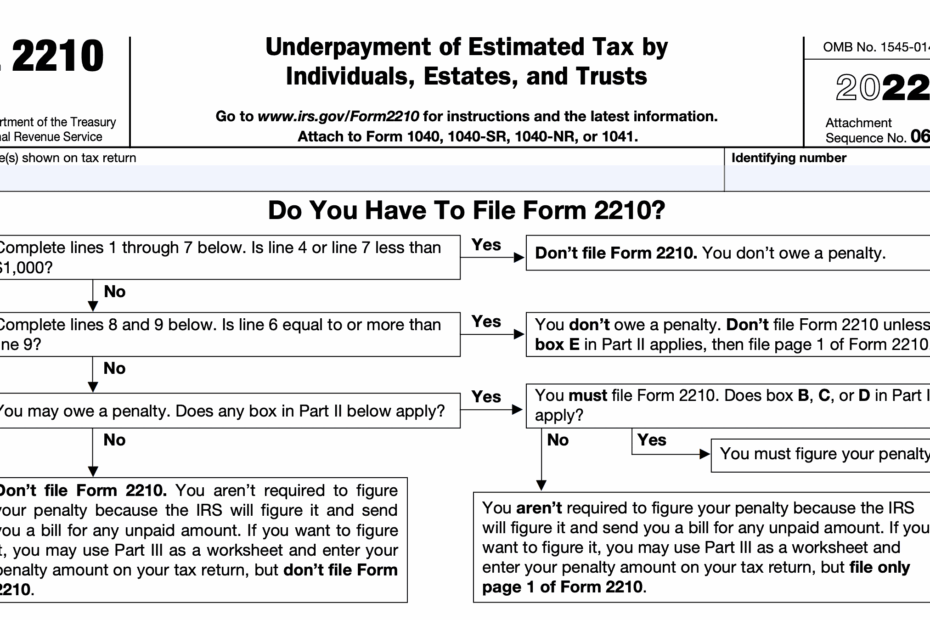

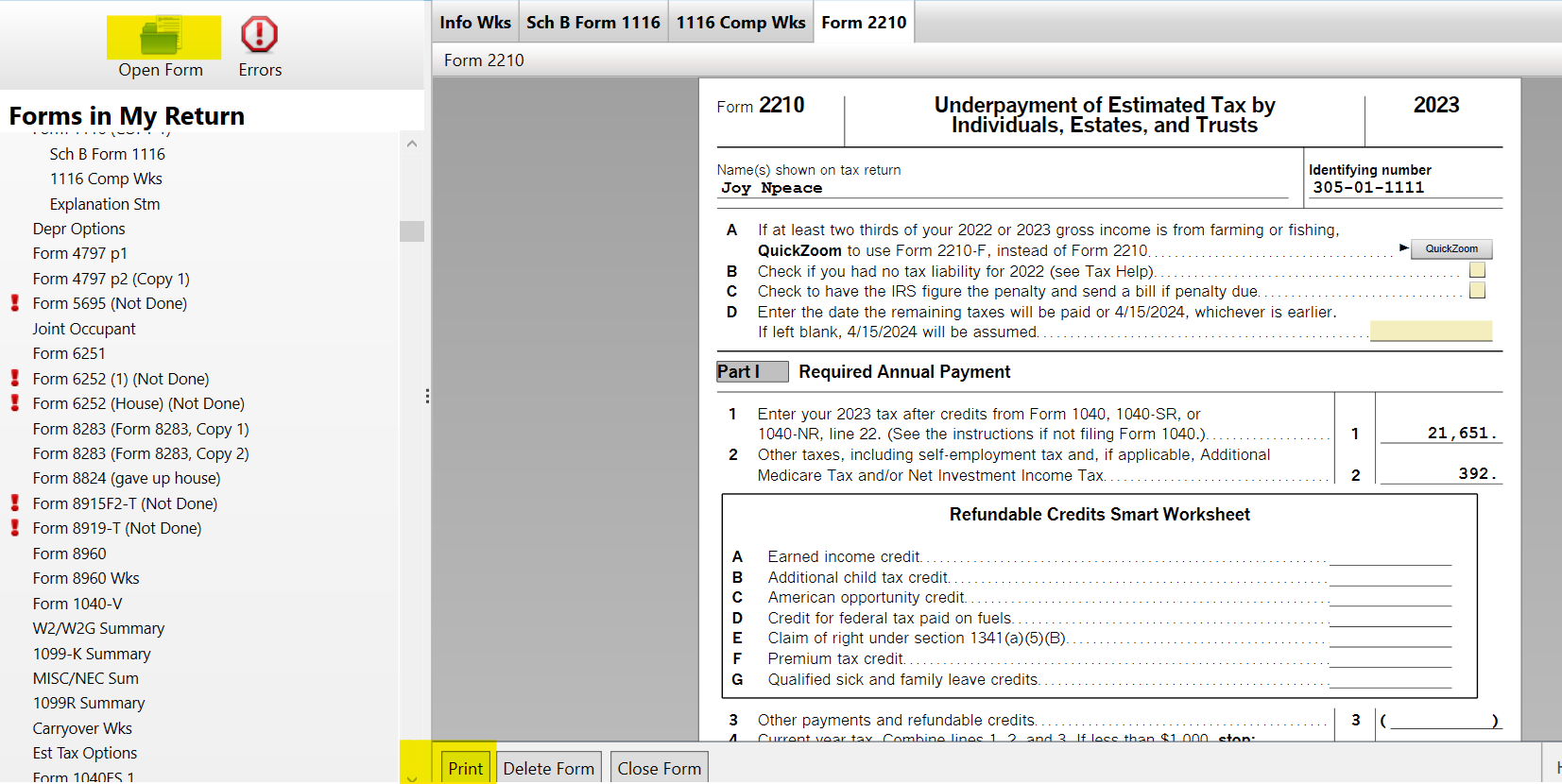

As we approach tax season, it’s important to stay informed about the various forms and documents that may be necessary for filing your taxes. One such form is IRS Form 2210, which is used to calculate any penalties for underpayment of estimated tax. Understanding this form and how to fill it out correctly can help you avoid any unnecessary fees or penalties.

IRS Form 2210 for 2024 is a crucial document for taxpayers who have income that is not subject to withholding, such as self-employment income, rental income, or investment income. This form helps individuals calculate whether they owe any additional taxes due to underpayment of estimated tax throughout the year.

