When it comes to reporting potential tax fraud to the Internal Revenue Service (IRS), Form 211 is the key document to use. This form allows individuals to confidentially report information regarding tax evasion, fraud, and other illegal activities to the IRS. By filling out and submitting Form 211, individuals can potentially qualify for a reward if the information provided leads to the collection of taxes, penalties, and interest from the guilty party.

For those looking to report tax fraud and potentially receive a reward, having access to a printable version of Form 211 is crucial. The printable form can be easily downloaded from the IRS website and filled out at your convenience. This allows individuals to gather all necessary information and submit it to the IRS in a timely manner.

Easily Download and Print Irs Form 211 Printable

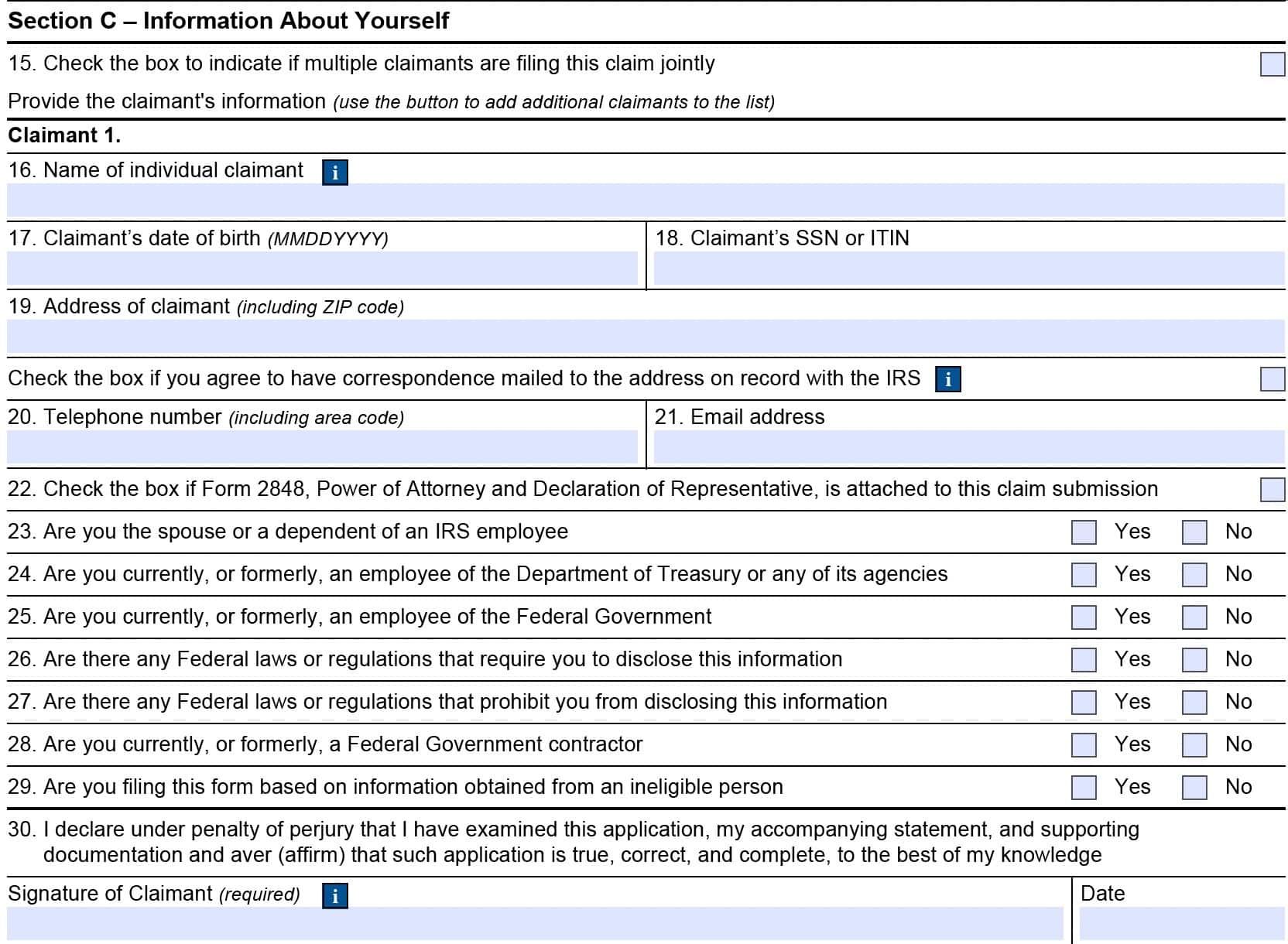

ARCHIVE How To Fill Out The IRS Non Filer Form Get It Back

ARCHIVE How To Fill Out The IRS Non Filer Form Get It Back

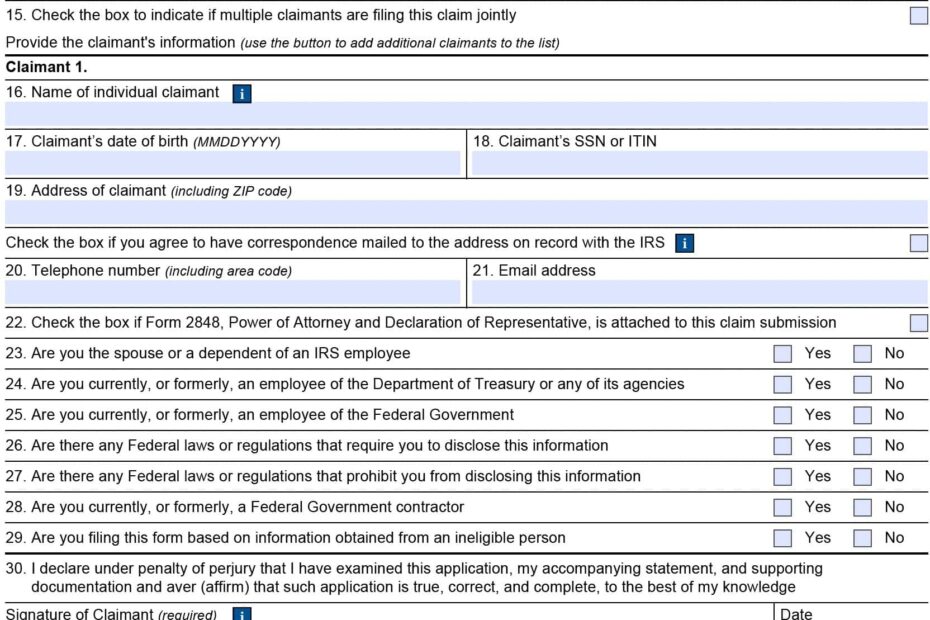

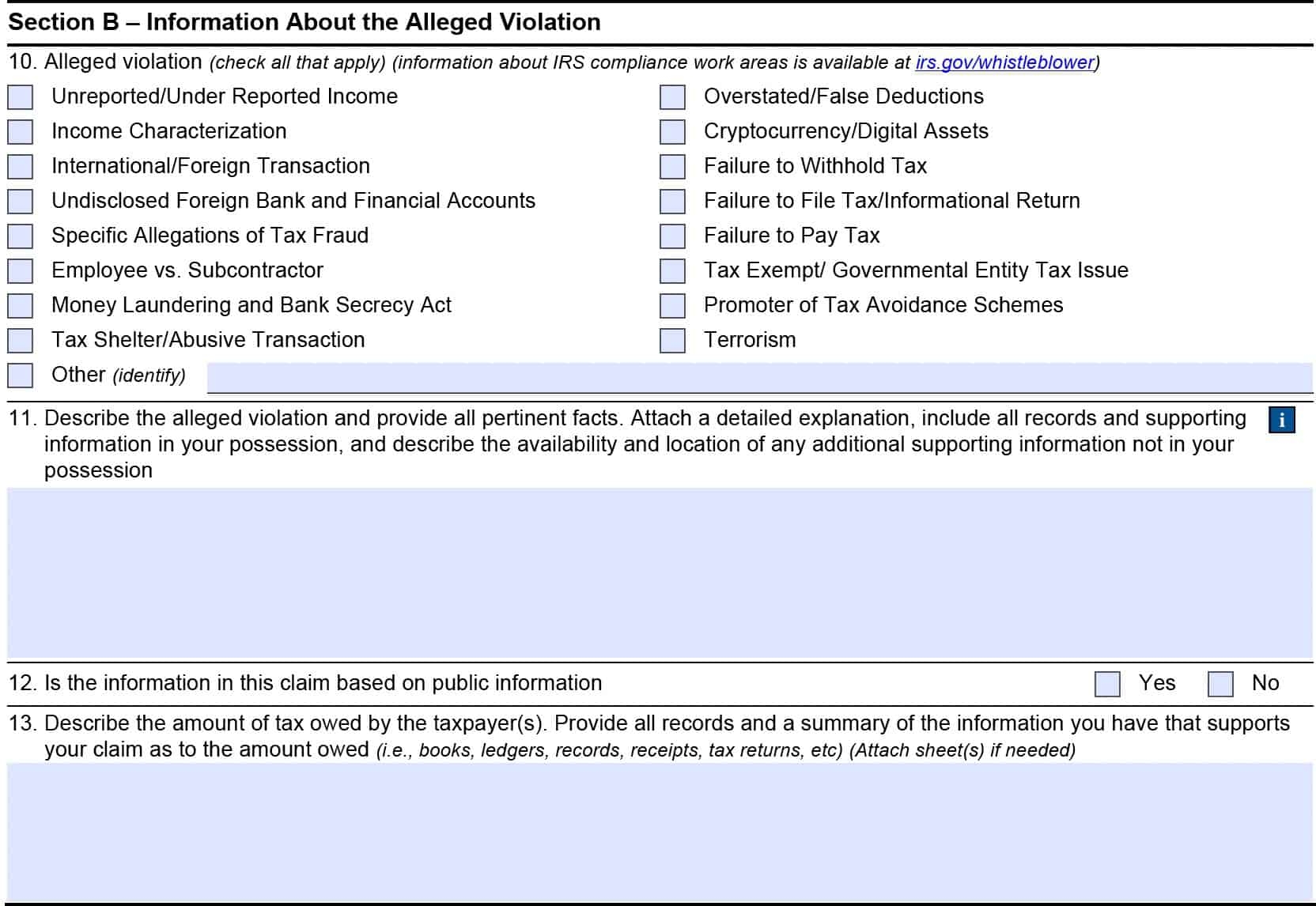

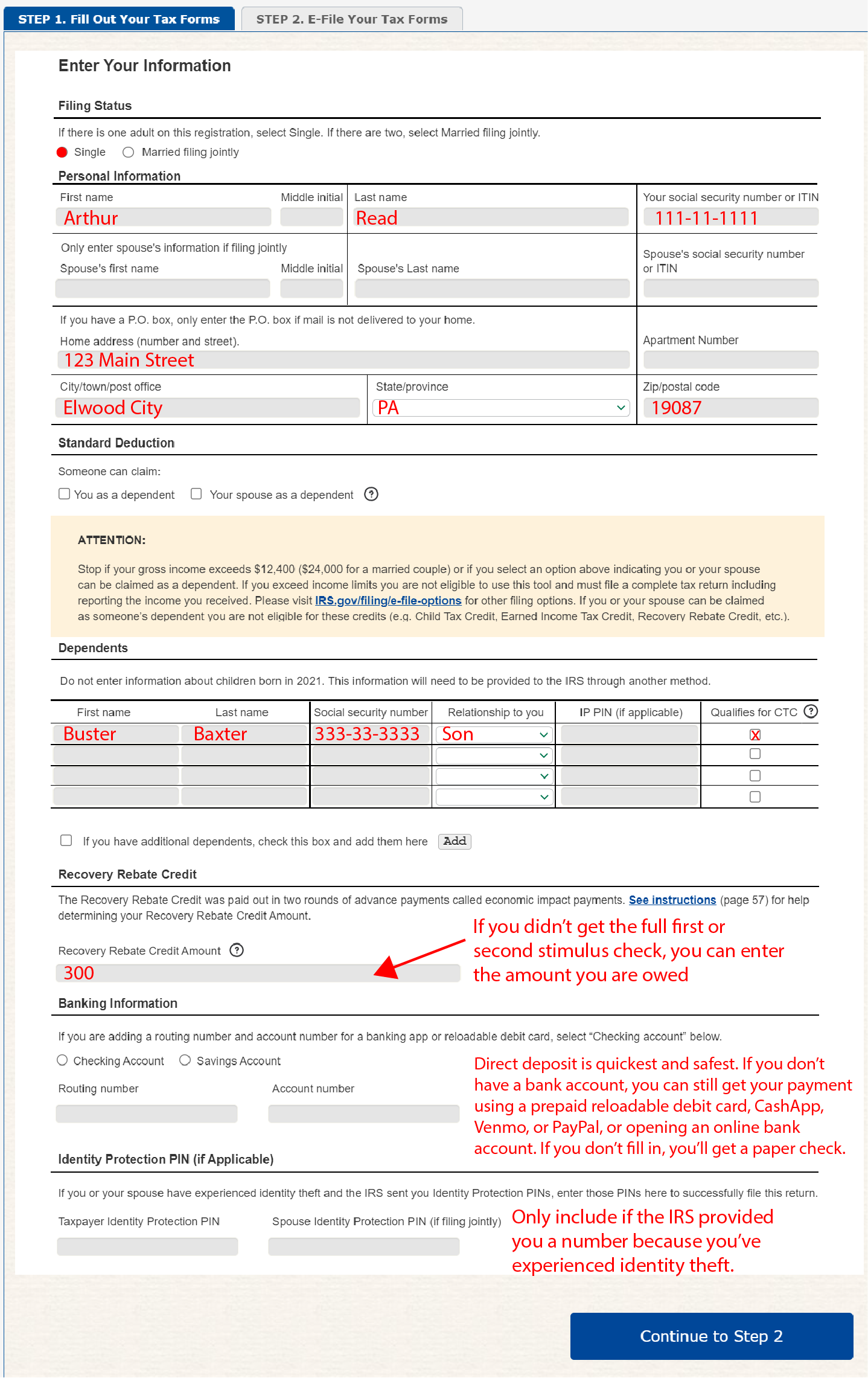

When filling out Form 211, it is important to provide as much detailed and accurate information as possible. This includes identifying the individual or business suspected of tax fraud, providing specific details about the fraudulent activity, and any supporting documentation that may be available. The more information provided, the better chance of the IRS being able to investigate and potentially collect taxes owed.

After completing Form 211, individuals can submit the form to the IRS by following the instructions provided on the form. It is important to note that the information