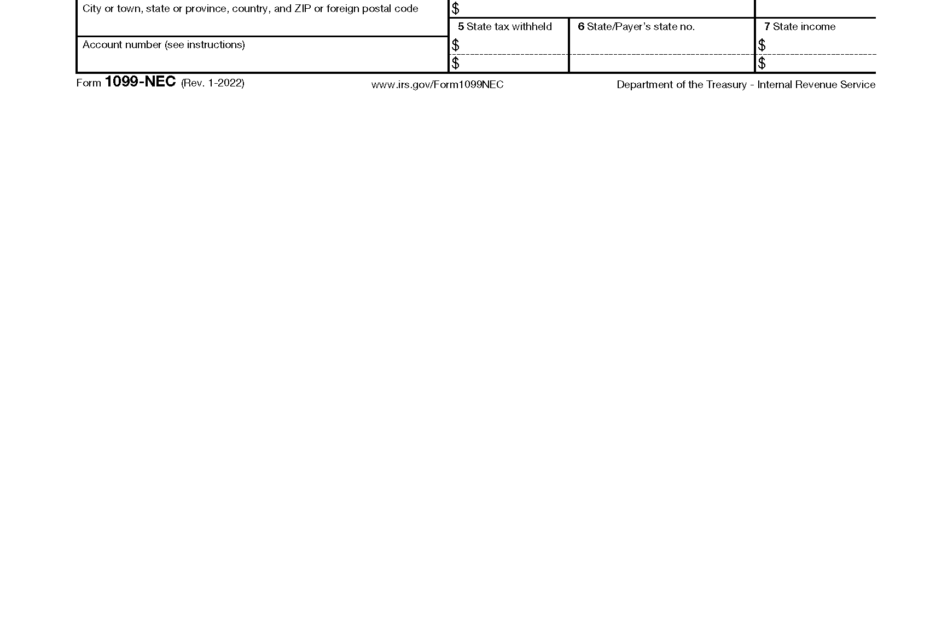

As a business owner or independent contractor, it is crucial to stay informed about tax regulations and forms. One such form that may be relevant to you is the IRS 1099-NEC Form 2025. This form is used to report non-employee compensation and is essential for tax filing purposes.

Understanding how to properly fill out and submit the IRS 1099-NEC Form 2025 is important to avoid any penalties or issues with the IRS. Fortunately, there are printable versions of this form available online to make the process easier for you.

Irs 1099-Nec Form 2025 Printable

Irs 1099-Nec Form 2025 Printable

Save and Print Irs 1099-Nec Form 2025 Printable

IRS 1099-NEC Form 2025 Printable

When looking for the IRS 1099-NEC Form 2025 Printable, it is important to ensure that you are using the most up-to-date version of the form. The IRS updates its forms regularly, so it is crucial to download the form from a reputable source such as the IRS website to ensure accuracy.

Once you have downloaded the form, make sure to fill it out completely and accurately. You will need to provide information about the non-employee compensation you received or paid out during the tax year. It is important to double-check all the information before submitting the form to avoid any errors.

After you have filled out the form, you can either mail it to the IRS or submit it electronically, depending on your preference. Make sure to keep a copy of the form for your records, as you may need it for future reference.

Overall, the IRS 1099-NEC Form 2025 Printable is a vital tool for reporting non-employee compensation accurately and efficiently. By staying informed and using the printable form correctly, you can ensure that your tax filing process goes smoothly and without any issues.

So, if you are a business owner or independent contractor who needs to report non-employee compensation, make sure to download the IRS 1099-NEC Form 2025 Printable and fill it out correctly to stay compliant with tax regulations.