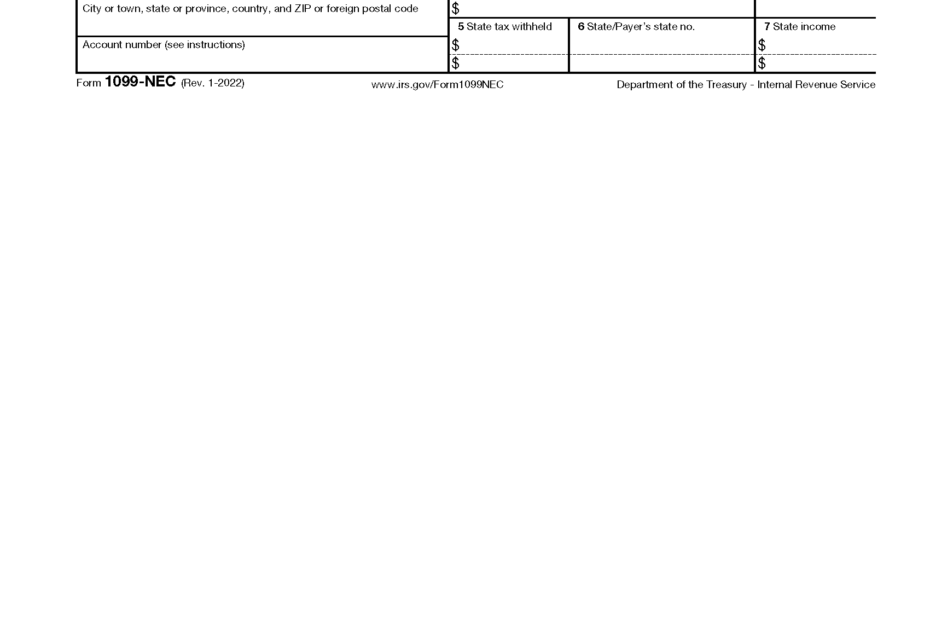

As the tax season approaches, it is important for businesses to be aware of the various forms that need to be filed with the IRS. One such form is the 1099-NEC, which is used to report nonemployee compensation. This form is essential for businesses that have paid independent contractors, freelancers, or other nonemployees over $600 in the previous tax year.

Filing the 1099-NEC form accurately and on time is crucial to avoid penalties from the IRS. To make this process easier, the IRS provides a printable version of the form that can be easily filled out and submitted. This printable form ensures that businesses can accurately report nonemployee compensation and comply with IRS regulations.

Irs 1099-Nec Form 2025 Printable

Irs 1099-Nec Form 2025 Printable

Quickly Access and Print Irs 1099-Nec Form 2025 Printable

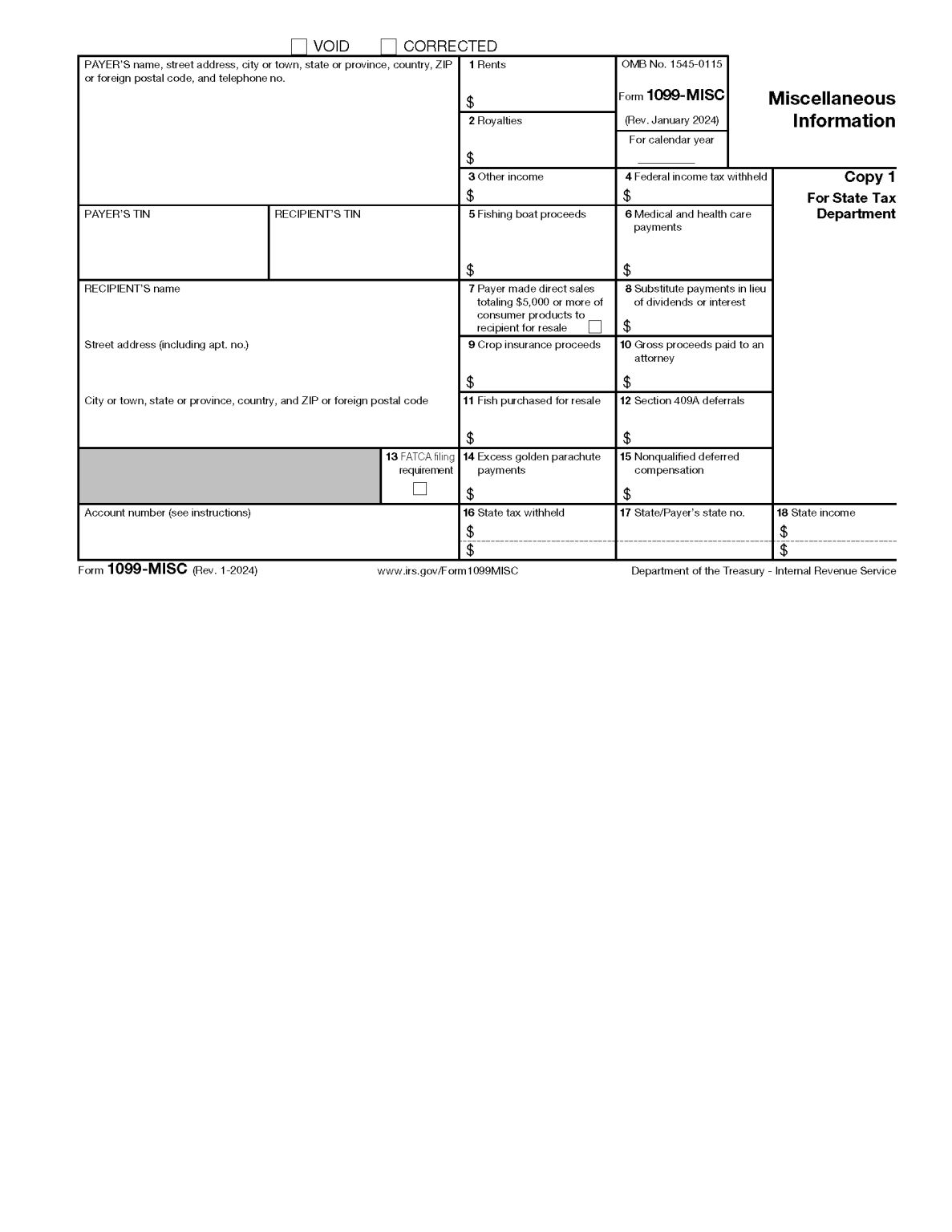

When filling out the IRS 1099-NEC form, businesses need to provide information such as the recipient’s name, address, and taxpayer identification number. They also need to report the total amount of nonemployee compensation paid during the tax year. This information is crucial for the IRS to track and verify income earned by nonemployees.

Businesses should also be aware of the deadline for filing the 1099-NEC form, which is typically January 31st of the following tax year. Failing to meet this deadline can result in penalties and fines from the IRS. By using the printable version of the form, businesses can ensure that they meet this deadline and avoid any potential issues with the IRS.

Overall, the IRS 1099-NEC form is an essential document for businesses that have paid nonemployee compensation. By using the printable version of the form, businesses can accurately report this information to the IRS and avoid any potential penalties. It is important for businesses to stay informed about tax regulations and requirements to ensure compliance and avoid any issues with the IRS.

As tax season approaches, it is crucial for businesses to be prepared and knowledgeable about the various forms that need to be filed. The IRS 1099-NEC form is one such form that businesses need to be aware of and file accurately. By using the printable version of the form, businesses can simplify the process of reporting nonemployee compensation and ensure compliance with IRS regulations.