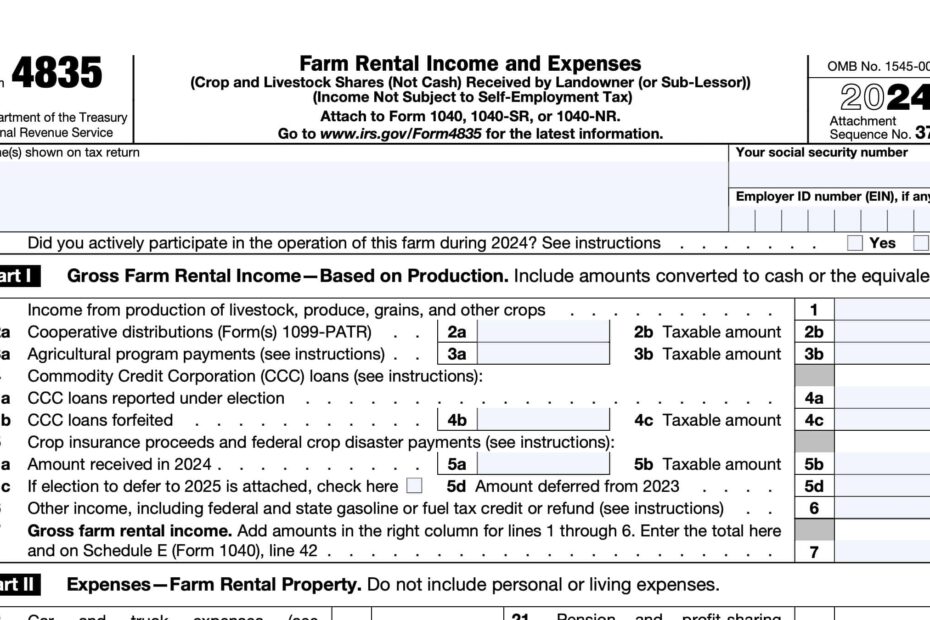

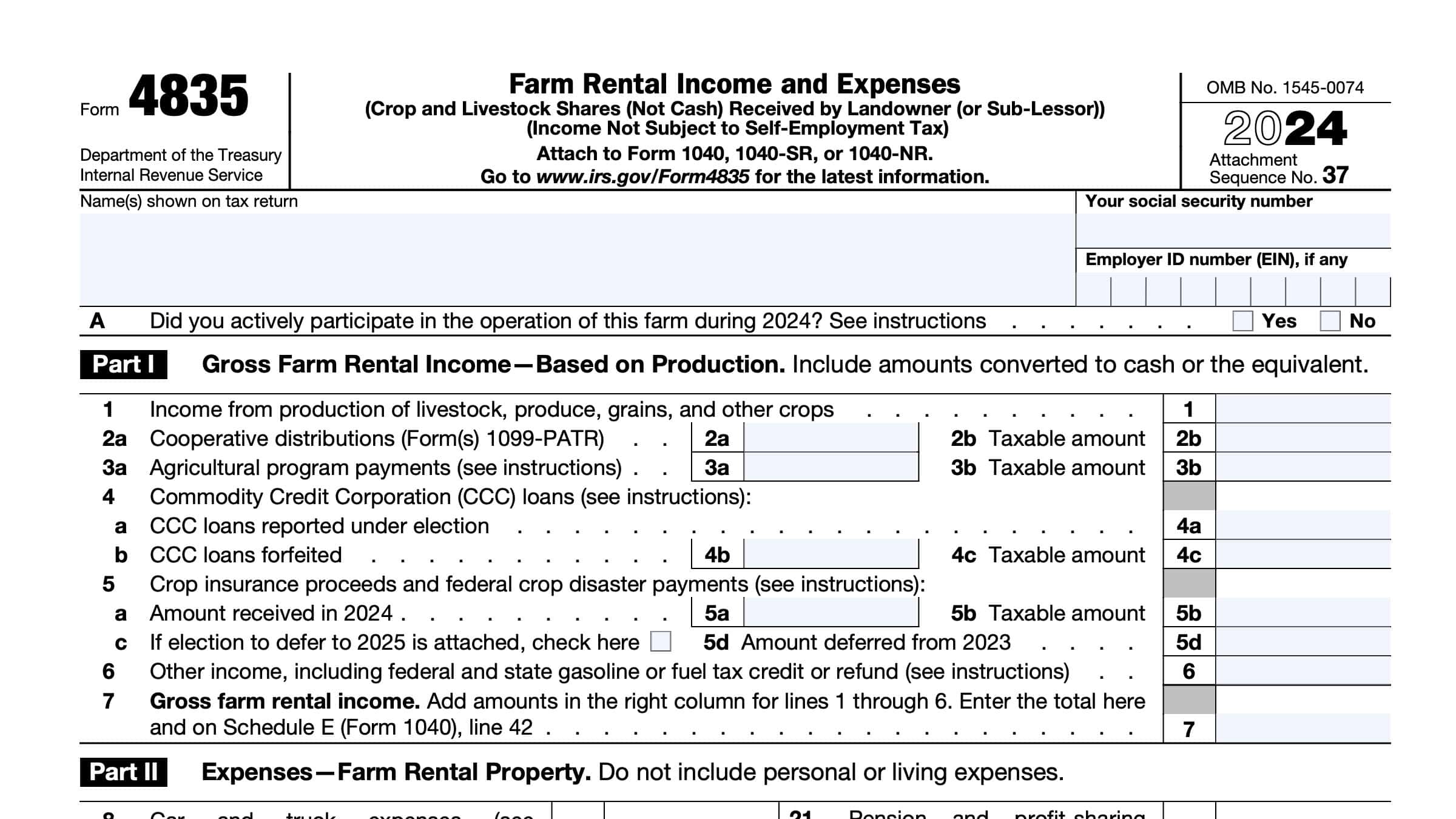

For individuals who earn income from farming activities, IRS Form 4835 is an essential document to report their earnings and expenses. This form is used to calculate the net profit or loss from farming operations, which is then included in the taxpayer’s overall income tax return. It is important to accurately complete and file Form 4835 to ensure compliance with tax laws and regulations.

