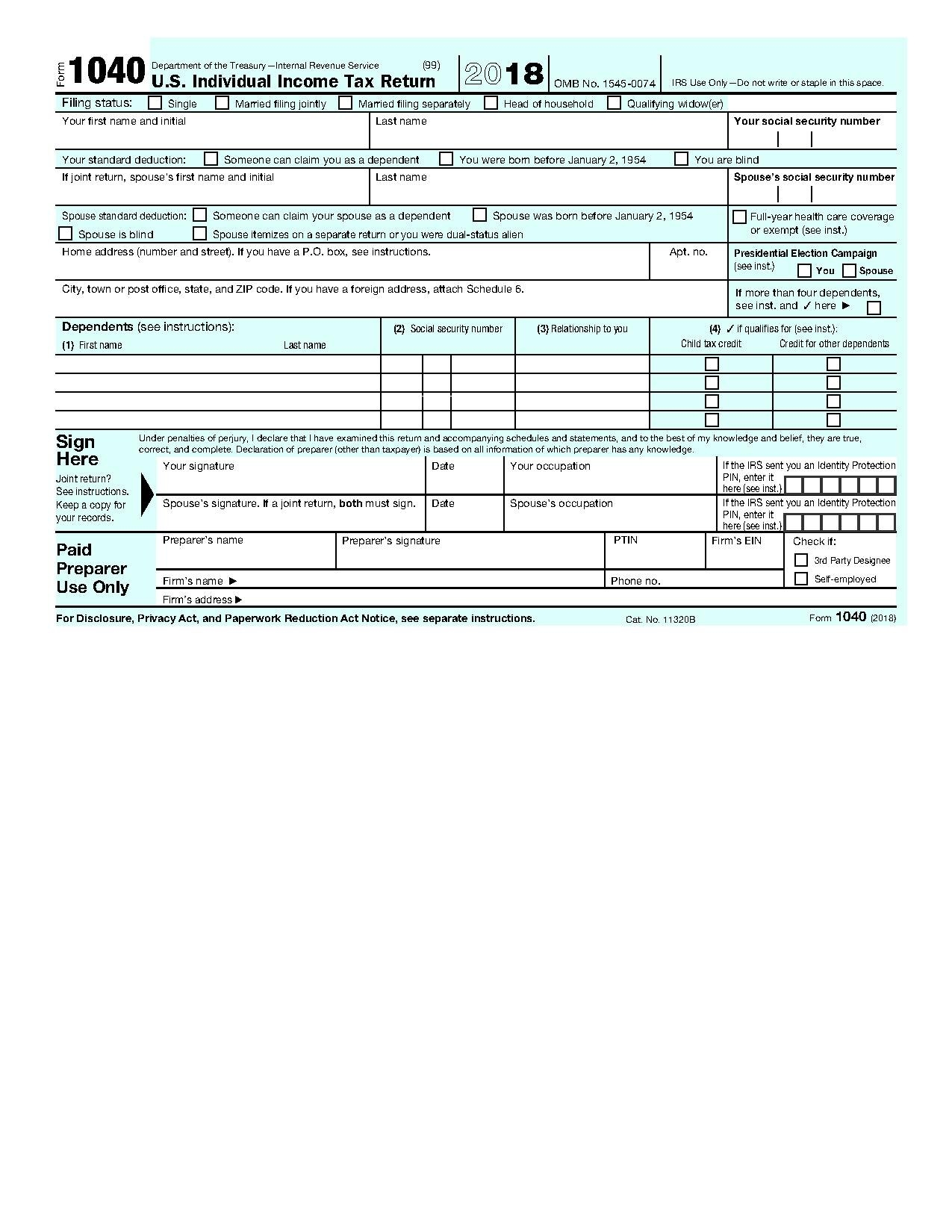

The IRS Form 1040 is the standard tax form used by individuals to file their annual income tax returns with the Internal Revenue Service. For the year 2024, the IRS has made the Form 1040 available in a printable format for taxpayers to easily fill out and submit.

Whether you are filing as a single individual, married couple, or head of household, the IRS 2024 Form 1040 Printable is designed to capture all necessary information about your income, deductions, credits, and tax liability for the year.

