When it comes to tax season, one of the most important forms to have on hand is the IRS 1099 Misc Form. This form is used to report miscellaneous income that is not captured on a W-2 form. It is crucial for freelancers, independent contractors, and small business owners to accurately report their income using this form to avoid any penalties or audits from the IRS.

For those looking to download the IRS 1099 Misc Form 2025 in a printable PDF format for free, there are several resources available online. Having this form readily accessible can make the tax filing process much smoother and more efficient.

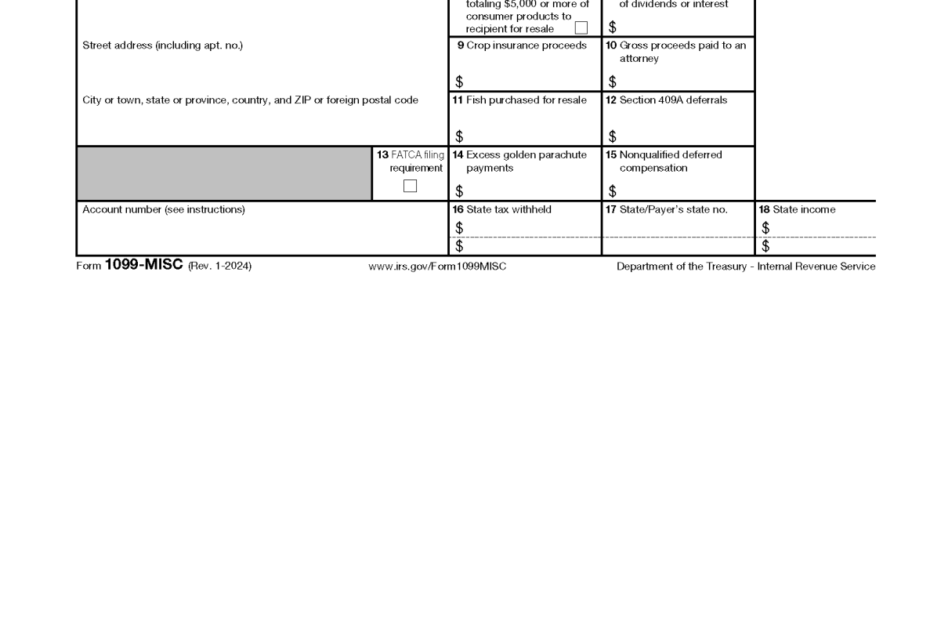

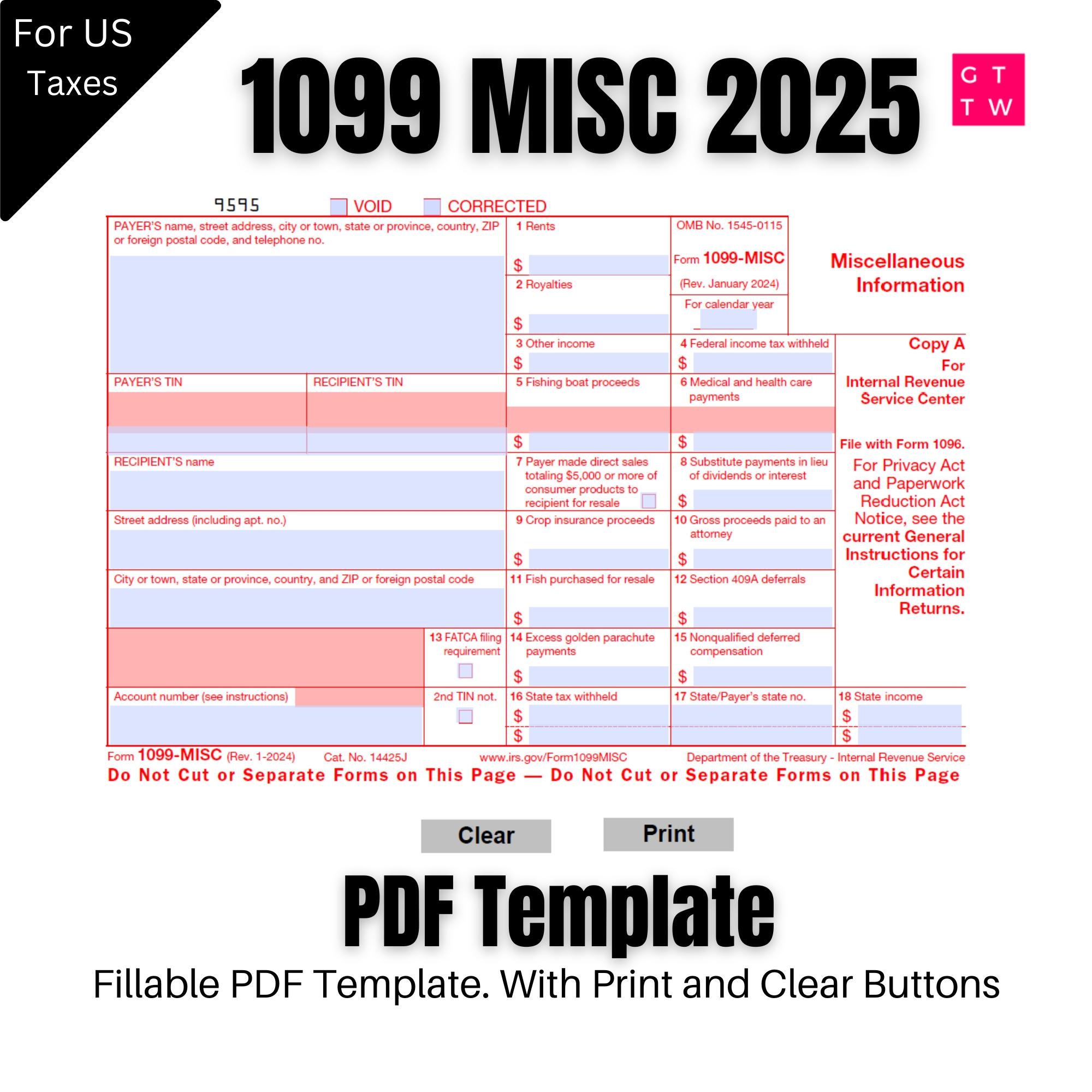

Irs 1099 Misc Form 2025 Printable Pdf Free Download

Irs 1099 Misc Form 2025 Printable Pdf Free Download

Save and Print Irs 1099 Misc Form 2025 Printable Pdf Free Download

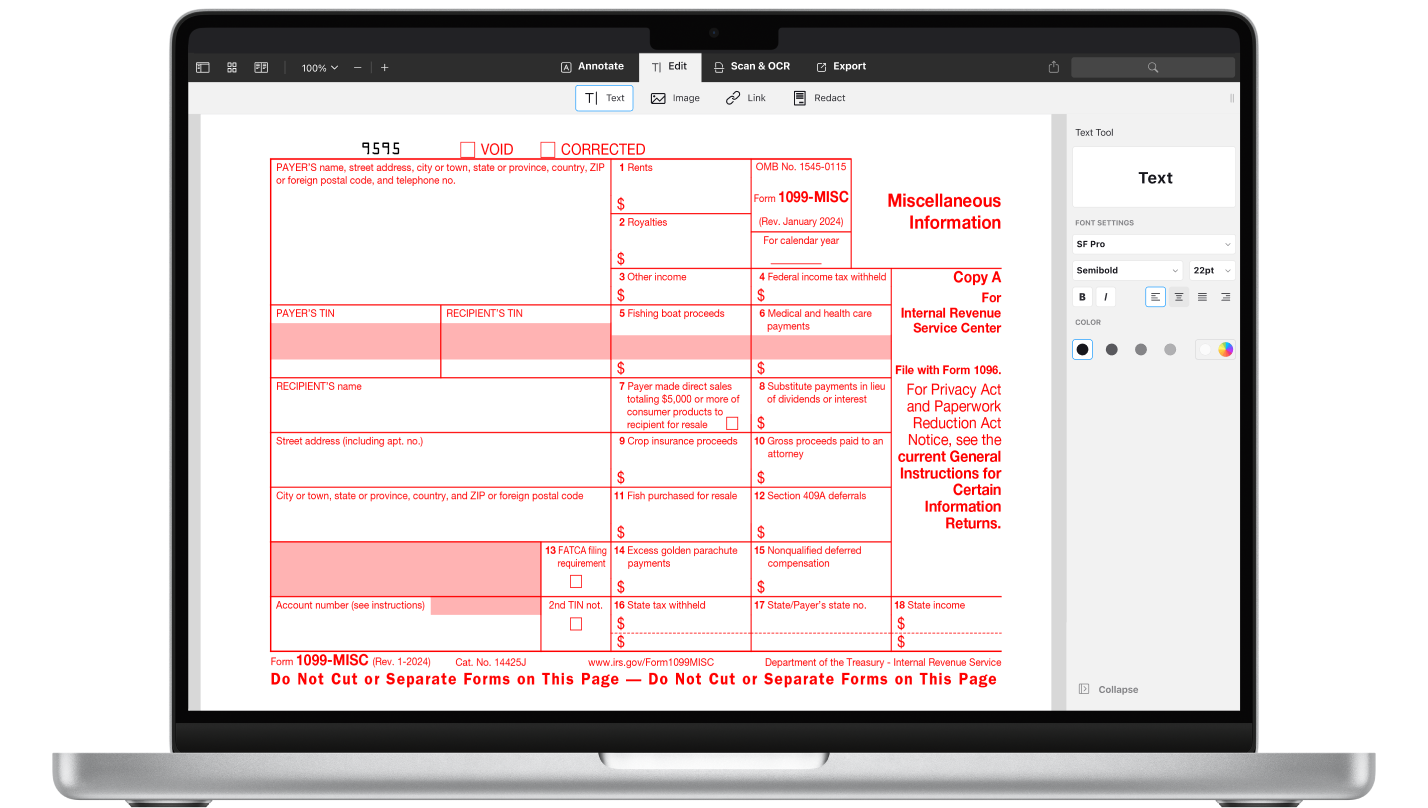

How To Fill Out IRS 1099 MISC Form PDF 2025 PDF Expert

How To Fill Out IRS 1099 MISC Form PDF 2025 PDF Expert

There are many websites that offer the IRS 1099 Misc Form 2025 in a printable PDF format for free. These sites make it easy to download and print the form so that you can quickly fill it out and submit it to the IRS. It is important to ensure that you are using the correct version of the form for the tax year in question to avoid any discrepancies.

Before filling out the IRS 1099 Misc Form, it is recommended to gather all necessary documentation, such as receipts, invoices, and payment records. This will ensure that you accurately report all income earned throughout the year. It is also important to double-check all information entered on the form to avoid any errors that could lead to penalties or delays in processing.

Once you have completed the IRS 1099 Misc Form 2025, you can either submit it electronically through the IRS website or mail it in. Be sure to keep a copy of the form for your records in case you need to reference it in the future. By staying organized and diligent in your tax reporting, you can avoid any potential issues with the IRS and ensure that you are compliant with tax laws.

In conclusion, having access to the IRS 1099 Misc Form 2025 in a printable PDF format for free can greatly simplify the tax filing process for individuals and businesses. By utilizing online resources and being thorough in your reporting, you can ensure that your tax return is accurate and submitted on time. Downloading this form and keeping detailed records of your income will help you stay on top of your tax obligations and avoid any unnecessary complications.