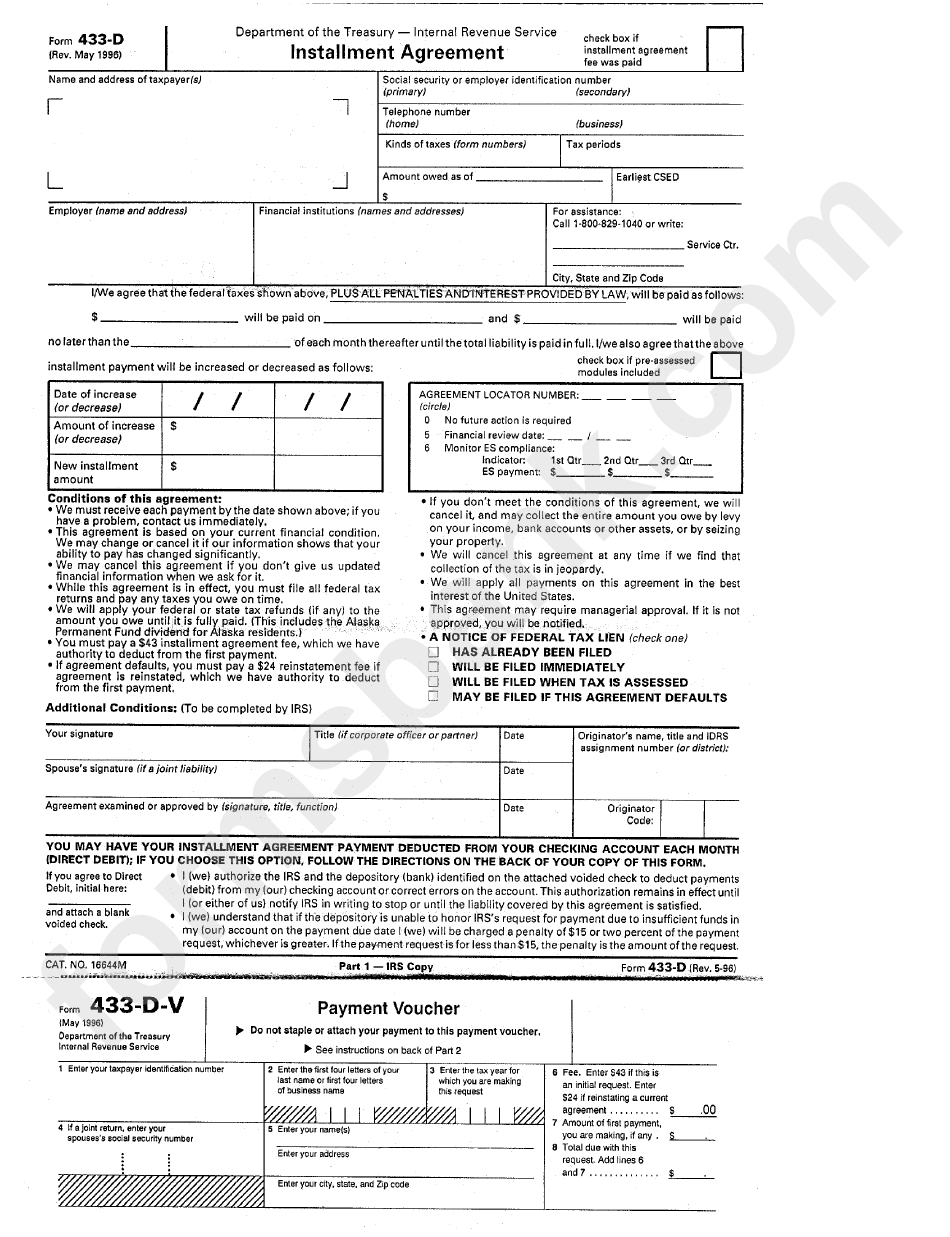

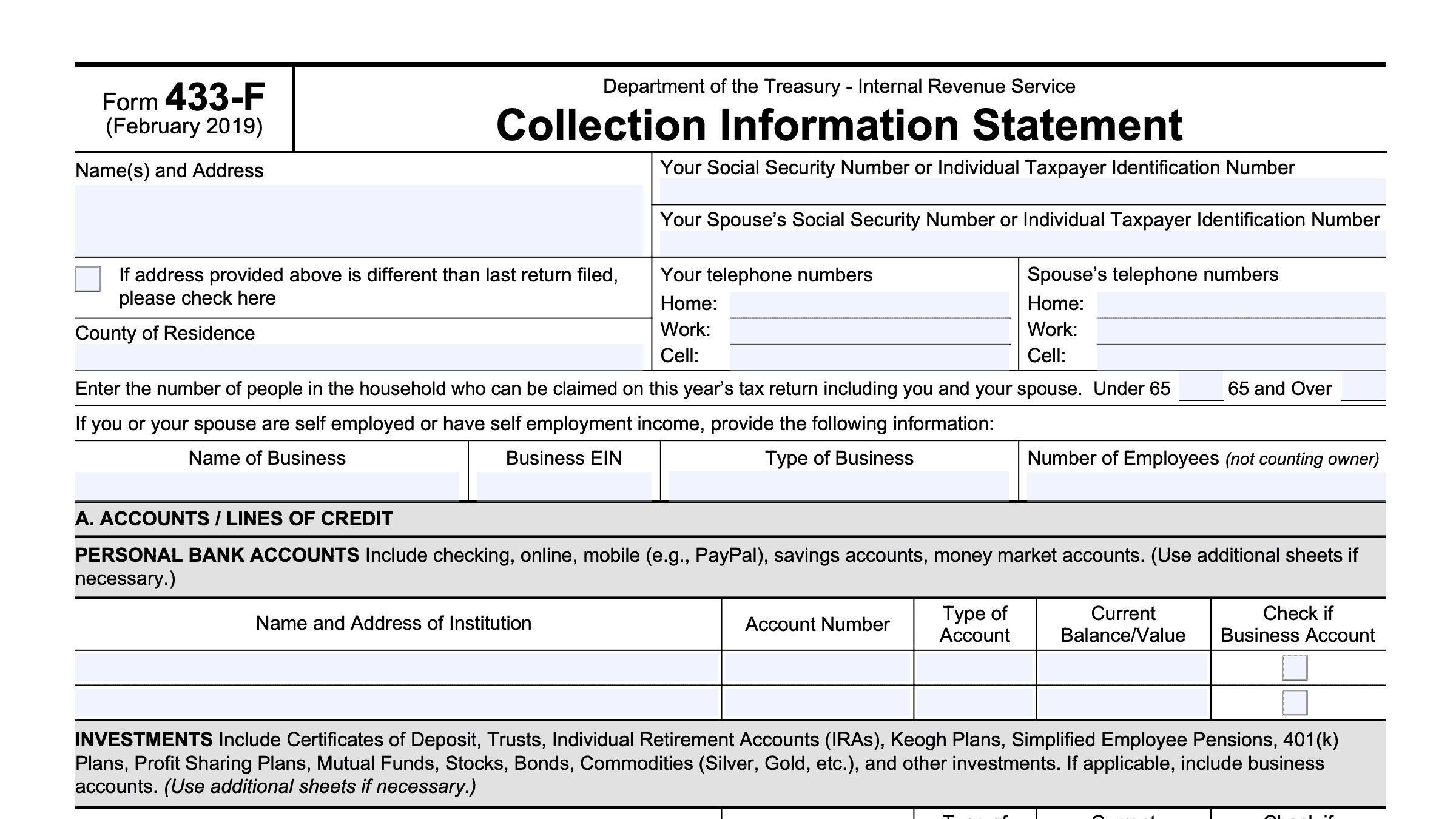

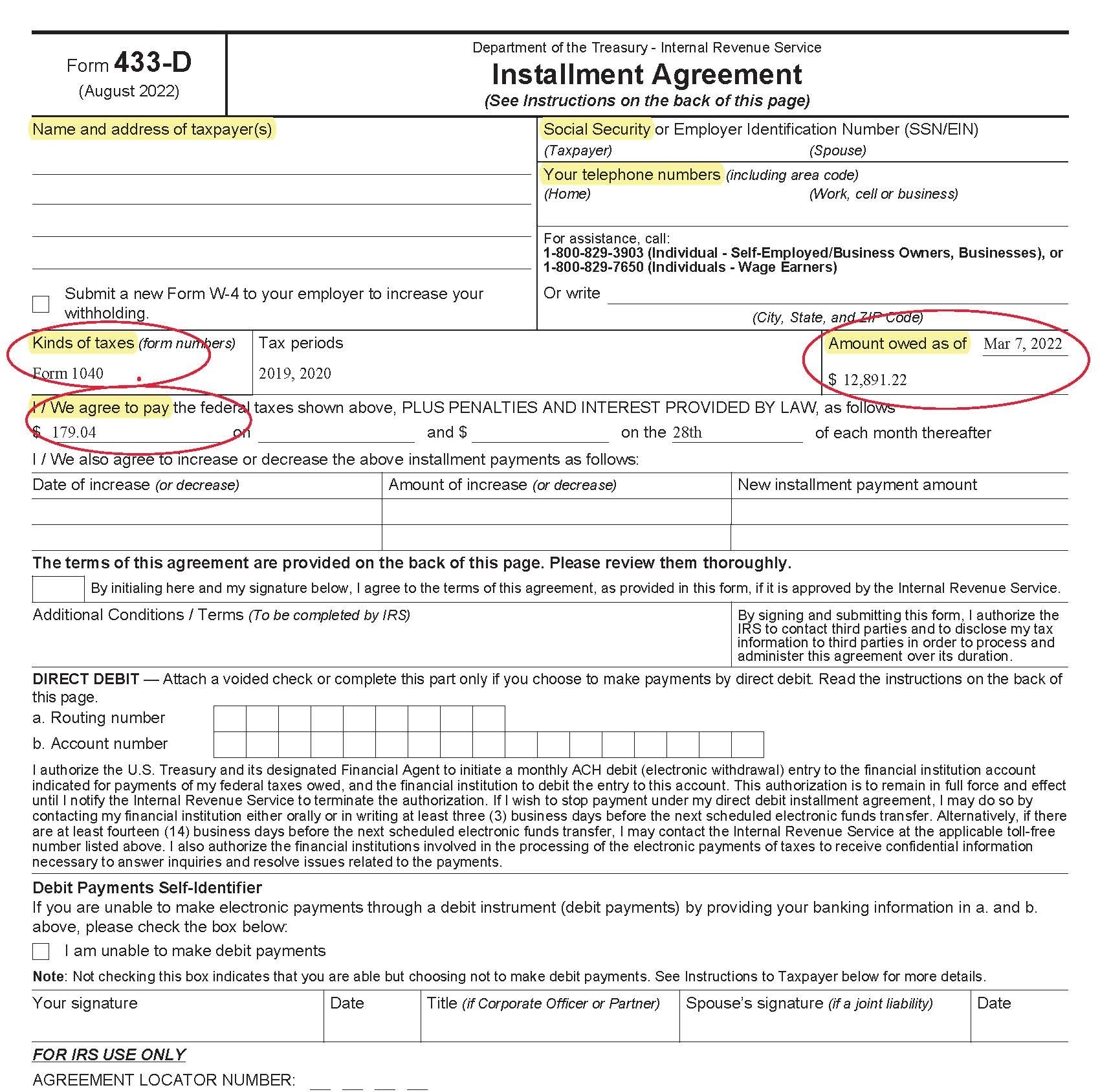

When dealing with the IRS, it’s important to have all the necessary forms in order to accurately report your financial information. One such form that may be required is the IRS Form 433-D. This form is used to provide detailed information about your assets, income, and expenses to determine your ability to pay off any outstanding tax debt.

IRS Form 433-D is a vital document for individuals or businesses who are in debt to the IRS and need to set up a payment plan. This form requires detailed information about your financial situation, including bank account balances, income sources, and monthly expenses. It is essential to fill out this form accurately and completely to avoid any delays or issues with your payment plan.

