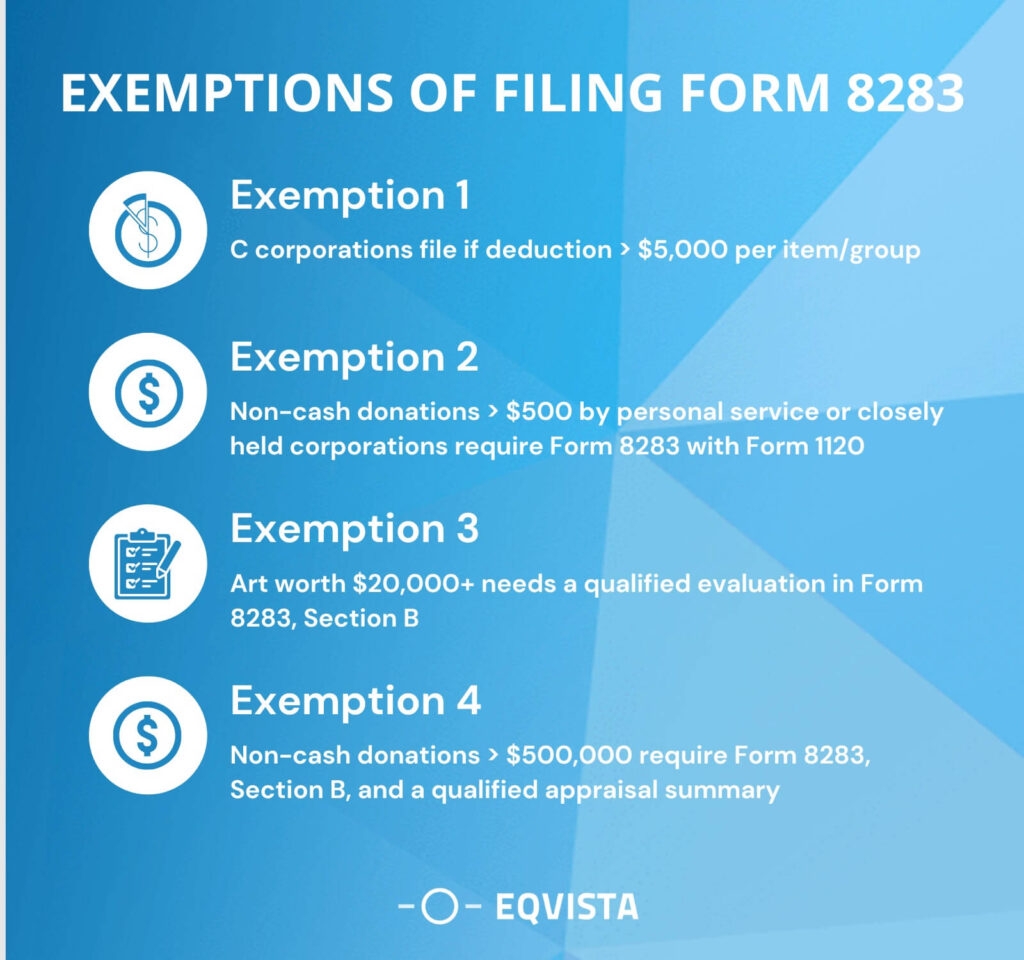

When it comes to tax deductions for charitable contributions, IRS Form 8283 is an essential document that you need to be familiar with. This form is used to report noncash charitable contributions that exceed $500 in value. It is important to accurately fill out this form to ensure compliance with IRS regulations and maximize your tax benefits.

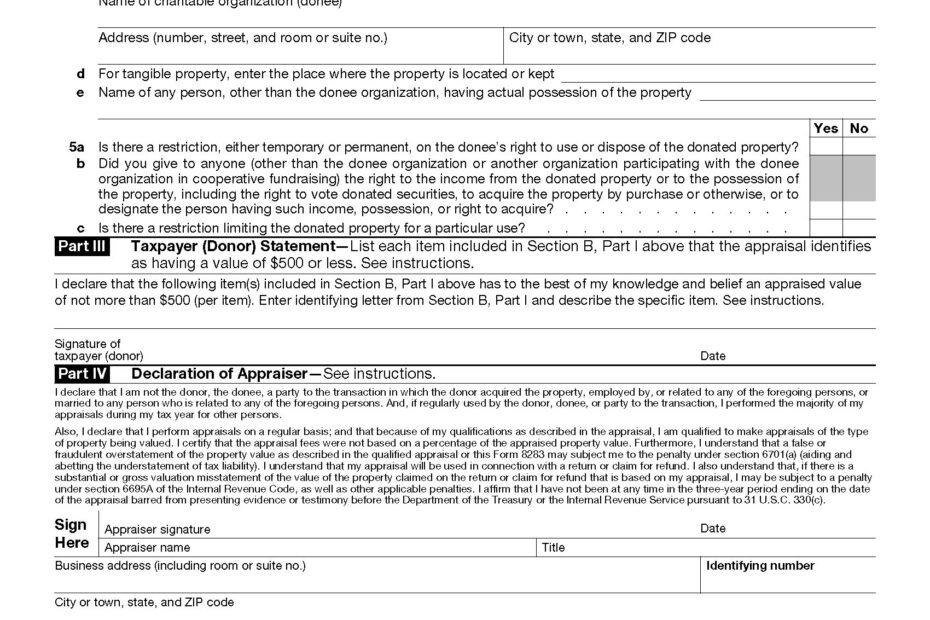

Form 8283 must be filed by taxpayers who make noncash donations such as clothing, household items, vehicles, or securities to qualified organizations. The form requires detailed information about the donated property, including its description, fair market value, and the organization receiving the donation. By properly completing Form 8283, you can claim a deduction on your tax return for the fair market value of the donated items.

Save and Print Irs Form 8283 Printable

Form 8283 Fill Online Printable Fillable Blank

Form 8283 Fill Online Printable Fillable Blank

When filling out Form 8283, it is important to ensure that you have the necessary documentation to support your charitable contributions. This includes receipts, appraisals, or other relevant records that substantiate the value of the donated property. Failure to provide adequate documentation can result in the disallowance of your deduction and potential penalties from the IRS.

IRS Form 8283 is available for download on the IRS website in a printable format. You can easily access the form, fill it out electronically or by hand, and submit it along with your tax return. Be sure to carefully review the instructions provided with the form to ensure accurate completion and compliance with IRS guidelines.

It is important to note that certain types of noncash contributions may require additional documentation or appraisals to support the claimed value. For example, donations of artwork, collectibles, or real estate valued at more than $5,000 may require a qualified appraisal to be attached to Form 8283. Understanding the specific requirements for different types of donations can help you avoid potential issues with the IRS.

In conclusion, IRS Form 8283 is a critical document for reporting noncash charitable contributions on your tax return. By accurately completing this form and providing the necessary documentation, you can take advantage of valuable tax deductions while ensuring compliance with IRS regulations. Make sure to download the printable form from the IRS website and consult with a tax professional if you have any questions about the reporting requirements for your charitable contributions.