Are you running out of time to file your taxes? If so, you may want to consider filing for an extension with the IRS. By doing so, you can get an additional six months to submit your tax return. This can help alleviate some of the stress and pressure that comes with meeting the deadline.

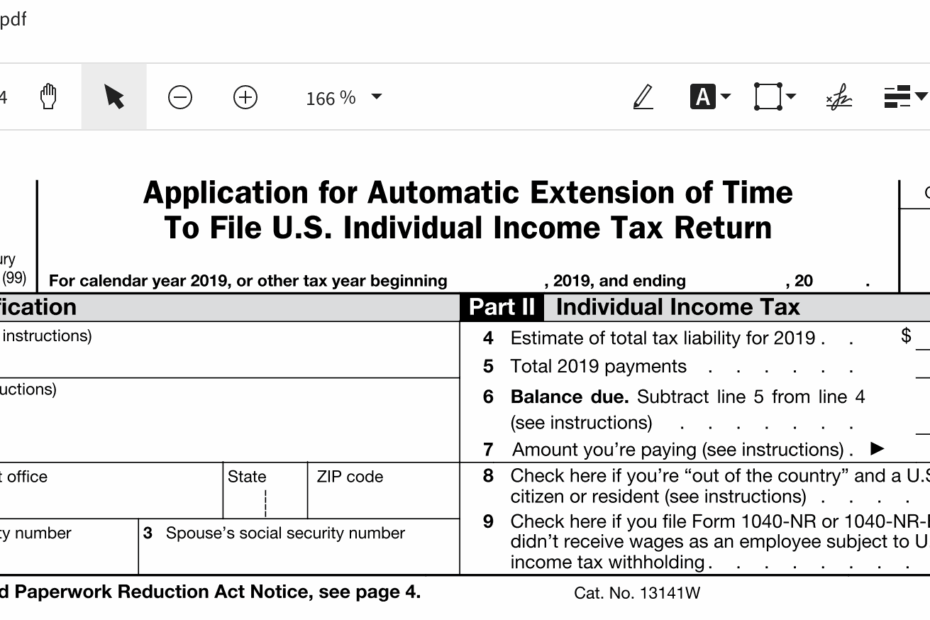

One way to request an extension is by using the IRS Extension Form Printable. This form allows you to easily apply for an extension online or by mail. It provides all the necessary information and instructions to help you successfully file for an extension.

Download and Print Irs Extension Form Printable

3 11 212 Applications For Extension Of Time To File Internal

3 11 212 Applications For Extension Of Time To File Internal

When completing the IRS Extension Form Printable, make sure to include your personal information, such as your name, address, and social security number. You will also need to estimate the total amount of tax owed and make a payment if necessary. It’s important to submit the form before the original tax deadline to avoid any penalties or fees.

After submitting the IRS Extension Form Printable, you will receive a confirmation from the IRS acknowledging your request for an extension. This will give you peace of mind knowing that your extension has been approved and that you have more time to prepare and file your tax return.

Remember, filing for an extension does not give you more time to pay any taxes owed. You are still required to pay any estimated taxes by the original deadline to avoid penalties and interest. However, the extension can give you the extra time you need to gather all the necessary documents and information to accurately complete your tax return.

In conclusion, if you find yourself in need of more time to file your taxes, consider using the IRS Extension Form Printable to request an extension. It’s a simple and convenient way to get the extra time you need to submit your tax return without facing any penalties. Take advantage of this option to ensure that you meet all IRS requirements and obligations.