IRS Form 1040 EZ is a simplified version of the standard Form 1040 for individuals who have a straightforward tax situation. This form is designed for taxpayers who have no dependents, do not itemize deductions, and have a taxable income of less than $100,000. Filing Form 1040 EZ can help you quickly and easily file your taxes without the need for complicated calculations or additional schedules.

IRS Form 1040 EZ is available for download on the IRS website in a printable format. You can easily access and print the form from the comfort of your own home. The form comes with instructions that guide you through the process of filling it out correctly. Make sure to double-check all the information you enter on the form to avoid any mistakes that could delay your tax return.

Download and Print Irs Form 1040 Ez Printable

Preparing A 1040EZ Tax Form Based On A Sample W2 Adult And

Preparing A 1040EZ Tax Form Based On A Sample W2 Adult And

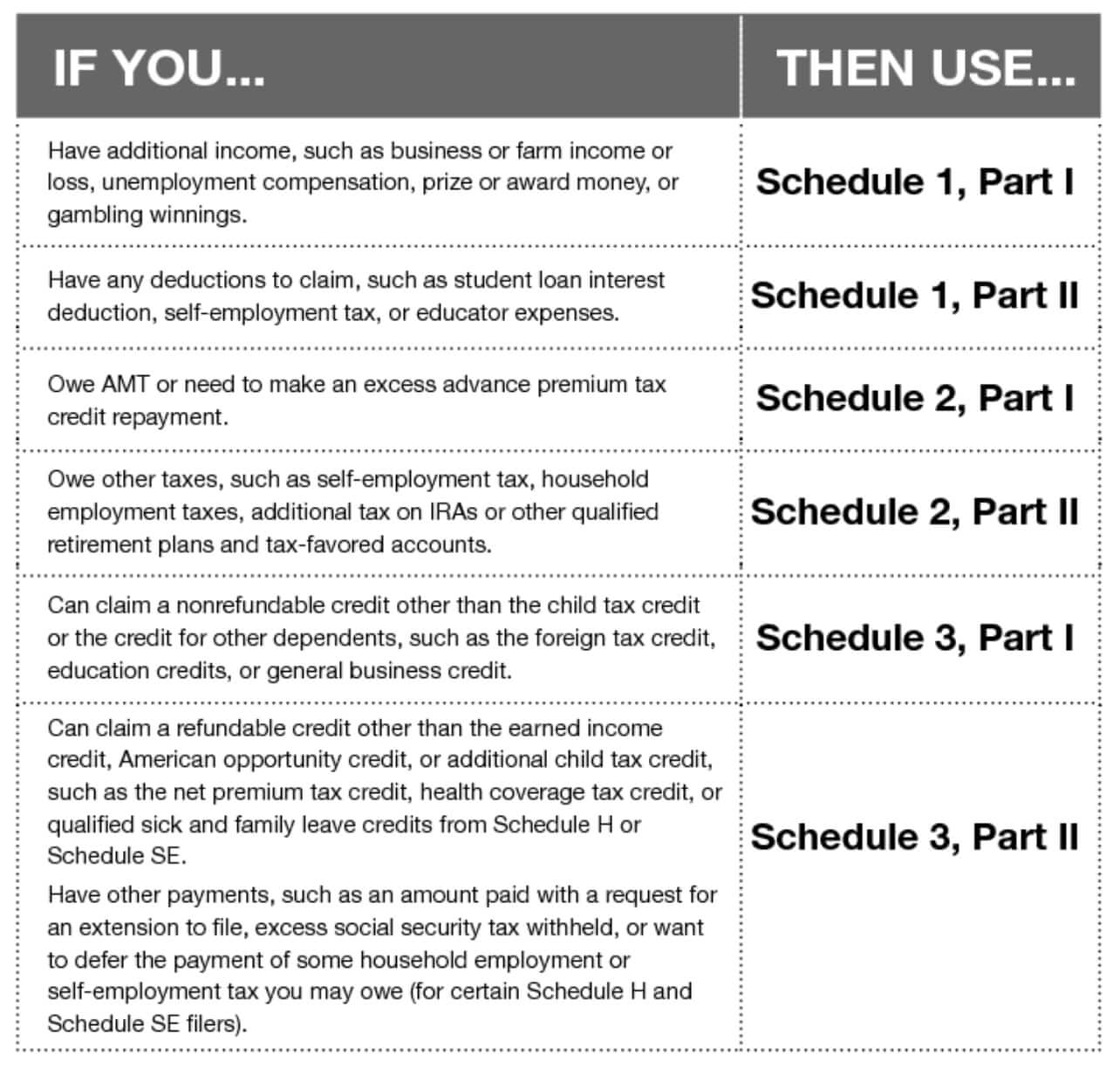

When filling out IRS Form 1040 EZ, you will need to provide information about your income, deductions, and tax credits. This includes your wages, salaries, tips, and any taxable interest you earned throughout the year. You will also need to report any federal income tax withheld from your paychecks and any refund you are claiming. Once you have completed the form, you can either mail it to the IRS or file it electronically.

It is important to note that IRS Form 1040 EZ has certain limitations, such as not being able to claim any adjustments to income or tax credits other than the Earned Income Credit. If you have a more complex tax situation, you may need to file the standard Form 1040 instead. Consulting with a tax professional can help you determine which form is right for your specific circumstances.

In conclusion, IRS Form 1040 EZ Printable provides a simple and convenient way for individuals with uncomplicated tax situations to file their taxes. By following the instructions and accurately filling out the form, you can ensure that your tax return is processed quickly and efficiently. Remember to keep a copy of your completed form for your records and to stay organized throughout the tax filing process.