Download and Print Irs 2024 Form 1040 Printable

1040 Tax Form 2024 2025 Fill Edit And Download PDF Guru

1040 Tax Form 2024 2025 Fill Edit And Download PDF Guru

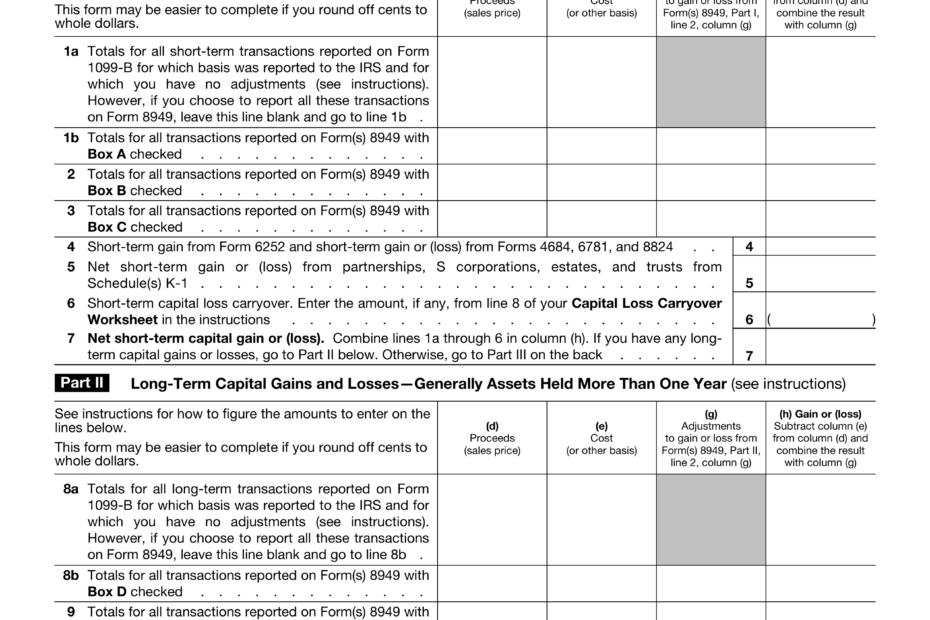

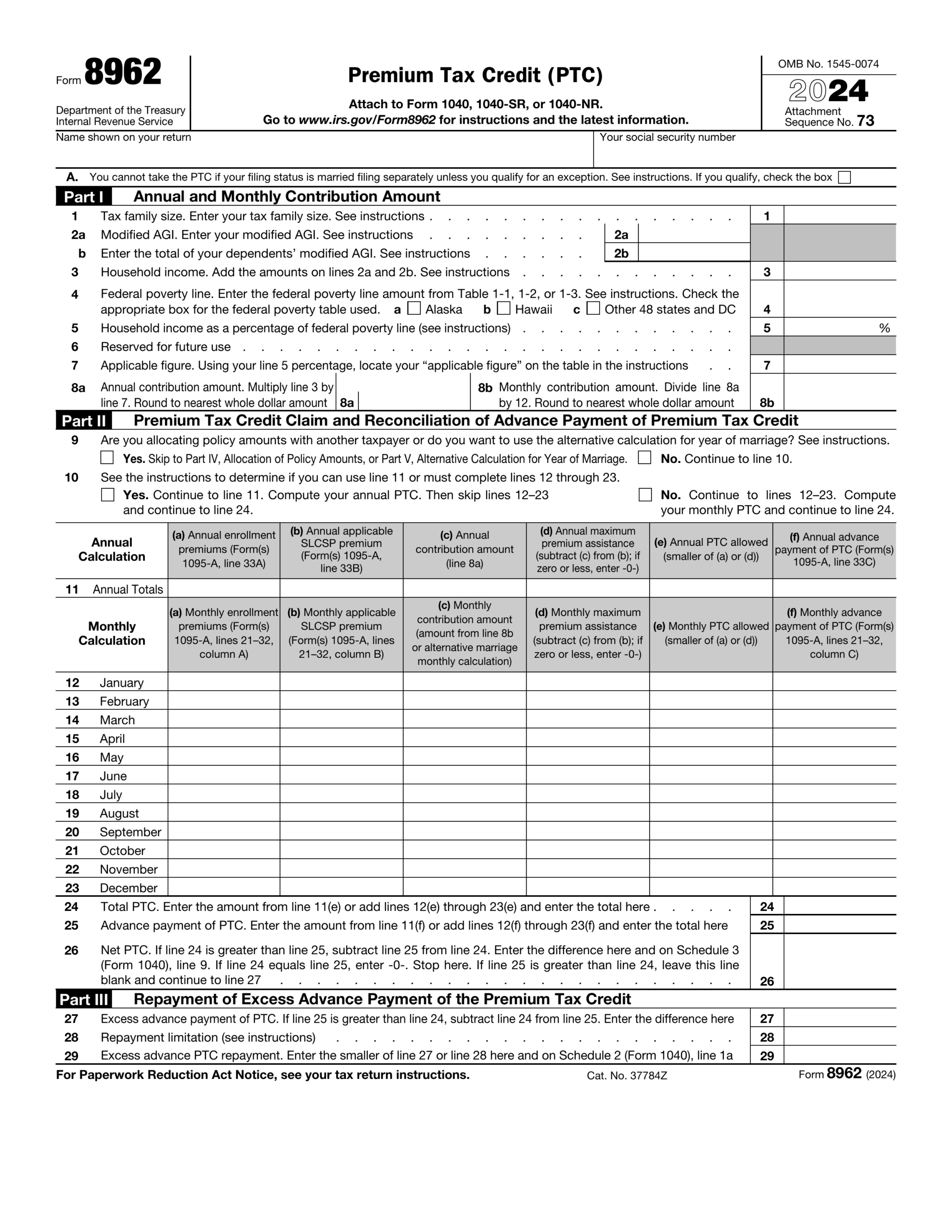

When completing the form, be sure to accurately report your income from all sources, including wages, salaries, tips, and investment earnings. You will also need to claim any deductions or credits you are eligible for to reduce your taxable income and potentially lower your overall tax bill.

It is important to carefully review the instructions provided with the IRS 2024 Form 1040 Printable to ensure you are completing it correctly and including all required supporting documentation. Failure to accurately report your income or claim deductions could result in penalties or audits by the IRS.

Once you have completed the form, you can either file it electronically through the IRS e-file system or mail it to the appropriate IRS processing center. Be sure to keep a copy of your completed form and any supporting documents for your records.

By using the IRS 2024 Form 1040 Printable, taxpayers can easily navigate the tax filing process and ensure they are fulfilling their legal obligation to report their income and pay any taxes owed. Remember to file your taxes on time to avoid any late payment penalties or interest charges.

Overall, the IRS 2024 Form 1040 Printable provides a convenient and straightforward way for individuals to fulfill their tax obligations and accurately report their income to the IRS. By following the instructions carefully and submitting the form by the deadline, taxpayers can avoid potential issues and ensure they are in compliance with federal tax laws.