Are you a freelancer, self-employed individual, or someone who receives income that isn’t subject to withholding? If so, you may need to file estimated quarterly taxes using IRS Form 1040-ES. This form is used to calculate and pay estimated taxes on income that is not subject to withholding, such as self-employment income, investment income, rental income, or other sources.

IRS Form 1040-ES is used to report and pay estimated taxes to the IRS on a quarterly basis. It is important to accurately estimate your tax liability and make timely payments to avoid penalties and interest charges. The form includes instructions on how to calculate your estimated tax liability and provides payment vouchers for each quarter.

Download and Print Irs Form 1040 Es Printable

IRS Form 1040 ES Instructions Estimated Tax Payments

IRS Form 1040 ES Instructions Estimated Tax Payments

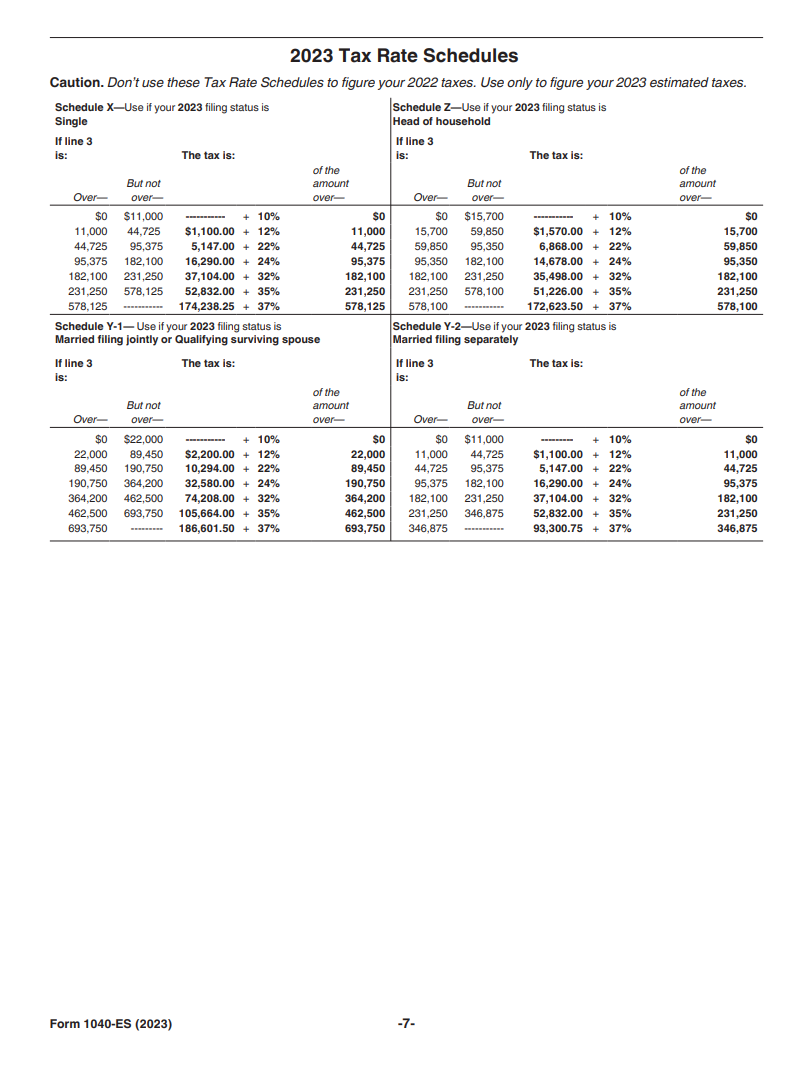

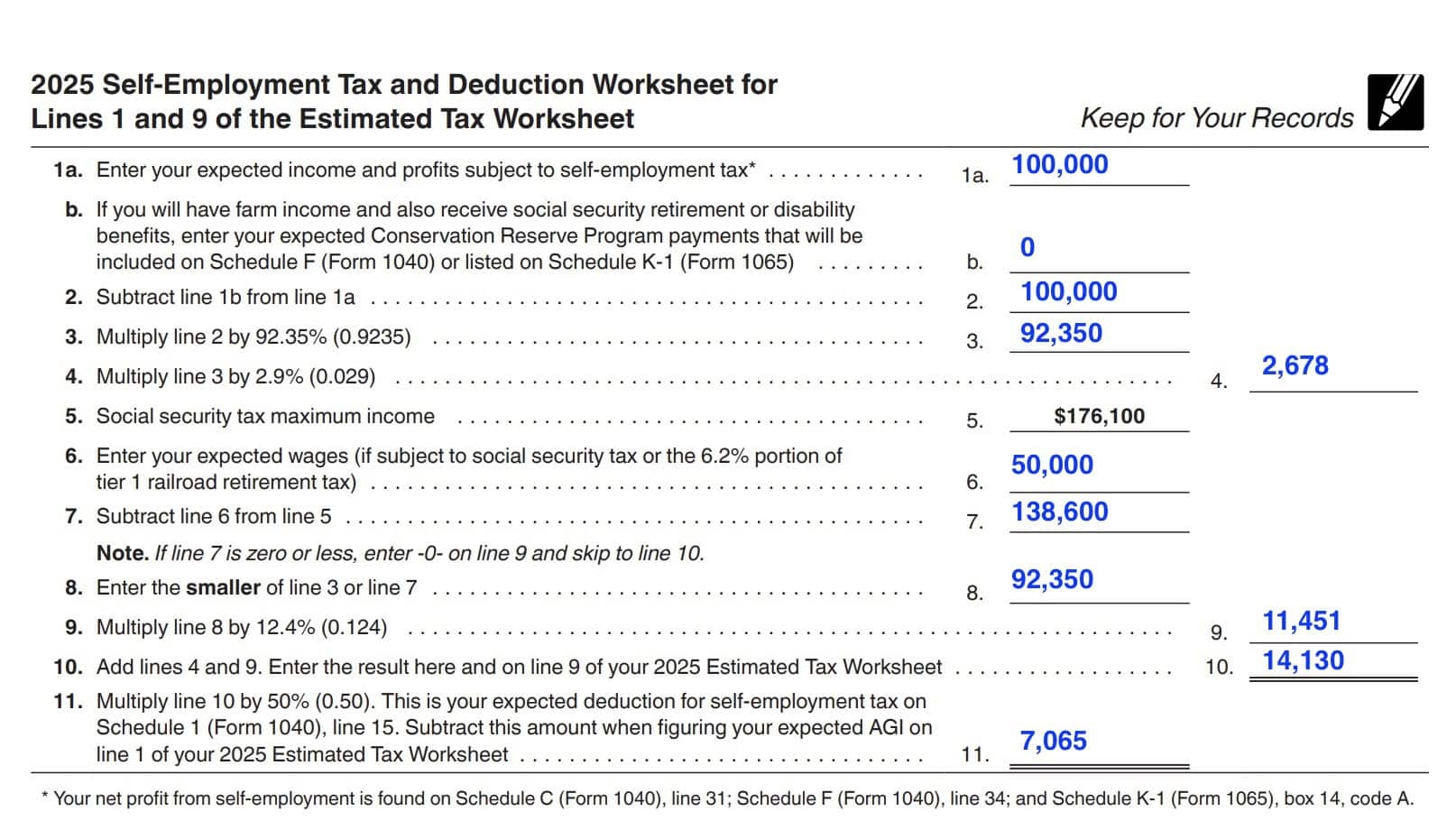

When using IRS Form 1040-ES, you will need to estimate your total income for the year, as well as any deductions and credits you may be eligible for. Based on this information, you will calculate your estimated tax liability and divide it into four equal quarterly payments. The due dates for these payments are typically April 15, June 15, September 15, and January 15 of the following year.

It is important to note that IRS Form 1040-ES is only for estimated taxes and should not be used to file your annual tax return. If you are required to file an annual tax return, you will still need to do so separately using the appropriate forms. However, filing and paying estimated taxes throughout the year can help you avoid a large tax bill and potential penalties when you file your annual return.

Overall, IRS Form 1040-ES is a valuable tool for individuals who need to pay estimated taxes on income that is not subject to withholding. By accurately estimating your tax liability and making timely payments, you can stay in compliance with IRS regulations and avoid penalties and interest charges. Be sure to consult with a tax professional if you have any questions or need assistance with completing the form.

In conclusion, IRS Form 1040-ES is an essential tool for individuals who need to pay estimated taxes on income not subject to withholding. By accurately estimating your tax liability and making timely payments, you can avoid penalties and interest charges. Make sure to consult with a tax professional for guidance on completing the form.