As tax season approaches, many individuals and businesses are preparing to file their taxes. One important form that is often required is the IRS 1099 form. This form is used to report various types of income, such as freelance earnings, rental income, or interest earned on investments. It is essential to have the correct form to ensure accurate reporting to the IRS.

For those looking to download the IRS 1099 form for the year 2025, a printable PDF version is available online. This allows individuals to easily access and fill out the form without the need to visit a physical IRS office or request a copy through the mail. The convenience of being able to download and print the form at home makes the tax filing process much more efficient.

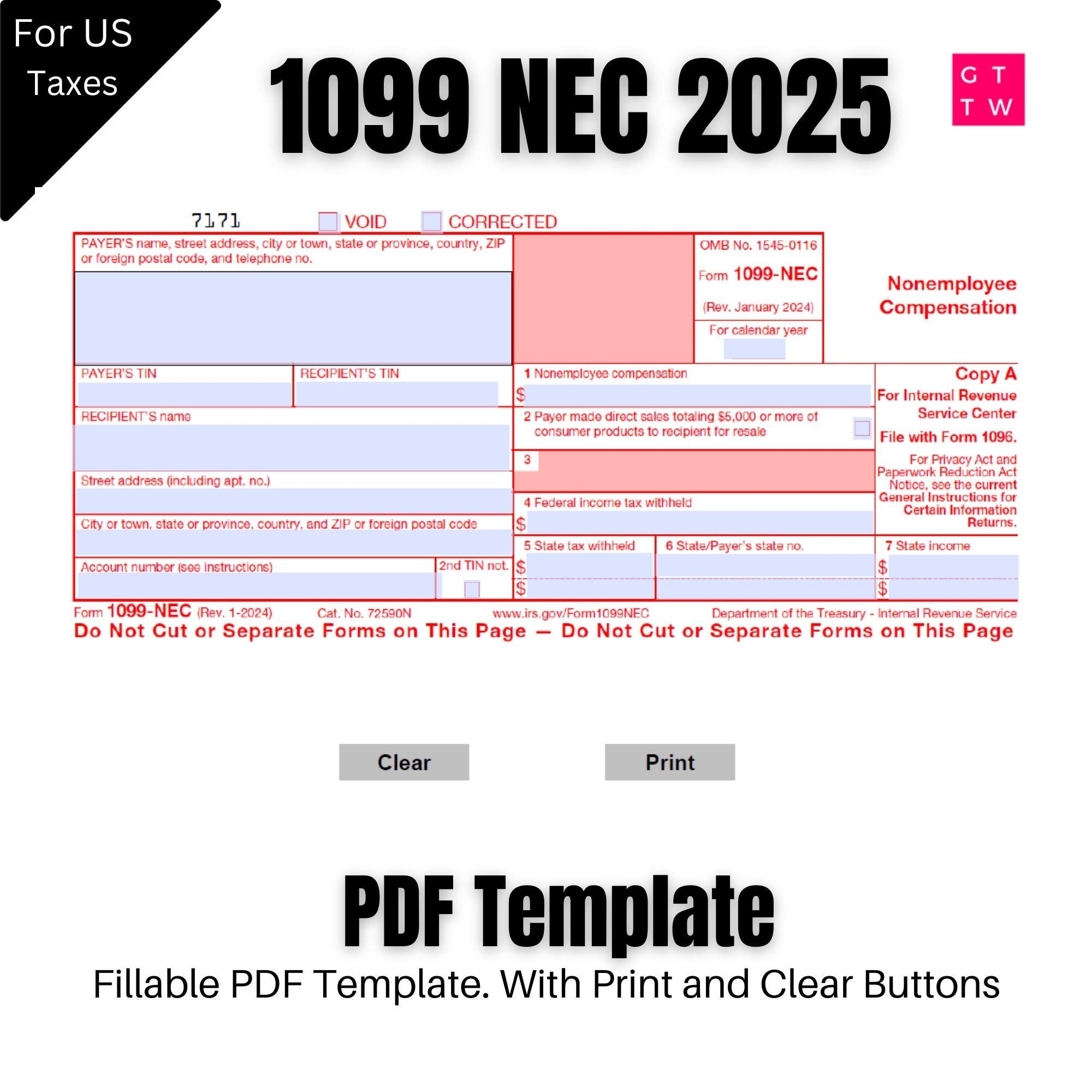

Irs 1099 Form 2025 Printable Pdf Download

Irs 1099 Form 2025 Printable Pdf Download

Easily Download and Print Irs 1099 Form 2025 Printable Pdf Download

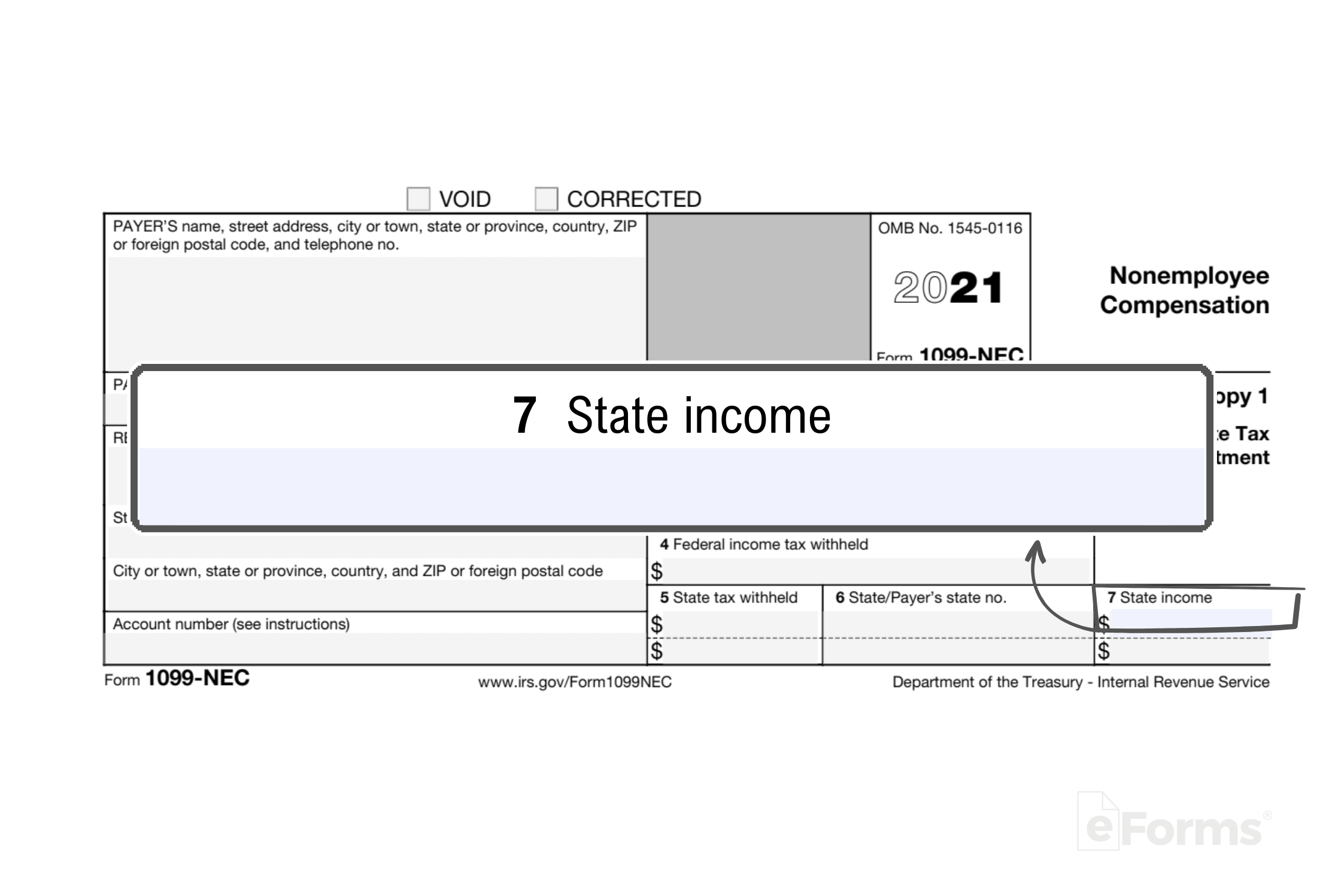

Free IRS 1099 NEC Form 2021 2025 PDF EForms

Free IRS 1099 NEC Form 2021 2025 PDF EForms

When downloading the IRS 1099 form, it is important to ensure that the correct version is being used for the specific tax year. Using the wrong form could result in errors on your tax return, potentially leading to penalties or delays in processing. The IRS website is a reliable source for obtaining the most up-to-date forms for the current tax year.