provided on Form 211 is confidential and protected by law. The IRS takes all reports of potential tax fraud seriously and will investigate each claim thoroughly.

In conclusion, for those looking to report potential tax fraud and potentially receive a reward, Form 211 is the key document to use. By accessing the printable version of Form 211, individuals can easily report tax fraud to the IRS and potentially qualify for a reward. Remember to provide detailed and accurate information on the form and follow the instructions for submission. Reporting tax fraud not only helps the IRS collect taxes owed but also helps maintain the integrity of the tax system.

3 11 3 Individual Income Tax Returns Internal Revenue Service

3 11 3 Individual Income Tax Returns Internal Revenue Service

3 21 25 Miscellaneous Tax Returns Internal Revenue Service

3 21 25 Miscellaneous Tax Returns Internal Revenue Service

Looking for a hassle-free solution to manage your money matters? Our printable checks for free provide a simple, reliable, and personalizable alternative from the comfort of your home. Be it for individual purposes, home businesses, or financial planning, Irs Form 211 Printable help you save time and money without sacrificing quality. Compatible with popular bookkeeping tools and easy to print, they’re a cost-effective option to pre-ordered checks. Print your own today and gain full control over your financial transactions—instant access, zero charges. Explore our ready-to-use templates and select the one that matches your purpose. With our intuitive interface, managing your finances has never been this streamlined. Get your printable checks for free and streamline your check-writing process with confidence!.