When it comes to tax-related matters, having the necessary documentation is crucial. One such form that is often required is the IRS Form 4506 T. This form is used to request transcripts of tax returns, W-2s, 1099s, and other tax documents from the IRS. Having a printable version of this form can make the process much easier for individuals and businesses.

IRS Form 4506 T is commonly used by individuals who need to provide proof of income for various reasons, such as applying for a loan, mortgage, or financial aid. It is also used by businesses to verify their financial information when applying for loans or contracts. Having a printable version of this form allows individuals and businesses to easily access and fill out the necessary information without having to visit an IRS office.

Quickly Access and Print Irs Form 4506 T Printable

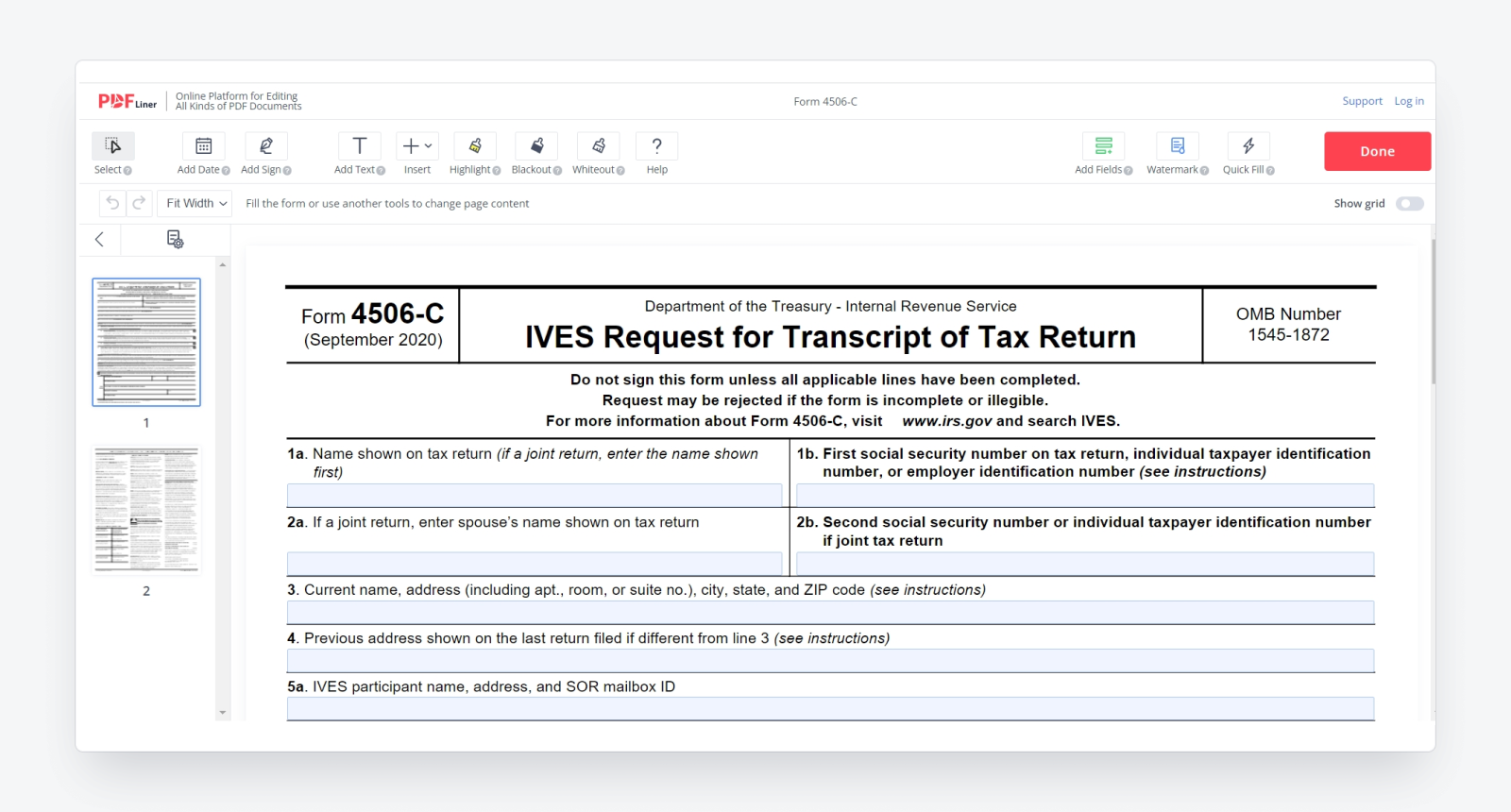

What Is Form 4506 C Brief Description And Tips Business Partner

What Is Form 4506 C Brief Description And Tips Business Partner

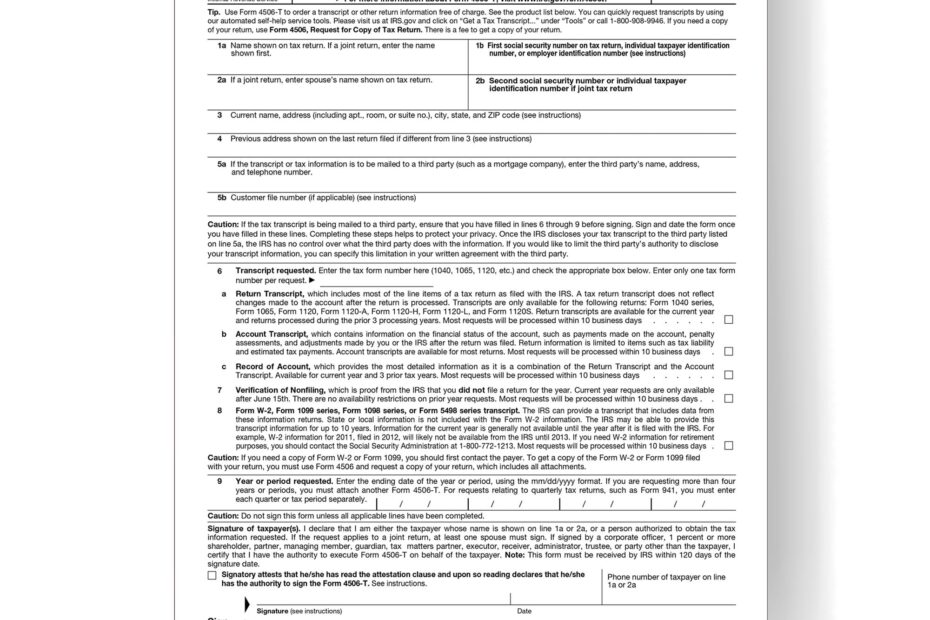

When filling out IRS Form 4506 T, it is important to provide accurate and complete information to ensure that the requested documents are received in a timely manner. The form requires details such as the name, address, Social Security number, and signature of the individual or business requesting the transcripts. Additionally, the form includes options for the type of transcripts needed and the tax years requested.

Once the form is filled out, it can be submitted to the IRS via mail or fax. The IRS typically processes requests for transcripts within 10 business days. Having a printable version of IRS Form 4506 T allows individuals and businesses to easily keep track of their requests and ensure that they have the necessary documentation for their tax-related needs.

In conclusion, having access to a printable version of IRS Form 4506 T can streamline the process of requesting tax transcripts and other important documents from the IRS. Whether you are an individual or a business, having the necessary documentation is essential for various financial transactions. By utilizing this form and submitting it accurately, you can ensure that you have the proof of income needed for your tax-related needs.