When it comes to tax season, one of the most important forms that you may need to fill out is the IRS 1099 form. This form is used to report various types of income that you have received throughout the year, such as freelance earnings, rental income, or interest income. It is crucial to accurately report this information to the IRS in order to avoid any potential penalties or fines.

One of the conveniences of the IRS 1099 form is that it is available in a printable format, making it easy for you to fill out and submit to the IRS. By using the IRS 1099 printable form, you can ensure that your income information is accurately reported and that you are in compliance with tax laws.

Easily Download and Print Irs 1099 Printable Form

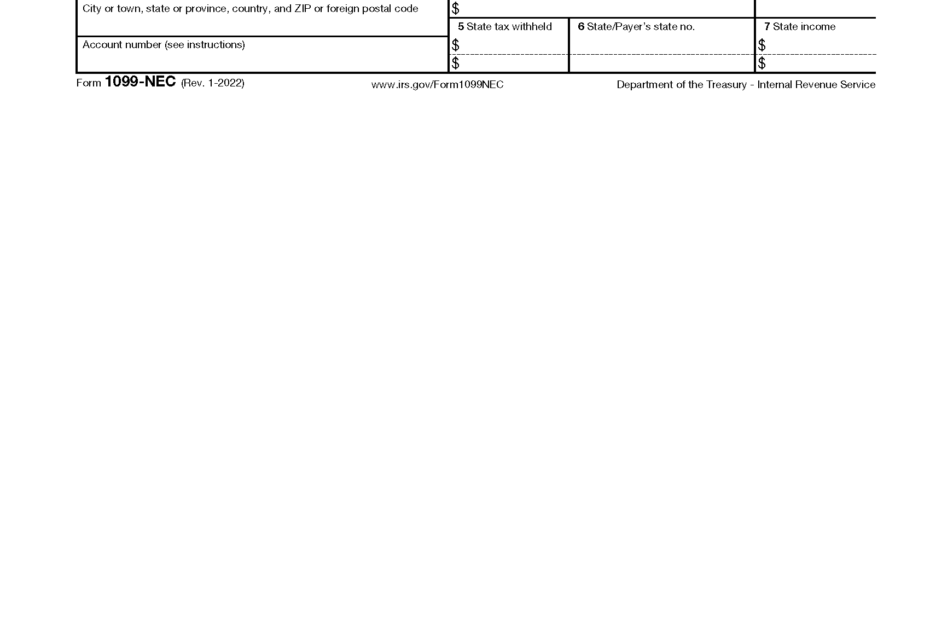

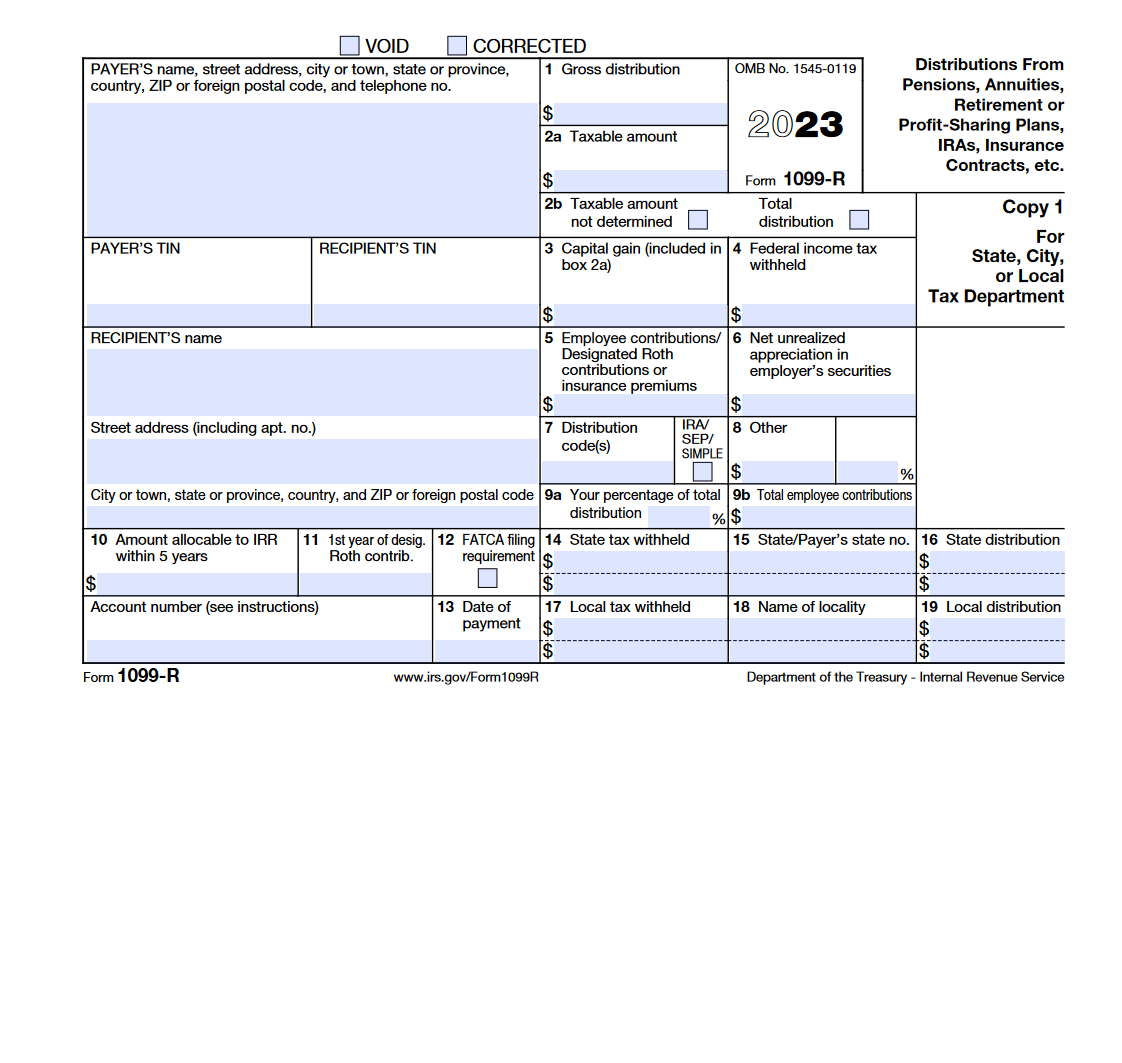

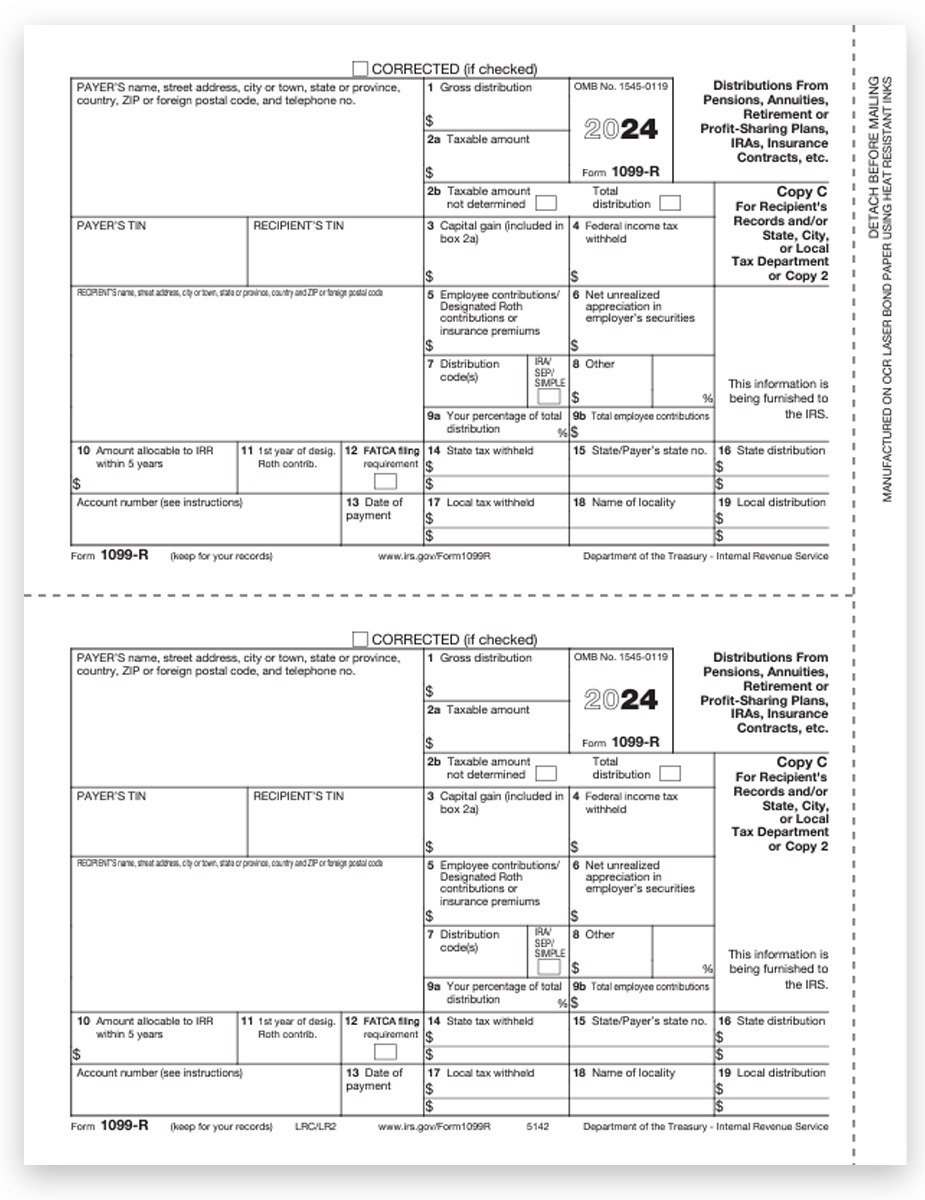

2024 1099 Forms IRS 1099 R Tax Forms Laser Printable Copy A Pack Of 100 Forms 1099 Misc Forms 2024

2024 1099 Forms IRS 1099 R Tax Forms Laser Printable Copy A Pack Of 100 Forms 1099 Misc Forms 2024

When filling out the IRS 1099 printable form, it is important to carefully review all the information that is required, such as your personal information, the type of income you are reporting, and the amount of income received. Double-checking your entries can help prevent any errors that could potentially lead to issues with the IRS.

In addition to the printable form, the IRS also provides instructions on how to fill out the 1099 form correctly. These instructions can be a valuable resource to help you navigate the process and ensure that you are accurately reporting your income. If you have any questions or concerns about filling out the form, it may be helpful to consult with a tax professional for guidance.

Overall, the IRS 1099 printable form is a valuable tool for reporting income to the IRS during tax season. By accurately filling out this form and submitting it on time, you can avoid potential penalties and ensure that you are in compliance with tax laws. Remember to keep a copy of the form for your records and to consult with a tax professional if you have any questions.

In conclusion, the IRS 1099 printable form is an essential document for reporting various types of income to the IRS. By using this form and following the instructions provided, you can ensure that your income is accurately reported and that you are in compliance with tax laws. Remember to file your taxes on time and keep a copy of your completed form for your records.