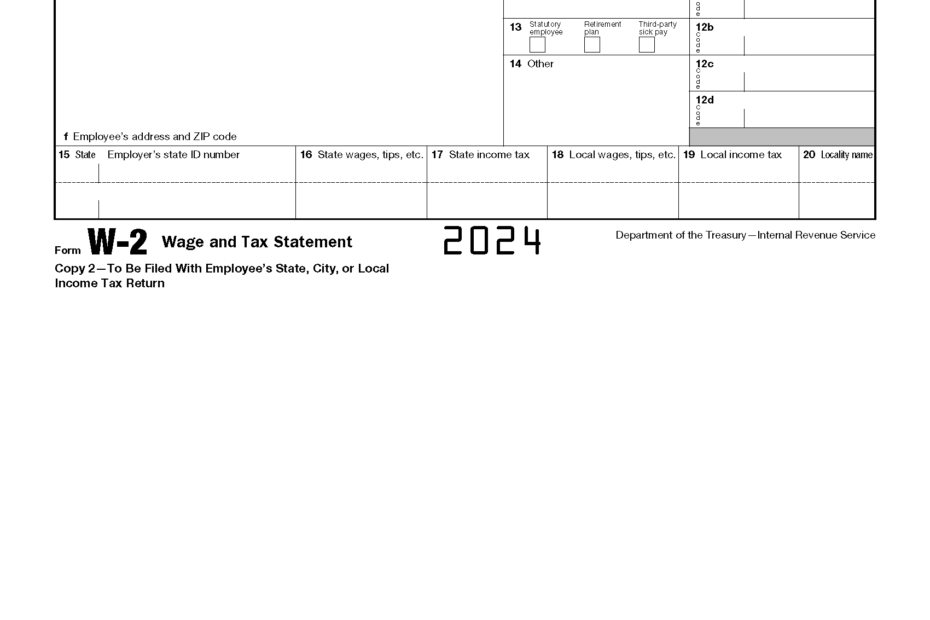

When tax season rolls around, one of the most important documents you’ll need is your W2 form. This form provides crucial information about your income and taxes withheld throughout the year. In order to file your taxes accurately, it’s essential to have this form in hand. The IRS 2024 W2 form is the latest version that employers use to report wages and taxes for their employees.

For those who prefer to fill out their tax forms by hand, having a printable version of the IRS 2024 W2 form can be incredibly helpful. This allows you to easily access and complete the form without the need for specialized software or online tools. Whether you’re an employee looking to file your taxes or an employer needing to provide W2 forms to your staff, having a printable version of the form can streamline the process.

Save and Print Irs 2024 W2 Form Printable

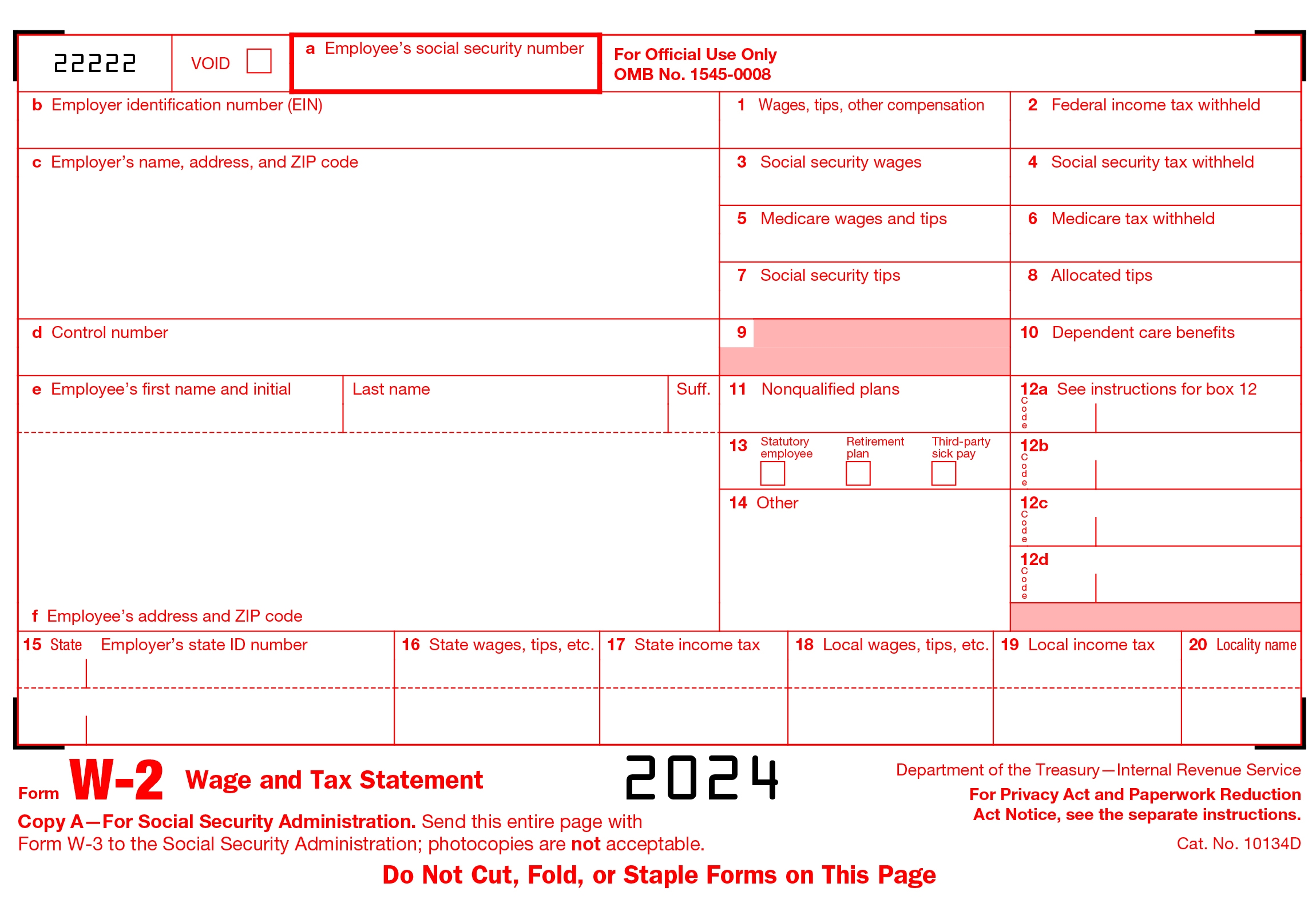

W2s 2024 W2 Tax Forms Copy A Federal IRS SSA W 2 Forms

W2s 2024 W2 Tax Forms Copy A Federal IRS SSA W 2 Forms

When using the IRS 2024 W2 form printable, be sure to double-check all information for accuracy. Any errors or discrepancies could lead to delays in processing your taxes or even trigger an audit. Make sure to carefully input all relevant data, including your personal information, income, and tax withholdings. Once you’ve completed the form, keep a copy for your records and submit the original to the IRS as instructed.

It’s important to note that the IRS 2024 W2 form printable is only valid for the tax year specified. As the IRS updates forms and regulations annually, be sure to use the correct form for the corresponding tax year. Using an outdated form could result in errors or penalties when filing your taxes. Always check the IRS website or consult with a tax professional to ensure you have the most current forms and information.

In conclusion, the IRS 2024 W2 form printable is a valuable tool for both employees and employers during tax season. By having access to this form, you can accurately report your income and taxes withheld to the IRS, ensuring compliance with tax laws and regulations. Be diligent in completing the form correctly and submitting it on time to avoid any issues with your tax return. With the right tools and information, you can navigate tax season with confidence.