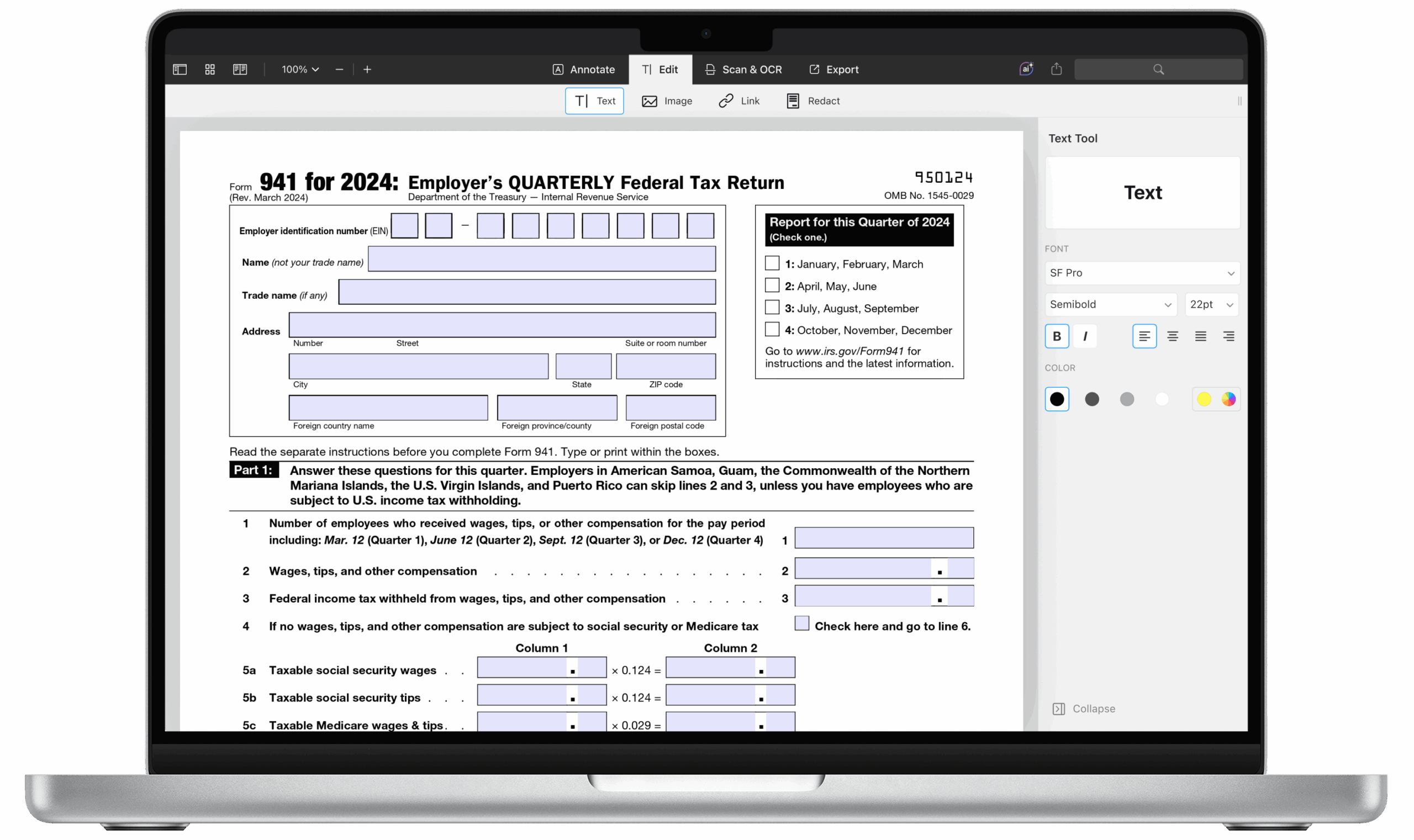

As a business owner, it is crucial to stay compliant with all tax regulations set forth by the Internal Revenue Service (IRS). One of the forms that must be filled out and submitted by employers is the IRS 941 Form 2024. This form is used to report quarterly wages paid to employees, as well as any taxes withheld from their paychecks.

Failure to properly file the IRS 941 Form 2024 can result in penalties and fines for your business. That is why it is important to ensure that you have the most up-to-date version of the form and that you fill it out correctly.

