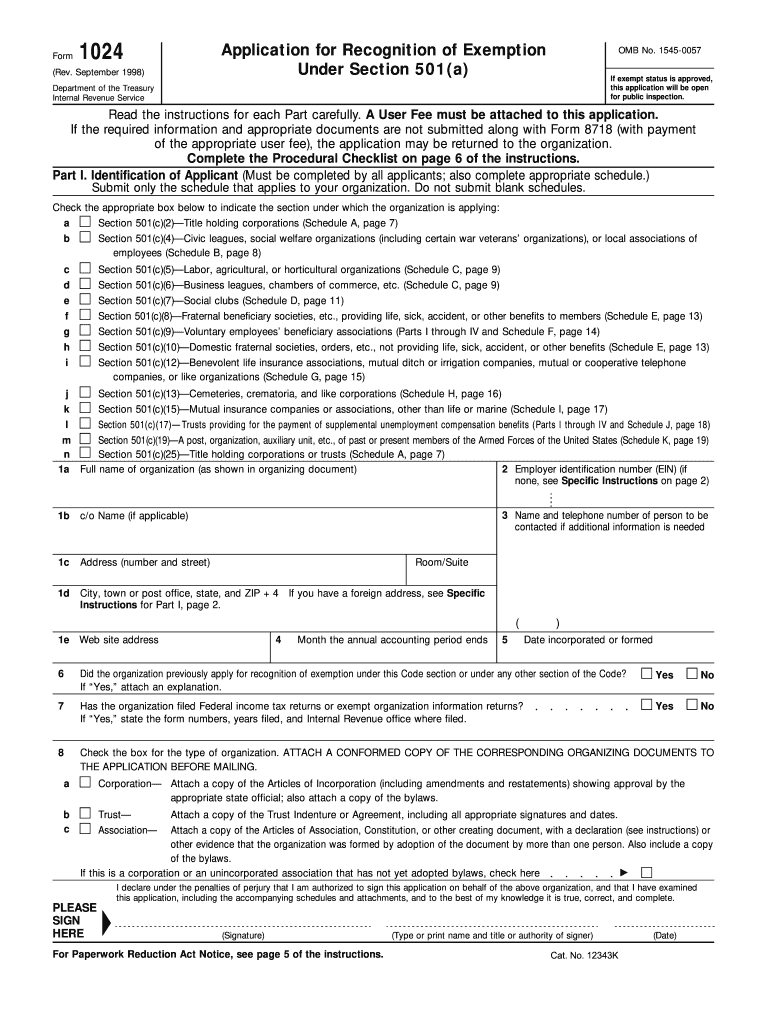

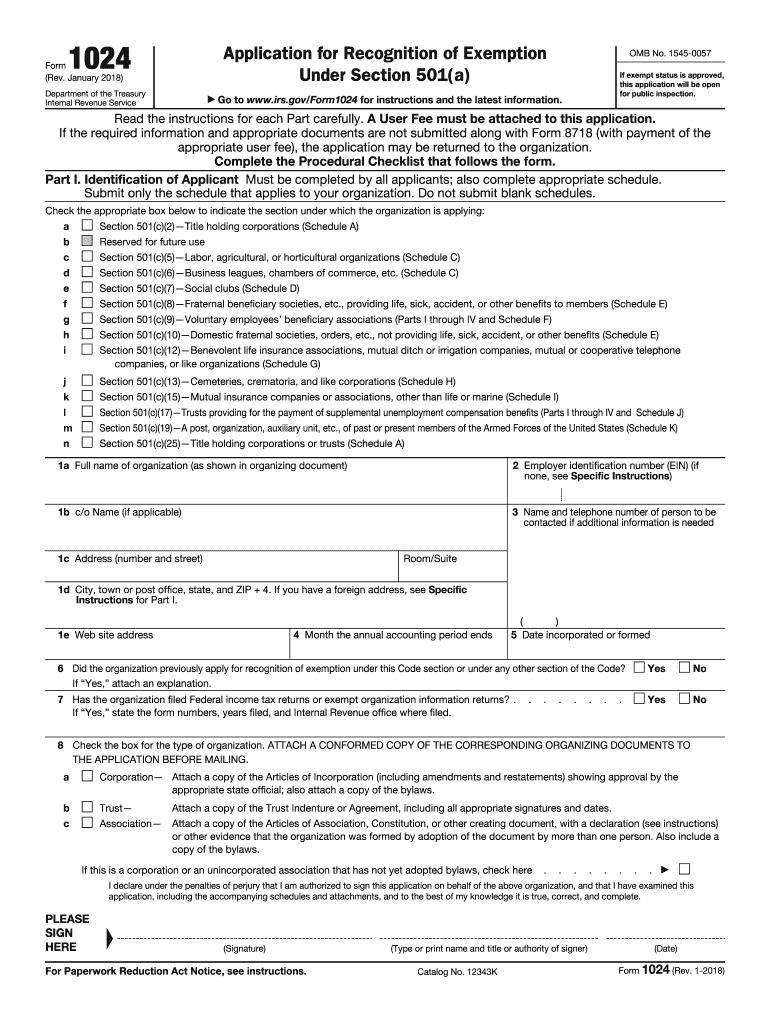

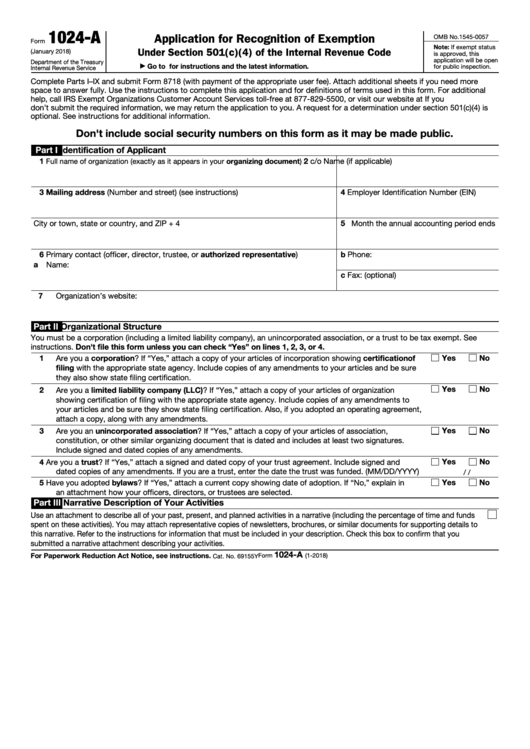

When it comes to applying for tax-exempt status for your organization, it’s important to fill out the necessary forms correctly. One of these forms is IRS Form 1024, which is used to apply for recognition of exemption under Section 501(a) of the Internal Revenue Code. This form is essential for organizations seeking tax-exempt status, and having a printable version can make the process much easier.

IRS Form 1024 Printable is readily available online, making it convenient for organizations to access and fill out. By downloading and printing the form, you can easily complete it at your own pace and ensure that all the required information is accurately provided. This can help streamline the application process and avoid any delays in obtaining tax-exempt status for your organization.

