IRS Form 1040 is a crucial document for taxpayers in the United States to file their annual income tax returns. The IRS updates the form periodically to reflect changes in tax laws and regulations. The 2025 version of Form 1040 is designed to streamline the filing process and make it easier for taxpayers to report their income and deductions accurately.

One of the key features of the 2025 version of Form 1040 is that it is available in a printable format, making it convenient for taxpayers to fill out and submit their tax returns. This printable version can be downloaded from the IRS website or obtained from local tax offices. It includes all the necessary fields and instructions for taxpayers to report their income, deductions, and credits.

Quickly Access and Print Irs Form 1040 Printable 2025

IRS Updates Tax Brackets Standard Deductions For 2025 CPA Practice Advisor

IRS Updates Tax Brackets Standard Deductions For 2025 CPA Practice Advisor

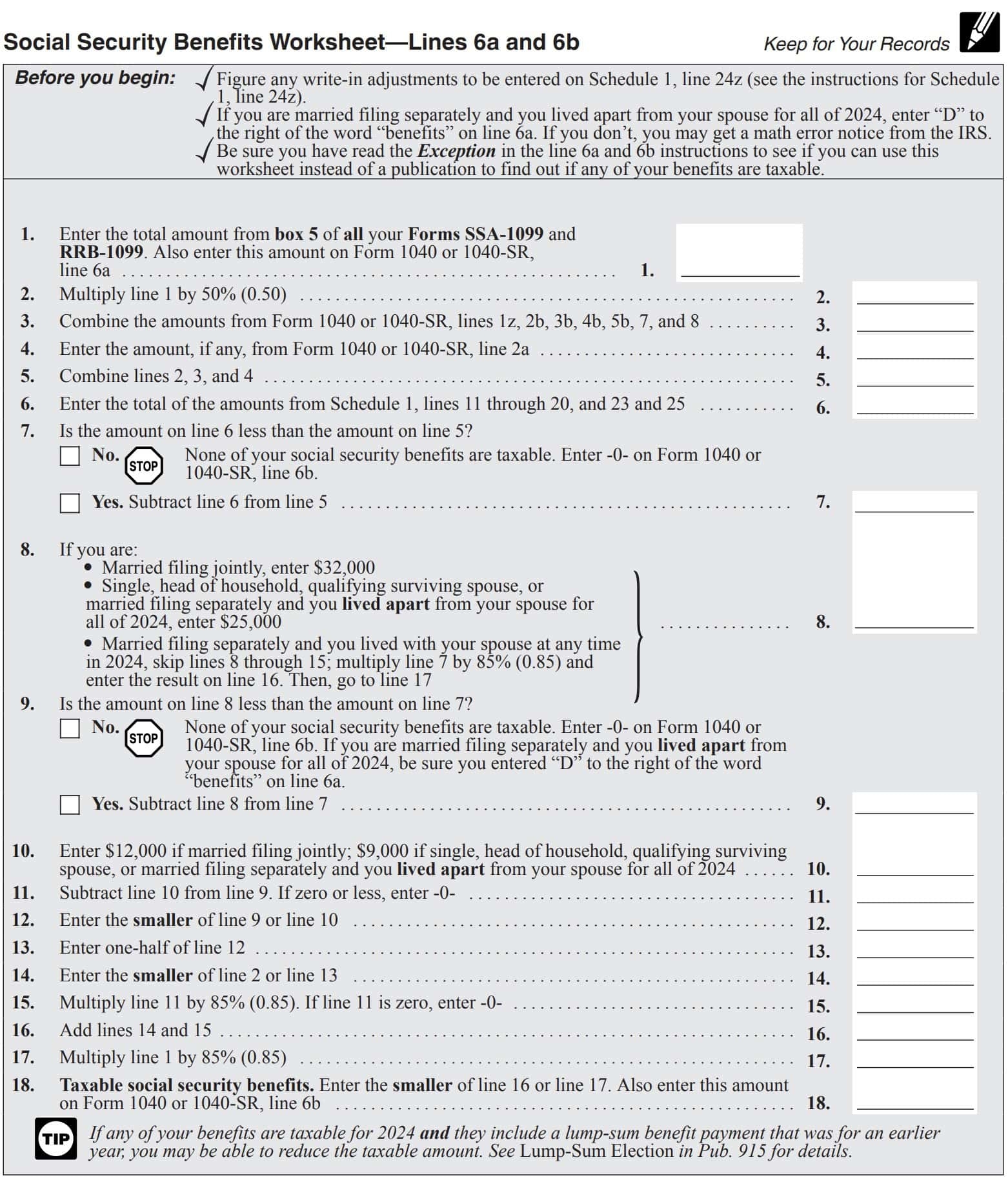

When filling out IRS Form 1040 Printable 2025, taxpayers must ensure that they provide accurate information about their income, expenses, and other relevant financial details. They should also double-check their calculations and attach any required documentation, such as W-2 forms or receipts for deductions. Filing an incomplete or incorrect tax return can result in penalties or audits by the IRS.

It is important for taxpayers to stay informed about changes to tax laws and regulations that may affect their filing requirements. The IRS provides resources and guidance to help taxpayers understand their obligations and maximize their tax refunds. By using the printable version of Form 1040, taxpayers can easily comply with their tax obligations and avoid potential issues with the IRS.

In conclusion, IRS Form 1040 Printable 2025 is a valuable tool for taxpayers to report their income and deductions accurately and efficiently. By following the instructions and providing accurate information, taxpayers can fulfill their tax obligations and avoid penalties. It is recommended that taxpayers consult with a tax professional or use online resources to ensure they are filing their tax returns correctly and taking advantage of all available deductions and credits.