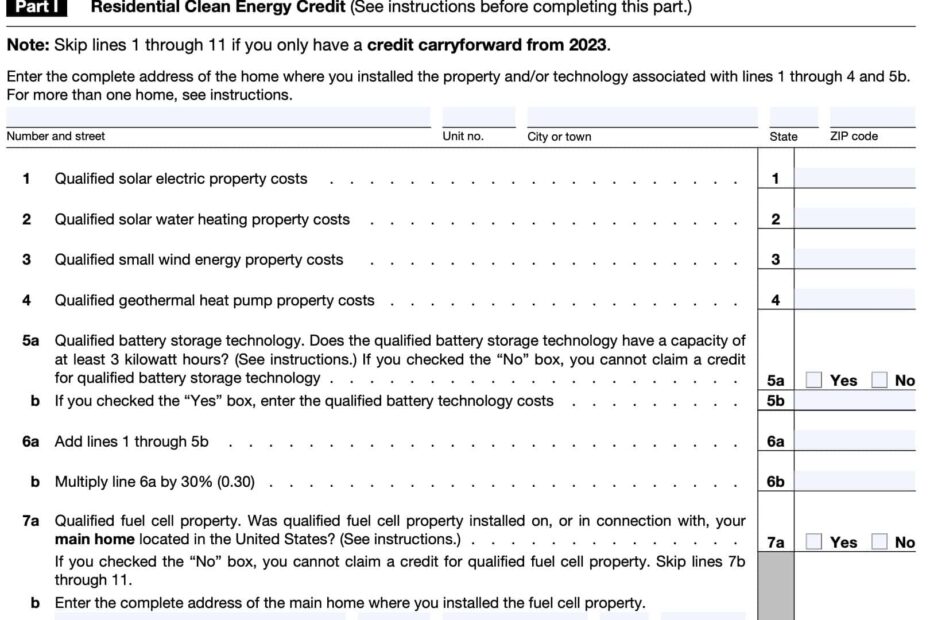

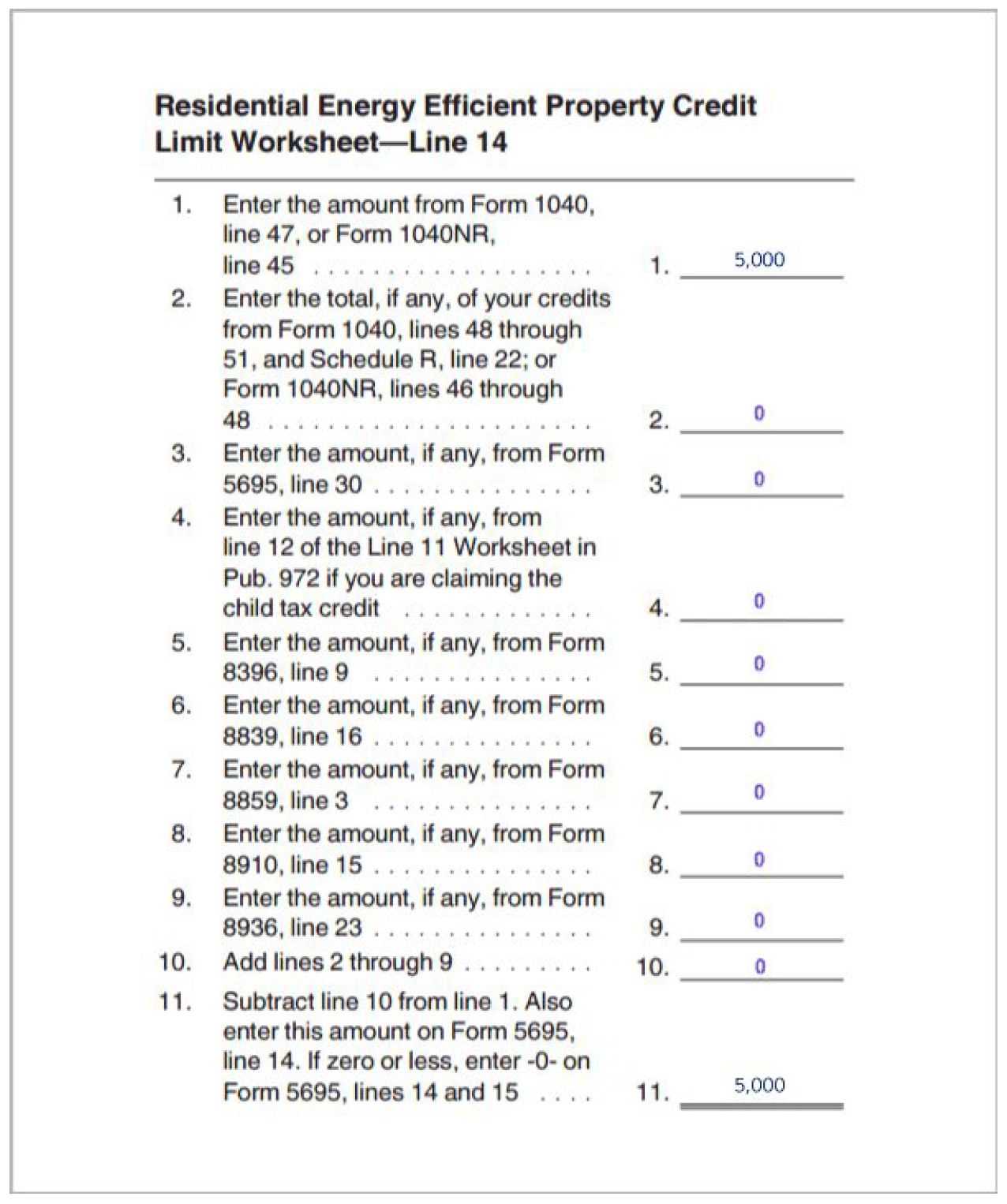

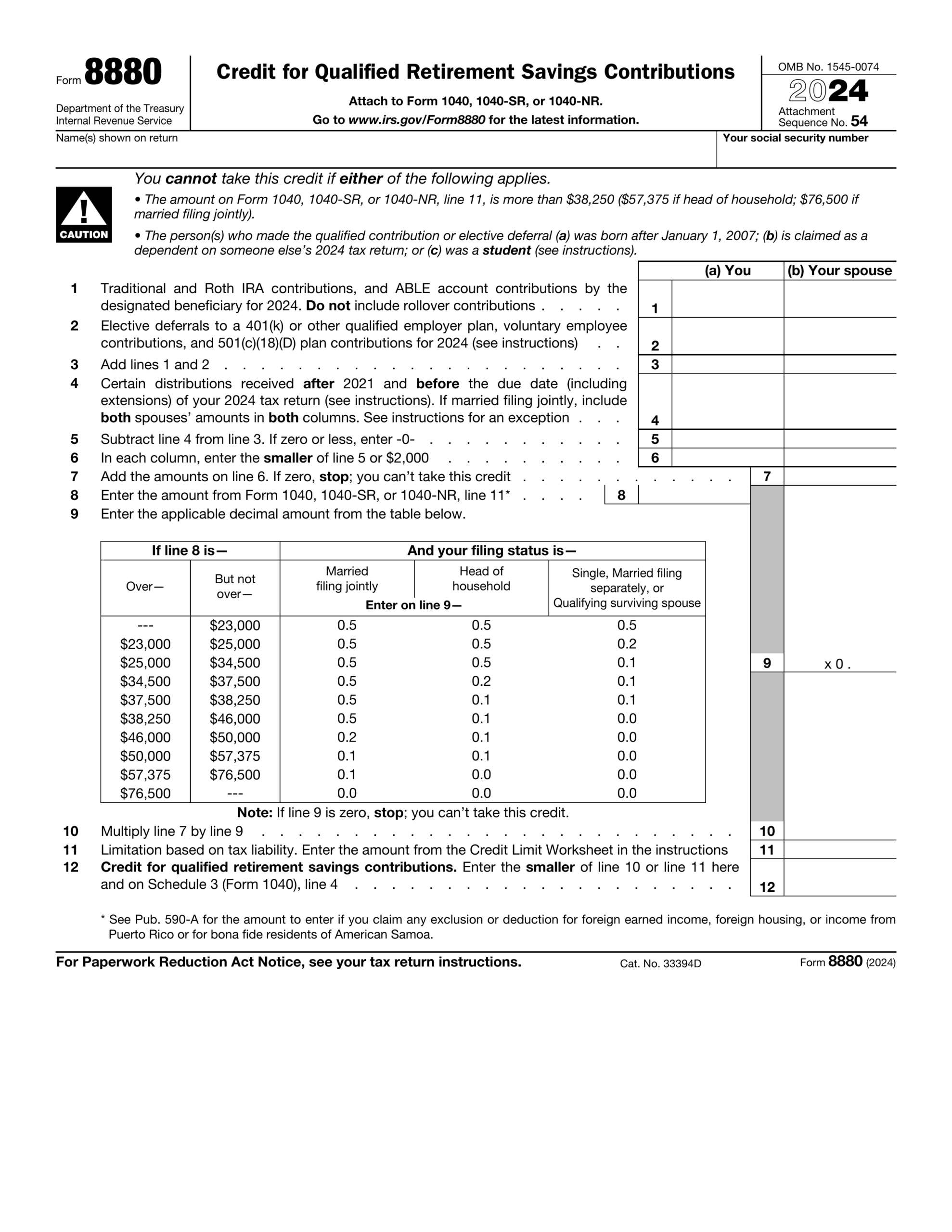

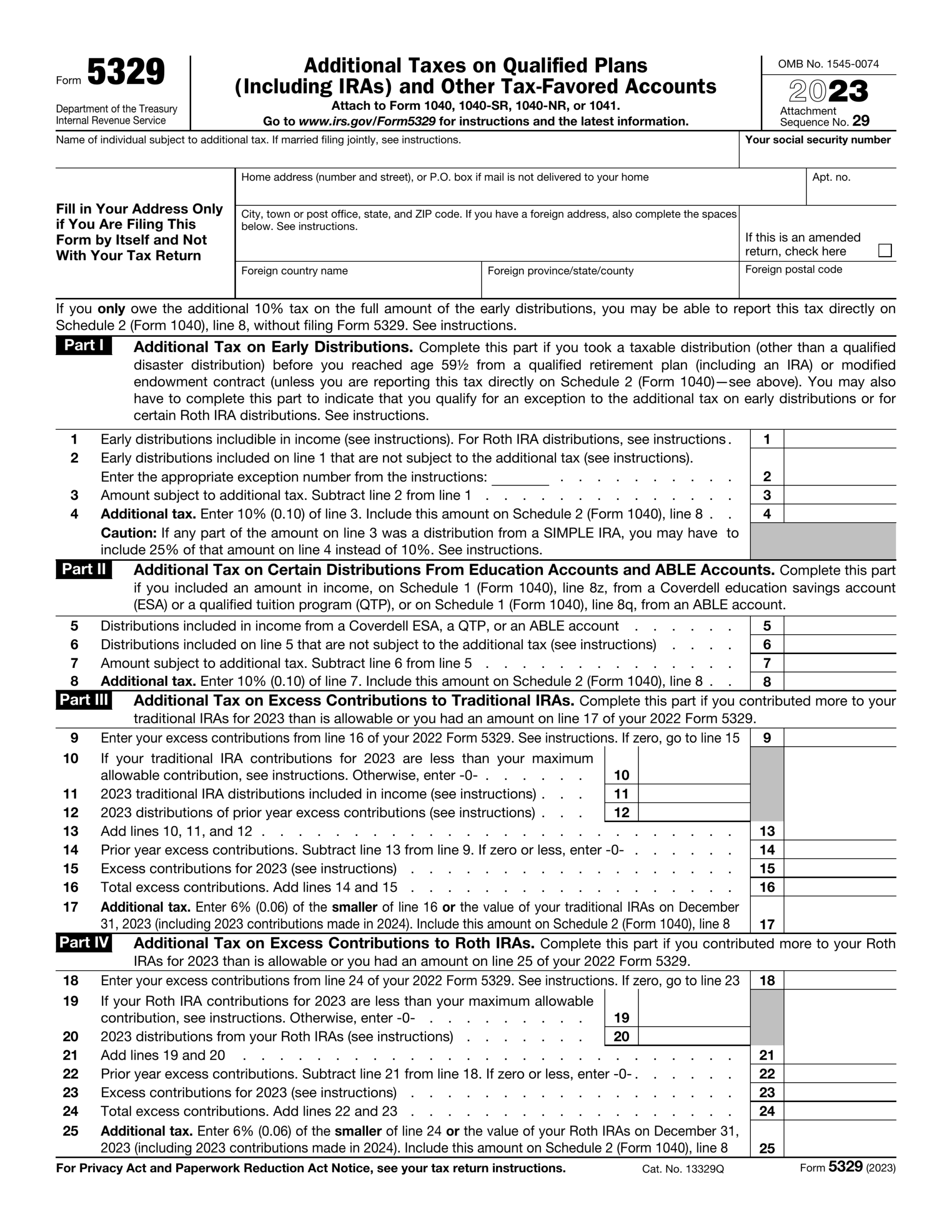

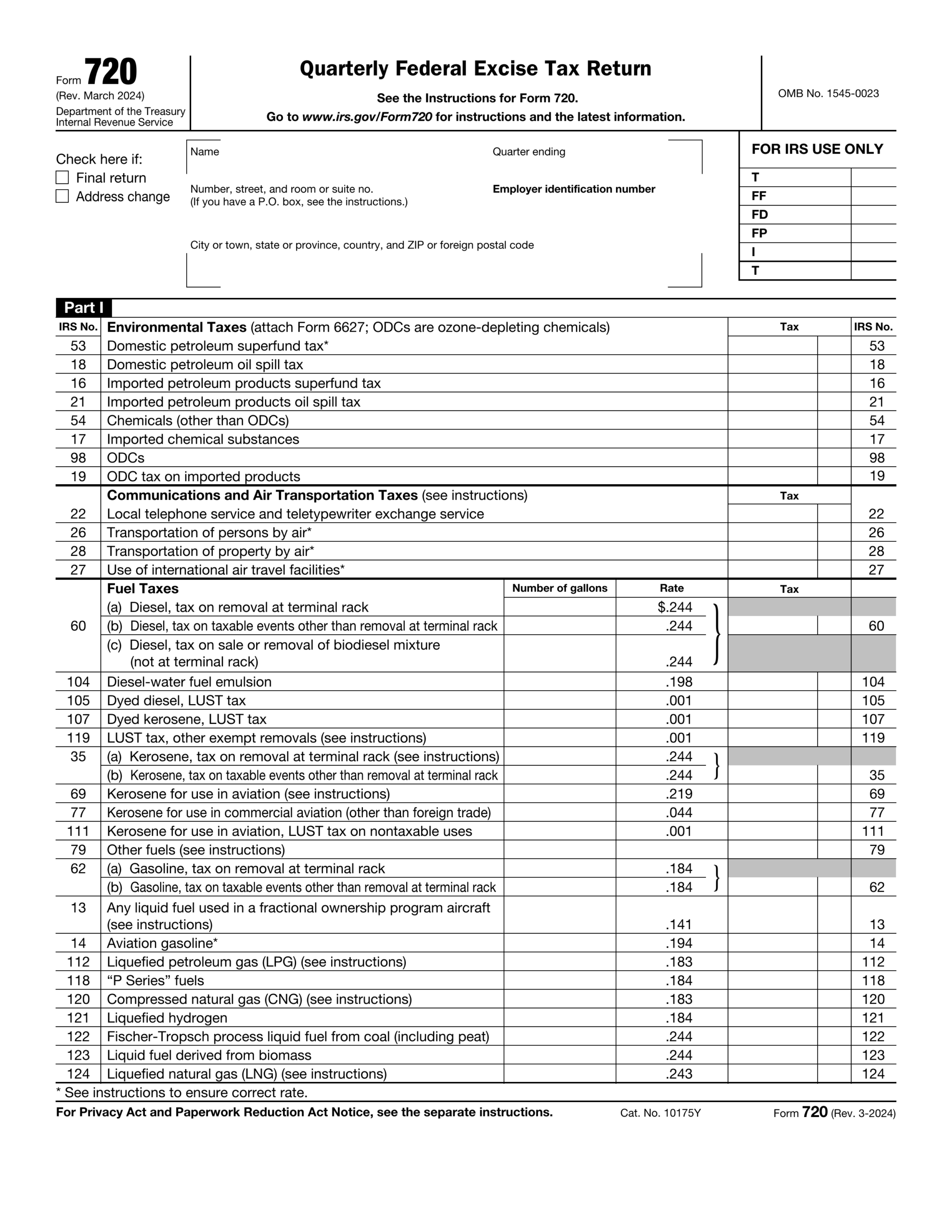

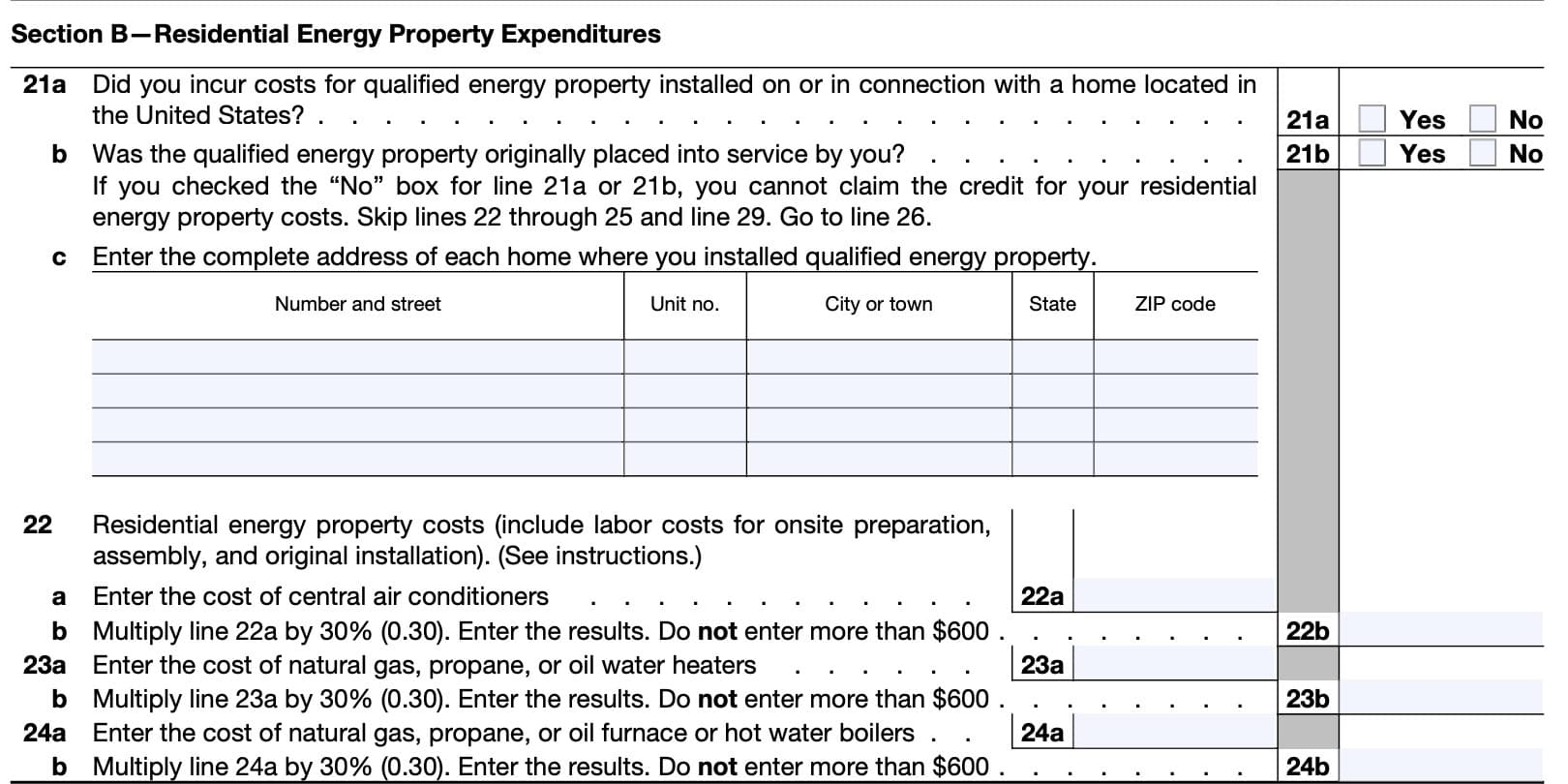

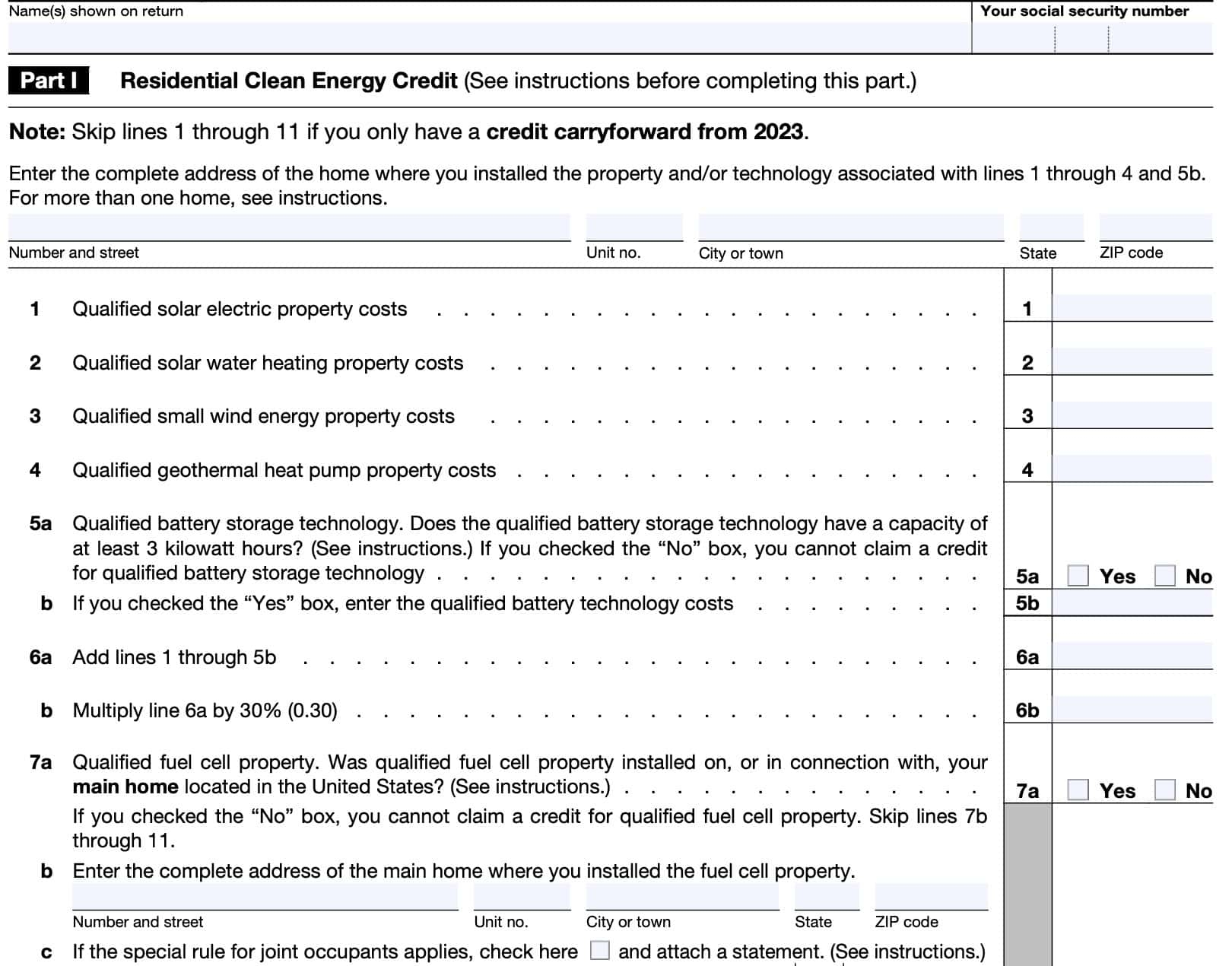

As we approach the tax season for 2024, it’s important to familiarize yourself with the necessary forms to ensure a smooth filing process. One such form is IRS Form 5695, which is used to claim residential energy credits. This form allows taxpayers to receive