Irs Form 2210 For 2024 Printable

Irs Form 2210 For 2024 Printable

Easily Download and Print Irs Form 2210 For 2024 Printable

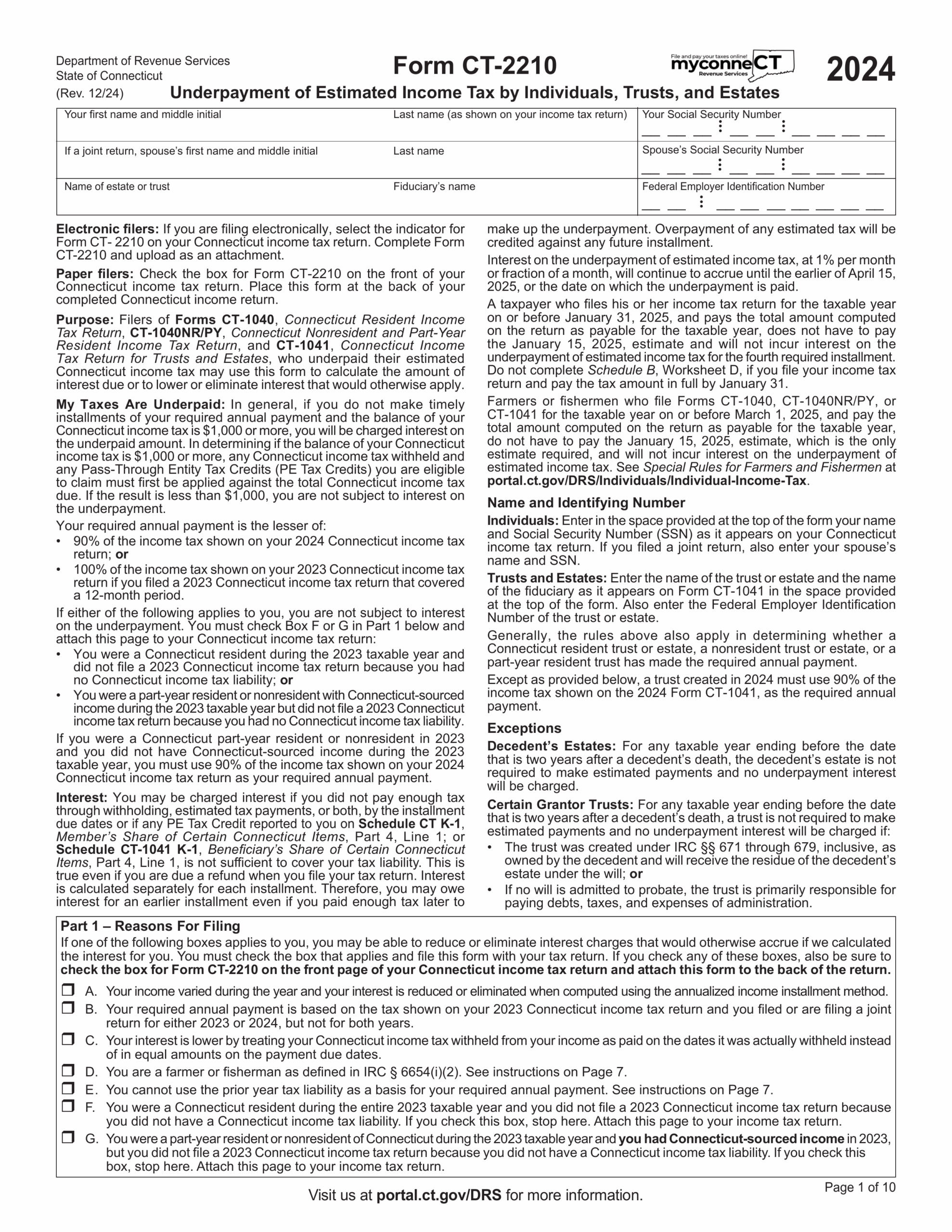

Form CT 2210 2024 2025 Fill Official Forms Online

Form CT 2210 2024 2025 Fill Official Forms Online

Irs Form 2210 For 2024 Printable

It’s important to note that IRS Form 2210 for 2024 is available in a printable format on the IRS website. This allows taxpayers to easily access the form and fill it out according to their individual circumstances. By carefully completing this form, taxpayers can determine if they need to pay any additional taxes or penalties.

When filling out IRS Form 2210, taxpayers will need to provide information such as their income, deductions, credits, and any estimated tax payments made throughout the year. By accurately reporting this information, individuals can ensure that they are not subject to any unnecessary penalties for underpayment of estimated tax.

It’s important to review the instructions for IRS Form 2210 carefully to ensure that you are filling out the form correctly. If you are unsure about how to complete any section of the form, it may be helpful to seek assistance from a tax professional who can provide guidance and ensure that you are in compliance with IRS regulations.

In conclusion, IRS Form 2210 for 2024 is a vital document for taxpayers who have income that is not subject to withholding. By understanding this form and filling it out accurately, individuals can avoid any penalties for underpayment of estimated tax. Be sure to access the printable version of IRS Form 2210 on the IRS website and consult with a tax professional if needed to ensure that you are meeting your tax obligations.