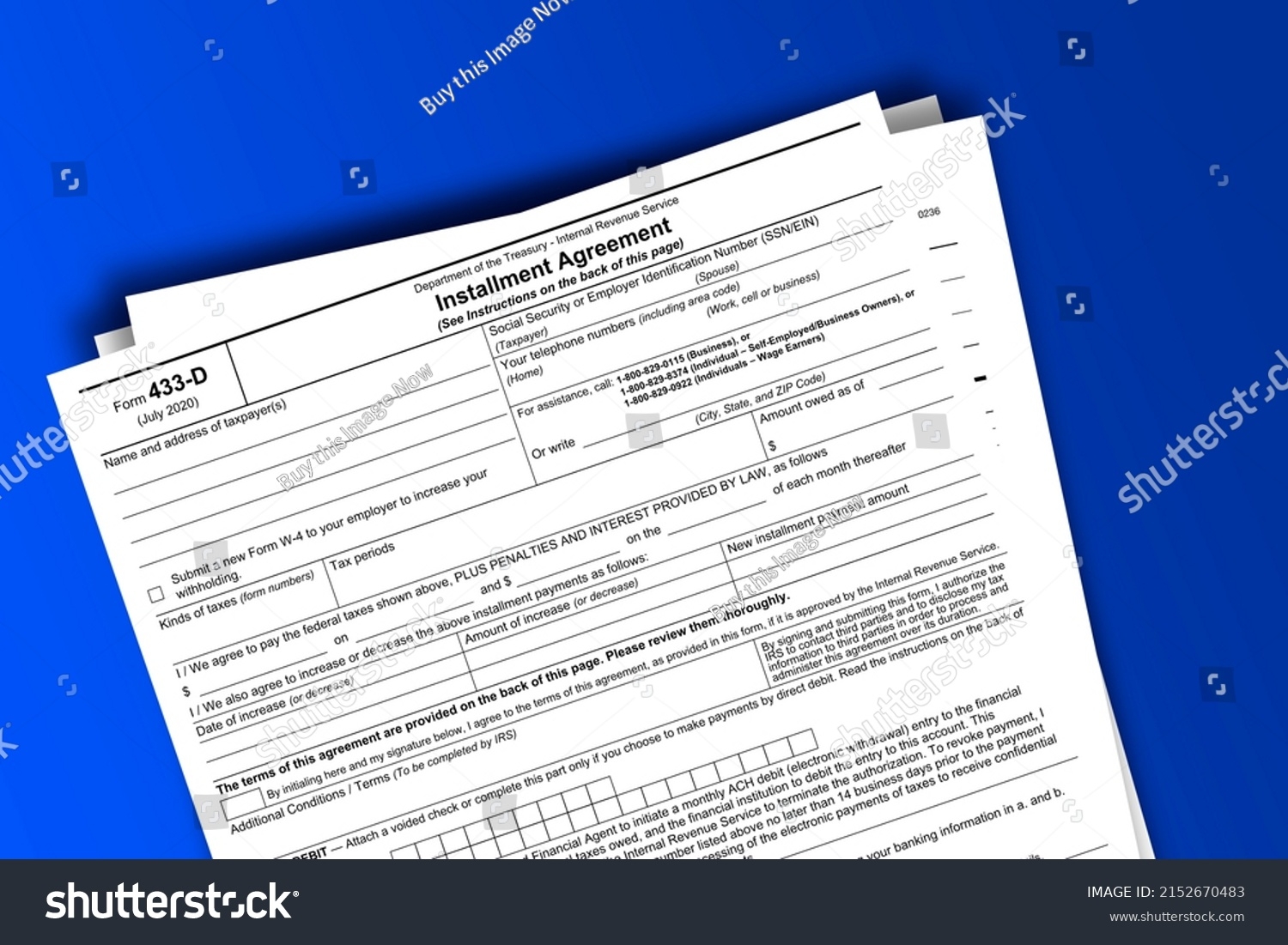

When it comes to dealing with the IRS, it is important to have all your financial information in order. One form that can help you do this is IRS Form 433-D. This form is used to provide the IRS with detailed information about your income, expenses, assets, and liabilities. By filling out this form accurately, you can help the IRS assess your financial situation and determine an appropriate course of action.

IRS Form 433-D is essential for individuals who are seeking to set up an installment agreement with the IRS or who are looking to negotiate a settlement for their tax debt. This form provides the IRS with a snapshot of your financial situation, allowing them to make informed decisions about your tax liability. It is important to fill out this form completely and accurately to avoid any delays or issues with your tax resolution process.

Save and Print Irs Form 433-D Printable

When filling out IRS Form 433-D, you will need to provide detailed information about your income, expenses, assets, and liabilities. This includes information about your monthly income, such as wages, dividends, and rental income, as well as details about your monthly expenses, such as rent, utilities, and transportation costs. You will also need to provide information about your assets, such as bank accounts, real estate, and vehicles, as well as information about your liabilities, such as credit card debt, loans, and unpaid taxes.

It is important to note that IRS Form 433-D is a legal document, and providing false information on this form can result in severe penalties. It is essential to be honest and accurate when filling out this form to avoid any potential legal consequences. If you are unsure about how to fill out IRS Form 433-D, it may be beneficial to seek the assistance of a tax professional who can help guide you through the process.

In conclusion, IRS Form 433-D is a crucial document for individuals seeking to resolve their tax debt with the IRS. By providing detailed information about your financial situation, you can help the IRS assess your tax liability and determine an appropriate course of action. It is important to fill out this form accurately and honestly to avoid any delays or issues with your tax resolution process.