credits for making energy-efficient improvements to their homes, such as installing solar panels or energy-efficient windows.

By using IRS Form 5695, taxpayers can potentially lower their tax liability while also making environmentally friendly upgrades to their homes. It’s important to note that not all energy-efficient improvements qualify for the credit, so it’s essential to review the guidelines before claiming the credit on your tax return.

Irs Form 5695 For 2024 Printable

Irs Form 5695 For 2024 Printable

Save and Print Irs Form 5695 For 2024 Printable

Form 5695 2024 2025 Fill Out U0026 Download PDF Guru

Form 5695 2024 2025 Fill Out U0026 Download PDF Guru

When filling out IRS Form 5695 for the 2024 tax year, make sure to gather all the necessary documentation to support your claims. This may include receipts for the energy-efficient improvements made to your home, as well as any other relevant information requested on the form. By being thorough and accurate in your reporting, you can avoid potential delays or issues with your tax return.

It’s also worth noting that IRS Form 5695 is available in a printable format on the IRS website, making it easy for taxpayers to access and fill out at their convenience. By downloading and printing the form, you can take your time to ensure all information is entered correctly before submitting it with your tax return.

In conclusion, IRS Form 5695 for the 2024 tax year is an essential document for taxpayers looking to claim residential energy credits. By understanding the eligibility requirements and properly filling out the form, you can potentially lower your tax liability while also making