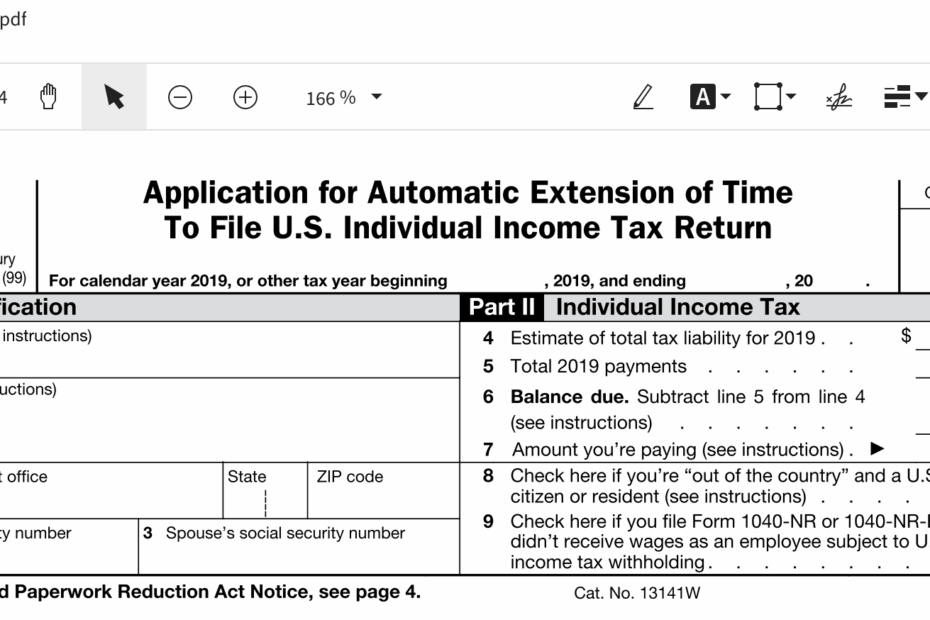

IRS Form 4868 is used by taxpayers who need more time to file their federal income tax return. It allows individuals to request an automatic extension of time to file their taxes, giving them an additional six months to submit their returns. This form is particularly useful for those who may need more time to gather necessary documents or information to accurately complete their tax return.

By filling out and submitting IRS Form 4868, taxpayers can avoid late filing penalties as long as they pay any estimated taxes owed by the original filing deadline. It’s important to note that the extension only applies to the filing of the tax return, not the payment of any taxes owed. Failure to pay taxes by the original deadline may result in penalties and interest.

Get and Print Irs Form 4868 Printable

Tax Extension Printable Form Printable Party Favors

Tax Extension Printable Form Printable Party Favors

IRS Form 4868 Printable

IRS Form 4868 is available for download on the official IRS website in a printable format. Taxpayers can easily access the form, fill it out, and submit it electronically or by mail. The form requires basic information such as name, address, social security number, estimated tax liability, and payment details.

When completing IRS Form 4868, it’s essential to accurately estimate the amount of tax owed to avoid penalties. Taxpayers should also ensure that all required information is provided and that the form is submitted before the original filing deadline to qualify for the extension. Filing for an extension using Form 4868 does not exempt taxpayers from paying any taxes owed by the original deadline.

Once IRS Form 4868 is submitted and approved, taxpayers will have an additional six months to file their federal income tax return. This extension gives individuals more time to gather necessary documents, seek professional assistance, or address any unforeseen circumstances that may have delayed the filing process.

In conclusion, IRS Form 4868 Printable is a valuable resource for taxpayers who need more time to file their federal income tax return. By submitting this form and paying any estimated taxes owed by the original deadline, individuals can avoid late filing penalties and ensure compliance with IRS regulations. It’s important to accurately complete the form and submit it on time to qualify for the extension.