Save and Print Irs Form 1024 Printable

IRS Form 1024 Fill Out Sign Online And Download Fillable PDF

IRS Form 1024 Fill Out Sign Online And Download Fillable PDF

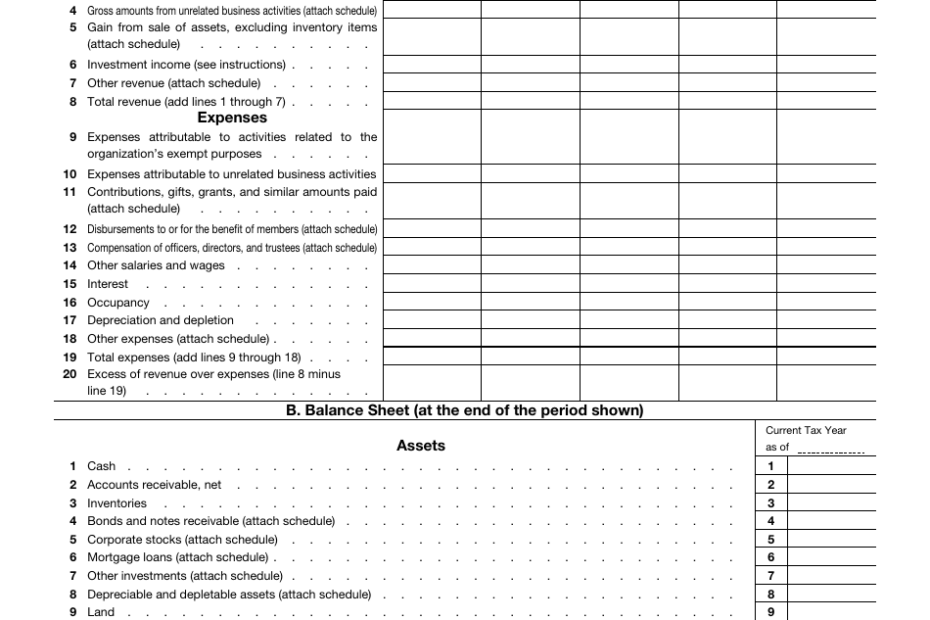

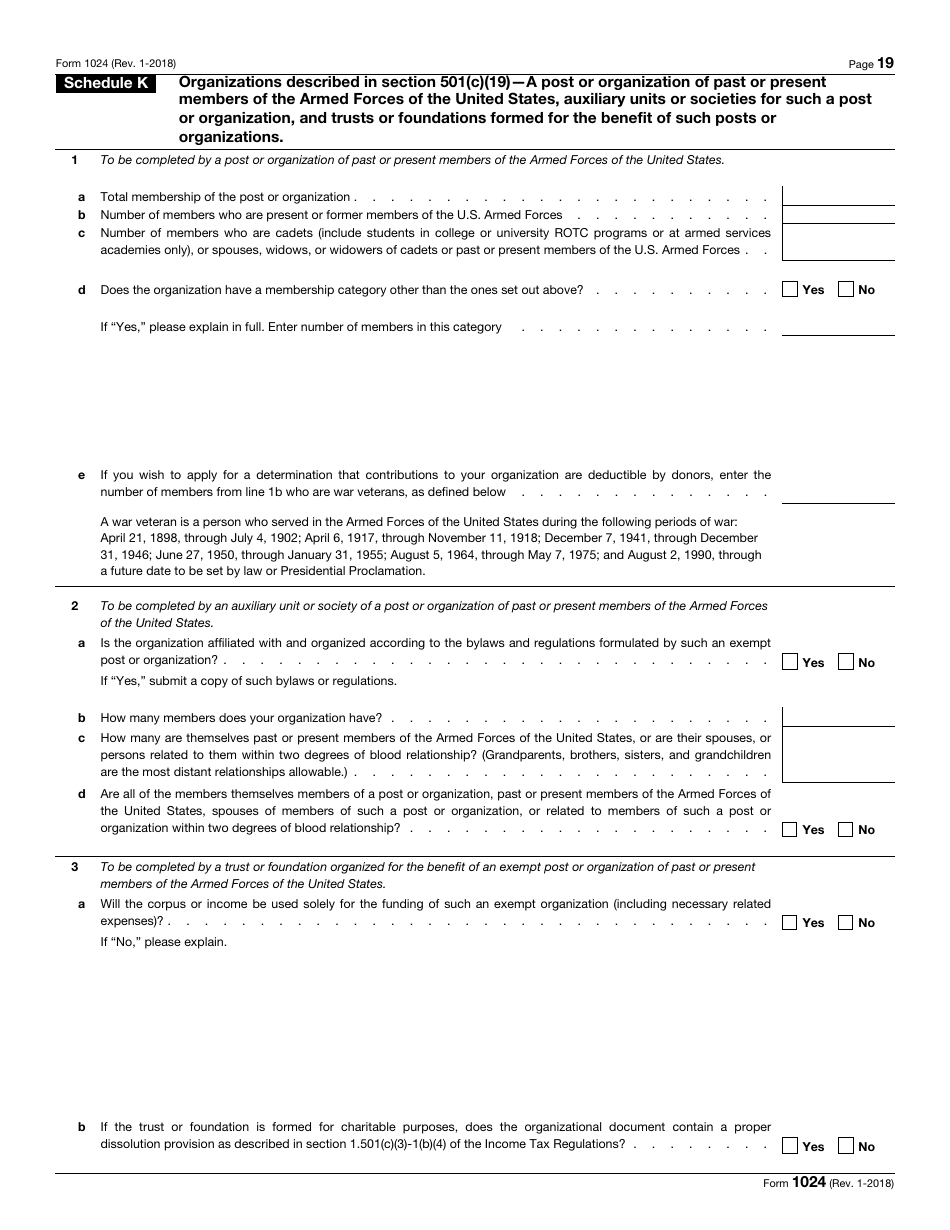

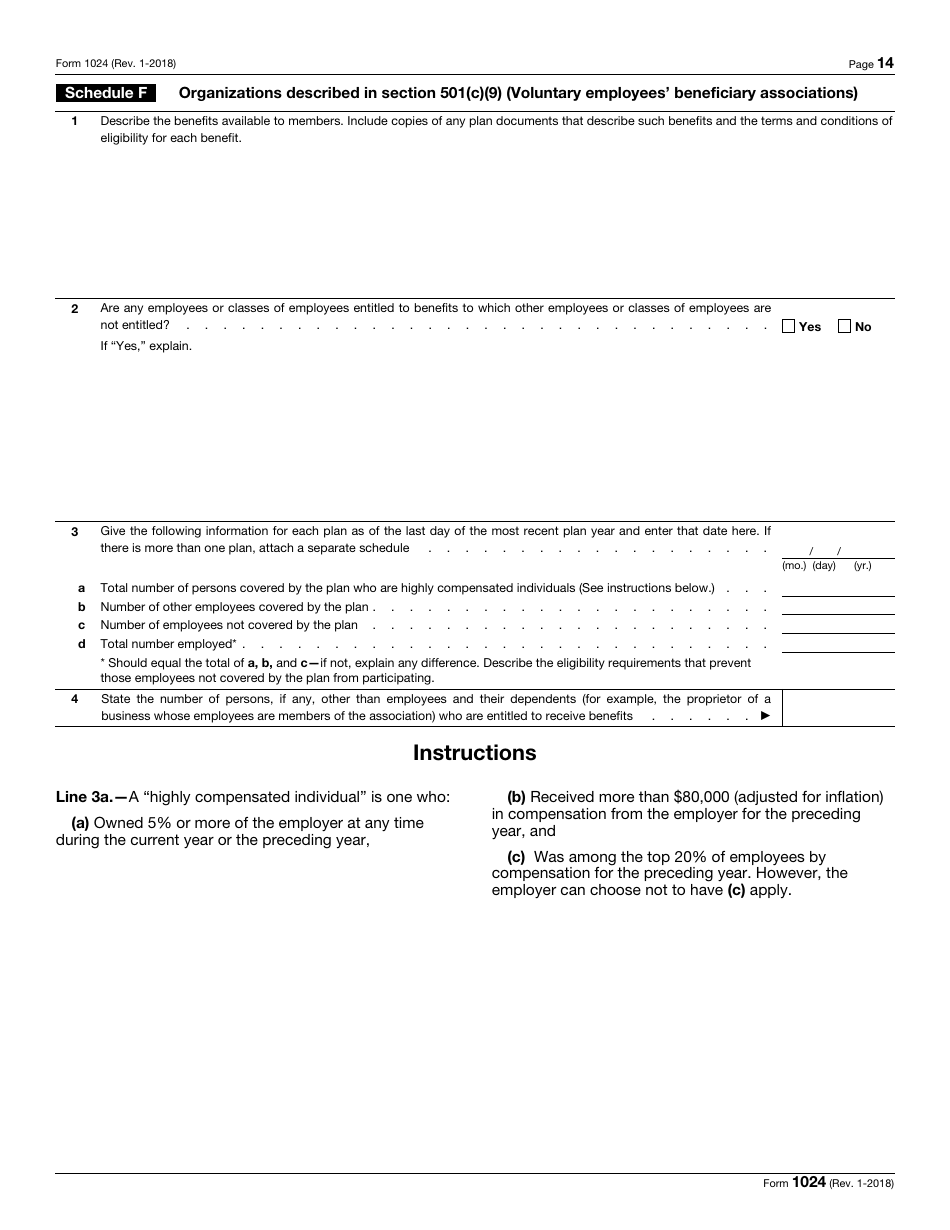

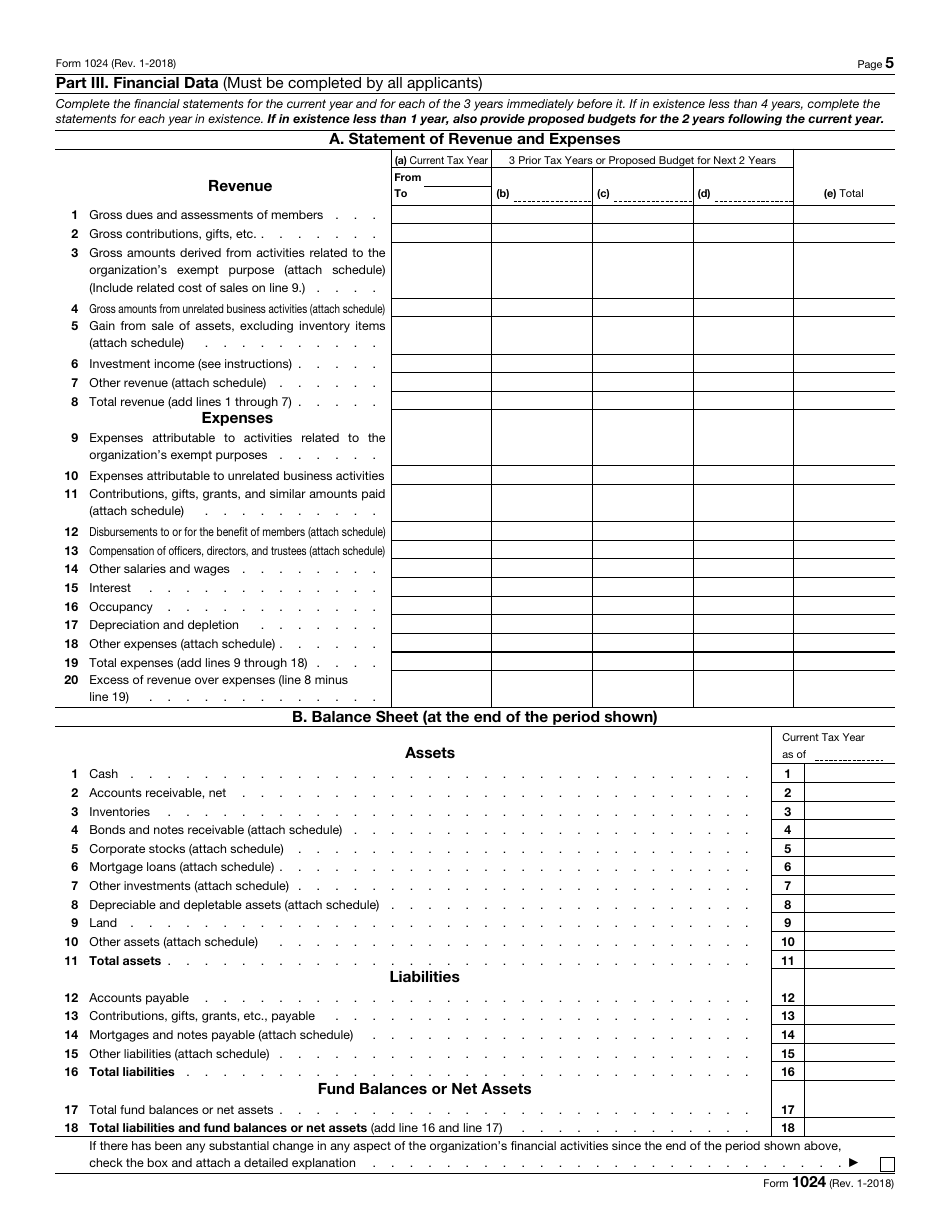

When filling out IRS Form 1024, it’s important to carefully follow the instructions provided by the IRS. Make sure to provide all the necessary information about your organization, including details about its activities, governance structure, and financial information. You will also need to include a statement of purpose and a statement of revenues and expenses for the current and three preceding years.

Once you have completed IRS Form 1024, you can submit it to the IRS along with the required fee. The IRS will then review your application and determine if your organization qualifies for tax-exempt status. It’s important to keep in mind that the process can take some time, so it’s essential to be patient and follow up with the IRS if necessary.

