When it comes to filing your taxes, it’s important to have all the necessary forms ready. One of the most common forms that individuals use is the IRS Form 1040. This form is used to report your annual income and determine how much tax you owe or how much of a refund you may be eligible for. It’s essential to have a clear understanding of this form to ensure accurate and timely filing.

The IRS Form 1040 is the standard form used by individuals to file their annual income tax return. It is divided into several sections, including income, deductions, credits, and taxes owed. The form is updated annually to reflect changes in tax laws and regulations, so it’s crucial to use the most current version when filing your taxes.

Quickly Access and Print Irs Form 1040 Printable

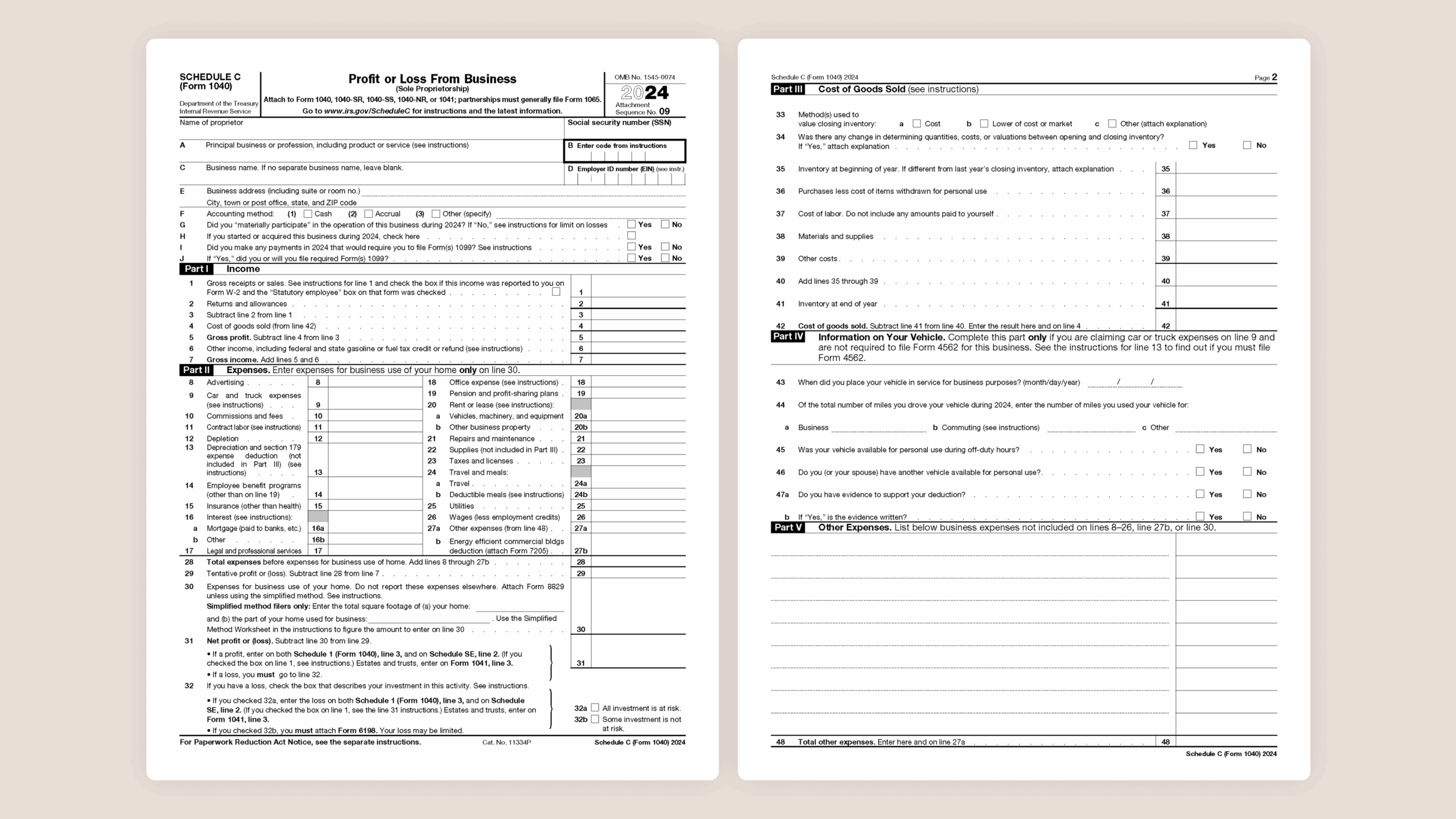

Understanding The Schedule C Tax Form

Understanding The Schedule C Tax Form

One of the benefits of the IRS Form 1040 is that it is available in a printable format on the IRS website. This means that you can easily download and print the form from the comfort of your own home. Having a printable version of the form allows you to fill it out at your own pace and double-check your information before submitting it to the IRS.

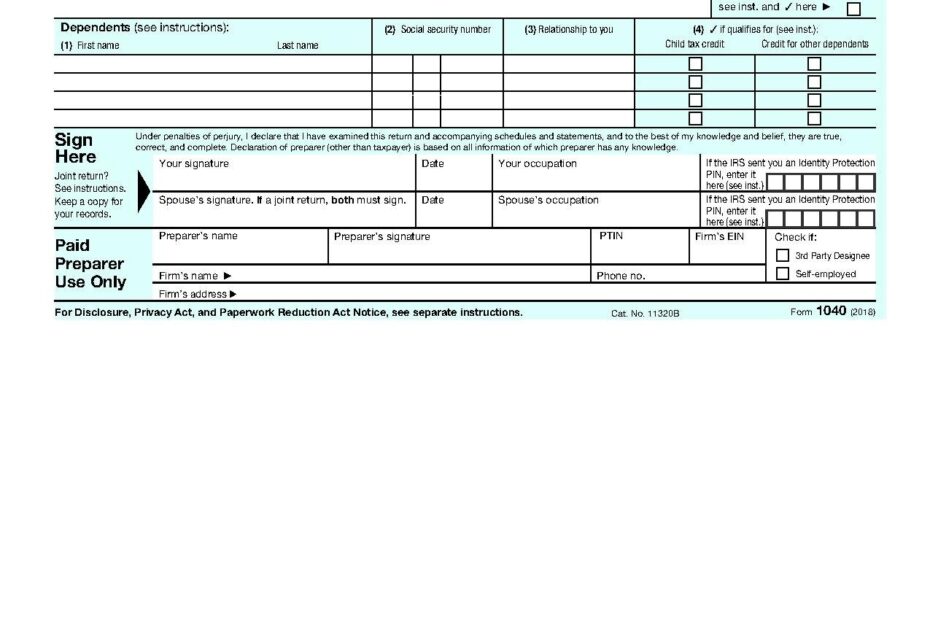

When filling out the IRS Form 1040, it’s important to have all your income documents, such as W-2s and 1099s, on hand. You will need to report your income from all sources, including wages, salaries, tips, and investment income. Additionally, you will need to provide information on any deductions or credits you may be eligible for to reduce your tax liability.

Once you have completed the IRS Form 1040, you can either mail it to the IRS or file it electronically using tax software or through the IRS website. Filing electronically is often faster and more secure, and it can also help you receive any refunds more quickly. Be sure to keep a copy of your completed form for your records.

In conclusion, the IRS Form 1040 is an essential document for filing your taxes accurately and on time. By using the printable version of the form, you can easily fill it out and submit it to the IRS with confidence. Remember to gather all your income documents and take advantage of any deductions or credits that may apply to your situation. Happy filing!