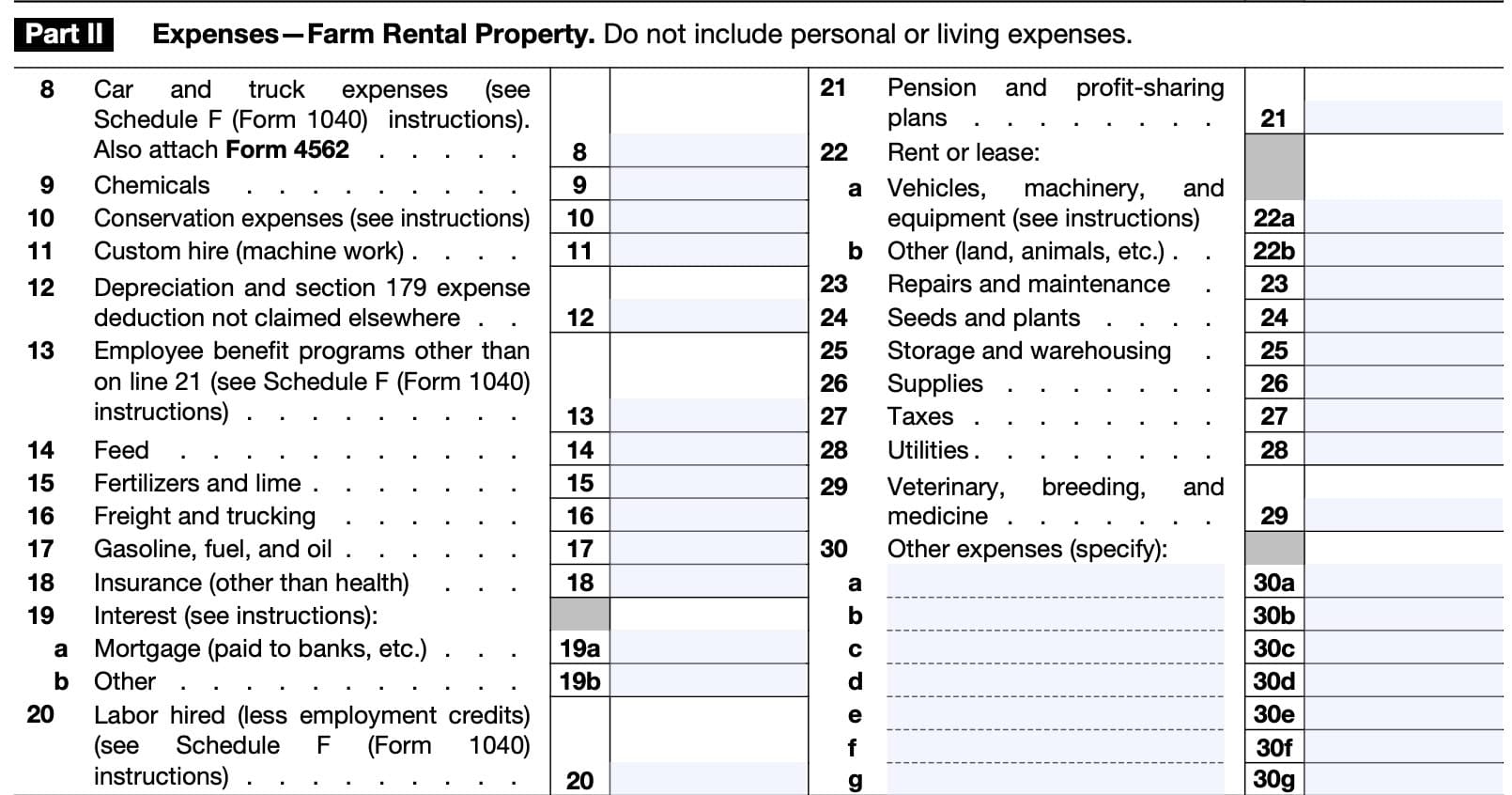

One of the benefits of IRS Form 4835 is that it allows farmers to deduct various expenses related to their farming activities, such as feed, seed, equipment, and labor costs. By deducting these expenses, farmers can reduce their taxable income and potentially lower their overall tax liability. Additionally, Form 4835 provides a clear and organized way for farmers to report their income and expenses, making it easier for them to track and manage their financial records.

Easily Download and Print Irs Form 4835 Printable

Form 4835 2024 2025 How To Fill U0026 Download PDF Guru

Form 4835 2024 2025 How To Fill U0026 Download PDF Guru

When filling out IRS Form 4835, farmers will need to provide detailed information about their farming activities, including the types of crops or livestock they produce, the size of their operation, and any income or losses incurred during the tax year. Farmers must also list all expenses related to their farming operations, including both cash and non-cash expenses. It is important to keep accurate records of all expenses throughout the year to ensure that Form 4835 is completed correctly.

Once IRS Form 4835 is completed, it should be attached to the farmer’s individual income tax return and filed with the IRS by the annual tax deadline. Farmers who file Form 4835 may also be eligible for certain tax credits and deductions, such as the farm income averaging provision or the conservation reserve program. By taking advantage of these tax benefits, farmers can maximize their tax savings and reduce their overall tax liability.

