As we approach tax season, it’s important to stay informed about any changes or updates to tax forms. One such form that may be relevant to you is the IRS 1099 NEC form. This form is used to report nonemployee compensation, and for the year 2025, there may be some updates to the form that you need to be aware of.

Whether you’re a freelancer, independent contractor, or small business owner, the IRS 1099 NEC form is an essential document for reporting income that is not subject to withholding. It’s important to accurately report this income to avoid any potential penalties or fines from the IRS.

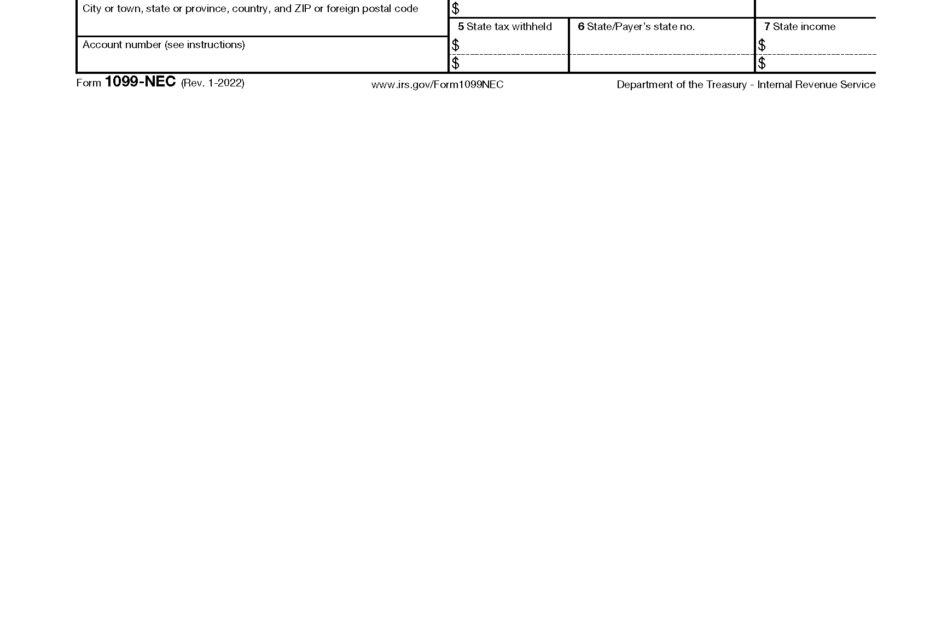

Irs 1099 Nec Form 2025 Printable Pdf Free Download

Irs 1099 Nec Form 2025 Printable Pdf Free Download

Download and Print Irs 1099 Nec Form 2025 Printable Pdf Free Download

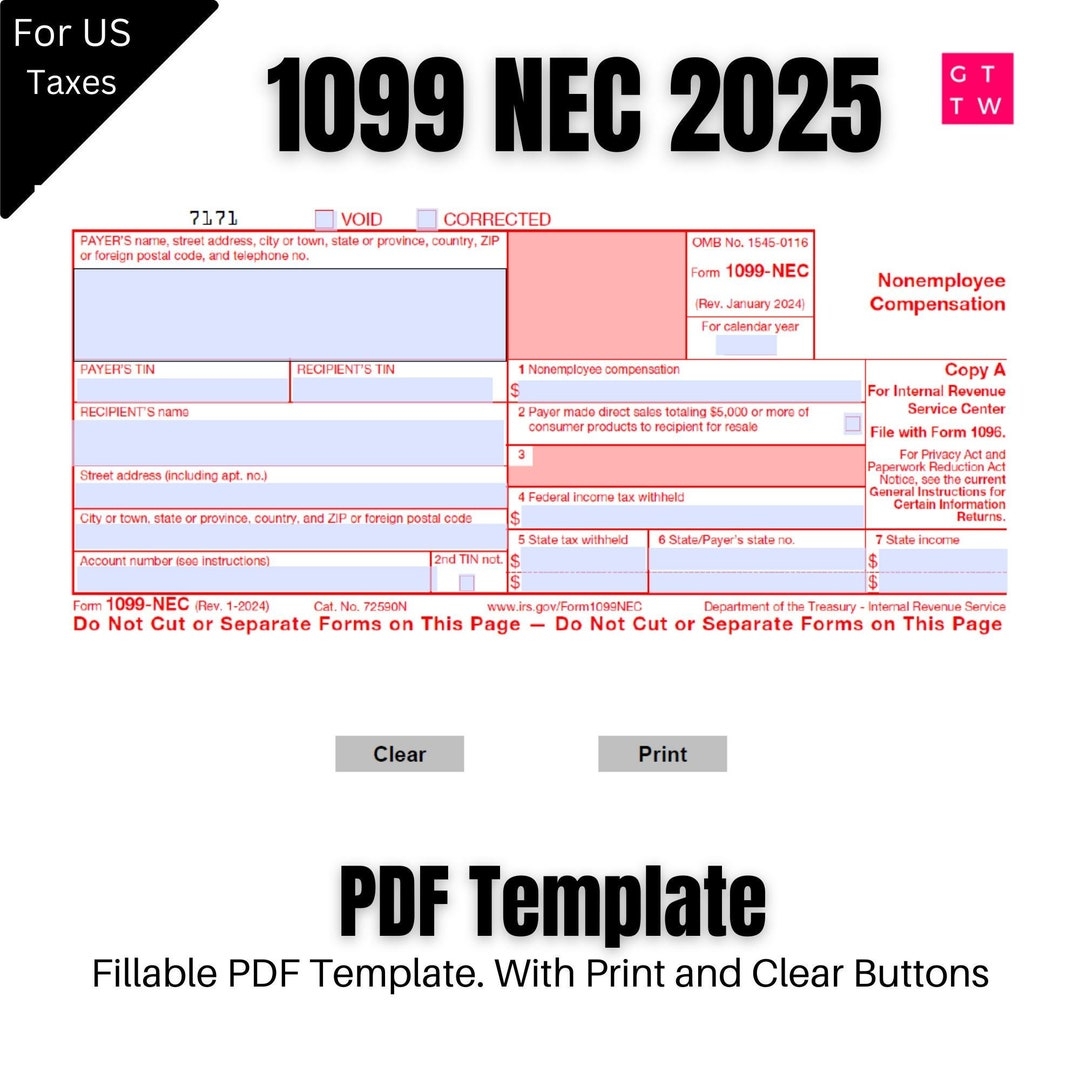

1099 NEC Editable PDF Fillable Template 2025 With Print And Clear Buttons Courier Font Etsy

1099 NEC Editable PDF Fillable Template 2025 With Print And Clear Buttons Courier Font Etsy

For your convenience, the IRS typically provides printable PDF versions of tax forms on their website. This allows you to easily download and print the forms you need without having to visit a physical IRS office or wait for forms to be mailed to you.

When downloading the IRS 1099 NEC form for 2025, make sure you are using the most up-to-date version to ensure compliance with current tax regulations. It’s also a good idea to double-check the instructions for filling out the form to avoid any errors that could delay the processing of your tax return.

By staying organized and proactive with your tax preparation, you can avoid any last-minute stress or confusion when it comes time to file your taxes. Utilizing resources like the IRS 1099 NEC form can help streamline the process and ensure that you are accurately reporting your income.

Remember, it’s always a good idea to consult with a tax professional or accountant if you have any questions or concerns about your tax filing obligations. They can provide guidance and advice tailored to your specific financial situation and help you navigate any complexities related to tax forms like the IRS 1099 NEC.

Overall, by being proactive and informed about the IRS 1099 NEC form for 2025, you can ensure a smooth and successful tax filing process. Take advantage of the resources available to you, such as printable PDF versions of tax forms, to stay ahead of the game and avoid any potential pitfalls when it comes to reporting your income.