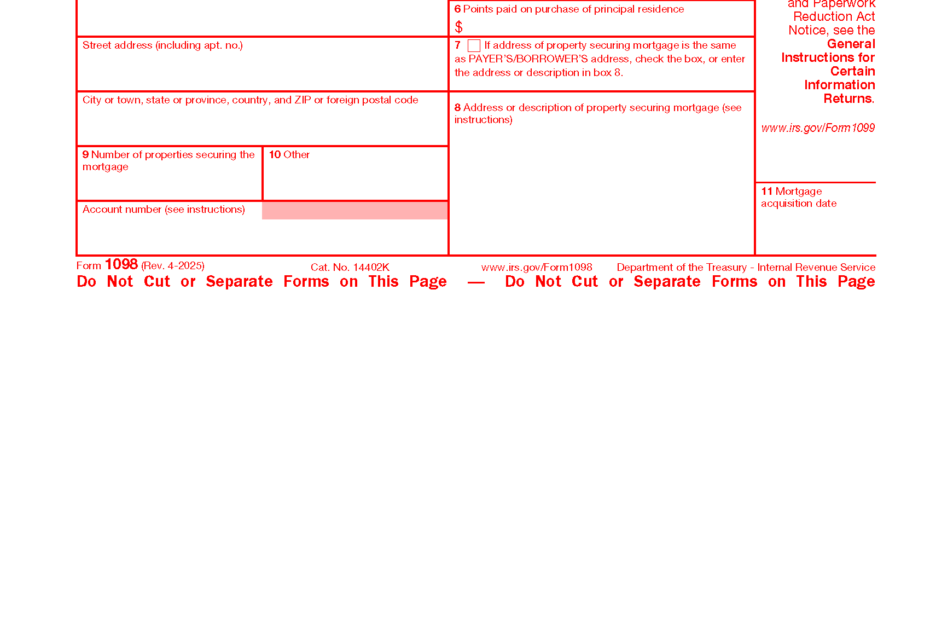

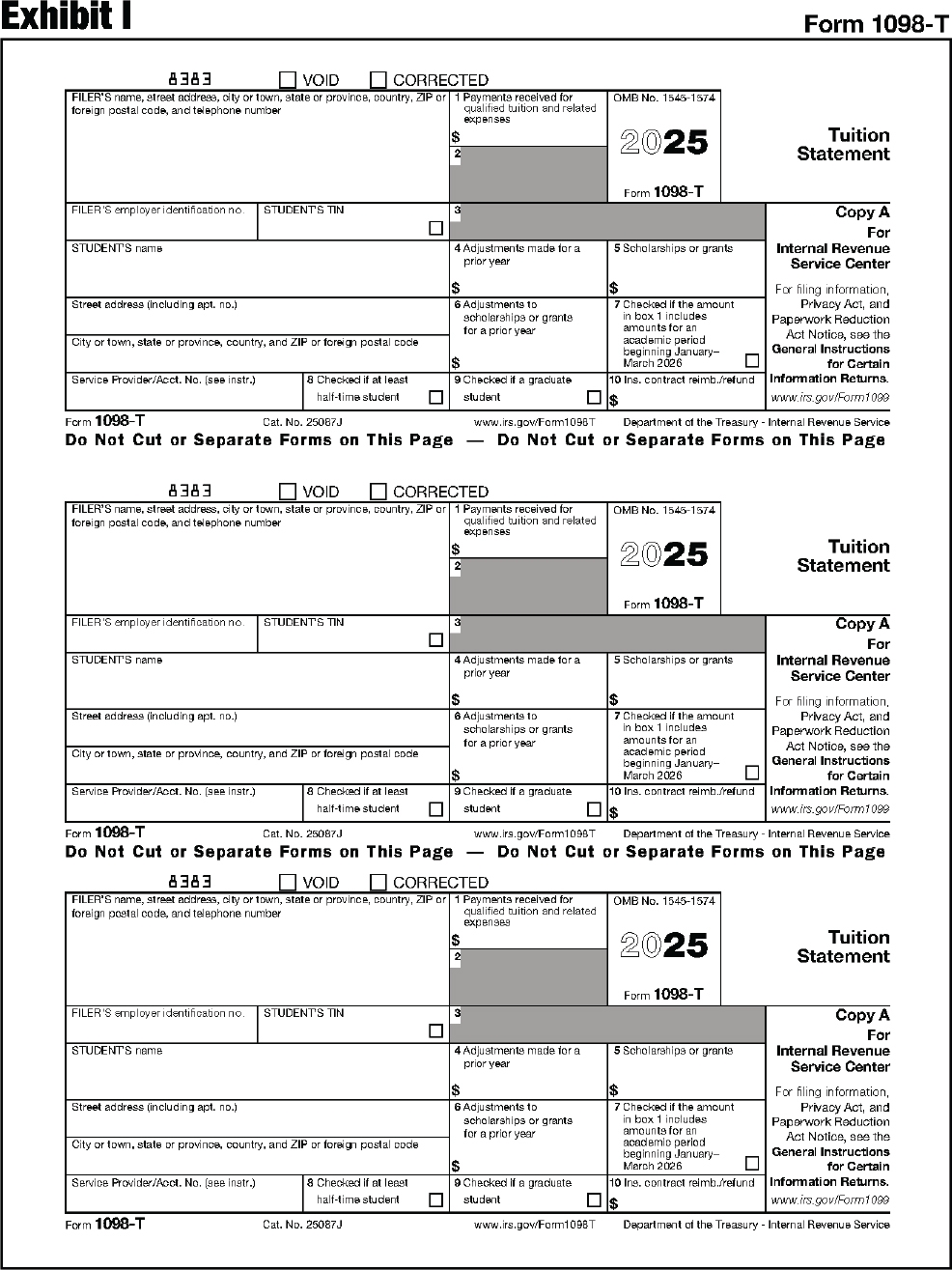

As we approach the tax season for the year 2025, it is important to familiarize ourselves with the necessary forms and documents required for filing our taxes. One such form is the IRS Form 1098, which is used to report mortgage interest, student loan interest, and other types of interest payments. This form is crucial for both individuals and businesses who have paid interest on loans throughout the year.

