IRS Form 5329 is used to report additional taxes on IRAs, retirement plans, and certain other tax-favored accounts. It is important for taxpayers to understand when and how to use this form to avoid penalties and potential issues with the IRS.

For the year 2025, the IRS has released a printable version of Form 5329 that can be easily accessed and filled out by taxpayers. This form is crucial for individuals who may have incurred additional taxes on their retirement accounts or other tax-favored investments.

Irs Form 5329 For 2025 Printable

Irs Form 5329 For 2025 Printable

Easily Download and Print Irs Form 5329 For 2025 Printable

IRS Form 5329 What It Is And How To Complete It

IRS Form 5329 What It Is And How To Complete It

What Does Form 5329 Cover?

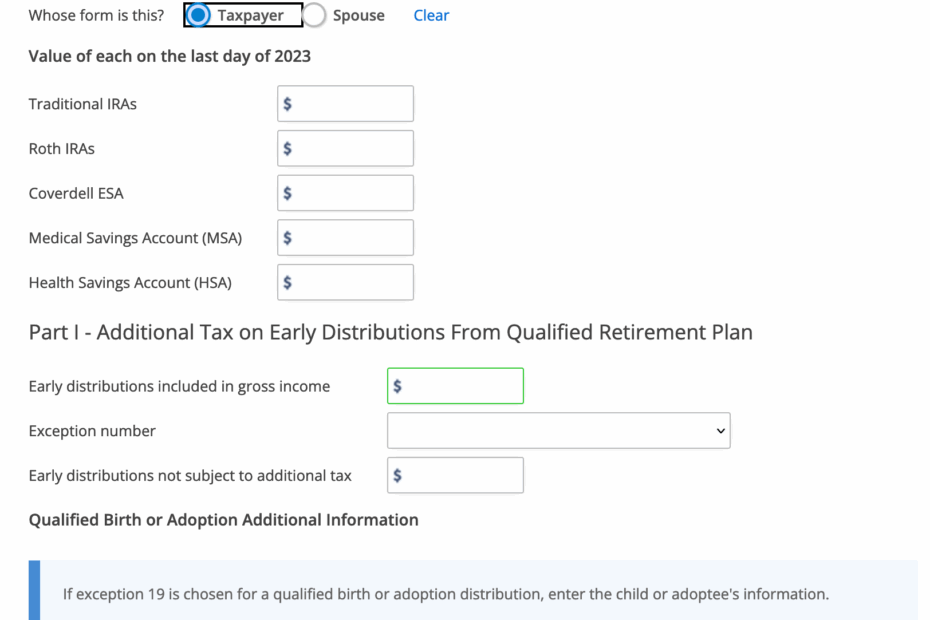

Form 5329 covers a range of tax-related situations, including early withdrawals from retirement accounts, excess contributions to IRAs, and failure to take required minimum distributions (RMDs) from retirement accounts. It is essential for taxpayers to accurately report and address these issues to avoid penalties and ensure compliance with IRS regulations.

When filling out Form 5329 for the year 2025, taxpayers should carefully review their financial records and transactions to accurately report any additional taxes owed. It is recommended to seek guidance from a tax professional or financial advisor if there are any uncertainties or complexities in the tax situation.

By using the printable version of Form 5329 for 2025, taxpayers can easily complete the necessary calculations and submit the form to the IRS. This streamlined process helps individuals stay compliant with tax laws and avoid potential penalties for inaccuracies or omissions in reporting additional taxes.

Overall, IRS Form 5329 for 2025 is a valuable tool for taxpayers to address and resolve tax issues related to retirement accounts and other tax-favored investments. By understanding the purpose of this form and accurately completing it, individuals can maintain good standing with the IRS and ensure their financial security in the long run.

Take advantage of the printable version of Form 5329 for 2025 to stay on top of your tax obligations and avoid potential penalties. By following the instructions provided and seeking assistance if needed, you can effectively navigate the complexities of tax laws and maintain compliance with IRS regulations.