Save and Print Irs 941 Form 2024 Printable

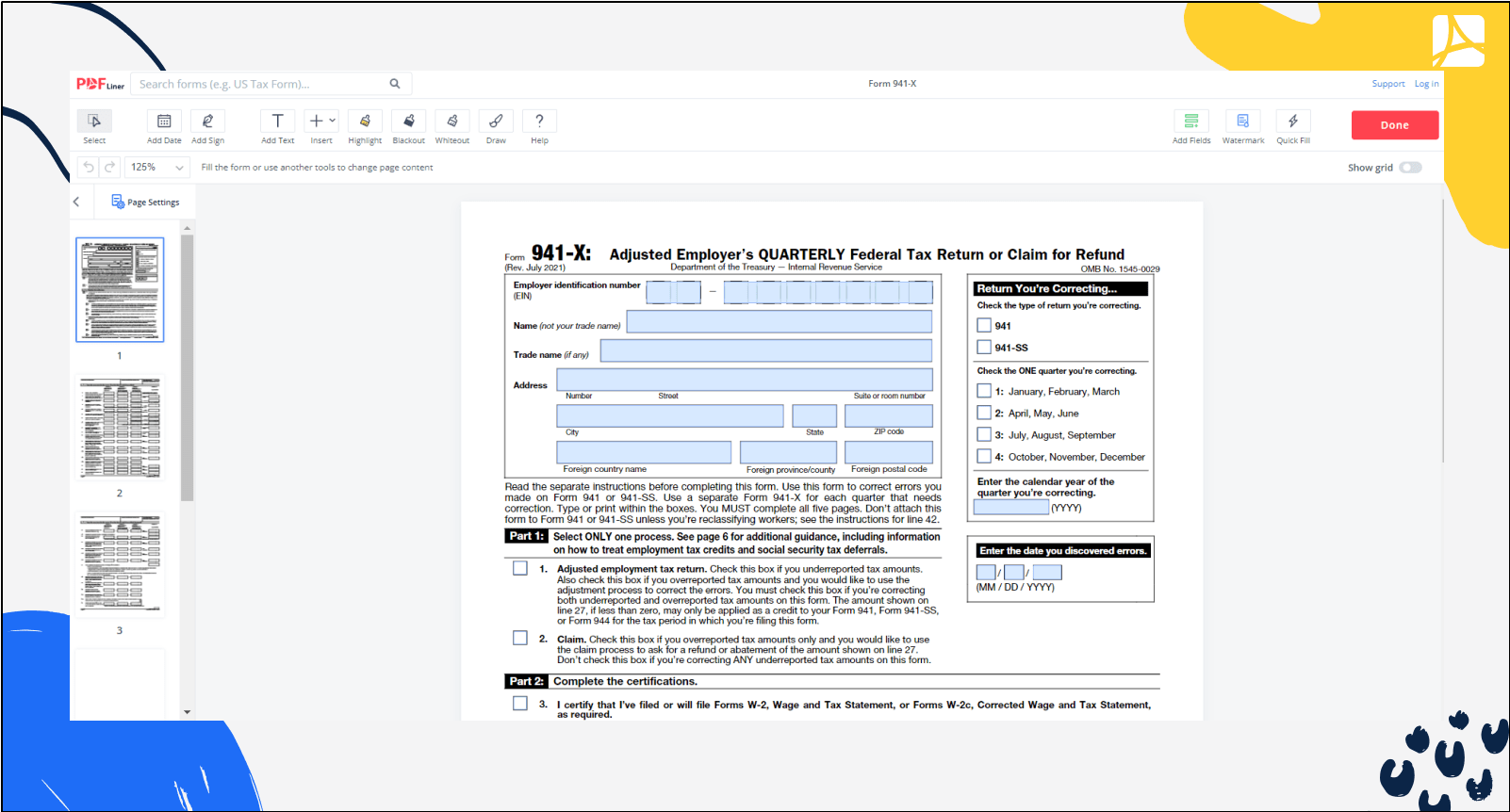

Form 941 X Print And Sign Form Online PDFliner

Form 941 X Print And Sign Form Online PDFliner

IRS 941 Form 2024 Printable

The IRS 941 Form 2024 can be easily found on the IRS website for download. This form is typically due at the end of each quarter, so it is important to stay on top of your filing deadlines. By utilizing the printable version of the form, you can easily fill it out by hand or input the information digitally before printing and submitting it.

When completing the IRS 941 Form 2024, be sure to accurately report the wages paid to your employees, as well as any federal income tax, social security tax, and Medicare tax withheld. Additionally, you will need to calculate the employer’s portion of social security and Medicare taxes owed based on the wages reported.

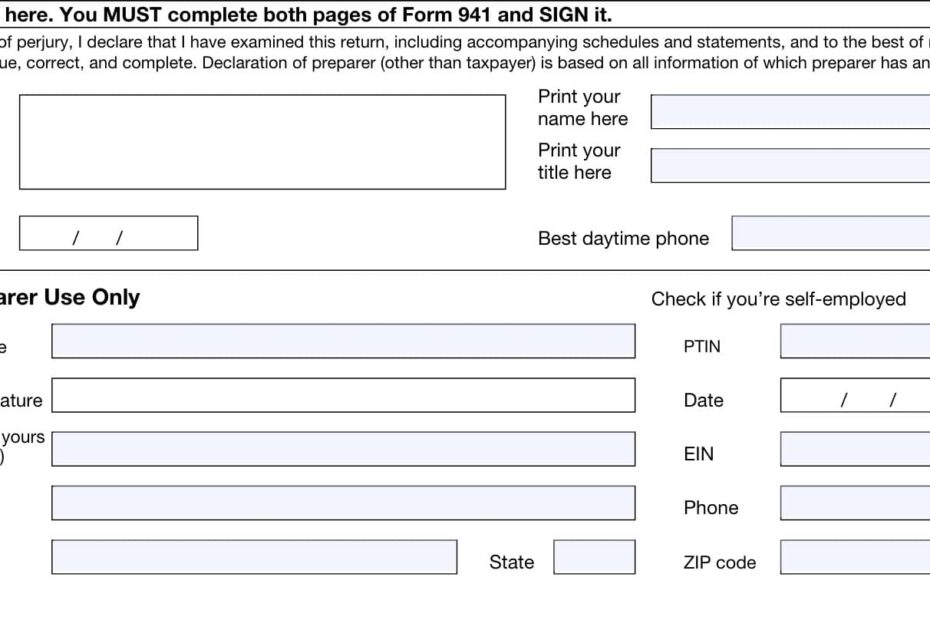

After completing the form, be sure to double-check all information for accuracy before submitting it to the IRS. Keeping detailed records of your quarterly filings will also help you stay organized and easily reference past information when needed.

Overall, staying compliant with IRS regulations, such as filing the IRS 941 Form 2024, is essential for the financial health of your business. By utilizing the printable version of the form and carefully following instructions, you can ensure that you are meeting your tax obligations and avoiding any potential penalties.

In conclusion, the IRS 941 Form 2024 is a vital document that must be completed accurately and submitted on time. By utilizing the printable version of the form, you can simplify the filing process and ensure that you are meeting all tax requirements set forth by the IRS.