IRS Form 1099s Printable is an essential document for taxpayers and businesses to report various types of income that are not typically included on a W-2 form. These forms are used to report income such as freelance earnings, interest, dividends, and more. It is crucial for individuals and businesses to accurately report this income to the IRS to avoid penalties and ensure compliance with tax laws.

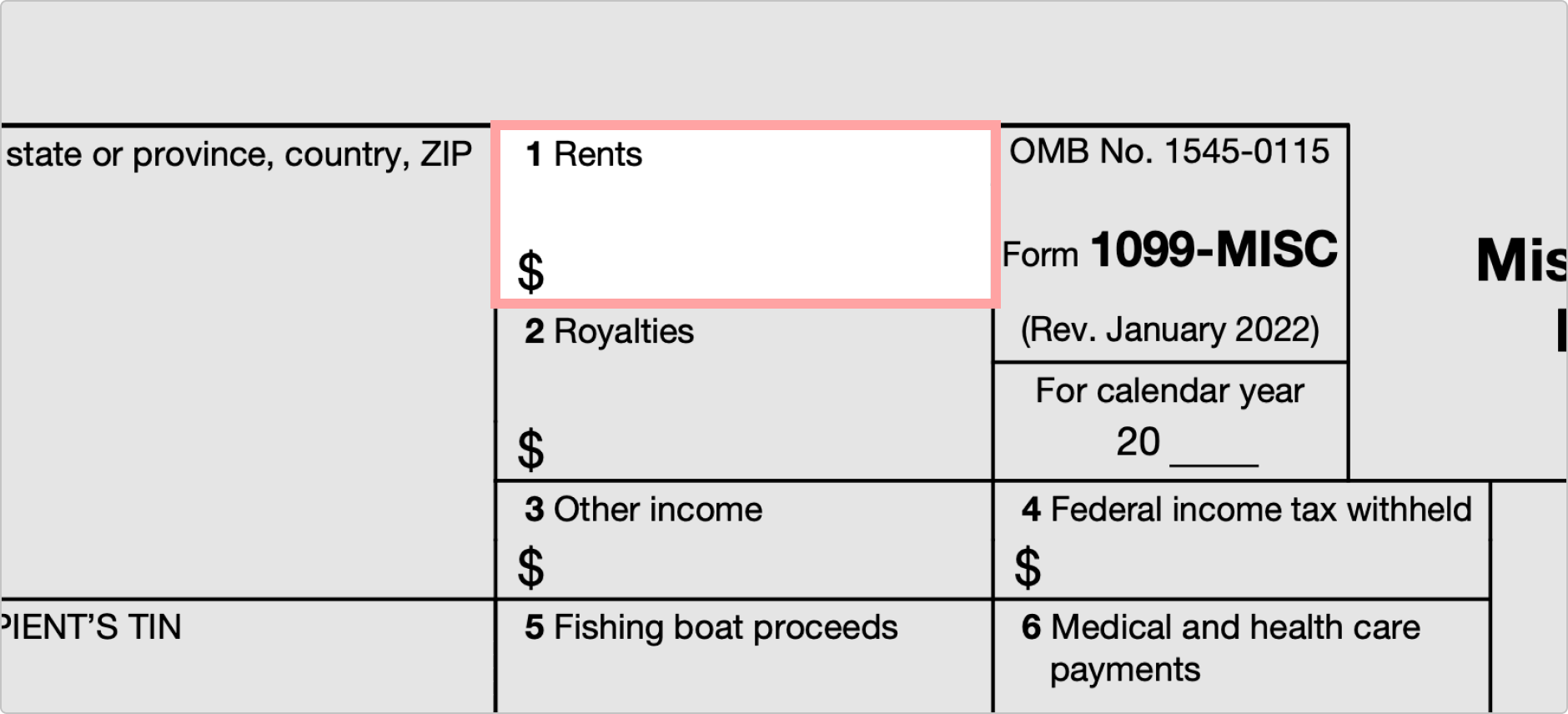

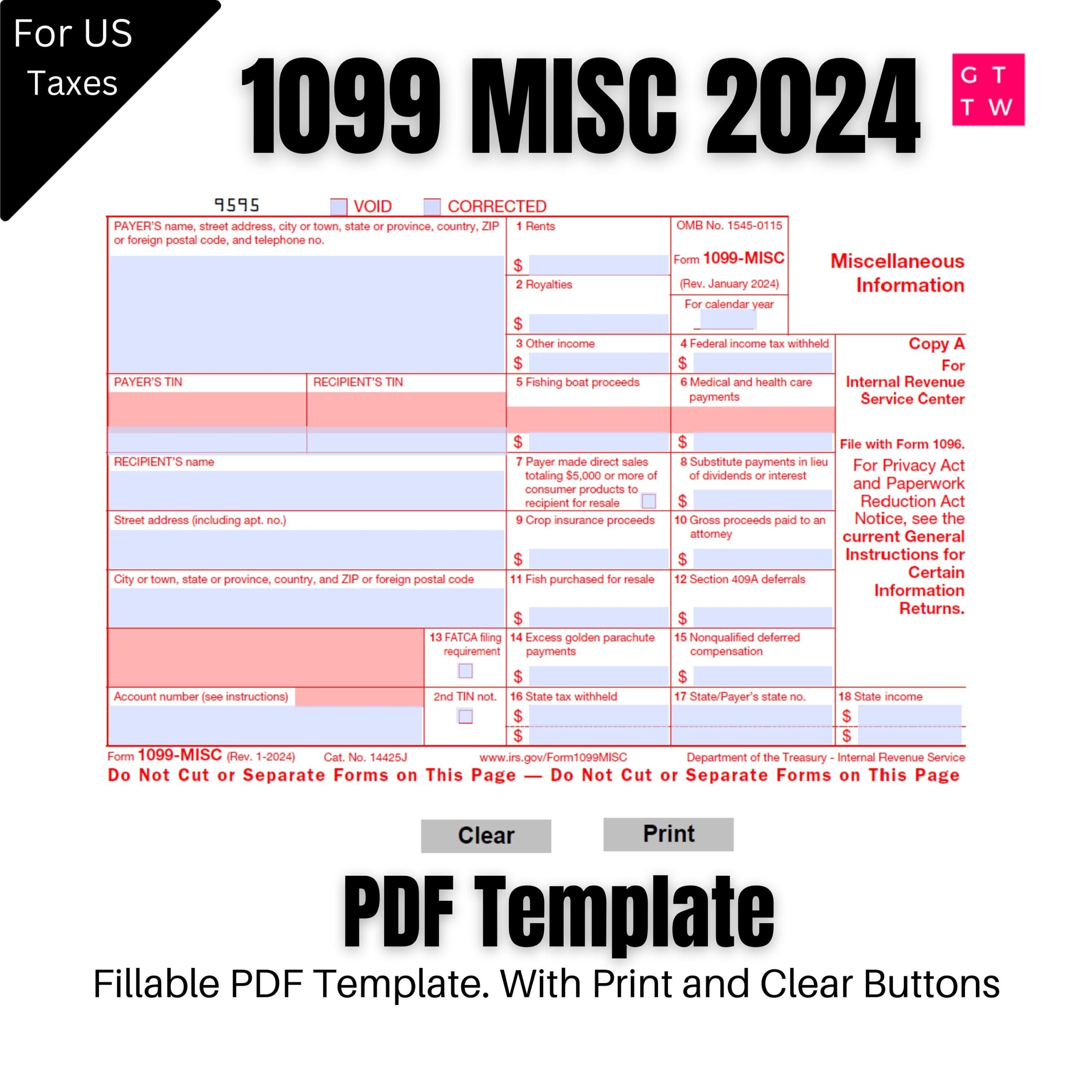

There are several types of IRS Form 1099s that taxpayers may need to file, depending on the nature of their income. These forms include 1099-INT for interest income, 1099-DIV for dividend income, 1099-MISC for miscellaneous income, and more. Each form has specific requirements and deadlines for filing, so it is important to familiarize yourself with the appropriate form for your situation.

Quickly Access and Print Irs Form 1099s Printable

2024 1099 MISC Form Fillable Print Template Digital Download Etsy

2024 1099 MISC Form Fillable Print Template Digital Download Etsy

When it comes to filing IRS Form 1099s Printable, it is important to ensure that the information is accurate and complete. This includes providing the correct taxpayer identification number (TIN) for the recipient, as well as accurate income amounts. Failing to report income accurately or on time can result in penalties from the IRS, so it is crucial to take this process seriously.

One of the benefits of IRS Form 1099s Printable is that they can be easily accessed and filled out online. The IRS provides printable versions of these forms on their website, making it convenient for taxpayers to file their income accurately. Additionally, there are many tax preparation software programs available that can help individuals and businesses navigate the process of filing these forms.

In conclusion, IRS Form 1099s Printable is a vital tool for reporting various types of income to the IRS. By understanding the different types of forms available and ensuring that the information provided is accurate, taxpayers can avoid penalties and ensure compliance with tax laws. Whether you are a freelancer, investor, or business owner, it is important to familiarize yourself with these forms and file them in a timely manner.