IRS Form 1040 SR is a specialized form for seniors who are 65 years or older. It is designed to make tax filing easier for those in this age group. The instructions for this form can sometimes be confusing, so it’s important to have a clear understanding of how to fill it out correctly.

By utilizing the IRS Form 1040 SR Instructions 2024 Printable, seniors can easily follow along and ensure they are completing their tax return accurately. This printable guide provides step-by-step instructions on how to fill out each section of the form, making the process much simpler for seniors.

Irs Form 1040 Sr Instructions 2024 Printable

Irs Form 1040 Sr Instructions 2024 Printable

Get and Print Irs Form 1040 Sr Instructions 2024 Printable

1040 Tax Form 2024 2025 Fill Edit And Download PDF Guru

1040 Tax Form 2024 2025 Fill Edit And Download PDF Guru

IRS Form 1040 SR Instructions 2024 Printable

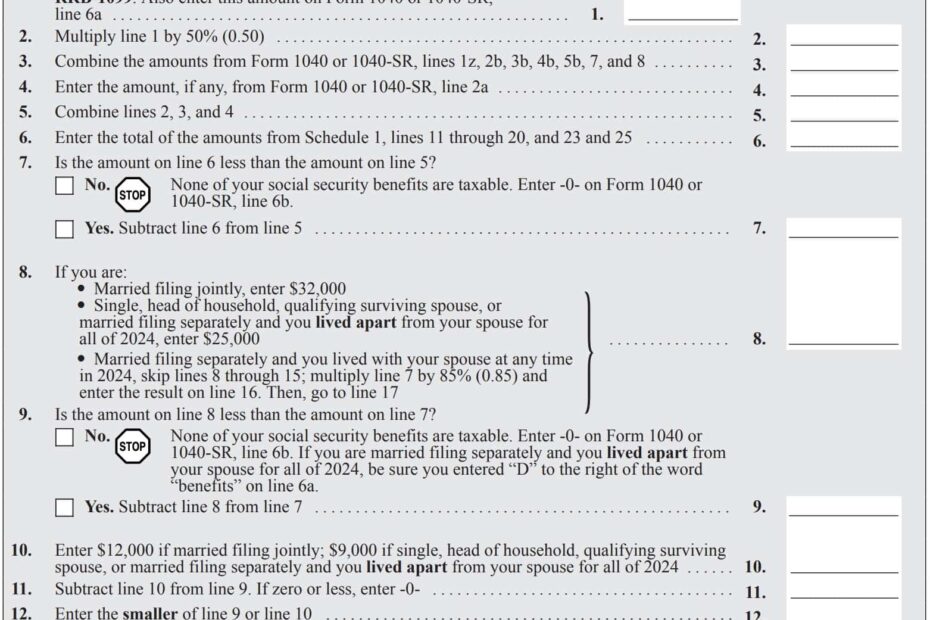

When using the IRS Form 1040 SR Instructions 2024 Printable, seniors should start by gathering all necessary documents, such as income statements, receipts, and any other relevant tax information. The instructions will guide them through each line of the form, explaining what information is needed and where to input it.

It is important for seniors to pay close attention to the details provided in the instructions, as any errors or omissions could result in delays or penalties. By following the step-by-step guide, seniors can ensure that they are accurately reporting their income, deductions, and credits, ultimately resulting in a correct tax return.

Additionally, the IRS Form 1040 SR Instructions 2024 Printable also provides information on common tax deductions and credits that seniors may be eligible for, such as the Senior Tax Credit or the Retirement Savings Contributions Credit. By understanding these potential tax breaks, seniors can maximize their tax savings and reduce their overall tax liability.

In conclusion, the IRS Form 1040 SR Instructions 2024 Printable is a valuable resource for seniors who are looking to file their taxes accurately and efficiently. By following the instructions provided in this printable guide, seniors can navigate the tax filing process with confidence and ensure they are taking advantage of all available tax deductions and credits.