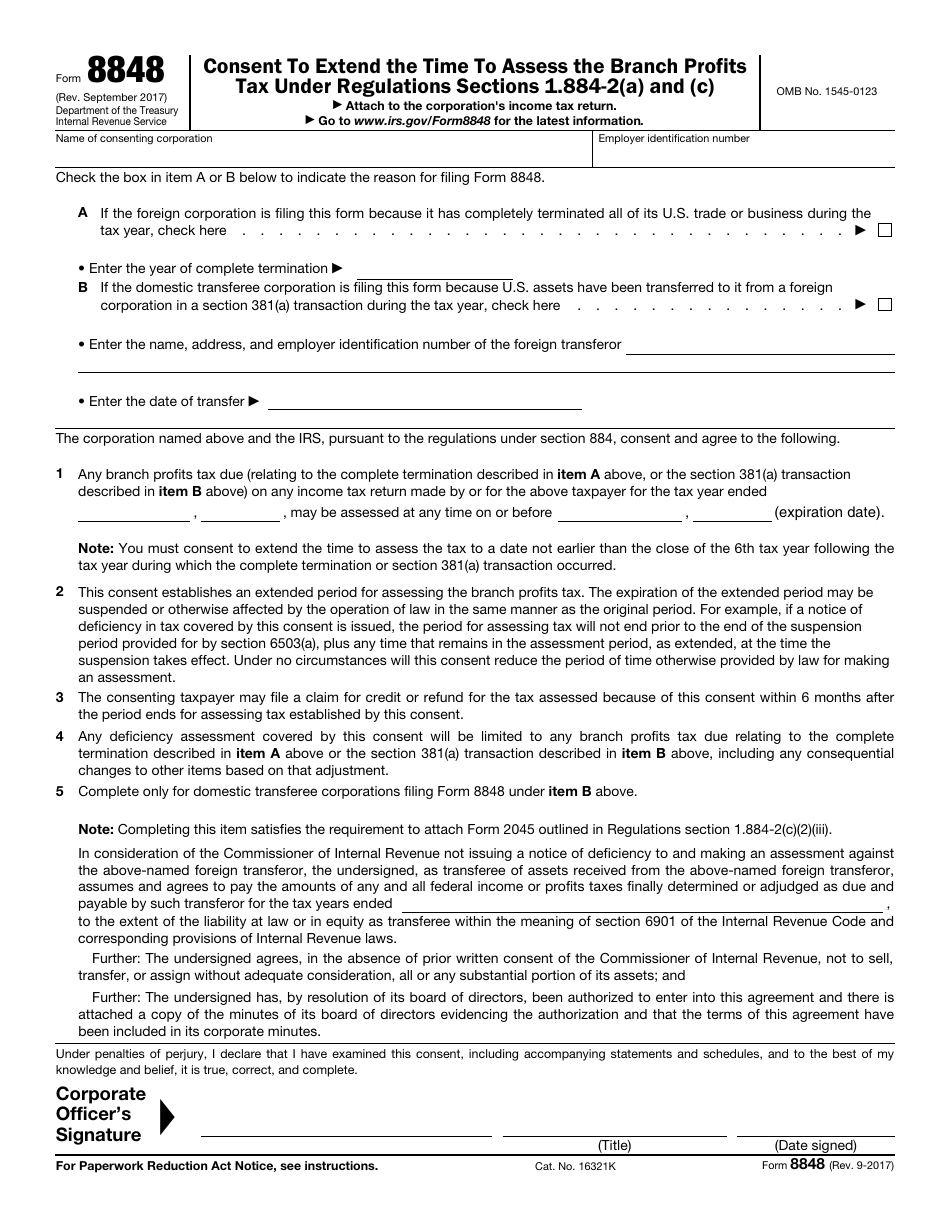

IRS Form 8848 Fill Out Sign Online And Download Fillable PDF Templateroller

IRS Form 8848 Fill Out Sign Online And Download Fillable PDF Templateroller

When completing Form 8840, you will need to provide information about your ties to Canada, such as your permanent home, family, personal belongings, and social, cultural, and economic ties. You must also certify that you do not have a closer connection to the U.S. than to Canada.

It is important to note that Form 8840 must be filed by the due date, which is generally June 15th for Canadian citizens. Failing to file this form could result in being considered a U.S. resident for tax purposes, which may have significant financial implications.

Fortunately, IRS Form 8840 is available for download on the IRS website and can be easily filled out and printed. By completing and submitting this form annually, you can ensure that you maintain your non-resident status and avoid any potential tax issues related to spending time in the U.S.

In conclusion, if you are a Canadian citizen who spends time in the U.S., filing IRS Form 8840 is essential to maintaining your non-resident status for tax purposes. By providing information about your ties to Canada and certifying your closer connection to your home country, you can avoid being considered a U.S. resident and the tax obligations that come with it.