In conclusion, IRS Form 4835 is a valuable tool for farmers to report their income and expenses from farming activities. By accurately completing and filing Form 4835, farmers can ensure compliance with tax laws and regulations, as well as take advantage of various tax benefits and deductions. It is important for farmers to keep detailed records of their farming activities throughout the year to facilitate the completion of Form 4835 and maximize their tax savings.

Form 4835 2024 2025 How To Fill U0026 Download PDF Guru

Form 4835 2024 2025 How To Fill U0026 Download PDF Guru

Form 4835 Hi Res Stock Photography And Images Alamy

Form 4835 Hi Res Stock Photography And Images Alamy

IRS Form 4835 Instructions Farm Rental Income U0026 Expenses

IRS Form 4835 Instructions Farm Rental Income U0026 Expenses

IRS Form 4835 Instructions Farm Rental Income U0026 Expenses

IRS Form 4835 Instructions Farm Rental Income U0026 Expenses

Searching for a stress-free way to manage your financial needs? These printable checks for free offer a user-friendly, safe, and editable alternative you can use at home. Be it for individual purposes, home businesses, or keeping track of expenses, Irs Form 4835 Printable save money and effort without lowering professionalism. Supports most accounting software and print-ready by design, they’re a smart choice to bank-ordered checks. Start printing today and take full control of your check issuing—no waiting, no fees. Explore our ready-to-use templates and pick the one that suits your style. With our intuitive interface, financial management has never been this streamlined. Download your Irs Form 4835 Printable and optimize your check-writing process with confidence!.