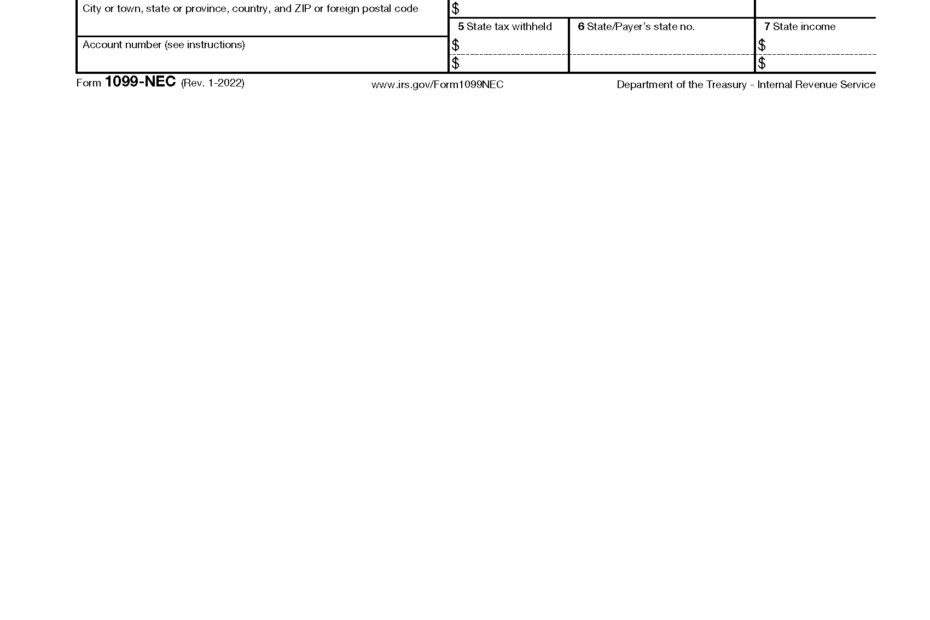

The IRS 1099 NEC form is used to report nonemployee compensation to the IRS. This form is typically used by businesses to report payments made to independent contractors, freelancers, and other non-employees. It is important to accurately report this information to avoid penalties and ensure compliance with tax laws.

With the IRS 1099 NEC printable form, businesses can easily fill out and submit the necessary information to the IRS. This form allows for the reporting of nonemployee compensation, as well as any federal income tax withheld from these payments. By using the printable form, businesses can ensure that they are accurately reporting this information and meeting their tax obligations.

Quickly Access and Print Irs 1099 Nec Printable Form

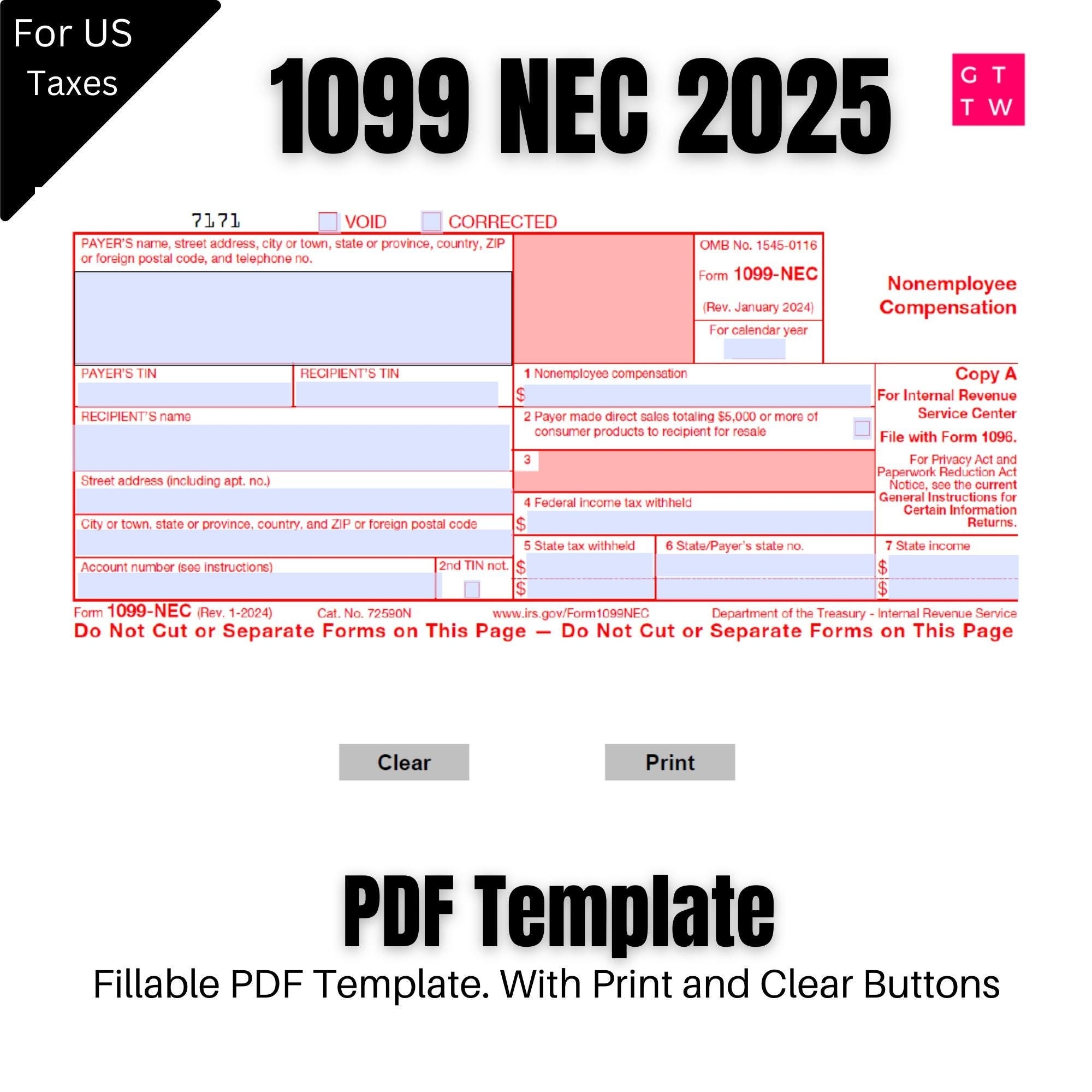

1099 NEC Editable PDF Fillable Template 2025 With Print And

1099 NEC Editable PDF Fillable Template 2025 With Print And

When filling out the IRS 1099 NEC form, businesses will need to provide the recipient’s name, address, and taxpayer identification number, as well as the amount of nonemployee compensation paid during the tax year. Additionally, businesses will need to report any federal income tax withheld from these payments. The printable form makes it easy to enter this information and submit it to the IRS.

It is important for businesses to carefully review the information on the IRS 1099 NEC form before submitting it to the IRS. Any errors or discrepancies could result in penalties or fines. By using the printable form, businesses can review the information before submitting it, ensuring that it is accurate and complete.

In conclusion, the IRS 1099 NEC printable form is a valuable tool for businesses to report nonemployee compensation to the IRS. By using this form, businesses can accurately report payments made to independent contractors and freelancers, helping to ensure compliance with tax laws and avoid penalties. It is important for businesses to carefully fill out and review this form before submitting it to the IRS.