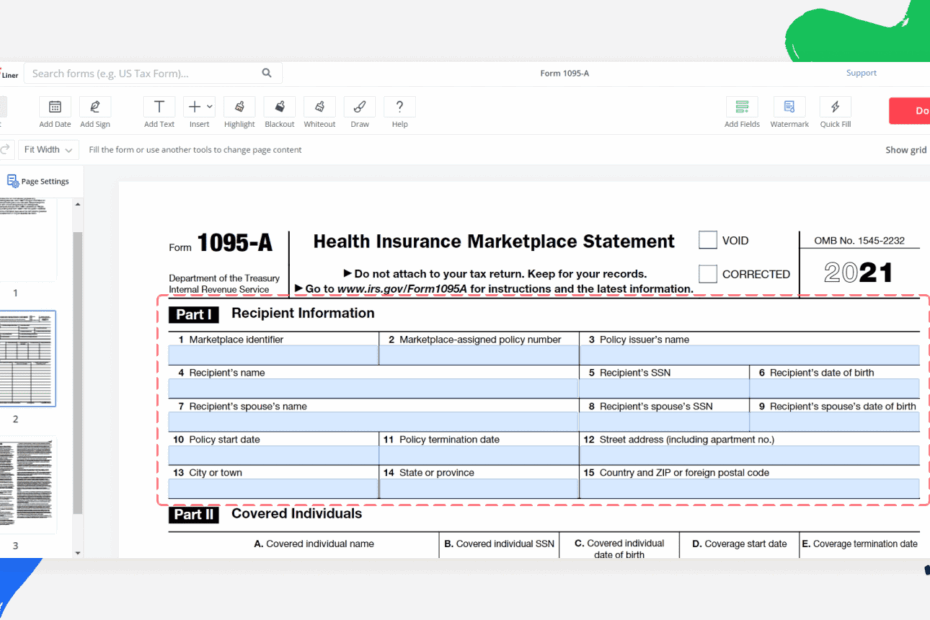

IRS Form 1095-A is an important document provided by the Health Insurance Marketplace to individuals who have enrolled in a qualified health plan. This form is used to report information about the coverage you had during the previous year and is essential for filing your taxes.

When tax season comes around, it’s important to have all the necessary documents in order to accurately report your income and any tax credits or deductions you may be eligible for. Form 1095-A is one of those crucial documents that you will need to have on hand.

Save and Print Irs Form 1095-A Printable

1095 Forms U0026 1095 Envelopes By TaxCalcUSA

1095 Forms U0026 1095 Envelopes By TaxCalcUSA

IRS Form 1095-A Printable

Form 1095-A is typically sent out by the Health Insurance Marketplace in January of each year to individuals who have enrolled in a qualified health plan. If you have not received your form by early February, you can contact the Marketplace to request a copy or access it online through your account.

The form will include important information such as the months you were covered by the plan, the premium amount, and any advanced premium tax credits you may have received. This information is used to reconcile any tax credits you received with the actual amount you were eligible for based on your income.

It’s important to carefully review your Form 1095-A for accuracy and to ensure that all the information matches your records. Any discrepancies should be addressed with the Marketplace as soon as possible to avoid any issues when filing your taxes.

Once you have verified that the information on your Form 1095-A is correct, you can use it to complete your tax return. The form will be used to fill out Form 8962, which is used to reconcile any premium tax credits you received throughout the year. This will help determine if you owe any additional taxes or if you are eligible for a refund.

In conclusion, IRS Form 1095-A is an essential document for individuals who have enrolled in a qualified health plan through the Health Insurance Marketplace. Make sure to keep track of this form and use it when filing your taxes to ensure that you are accurately reporting your income and any tax credits you may be eligible for.