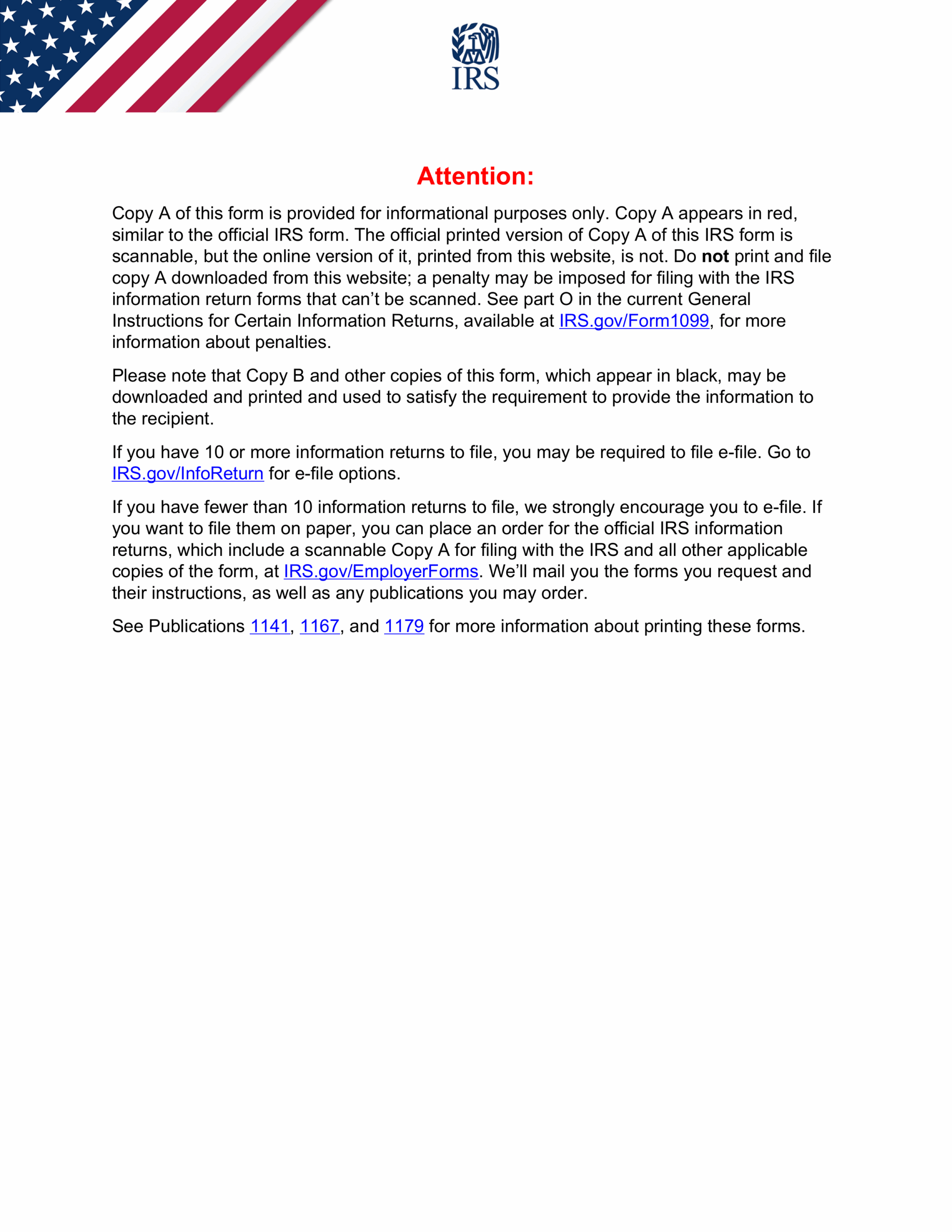

By understanding the IRS Form 1098 and its requirements, taxpayers can ensure that they are accurately reporting their interest payments and maximizing their deductions. The printable version of Form 1098 for 2025 allows individuals to easily fill out the necessary information and submit it to the IRS along with their tax return.

Irs Form 1098 For 2025 Printable

Irs Form 1098 For 2025 Printable

Get and Print Irs Form 1098 For 2025 Printable

Fill Form 1098 E 2024 2025 Create Edit Forms Online

Fill Form 1098 E 2024 2025 Create Edit Forms Online

When filling out the IRS Form 1098 for 2025, taxpayers will need to provide details such as the name, address, and taxpayer identification number of the lender, as well as the amount of interest paid during the tax year. Additionally, individuals will need to indicate whether the loan was for a primary residence, a second home, or other purposes. By accurately completing this form, taxpayers can ensure that they are claiming all eligible deductions and credits related to their interest payments.

It is important to note that the IRS Form 1098 for 2025 is not only beneficial for individuals who have paid mortgage interest, but also for those who have paid student loan interest or other types of interest throughout the year. By keeping track of these payments and accurately reporting them on Form 1098, taxpayers can potentially reduce their tax liability and maximize their tax savings.

In conclusion, the IRS Form 1098 for 2025 is a crucial document for individuals and businesses who have paid interest on loans throughout the tax year. By understanding the requirements of this form and accurately reporting their interest payments, taxpayers can ensure that they are in compliance with IRS regulations and are taking full advantage of any available tax deductions. The printable version of Form 1098 for 2025 makes it easy for taxpayers to complete and submit this important document along with their tax return.