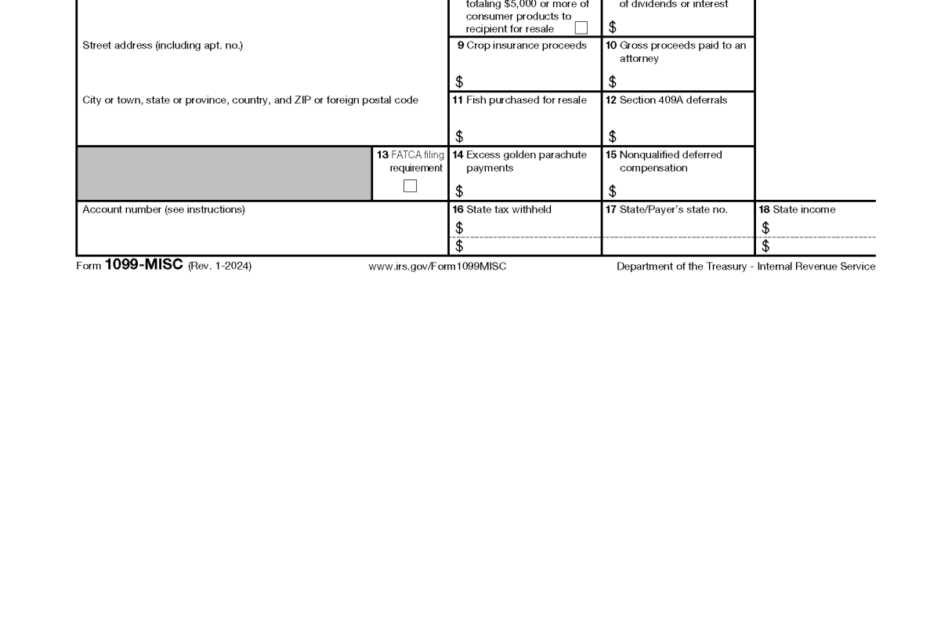

Once the form is downloaded and printed, individuals can begin filling out the necessary information. This may include details such as the payer’s name and address, the recipient’s identification number, and the amount of income received. Accuracy is crucial when completing the form to avoid any discrepancies that could trigger an audit by the IRS.

After the form is completed, it should be submitted along with the individual’s tax return by the specified deadline. Failing to include the 1099 form when required could result in penalties or additional taxes owed. By staying organized and following the IRS guidelines, individuals can effectively file their taxes and avoid any potential issues.

In conclusion, the IRS 1099 form is a vital document for reporting various types of income to the IRS. By downloading the printable PDF version for the year 2025, individuals can easily access and complete the form from the comfort of their own home. Remember to double-check that the correct form is being used and submit it along with your tax return to ensure compliance with IRS regulations.