Overall, having access to IRS Form 1024 Printable can make the process of applying for tax-exempt status much more manageable. By carefully filling out the form and providing all the necessary information, you can increase the chances of your organization being granted tax-exempt status. So, if you’re looking to apply for tax-exempt status, be sure to download and fill out IRS Form 1024 to get started on the right track.

In conclusion, IRS Form 1024 Printable is a valuable resource for organizations seeking tax-exempt status. By using this form, you can easily fill out the necessary information and submit it to the IRS for review. Make sure to follow the instructions provided and provide all the required information to increase your chances of being granted tax-exempt status for your organization.

2018 2025 Form IRS 1024 Fill Online Printable Fillable Blank PdfFiller

2018 2025 Form IRS 1024 Fill Online Printable Fillable Blank PdfFiller

IRS Form 1024 Fill Out Sign Online And Download Fillable PDF

IRS Form 1024 Fill Out Sign Online And Download Fillable PDF

Irs Form 1024 Fillable Printable Forms Free Online

Irs Form 1024 Fillable Printable Forms Free Online

IRS Form 1024 Fill Out Sign Online And Download Fillable PDF

IRS Form 1024 Fill Out Sign Online And Download Fillable PDF

Need a stress-free way to take care of your financial needs? Our free printable checks provide a straightforward, reliable, and personalizable solution right from home. Whether for individual purposes, small enterprises, or keeping track of expenses, these printable checks save both time and cash without sacrificing professionalism. Compatible with common finance software and designed for easy printing, they’re a smart option to bank-ordered checks. Print your own today and fully manage your financial transactions—no delays, zero charges. Explore our free templates and choose the one that fits your needs. With our beginner-friendly tools, managing your finances has never been this easy. Access your printable checks for free and streamline your check-writing process with security!.