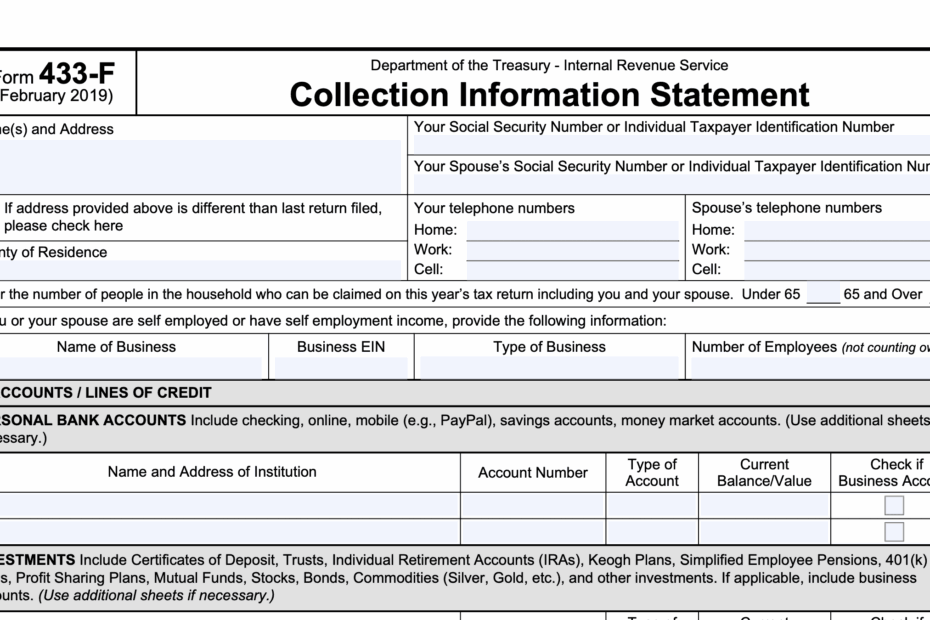

When dealing with tax matters, it is important to ensure that all necessary forms are filled out correctly and submitted on time. One such form that individuals may need to complete is IRS Form 433-F. This form is used by the Internal Revenue Service to gather information about a taxpayer’s financial situation in order to determine their ability to pay outstanding tax debt.

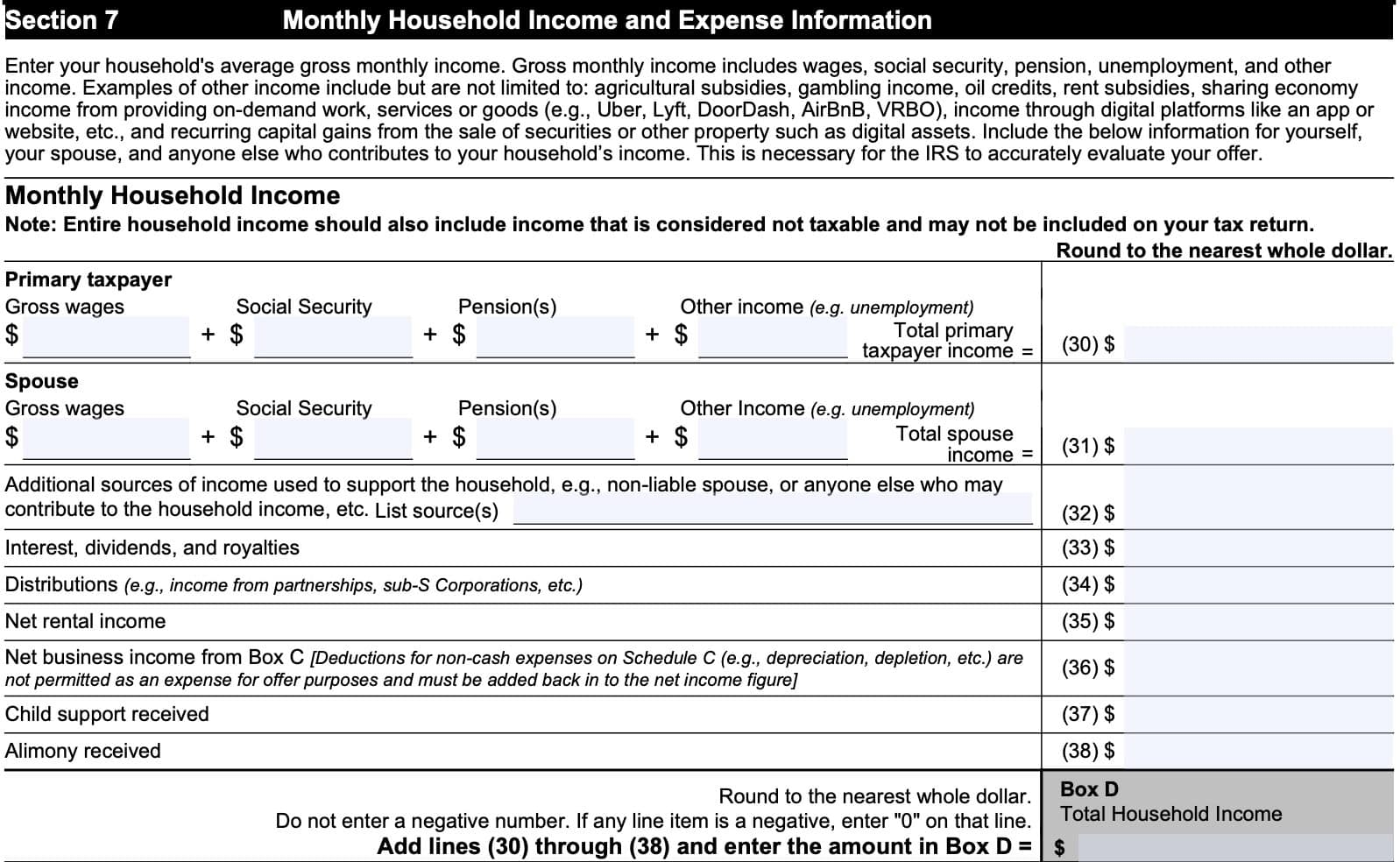

IRS Form 433-F is a financial statement that requires detailed information about a taxpayer’s income, expenses, assets, and liabilities. It is designed to help the IRS assess the taxpayer’s financial situation and determine the appropriate course of action for resolving any tax debt that may be owed.

Download and Print Irs Form 433 F Printable

Form 433 F 2024 2025 Fill Edit And Download PDF Guru

Form 433 F 2024 2025 Fill Edit And Download PDF Guru

When completing IRS Form 433-F, it is important to provide accurate and up-to-date information. Failure to do so could result in delays in processing the form or even potential penalties for providing false information. Additionally, taxpayers should be prepared to provide supporting documentation for the information provided on the form, such as bank statements, pay stubs, and asset valuations.

Once IRS Form 433-F is completed, taxpayers have the option to submit it electronically or by mail. If submitting by mail, it is important to send the form to the correct IRS office and to include any required documentation with the submission. It is also recommended to keep a copy of the completed form for your records.

In conclusion, IRS Form 433-F is an important document for taxpayers who are dealing with tax debt and need to provide the IRS with a detailed financial snapshot. By completing the form accurately and submitting it on time, taxpayers can help ensure a smooth process for resolving any outstanding tax issues.