energy-efficient improvements to your home. Be sure to review the guidelines carefully and gather all necessary documentation to support your claims when completing this form.

As tax season approaches, it’s important to be prepared and informed about the forms you’ll need to file your taxes accurately. IRS Form 5695 for 2024 is a valuable tool for homeowners looking to claim energy credits, so be sure to download and print the form to get started on your tax return.

Form 5695 2024 2025 Fill Out U0026 Download PDF Guru

Form 5695 2024 2025 Fill Out U0026 Download PDF Guru

Form 5695 2024 2025 Fill Out U0026 Download PDF Guru

Form 5695 2024 2025 Fill Out U0026 Download PDF Guru

IRS Form 5695 Instructions Residential Energy Credits

IRS Form 5695 Instructions Residential Energy Credits

IRS Form 5695 Instructions Residential Energy Credits

IRS Form 5695 Instructions Residential Energy Credits

Looking for a hassle-free solution to take care of your finances? Our printable checks for free provide a simple, safe, and editable alternative you can use at home. Whether for your own needs, small enterprises, or budgeting, these printable checks save time and money without compromising professionalism. Compatible with most accounting software and print-ready by design, they’re a smart alternative to store-bought checks. Print your own today and fully manage your financial transactions—instant access, zero charges. Explore our ready-to-use templates and pick the one that suits your style. With our beginner-friendly features, financial management has never been this easy. Access your free printable checks and streamline your payments with confidence!.