Quickly Access and Print Irs Form 433 D Printable Pdf

Fillable Form 433 D Edit Sign U0026 Download In PDF PDFRun

Fillable Form 433 D Edit Sign U0026 Download In PDF PDFRun

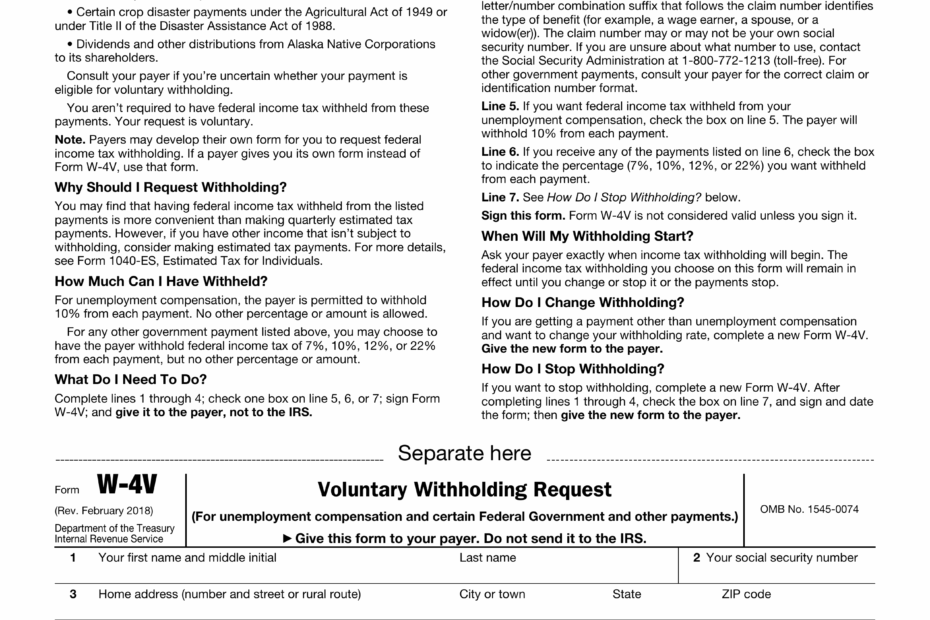

When filling out IRS Form 433-D, it’s important to gather all necessary documentation, such as bank statements, pay stubs, and expense receipts. This will ensure that you provide accurate and up-to-date information to the IRS. Once the form is complete, you can either submit it online or mail it to the IRS for processing.

It’s important to note that the IRS Form 433-D is a printable PDF document that can be easily accessed and downloaded from the IRS website. This makes it convenient for individuals to fill out the form at their own pace and in the comfort of their own home. Additionally, the PDF format allows for easy printing and submission to the IRS.

In conclusion, IRS Form 433-D is a crucial document for individuals or businesses looking to set up a payment plan with the IRS. By accurately completing this form and providing all necessary financial information, you can ensure a smooth process and avoid any potential issues with your payment plan. Make sure to download the printable PDF version of Form 433-D from the IRS website and fill it out diligently to resolve your tax debt efficiently.

Dealing with tax debt can be a stressful and overwhelming experience, but having the right forms, such as IRS Form 433-D, can make the process easier and more manageable. By providing accurate financial information and following the necessary steps, you can work towards resolving your tax debt and getting back on solid financial footing.

IRS Form 433 F Instructions The Collection Information Statement

IRS Form 433 F Instructions The Collection Information Statement

Completing Form 433 D Installment Agreement After IRS Audit Tax

Completing Form 433 D Installment Agreement After IRS Audit Tax

Form 433 D 2024 2025 Fill Edit And Download PDF Guru

Form 433 D 2024 2025 Fill Edit And Download PDF Guru

Searching for a simple method to take care of your finances? Our Irs Form 433 D Printable Pdf offer a user-friendly, secure, and editable alternative right from home. Be it for your own needs, small enterprises, or keeping track of expenses, printable checks save both time and cash without sacrificing quality. Works well with common finance software and easy to print, they’re a wise alternative to bank-ordered checks. Print your own today and gain full control over your check issuing—no waiting, zero charges. Browse our free templates and select the one that matches your purpose. With our intuitive interface, financial management has never been this streamlined. Access your printable checks for free and streamline your payments with security!.