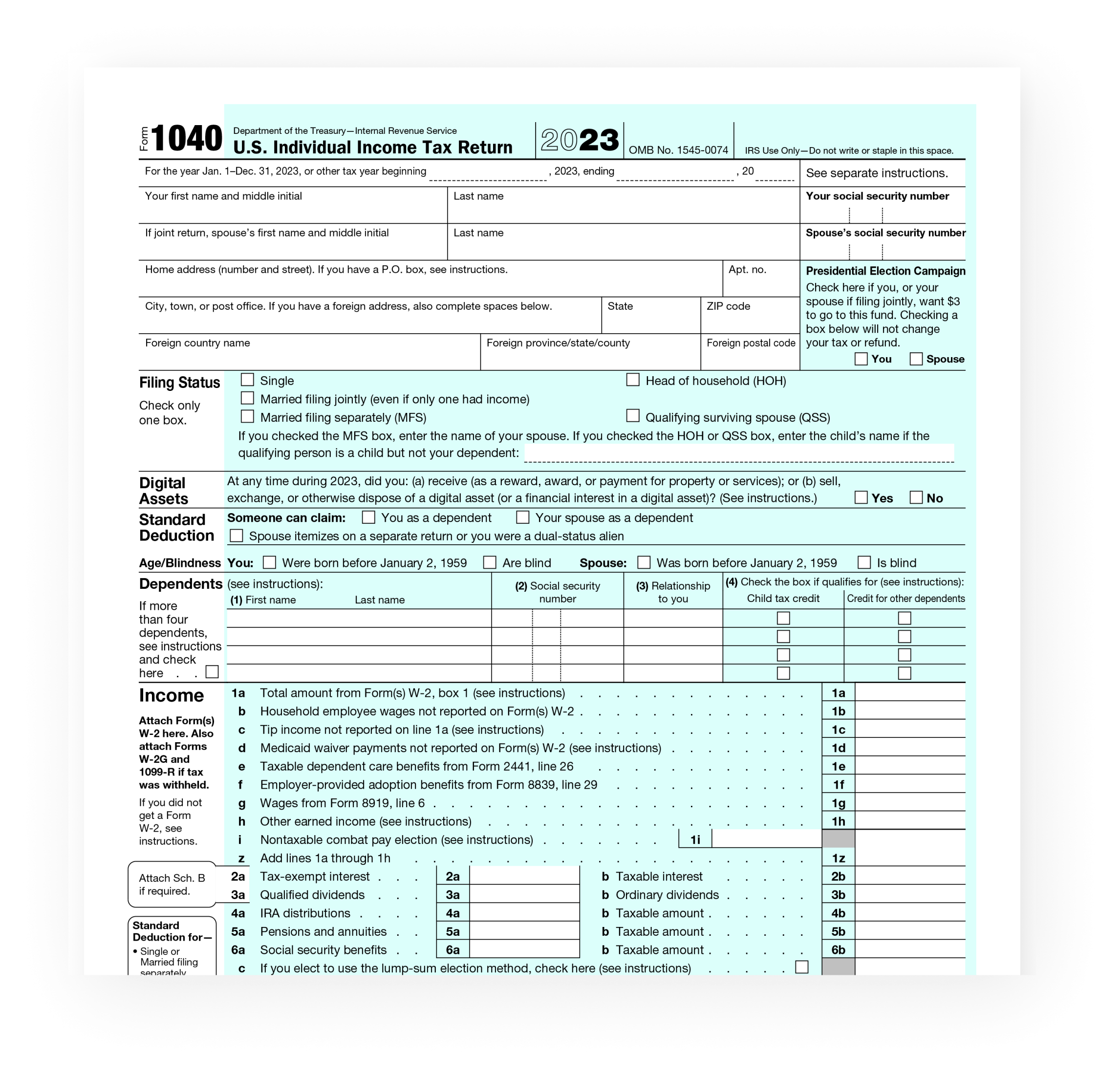

IRS Form 1040 V is a payment voucher that is used when you owe money on your tax return. This form allows you to easily submit your payment along with your tax return, ensuring that your payment is properly credited to your account. It is important to use Form 1040 V when making a payment to the IRS to avoid any processing delays or errors.

Form 1040 V is a simple one-page form that includes your personal information, the amount you are paying, and the tax year for which you are making the payment. You can easily download and print Form 1040 V from the IRS website, making it convenient to include with your tax return.

Quickly Access and Print Irs Form 1040 V Printable

How To Fill Out IRS Form 1040 What Is IRS Form 1040 ES

How To Fill Out IRS Form 1040 What Is IRS Form 1040 ES

When filling out Form 1040 V, be sure to double-check all the information you provide to avoid any mistakes. It is recommended to use a check or money order when making a payment with Form 1040 V, as cash payments are not accepted. Include your payment voucher and payment in an envelope and mail it to the address provided on the form.

It is important to submit your payment by the tax deadline to avoid any penalties or interest charges. If you are unable to pay the full amount owed, you can still submit Form 1040 V with a partial payment to reduce the amount of penalties and interest that may accrue.

Overall, IRS Form 1040 V is a simple and convenient way to submit your payment to the IRS when you owe money on your tax return. By using this form, you can ensure that your payment is properly credited to your account and avoid any processing delays or errors. Be sure to download and print Form 1040 V from the IRS website and submit your payment by the tax deadline to stay in compliance with your tax obligations.

Make sure to always consult with a tax professional or accountant if you have any questions or concerns about using Form 1040 V or making a payment to the IRS.