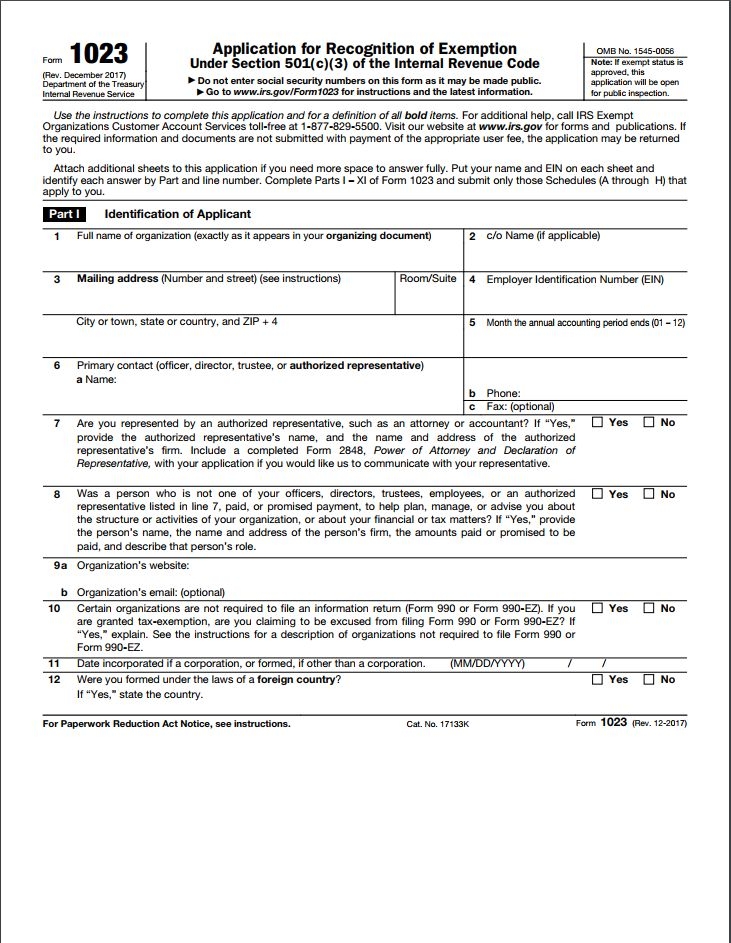

Are you looking to apply for tax-exempt status for your organization? The IRS Form 1023 is the official application form for nonprofits seeking 501(c)(3) status. This form is crucial for organizations looking to receive tax-deductible donations and other benefits. It’s important to fill out this form accurately and completely to ensure your organization meets the requirements for tax-exempt status.

Form 1023 is a comprehensive document that requires detailed information about your organization’s activities, governance structure, finances, and more. The IRS provides a printable version of Form 1023 on their website, making it easy for organizations to access and complete the application. This form must be submitted to the IRS along with the required fee and supporting documents to be considered for tax-exempt status.

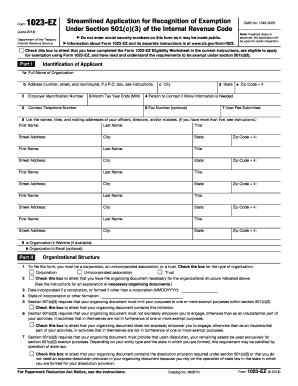

Irs 501c3 Application Form 1023 Printable

Irs 501c3 Application Form 1023 Printable

Get and Print Irs 501c3 Application Form 1023 Printable

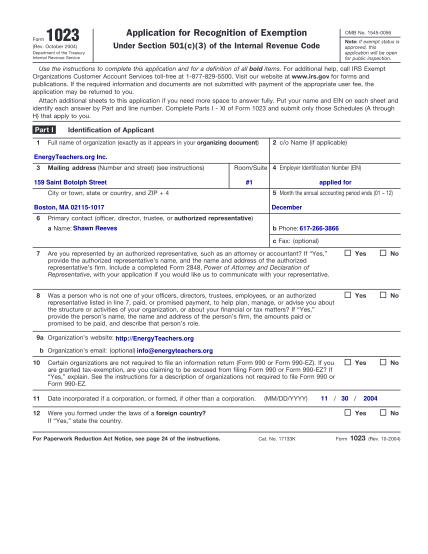

Fillable Form 1023 Application For 501 C 3 Exemption

Fillable Form 1023 Application For 501 C 3 Exemption

When filling out Form 1023, it’s important to pay close attention to the instructions and provide accurate information. The IRS reviews each application carefully to ensure that the organization meets the requirements for tax-exempt status. Any errors or omissions on the form could result in delays or even denial of tax-exempt status.

Before submitting Form 1023, it’s a good idea to consult with a tax professional or attorney who specializes in nonprofit law. They can help you navigate the application process and ensure that your organization meets all the necessary requirements for tax-exempt status. Additionally, they can help you prepare the required supporting documents, such as financial statements and governance documents.

Once you’ve completed Form 1023 and gathered all the necessary documents, you can submit your application to the IRS. The processing time for Form 1023 can vary, but you can check the status of your application online through the IRS website. Once your organization is approved for tax-exempt status, you’ll receive an official determination letter from the IRS confirming your 501(c)(3) status.

In conclusion, the IRS Form 1023 is a crucial document for organizations seeking tax-exempt status. By filling out this form accurately and completely, you can increase your chances of receiving 501(c)(3) status and enjoying the benefits that come with it. Be sure to consult with a professional to help you navigate the application process and ensure your organization meets all the necessary requirements.