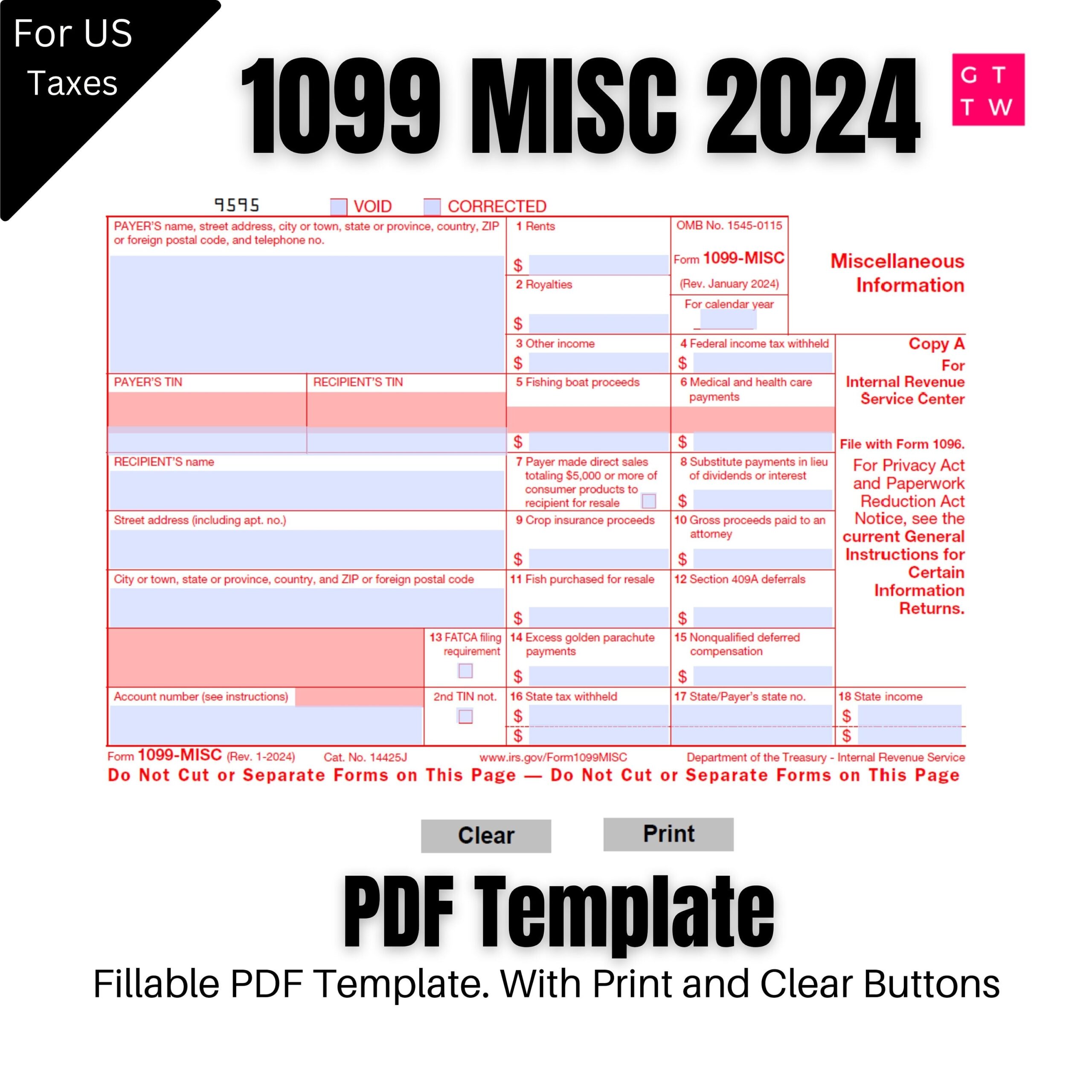

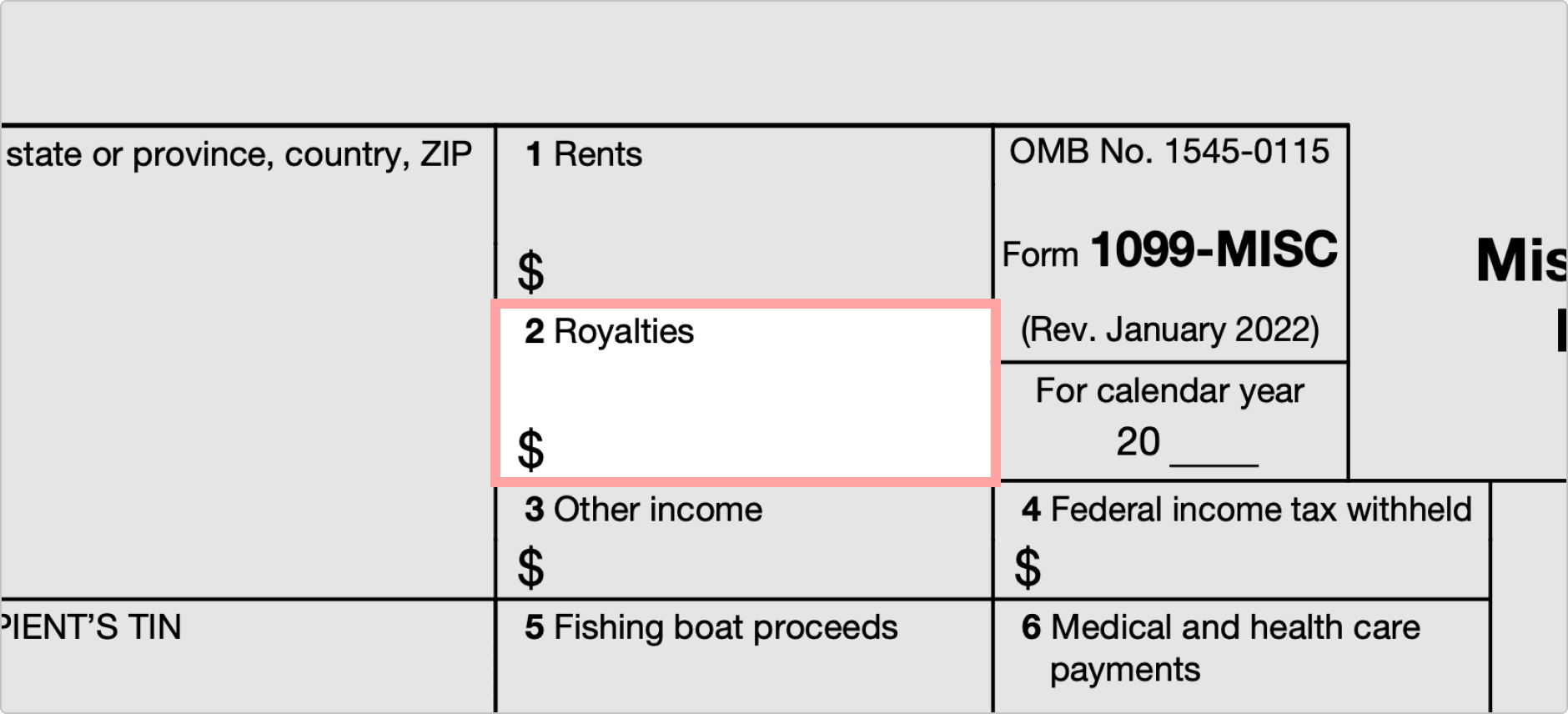

As tax season approaches, it’s important to be prepared with all the necessary forms and documents to file your taxes accurately. One such form that you may need is the IRS 1099 Misc form. This form is used to report miscellaneous income that you have received throughout the year, such as freelance earnings, rental income, or royalties.

It’s crucial to ensure that you have the correct form and that it is filled out accurately to avoid any penalties or errors in your tax filing. Fortunately, the IRS provides a printable version of the 1099 Misc form that you can easily access and fill out at your convenience.

Save and Print Irs 1099 Misc Form Printable

2021 Nec 1099 Forms 2024 1099 MISC Tax Forms Kit 25 Pack IRS

2021 Nec 1099 Forms 2024 1099 MISC Tax Forms Kit 25 Pack IRS

IRS 1099 Misc Form Printable

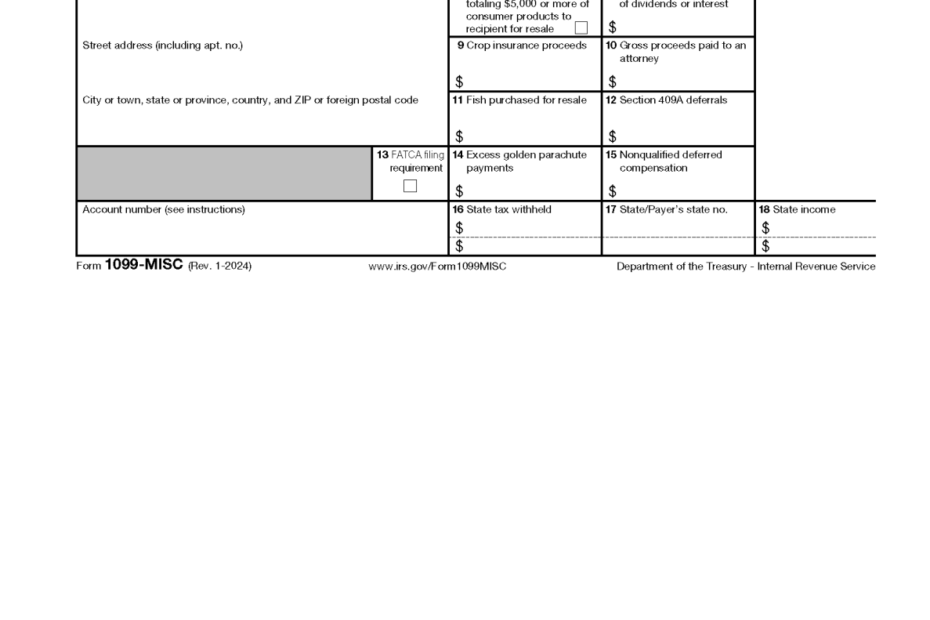

The IRS 1099 Misc form is available for download on the official IRS website. You can simply visit the website, search for the form, and download it to your computer or print it out. The form is typically in PDF format, making it easy to fill out electronically or by hand.

When filling out the form, be sure to include all the necessary information accurately, such as your name, address, Social Security number, and the amount of miscellaneous income you received. Double-check your entries to ensure that everything is correct before submitting the form to the IRS.

Once you have completed the form, you can either mail it to the IRS or submit it electronically, depending on your preference. Keep a copy of the form for your records in case you need to refer back to it in the future.

Remember that the deadline for submitting the IRS 1099 Misc form is typically January 31st of each year, so be sure to file it on time to avoid any penalties or late fees. If you have any questions or need assistance with filling out the form, don’t hesitate to seek help from a tax professional or the IRS.

In conclusion, the IRS 1099 Misc form is an essential document for reporting miscellaneous income and ensuring that you are compliant with tax regulations. By utilizing the printable version of the form provided by the IRS, you can easily file your taxes accurately and on time. Be sure to take the time to fill out the form correctly and submit it by the deadline to avoid any issues with your tax filing.